2024 Week 16

Notes, thoughts and observations - Compiled weekly

Every one that has eye can see that the Fed isn’t cutting interest rates. Apparently the stock market just realized? Bottom line inflation isn’t over and adding tarrifs to steel imports will only add fuel to the fire. Property and insurance is also piliing on inflation pressure

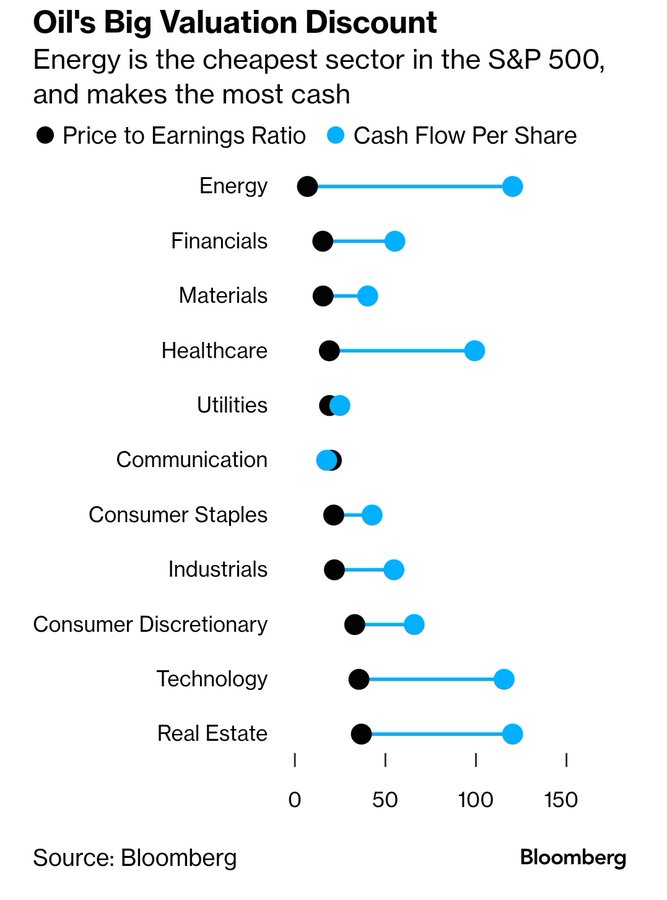

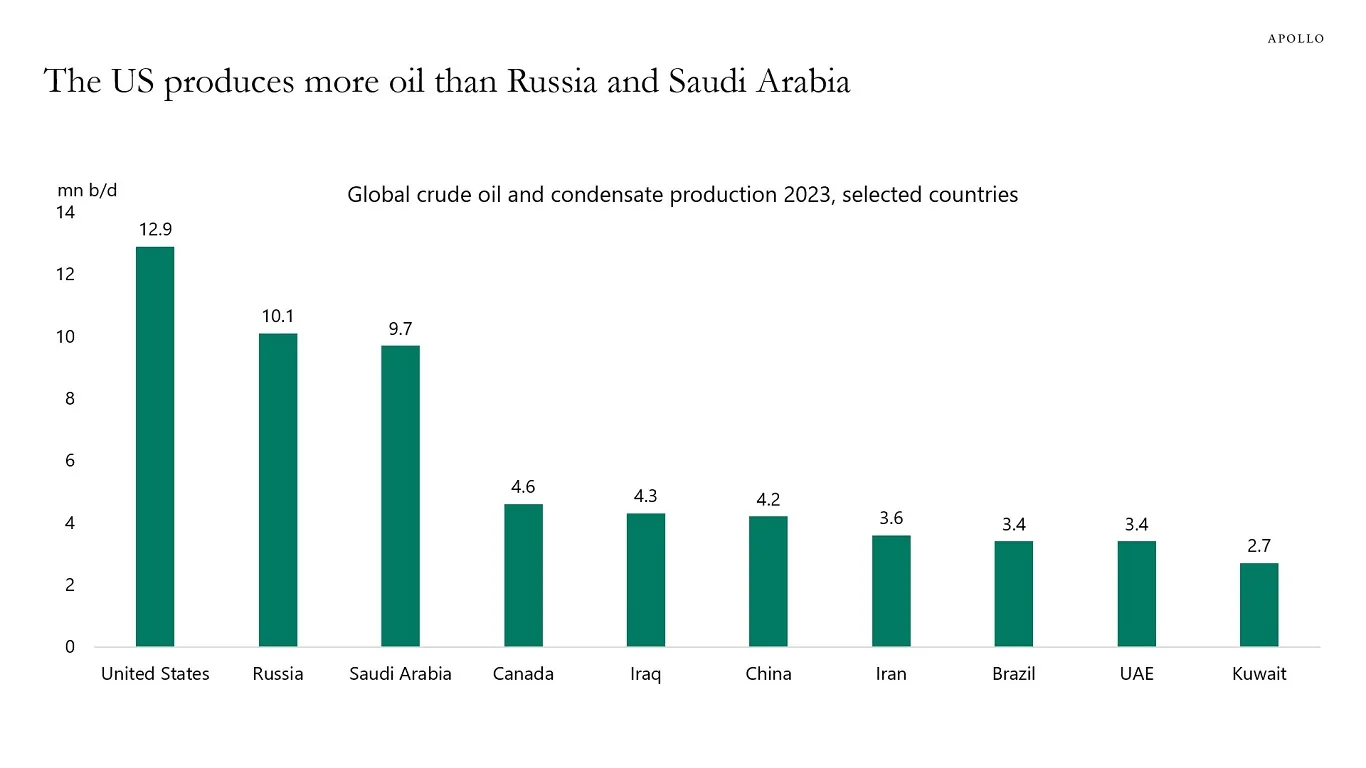

But it isn’t all gloom and doom. Long term energy production will ensure that the US economy remains top dog in the world. We produced a staggering 12.9 million barrels per day in 2023. There is also a broad consensus that natural gas is the right bridge energy to remove the last of the coal fired plants. All of this will remain a tailwind for the US, especially energy intensive industries.

