2024 Week 17

Notes, thoughts and observations - Compiled weekly

I think we all learned an important lesson about stories from journalists who seek to sensationalize topics to generate clicks. The predicted Baltimore supply chain issues never materialized after shipping was shut down by the collapse of the Francis Scott Key Bridge.

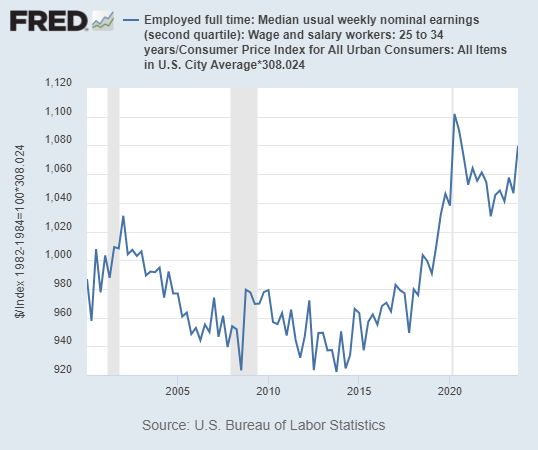

Young workers have the lowest unemployment rate since the 60s and weekly wages are higher than in the past. Again, this contradicts the prevailing narrative that Gen Z is doing worse than previous generations. Look past the commentary at the data.

Median weekly earnings, inflation-adjusted, for young people are the highest they have ever been

Wall Street wasn’t happy with META’s spending on AI. They’d rather the money be returned to the shareholders. We heard a very similar critique with Amazon as Bezos directed online retail profits into building what would become Amazon Web Services. The future of consumer AI will be through service providers, and companies like Meta and Microsoft will play a part.

The idea of natural gas as a bridge fuel is gaining mainstream support with the likes of Jim Cramer admitting as much. I’m still cautious that it will quickly bridge us to nuclear power which is the only reliable base load source that is carbon friendly.

