2024 Week 12

Notes, thoughts and observations - Compiled weekly

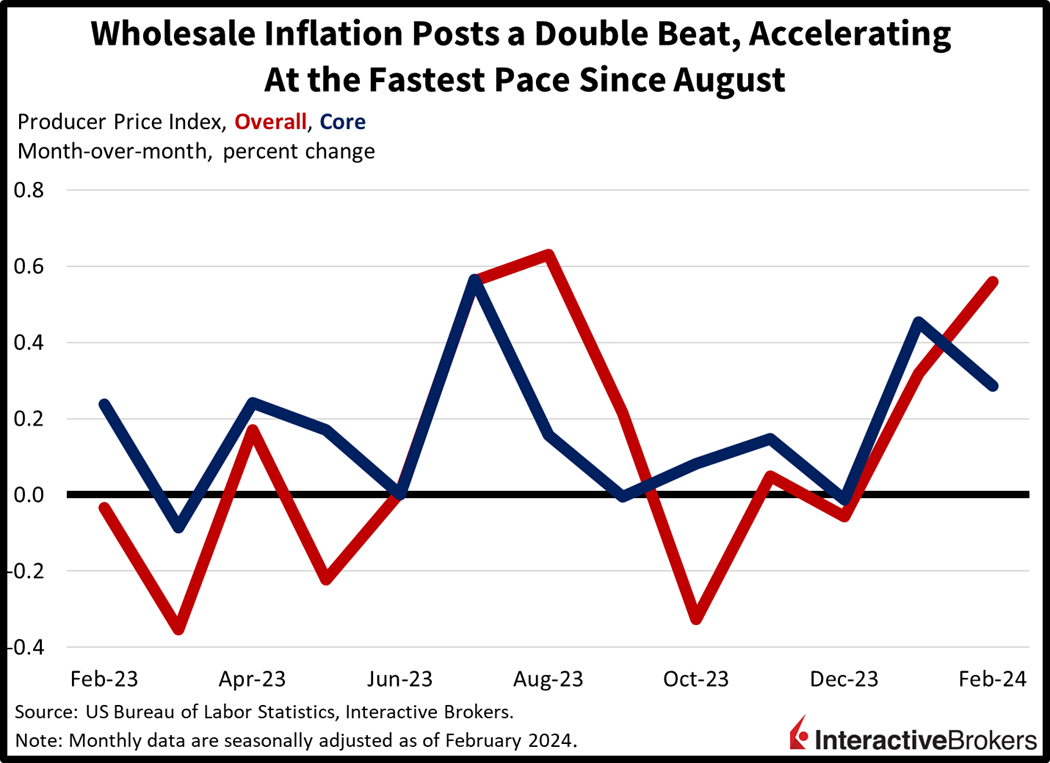

I’m not sure why I note this every week, but the projected Fed rate cuts aren’t coming. By the Feds on definition, we have neither seen a decline in employment nor a decline in inflation. The latest PPI numbers support this. Yet somehow Wall Street is betting on rate cuts. At this point I’m just speculating on what type of tantrum the market will throw when reality is accepted.

Environmental concerns continue to top business headlines and new Federal emission regulations have everyone banking on a future sales benefit from more strict emission requirements. But sales data shows that consumers don’t want EVs. EV manufacturer Fisker is halting production and could be on the verge of bankruptcy. Meanwhile climate alarmism is once again pointing to ‘chartbusting’ extremes due to a 1.5-degree Celsius temperature increase. Bottom line is that climate alarmism didn’t work, and future efforts need to focus on mitigation strategies.

The world of semiconductors and machine learning continues to move at a brisk pace. Further investment in domestic semiconductors by the US will probably fuel an expansion and speculation similar to the solar industry under a similar Obama program. The trend around AI mergers and acquisitions continues with Apple acquiring DarwinAI and Microsoft scooping up Inflection AI. The overall trend is that Big Tech will be the big winners of AI.

TOPICS

- Inflation

- Labor Market

- Environment

- Climate Change

- Domestic Semiconductor

- Mergers and Acquisitions

- Cybersecurity

- AI and ML

- EV Battery Technology

Inflation

OPINION - Rate cuts not coming

- (IBKR Campus)

- PPI Double Beat Brings Back Memories of Volcker, Jackson Hole

- Wholesale inflation data amidst this morning’s lower-than-expected unemployment claims are sending market players back to the drawing board as they reevaluate the path of potential Fed rate cuts

- Wholesale price gains were broad, with goods and commodities leading while services gained at more tempered levels. Energy, with a 4.4% increase, climbed the most followed by foods, with a gain of 1%