US energy security will fuel future economic growth

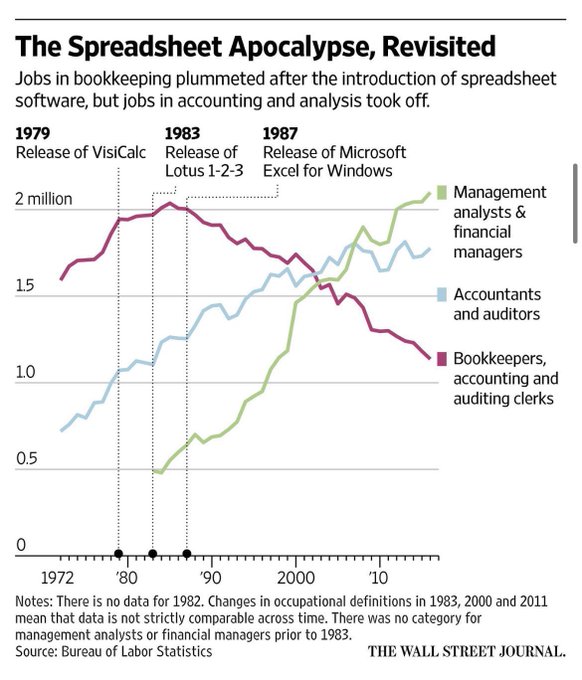

The labor market is robust but wage growth has cooled. Long term worker pay needs to stabilize with long term inflation. Inflation is squeezing margins but businesses should expect increasing worker demand for raises. Demographics, increased union support and reshoring will all drive wages.

Elon Musk creates a lot of buzz, but if you look at two of his companies his actual impact is pretty visible. SpaceX has spurred an entire industry of providing cheaper commercial access to space. While success if obvious, the associated cost have not fully worked out. A recent impact of space debris on a home in Florida could become more common and the insurance industry is taking notice. Ultimately who is responsible when a Star Link microsatellite deorbits into someone’s property?