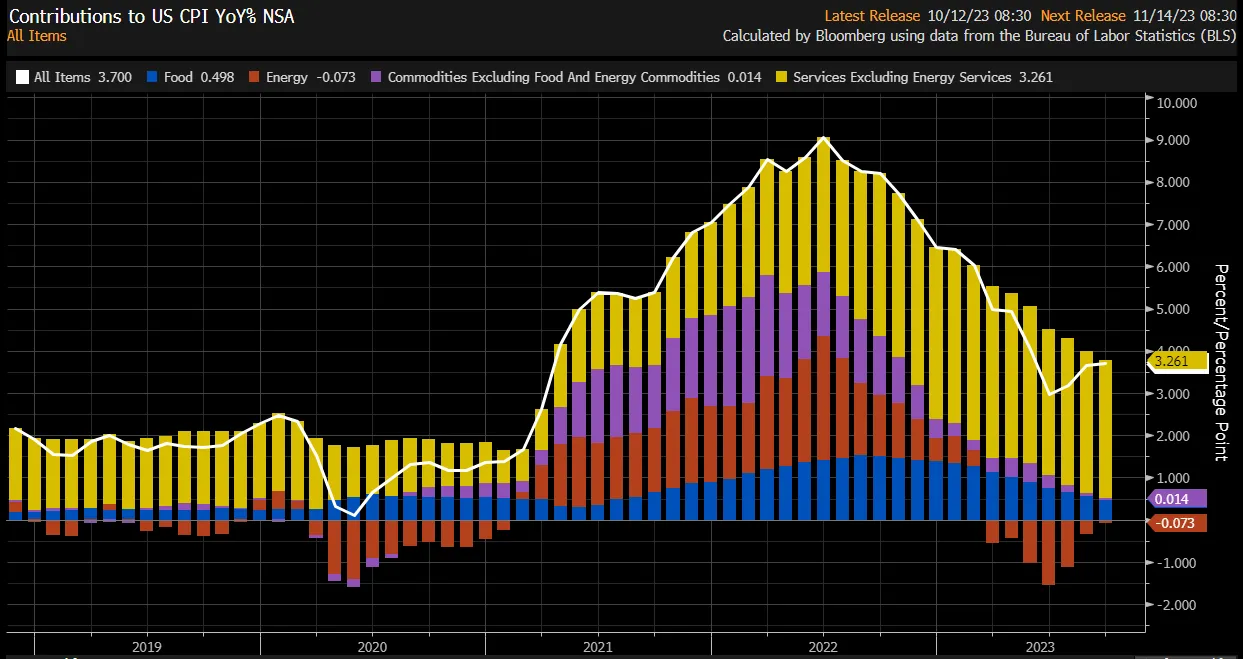

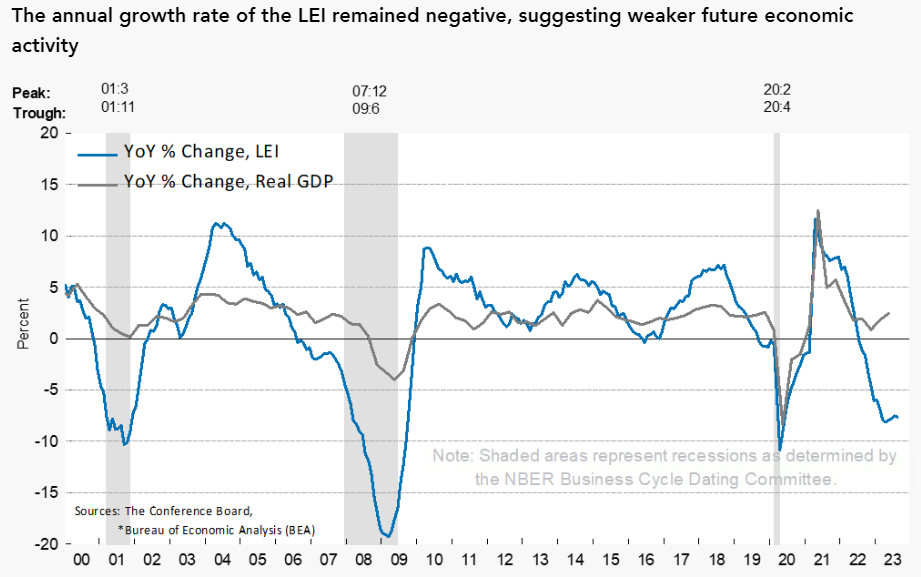

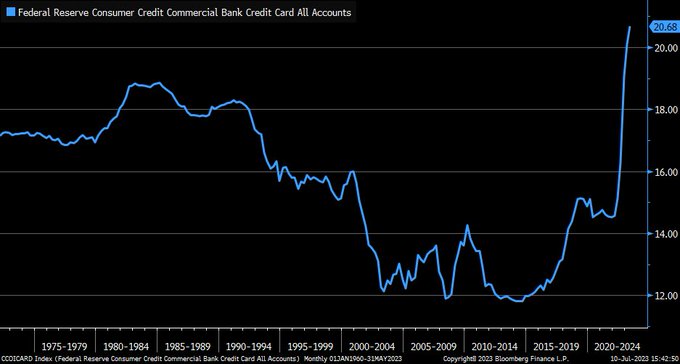

Finally, the economy seems to be roaring ahead despite predictions of current or pending recession. GPD grew steadily but inflation also. Shelter costs and pending trade tariffs will only make inflation stickier. I see daily commentary on how indicators point toward future recession, but I’m mindful that while these indicators have a high correlation the timing is never consistent.

