2024 Week 16

Notes, thoughts and observations - Compiled weekly

Every one that has eye can see that the Fed isn’t cutting interest rates. Apparently the stock market just realized? Bottom line inflation isn’t over and adding tarrifs to steel imports will only add fuel to the fire. Property and insurance is also piliing on inflation pressure

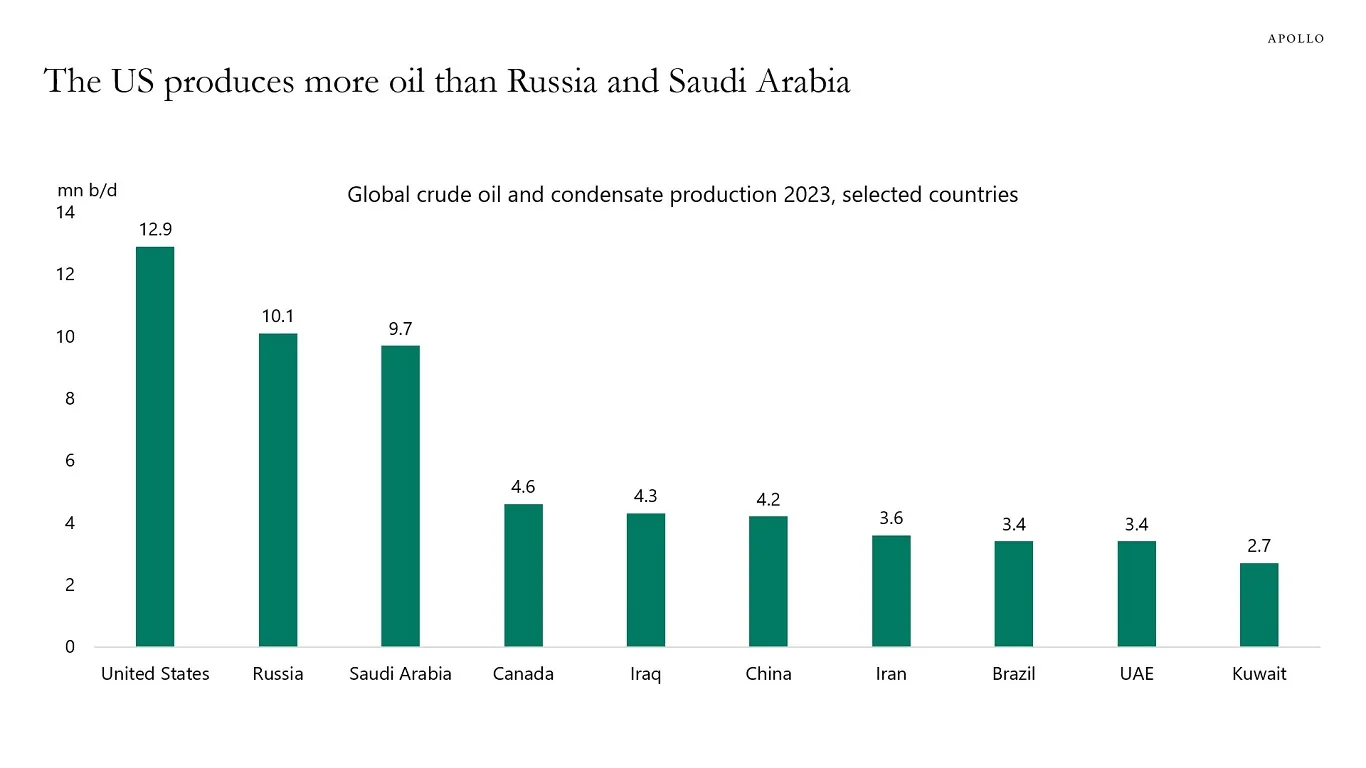

But it isn’t all gloom and doom. Long term energy production will ensure that the US economy remains top dog in the world. We produced a staggering 12.9 million barrels per day in 2023. There is also a broad consensus that natural gas is the right bridge energy to remove the last of the coal fired plants. All of this will remain a tailwind for the US, especially energy intensive industries.

