2023 Week 48

Notes, thoughts and observations - Compiled weekly

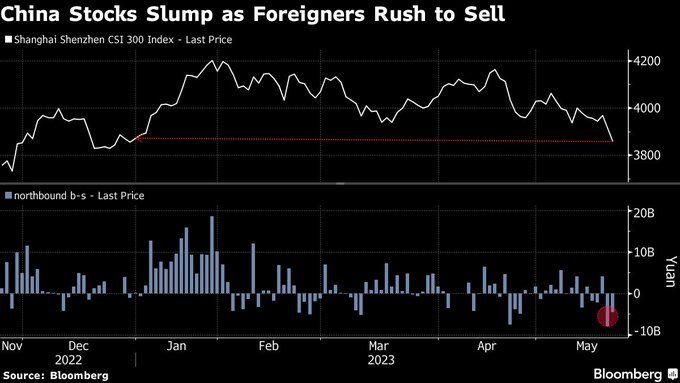

Where is the stock market going? If the yield curve and consumer spending is an indicator we could be headed for a recession. On the other hand, Black Friday card data says that spending may not be as weak as expected and the VIX indicates a new kind of bullishness not seen in a while. On thing is clear, sectors that performed well outperformed the S&P 500 by a significant amount.

Rent or buy? No not talking about a home, but rather machine learning cycles. Companies like Snowflake continue to grow amid high demand for Nvidia chips. Sometimes it makes sense to rent a server rather than rack your own hardware.

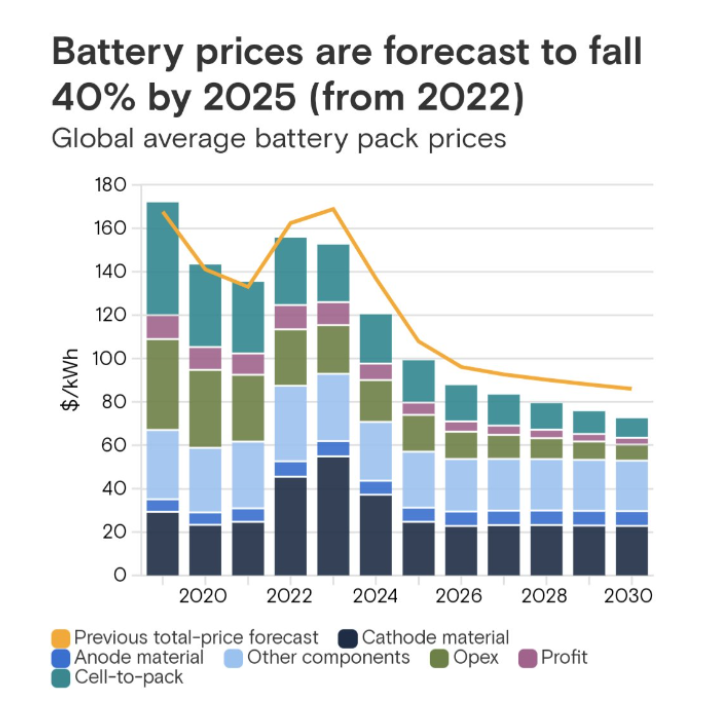

A couple of bright spots. First battery prices are expected to fall and newer technology will improve performance. Likewise, life extending technology like CRISPR gene editing is opening new possibilities in treatment. Finally, even though modular nuclear technology is a non-starter at the moment, the broader application of “hot rocks making steam” is still a benefit to reducing carbon output.

Anode and cathode material costs are important

TOPICS

- Consumer Credit

- Fed Rate

- Recession

- Battery Technology

- Cybersecurity

- Stock Market

- Life Extending Technology

- AI and ML

- Nuclear Power