TOPICS

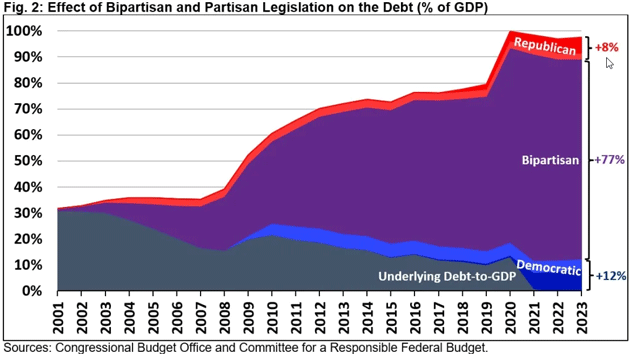

- Inflation

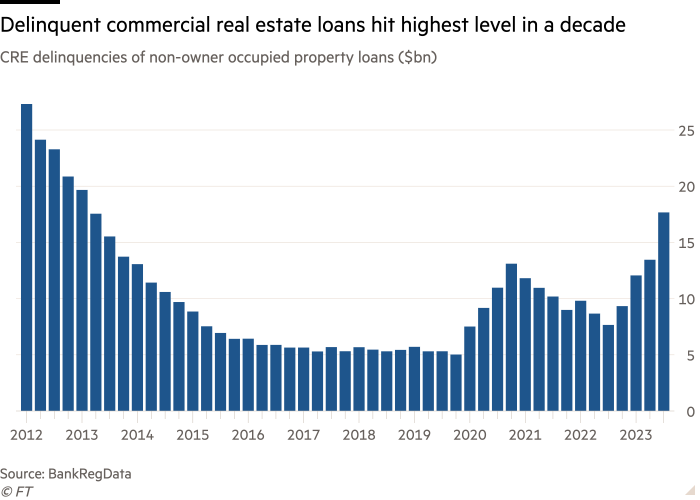

- Bankruptcy

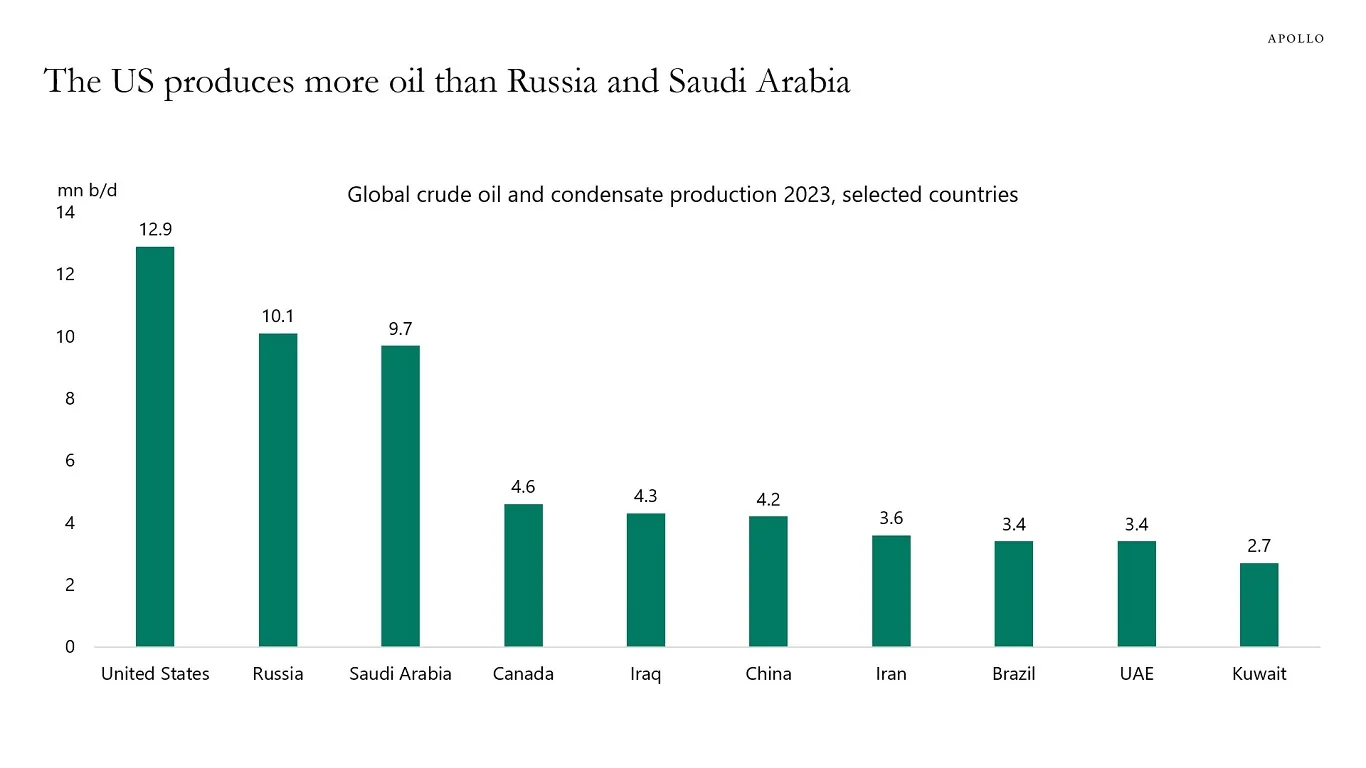

- Energy