US energy security will fuel future economic growth

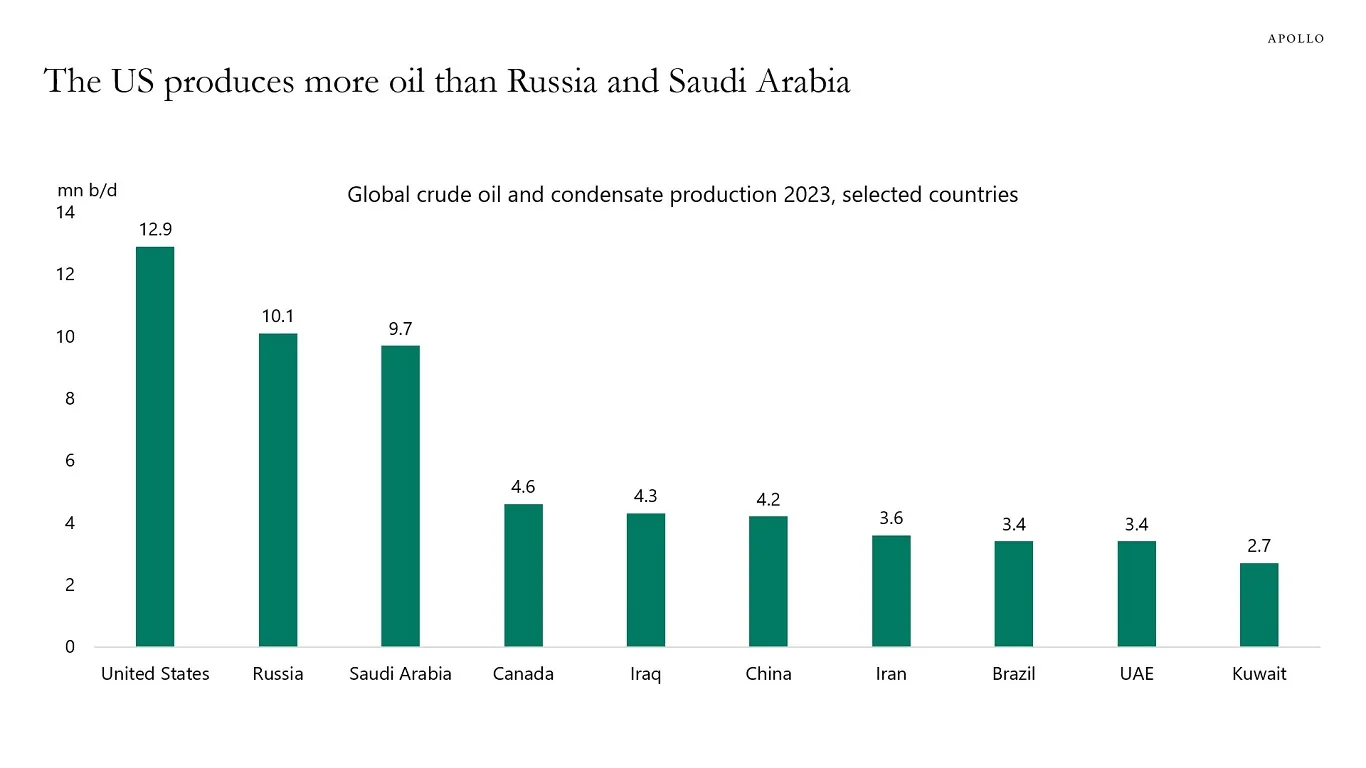

The labor market is robust but wage growth has cooled. Long term worker pay needs to stabilize with long term inflation. Inflation is squeezing margins but businesses should expect increasing worker demand for raises. Demographics, increased union support and reshoring will all drive wages.

Elon Musk creates a lot of buzz, but if you look at two of his companies his actual impact is pretty visible. SpaceX has spurred an entire industry of providing cheaper commercial access to space. While success if obvious, the associated cost have not fully worked out. A recent impact of space debris on a home in Florida could become more common and the insurance industry is taking notice. Ultimately who is responsible when a Star Link microsatellite deorbits into someone’s property?

Likewise Tesla has long been the leader in electric cars it he US. Musk’s stated goal was to accelerate the EV technology, and he suceeded. With increasing competition from domestic and foreign manufacturers the company has doubled down on self-driving software side of the business. Again the insurance industry is taking notice. In my opinion, the biggest threat to Musk’s vision is not the technology or the consumers but the regulatory and risk mitigation aspects.

TOPICS

Fed Rate

OPINION - Soft landing, no rate cuts

- (Seeking Alpha)

- A third straight month of rising CPI convinced many investors to dial back their rate cut expectations.

- The US consumer price index rose 3.5% in the year ended March, and 3.8% in the core reading that excludes food and energy.

- Former Treasury Secretary Larry Summers says June rate cut could be a mistake by Fed

- Both headline and core CPI for March increased more than anticipated on a M/M basis.

