2024 Week 12

Notes, thoughts and observations - Compiled weekly

I’m not sure why I note this every week, but the projected Fed rate cuts aren’t coming. By the Feds on definition, we have neither seen a decline in employment nor a decline in inflation. The latest PPI numbers support this. Yet somehow Wall Street is betting on rate cuts. At this point I’m just speculating on what type of tantrum the market will throw when reality is accepted.

Environmental concerns continue to top business headlines and new Federal emission regulations have everyone banking on a future sales benefit from more strict emission requirements. But sales data shows that consumers don’t want EVs. EV manufacturer Fisker is halting production and could be on the verge of bankruptcy. Meanwhile climate alarmism is once again pointing to ‘chartbusting’ extremes due to a 1.5-degree Celsius temperature increase. Bottom line is that climate alarmism didn’t work, and future efforts need to focus on mitigation strategies.

The world of semiconductors and machine learning continues to move at a brisk pace. Further investment in domestic semiconductors by the US will probably fuel an expansion and speculation similar to the solar industry under a similar Obama program. The trend around AI mergers and acquisitions continues with Apple acquiring DarwinAI and Microsoft scooping up Inflection AI. The overall trend is that Big Tech will be the big winners of AI.

TOPICS

- Inflation

- Labor Market

- Environment

- Climate Change

- Domestic Semiconductor

- Mergers and Acquisitions

- Cybersecurity

- AI and ML

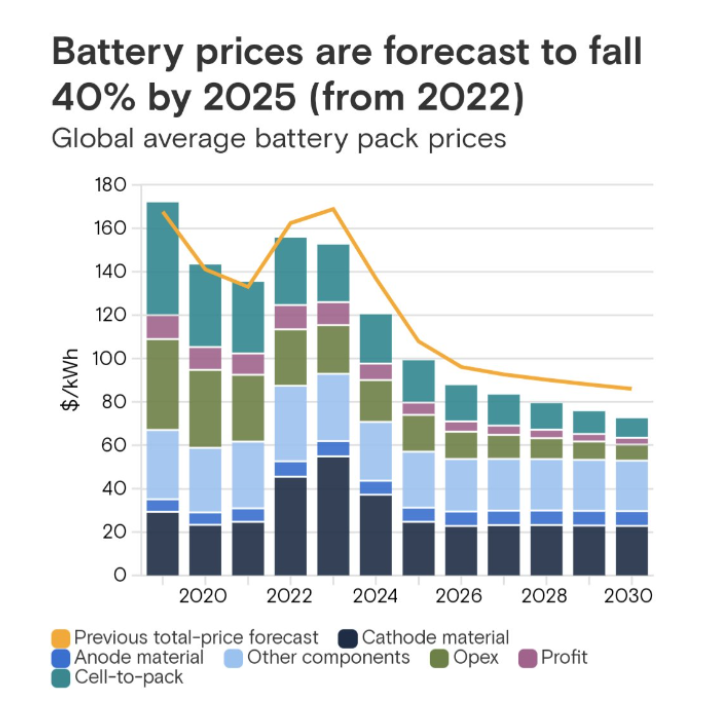

- EV Battery Technology