- Domestic Recession

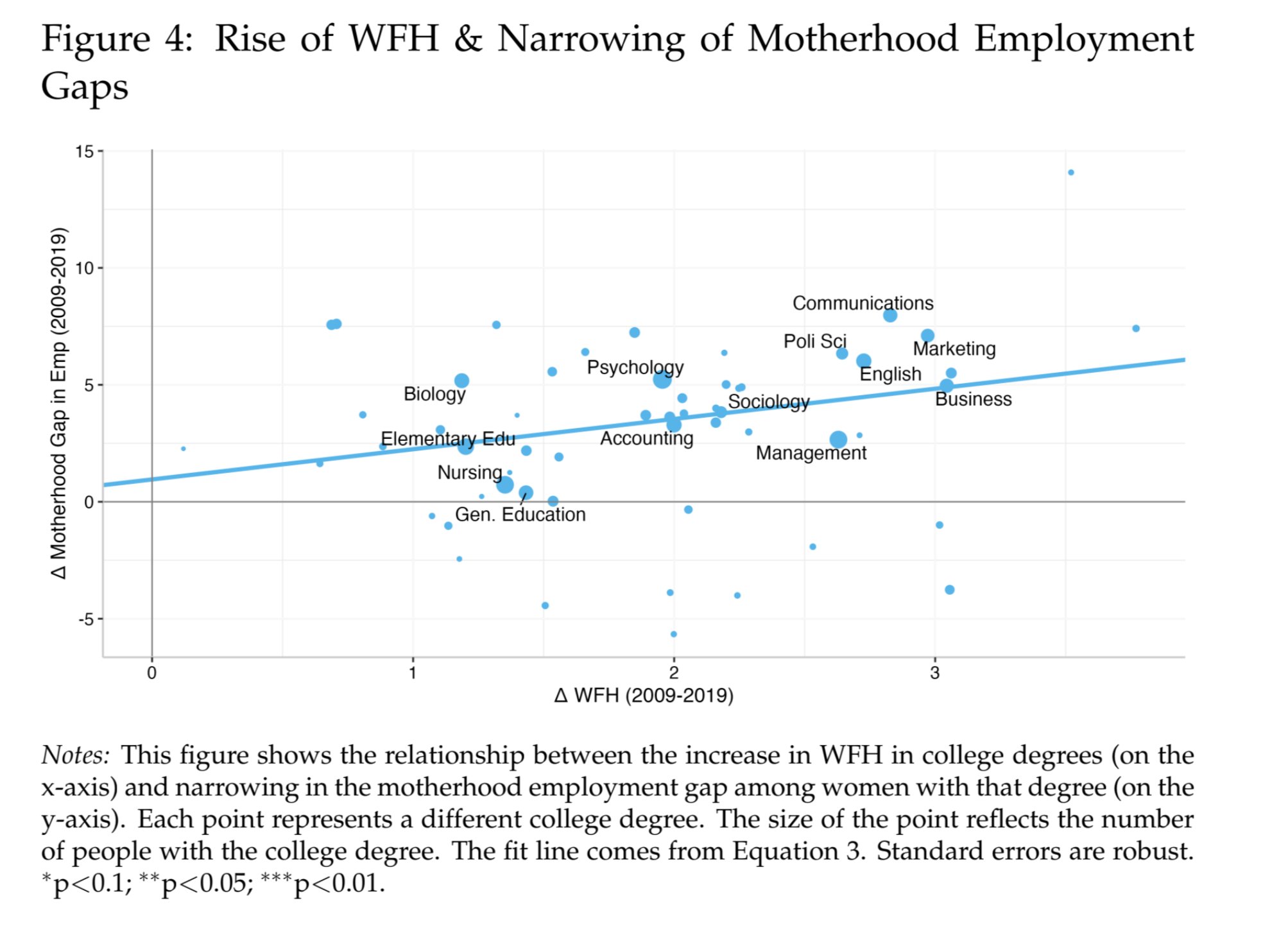

- Labor Market

- Population

- Mergers and Acquisitions

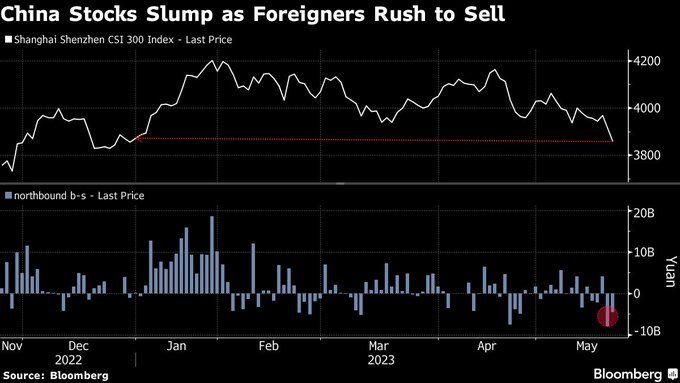

- Globalization

- AI and ML