- “I was not hugely surprised by the numbers,” Summers told Bloomberg.

- “In an economy that’s growing faster than potential, with an unemployment rate that has a free handle, in the presence of massive and growing budget deficits and epically easy financial conditions.. should not be a surprise to anyone, and that’s what (the CPI) data suggests”

- “But on current facts, a rate cut in June seems to me would be a dangerous and egregious error comparable to the errors the Fed was making in the summer of 2021 when it just didn’t get the thread on inflation,”

- According to the CME FedWatch tool, the odds of a 25 basis point cut in June currently stands at about 27%, compared to ~51% a week ago and around 58% a month ago.

Inflation

OPINION - If goes through it could add fuel to the China trade war that will drive inflation in the US short term

- (Seeking Alpha) ::

- Current average tariff on certain steel and aluminum products is 7.5% under a Trump-era policy

- Biden is expected to propose raising to 25% the tariffs

- Current average tariff on certain steel and aluminum products is 7.5% under a Trump-era policy

OBSERVATION - Pressure from all sides

- (Over My Shoulder)

- Often note the questionable way inflation benchmarks like CPI account for housing costs

- “Owner’s equivalent rent” is a derived number with little relationship to what homeowners actually pay.

- Why home insurance is driving up CPI.

- Rising property insurance rates are another top inflation contributor. Horror stories abound, particularly from California and Florida.

- Insurance works only when carriers can match premium rates with claim costs.

- Higher construction costs and state level regulations

- Land availability has pushed development into places more vulnerable to fires, flooding, and other such perils

- Often note the questionable way inflation benchmarks like CPI account for housing costs

Energy

OPINION - US energy security will fuel future economic growth

- (Sandbox Daily)

- Record U.S. oil output, the U.S. produced more crude oil last year than any nation at any time.

- Crude oil production in the United States averaged a staggering 12.9 million barrels per day in 2023

- Together, the United States, Russia, and Saudi Arabia accounted for 40% (32.8 million bpd) of global oil production in 2023.

OPINION - Natural gas is the bridge energy

- (Global Macro Update)

- Natural Gas - The Most Important Global Commodity of the Decade

- The US produces massive amounts of natural gas as a byproduct of oil production.

- Natural gas trades on a regional basis because it is difficult to transport.

- The US has 3 million miles of mainline and other pipelines, which are necessary to move gas across land, but we could use more.

- Converting gas into liquid (LNG) makes it more efficient to ship, but it requires cooling the gas to -260 degrees F.

- Natural gas is a perfect bridge to get us from where we are today to a future with more nuclear energy.

Labor Market

OBSERVATION - Wages need to stabilize with long term inflation

- (Sandbox Daily)

- Despite the recent upside inflation surprises, the broader disinflationary narrative remains intact, albeit on shaky ground after upside inflationary surprises in Q1.

- One key reason is that the labor market continues to rebalance nicely.

- Over the next year, wage growth should converge to 3.5%, the pace consistent with 2% assuming a productivity trend of 1.5% and stable profit margins.

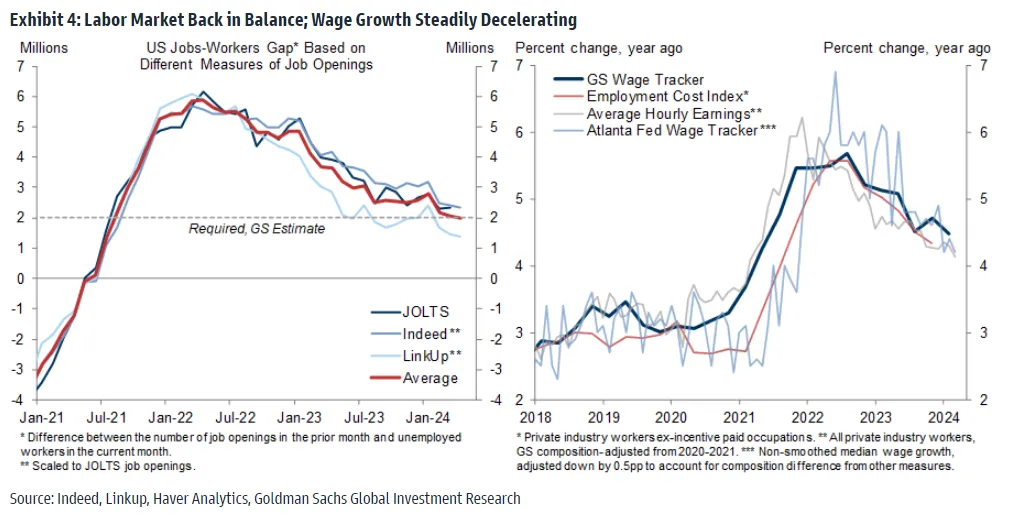

OBSERVATION - Demographic labor shift

- (Connecting the Dots)

- Labor Imbalance - People keep thinking economic weakness will raise unemployment, forcing the Fed to cut rates. It’s going to happen any month now, they’ve been saying… for years.