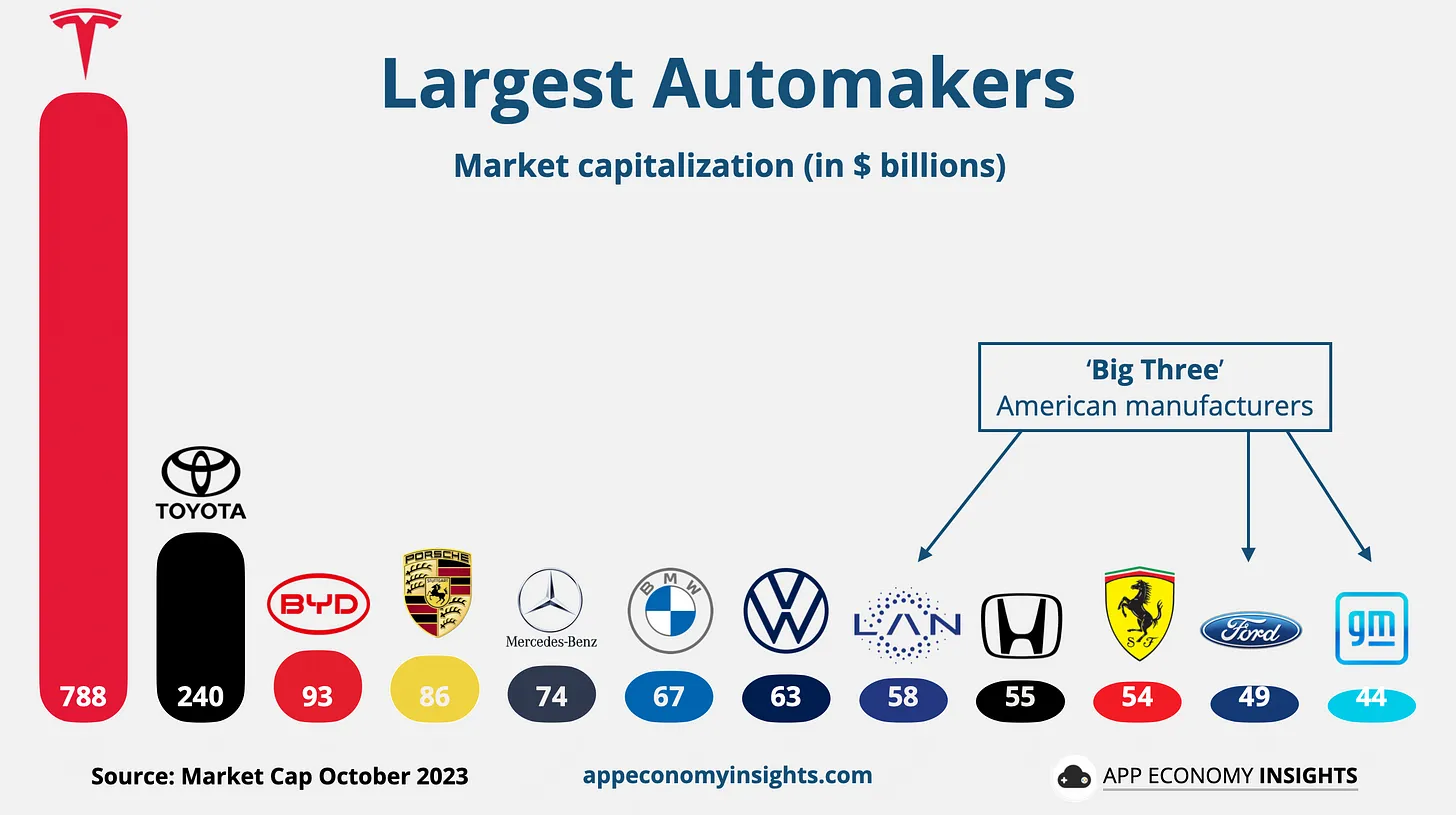

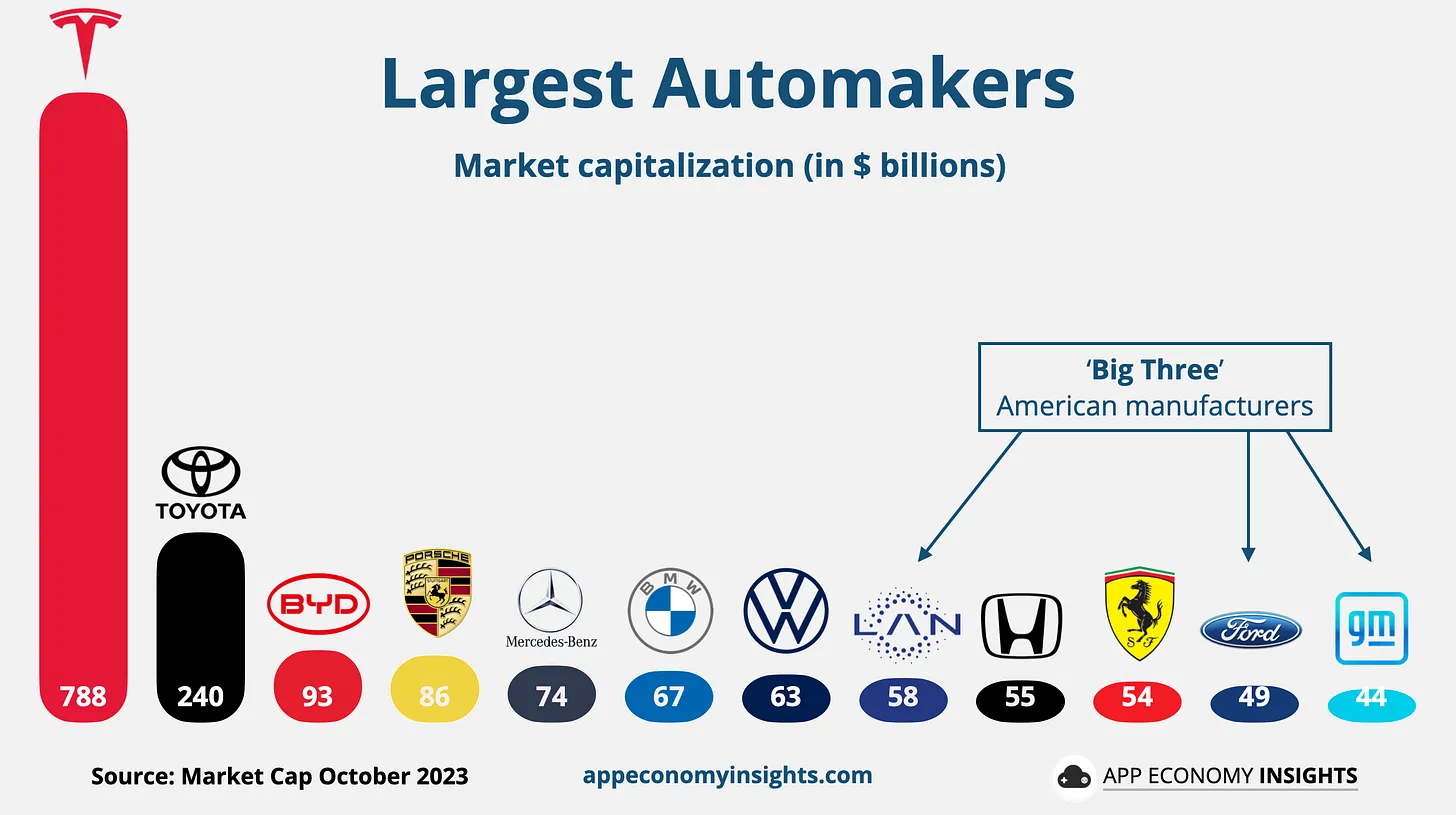

Likewise Tesla has long been the leader in electric cars it he US. Musk’s stated goal was to accelerate the EV technology, and he suceeded. With increasing competition from domestic and foreign manufacturers the company has doubled down on self-driving software side of the business. Again the insurance industry is taking notice. In my opinion, the biggest threat to Musk’s vision is not the technology or the consumers but the regulatory and risk mitigation aspects.