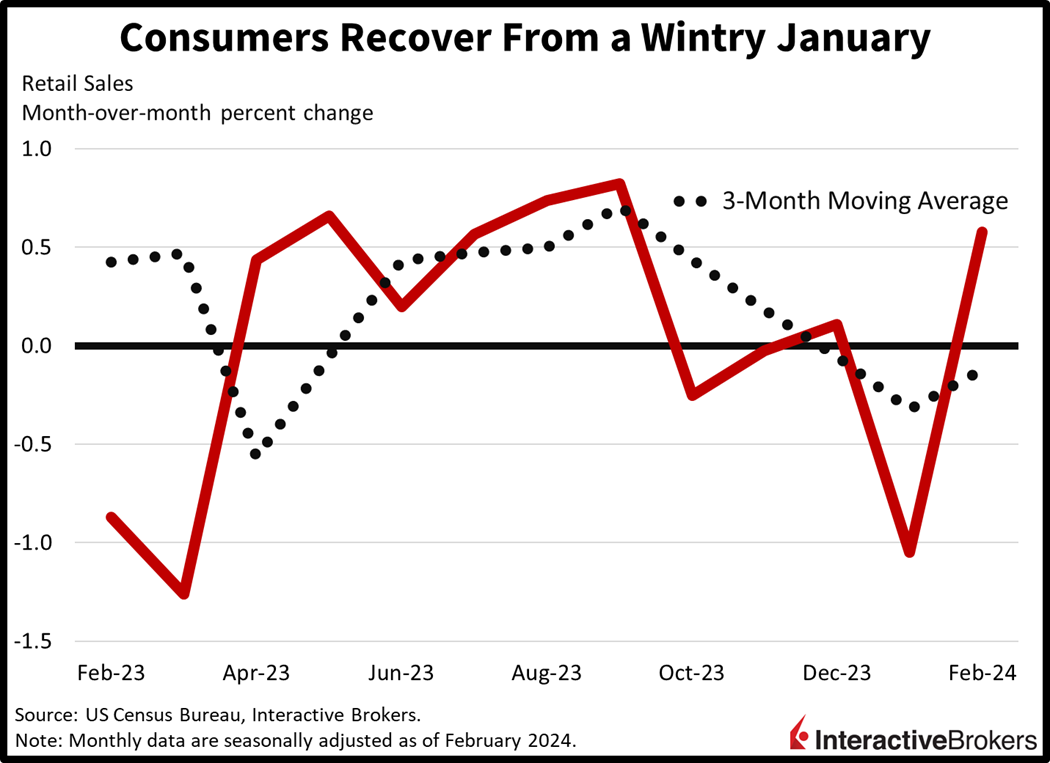

- Retail sales made a comeback last month as weather conditions improved, incentivizing consumers to go out and shop.

TRUTH “Consumer expectations for long-term inflation have risen”

- (Brief.News)

- U.S. Wholesale Prices Surge, Stoking Inflation Fears Amid Rate Hike Speculation

- Prices surged unexpectedly in February, with the PPI rising 1.6% over the last 12 months and 0.6% from the previous month, outpacing forecasts.

- Consumer expectations for long-term inflation have risen, with consumer prices seeing a 3.2% increase from the previous year, influenced by energy prices and other factors like airline fares and used vehicle costs.

Labor Market

OBSERVATION - Continued union activity

- (Seeking Alpha)

- Third time’s the charm? Volkswagen Tennessee autoworkers vote to unionize

- Filed a petition with the National Labor Relations Board that will allow a vote to join the United Auto Workers union

Environment

OPINION - Fisker is done, popping of the EV bubble

- (Seeking Alpha)

- Fisker is halting production for six weeks as the cash-strapped electric vehicle maker goes on overdrive trying to avoid bankruptcy by securing funds to keep its business running.

- Also secured a $150M financing commitment from an existing investor, contingent on conditions including filing its delayed 2023 annual report and continuing deal talks with a large automaker for a potential investment and North America manufacturing.

- Went public in 2020 through a SPAC deal, produced ~1,000 vehicles in 2024 through March 15, and delivered ~1,300 globally. It has ~4,700 vehicles in its inventory.

- “We overestimated EV demand and underestimated how difficult it would be for EV makers to grow production footprints,”

Climate Change

OPINION - Climate alarmism didn’t work, we need to focus on mitigation strategies now.

- ( CNBC)

- Earth on the brink of key warming threshold after year of ‘chart-busting’ extremes, researchers say]

- Latest annual “State of the Global Climate” report outlined how extreme weather events in 2023 wreaked havoc for millions of people across the globe

- “Never have we been so close (temporarily) to the 1.5° C lower limit of the Paris Agreement on climate change

- The 1.5 degrees Celsius level is widely recognized as an indicator of when climate impacts become increasingly harmful to people and the planet

- Confirmed 2023 as the hottest year on record and said the period from 2014 to 2023 also reflected the hottest 10-year period on record.

- Researchers said renewable capacity additions increased by nearly 50% in 2023 to a total of 510 gigawatts.