- Notice how the ratio of working-age to elderly Americans has been shrinking. That’s because people are a) living longer and b) having fewer children. The ratio fell from 6.6 workers per elderly person in 1960 to 4.0 in 2020.

- How are fewer workers going to support more consumers?

- Labor-saving technologies

- AI systems excel at processing information. They aren’t great at helping grandma take a bath.

- Millions of service jobs are highly secure, almost regardless of economic conditions, because demand for them is “non-discretionary.”

- Labor-saving technologies

OBSERVATION - Musk’s misdirection to keep selling the growth story

- (Elektrek)

- Tesla is planning to lay off over 14,000 employees—more than 10% of its global workforce

- Electric vehicle sales have begun to stagnate amid a decline in demand and increased competition from Chinese carmakers.

- Elon Musk said the layoffs are part of cost-cutting measures as the company prepares for its next phase of growth.

- Two top executives at Tesla announced their departure: engineering executive Drew Baglino and policy and outreach executive Rohan Patel.

- Tesla posted its first year-over-year decline in quarterly sales since 2020.

- Report came after China’s BYD briefly overtook Tesla as the world’s top seller of battery electric vehicles last year

- Musk said Tesla would soon release a cheaper, $25K model rumored to compete with BYD.

- That plan has now reportedly been tabled, with Musk prioritizing the debut of a robotaxi fleet in August.

Automotive

OBSERVATION - Prices comparable enough that consumers can make choices on why type of power plant fits their needs.

- (USA Today)

- Another roadblock to convincing Americans to buy an EV: plunging resale values

- The average price for a used electric vehicle fell by up to 32% while the average for a gas model slipped by 3.6%.

- “Consumers didn’t used to be worried about the resale value of an EV, but Musk cutting prices made people feel like they owe $50,000 on their Tesla and now, it’s only worth $40,000,”

- The average price for a used EV stood at $30,904 in February, compared with $31,153 for a used gas car

- “Used car shoppers with a $31,000 budget have access to the majority of models today, regardless of drivetrain,”

EVs

OPINION - Musk’s misdirection to keep selling the growth story

- (electrek)

- Tesla is planning to lay off over 14,000 employees—more than 10% of its global workforce

- Electric vehicle sales have begun to stagnate amid a decline in demand and increased competition from Chinese carmakers.

- Elon Musk said the layoffs are part of cost-cutting measures as the company prepares for its next phase of growth.

- Two top executives at Tesla announced their departure: engineering executive Drew Baglino and policy and outreach executive Rohan Patel.

- Tesla posted its first year-over-year decline in quarterly sales since 2020.

- Report came after China’s BYD briefly overtook Tesla as the world’s top seller of battery electric vehicles last year

- Musk said Tesla would soon release a cheaper, $25K model rumored to compete with BYD.

- That plan has now reportedly been tabled, with Musk prioritizing the debut of a robotaxi fleet in August.

- Tesla is planning to lay off over 14,000 employees—more than 10% of its global workforce

OPINION - Cutting the bottom 10%

- (Seeking Alpha)

- Tesla confirms layoffs of more than 10% of its global workforce

- “there has been duplication of roles and job functions in certain areas.”

- “made the difficult decision to reduce our headcount by more than 10% globally.”

- “This will enable us to be lean, innovative and hungry for the next growth phase cycle.”

Commercial Space

OBSERATION - A new type of insurance risk for commercial space access.

- (Brief.News)

- ISS Debris Strikes Florida Home: Space Junk Legal Woes Mount

- On March 8, 2024, a 1.6-pound metal bracket from the ISS caused significant damage to a house in Naples, Florida.

- NASA identified the debris as part of a 5,800-pound cargo pallet of old batteries released in 2021, intended to burn up upon re-entry.

- Concerns have escalated regarding the risks of space debris as NASA investigates the re-entry survival of the object.

- Legal challenges emerge as parties work to determine financial responsibility for the damage caused by the space debris.