2024 Week 8

Notes, thoughts and observations - Compiled weekly

This week I note that, as Blake Millard illustrates in his newsletter, a massive shift in resources will result from record numbers of retirees. Blake cites several reasons for a 2.7 million uptick but stops short of speculating the impact. Personally, I agree with the notion that an increase in retirees will lead to more conservative investment strategies that could take some wind out of the stock market’s sales. Then again, everyone Gen X and younger continue to plow money into the stock market via 401(k)s, so who knows?

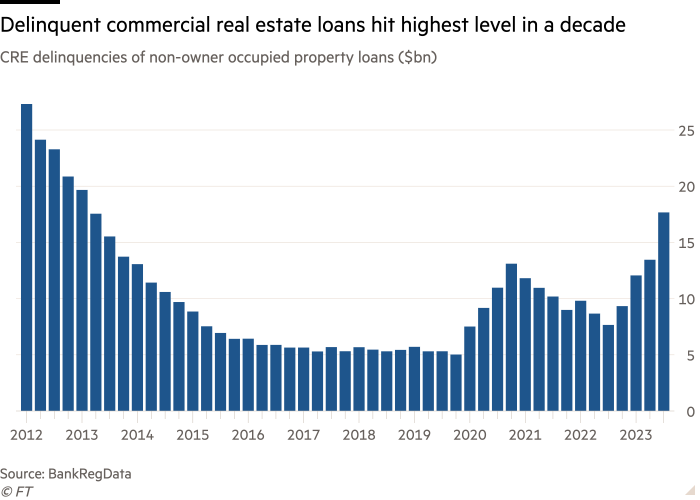

Gavekal, via Mauldin Econ’s “Over My Shoulder” provides confirmation that CRE is a real risk for regional banking, but not for the broader economy. We don’t really know how big the problem is because of lack of price transparency. Either way the CRE crisis could be bad for borrowers who rely on loans from regional banks.

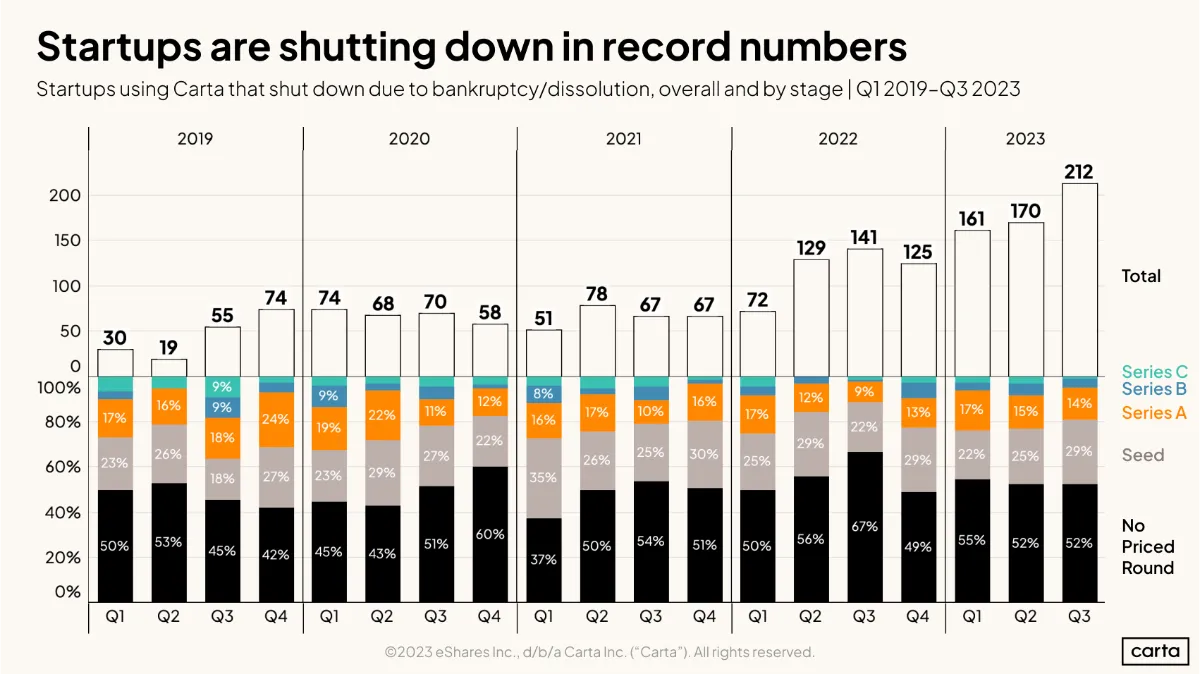

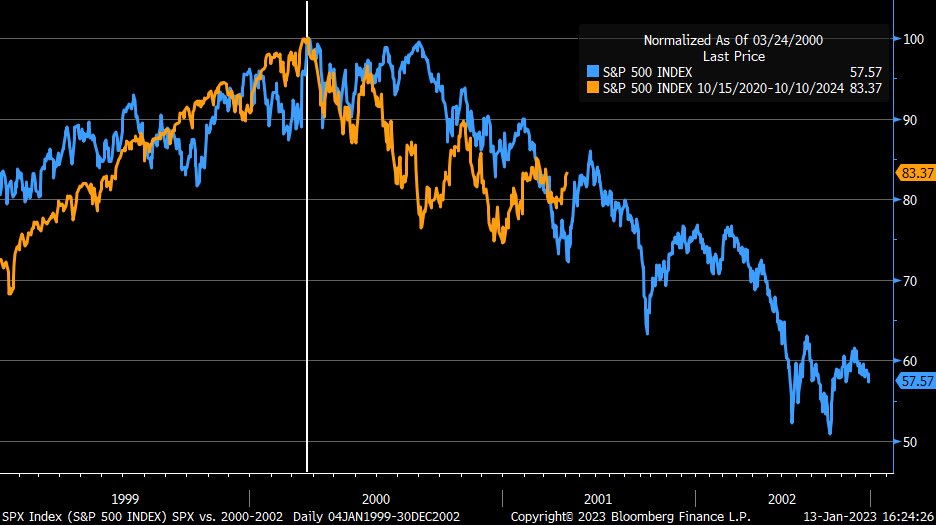

Nvidia reported earnings this week, but it couldn’t stop the obsession or comparisons between the stock and Cisco during the dot com bubble. The trend line is eerily similar, but the chip maker is different than the network hardware manufacturer. For starters Nvidia’s GPU chips are dominant in the market, though they could eventually be challenged in the next few years. There is truly no equivalent to Nvidia, and it would require a massive collapse in the AI industry to trigger the same sort of quick downfall.

Eerily similar, personally don’t think NVDA crashes unless massive bankruptcies by AI startups

Regarding globalization, China has two problems: rising labor costs and a shrinking workforce. But as Mauldin Econ notes productivity can bridge the gap, at least for a while. Compound this with financial troubles in the real estate sector and I think China will lose a lot of ground to other Asian nations, but still retain the lead. Long term the success of home-grown solutions will dictate China’s position in the global supply chain.

Finally, Walmart is at it again. After a failed attempt at creating its own streaming service, the retailer is trying to buy Vizio. If you recall Walmart abandoned its service in 2019 to focus on Vudu (purchased in 2010), only to sell it in 2020. So why does Walmart want to buy a TV company? Advertising, or at least that is the bet. I think this initiative is outside of Walmart’s core competencies.