Domestic Semiconductor

OBSERVATION - Application specific chips are a growth area of semiconductors that don’t necessarily depend on the latest and greatest fab equipment

- (Investor Business Daily)

- Broadcom announced a new ASIC customer, its third to go with Meta and Alphabet, at its AI infrastructure conference.

- Broadcom said it expected to ship products to this new customer sometime in the next few months.

EXPECTATION - Government fueled expansion, similar to the green initiative bump from Obama

- (Tech Crunch)

- White House proposes up to $8.5B to fund Intel’s domestic chip manufacturing

- During a visit to Intel’s Ocotillo Campus in Chandler, Arizona.

- Projected to create approximately 20,000 construction jobs, 10,000 manufacturing jobs, and 3,000 jobs in Phoenix, with high average salaries.

- Intel’s initiative focuses on producing advanced chips for AI, quantum computing, and next-generation 6G communications.

- Competitors TSMC and Samsung are anticipated to reveal similar funding agreements with the U.S. government.

Mergers and Acquisitions

CSCO looking for a spark, shares down 7.84% over last 5 years; SPLK up 23.23% over past five, peaked in 2020

- (Seeking Alpha)

- Cisco said on Monday that it has completed its acquisition of Splunk, days after the $28B deal received approval from the European Commission.

- Splunk will no longer trade on the Nasdaq as a result of the merger.

- The deal was expected to close late in the first quarter or early in the second quarter of calendar year 2024.

- Market Cap: $26.43 billion

- Share Price: $156.90

- Cisco said on Monday that it has completed its acquisition of Splunk, days after the $28B deal received approval from the European Commission.

Cybersecurity

OPINION - Long term success and probably market beating performance if stock valuation is good (Zscaler probably a better buy at this point)

- (Seeking Alpha)

- CrowdStrike and Zscaler are seen as the two cybersecurity firms best positioned to benefit from an increase in spending after the recent string of hacks on healthcare companies

- In February, United Healthcare subsidiary Change Healthcare was hit with a cyberattack that resulted in the cash flows of roughly 80% of U.S. hospitals being impacted.

- In light of the Change Healthcare hack the U.S. appears to be ready and willing to increase cybersecurity spending

- The Biden administration also requested a 10% year-over-year increase in its fiscal 2025 budget for cybersecurity spending

AI and ML

OBSERVATION - The logical outcome is that Big Tech businesses are the biggest winners in AI

- (Pragmatic Engineer)

- Cofounders Mustafa Suleyman and Karén Simonyan are leaving Inflection AI to join Microsoft.

- Microsoft pays out the investors of Inflection AI

- Inflection AI announced it will now host its model on Microsoft Azure

- Acquiring Inflection AI could be worth it for Microsoft just for the GPUs, alone

- AI companies are also having trouble getting users to pay

- One thing that could speed up consolidation is that unfortunate fact that users seem reluctant to pay for AI tools.

OPINION - “This time it’s different.. LOL”

- (Seeking Alpha)

- Is AI a bubble? Yes, says Citi. But it could last.

- The area of the market that is most impacted by the rise of AI is semiconductors, with stalwarts like Nvidia (NASDAQ:NVDA) and AMD (NASDAQ:AMD) seeing massive jumps in valuations in recent memory.

- Danely believes that 2024 is more similar to 1999 in that valuations are likely to keep expanding. Valuations of high flying tech companies did not “come apart until late 2000,” he said, suggesting stocks have a little more room to run.

- “this is not a bubble but instead the start of a 4th Industrial Revolution now on the doorstep that will have major growth ramifications for the tech sector led by the software/use case phase in motion,” Wedbush Securities

OBSERVATION - M&A around AI trend

- (Seeking Alpha)

- Apple acquires Canadian startup DarwinAI as AI arms race accelerates: report

- Also hired Alexander Wong, a researcher at the University of Waterloo who helped build DarwinAI, as a director of its AI group

- DarwinAI has worked with a growing list of major companies on AI projects dating back to at least 2020, including Audi, Intel (INTC), Nvidia (NVDA), Honeywell (HON) and Lockheed Martin (LMT).

- “DarwinAI integrates cutting edge technology to reduce the size of deep neural networks while increasing efficiency. The company also facilitates the ability to understand why a network makes the decisions it does,” reads a description of the company on Intel’s website.

EV Battery Technology

- (IEEE)

- Who Will Free EV Motors from the Rare Earth Monopoly? A materials breakthrough makes GE Aerospace a contender

- A race is underway to build the ideal, mean-and-green motor

- At least as powerful, reliable, and lightweight as today’s industry standard rare-earth permanent magnet synchronous motor

- A sleeper option, synchronous reluctance motors, is getting a surge of interest, thanks to materials-science breakthroughs at GE Aerospace