2023 Week 36

Notes, thoughts and observations - Compiled weekly

More bad news for residential real estate; profitability in focus; national debt balloons; weird energy ideas in UK and sticky gas prices; platform consolidation; econ cycle nears end, what’s next;

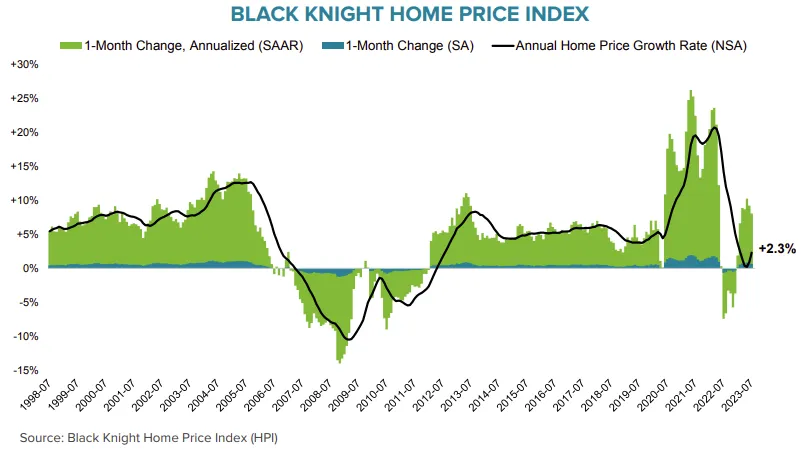

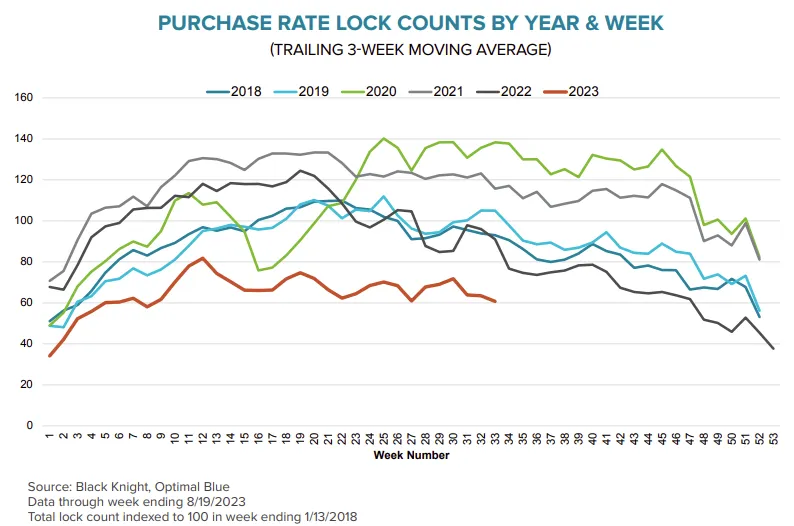

The residential real estate market continues to suffer from perceived higher interest rates. Historically not above average, but relatively higher given the long low/no interest rates of recent memory. Housing supply continues to prop up prices which means home sales will certainly slow.

As fundraising and investment has become harder to find companies are now focused on improving profitability. AI companies are not alone, and the once hot tech sector is in the same boat raising prices and cutting costs. This will put pressure on SaaS contracts and employment and belt tightening continues.

The US debt continues to climb and will become prohibitive at some point due to higher interest rates. Meanwhile the UK mulls the idea of natural gas-powered heat pumps which is a weird idea given the Russian embargo and supply shortages. Oil supply tightening will continue to keep fuel prices high

Finally, streaming platforms continue to consolidate as Comcast looks for an exit on Hulu. It is worth noting that Comcast and Disney are still fighting over broadcasting contracts. And is the cycle nearly done? Whether you believe the economy was in recession the historical indicators say we’re nearing the end.

TOPICS

Real Estate

OPINION - I maintain that higher rates will immobilize the residential housing market.

- (Calculated Risk)

- Black Knight Mortgage Monitor: Purchase Rate Locks “are now running 39% below pre-pandemic levels”

- Black Knight: As Interest Rates Hit 22-Year Highs, 51% of Homebuyers Face $2,000+ Monthly Mortgage Payments; Nearly a Quarter Face $3,000 Payments or More

- Black Knight on purchase rate locks:

- Purchase locks are now running 39% below pre-pandemic levels – among the steepest deficits we’ve seen so far this year

OPINION - A supply issue more so than anything

- (Seeking Alpha)

- U.S. home prices rise by most in 10 months amid inventory shortage - Redfin

- The median home-sale price climbed 5% to $380K from a year before during the four weeks ended August 27

- The inventory shortage “is causing competition for desirable homes despite high mortgage rates and a relatively small pool of buyers.”

Profitability

OPINION - Profitability will be a struggle/focus for most tech companies. It will shake out the strong from the weak

- (Seeking Alpha)

- C3.ai says will not be profitable in Q4 of fiscal year 2024, stock slips ~6% after hours

- “After careful consideration with our leadership and our marketing partners, we have made the decision to invest in lead generation, branding, market awareness, and customer success related to our Generative AI solutions,”

- As a result of this decision, C3.ai (AI) said it does not expect to be non-GAAP profitable in Q4 FY 2024, though it still anticipates being cash positive in that period and in FY 2025.

Debt

OPINION - A crisis at some point

- (The Dispatch)

- The U.S. federal budget deficit is expected to double to $2 trillion this fiscal year, according to the Committee for a Responsible Federal Budget. In addition to larger interest payments on debt already accrued, the government is also bringing in less revenue this fiscal year—which ends September 30—in part due to a slumping stock market that reduced revenue from capital gains taxes.

Energy

OBSERVATION - Would create more demand for natural gas, which is severely impacted by the Ukraine war

- (Economist)

- Propane-powered heat pumps are greener

OPINION - Higher fuel prices will stick around

- (Seeking Alpha)

- Commodity Roundup: Oil trades above $90/bbl; precious metals ease

- “The implied tightening that goes with this longer than expected period is likely to support, potentially not raise, prices post the peak summer demand season and into the refinery maintenance period which sees crude demand drop,” Saxo Bank’s Ole Hansen said in a note.

M and A

OBSERVATION - Streaming platform consolidation continues (one of my 2023 Q3 prediction/watch items)

- (Seeking Alpha)

- Comcast gains as CEO says Hulu sales process will start Sept. 30

- The process was originally set to start in January.

- Disney (NYSE:DIS) holds a 67% stake in Hulu after the buyouts of previous partners Fox and Time Warner, while Comcast (CMCSA) holds the other third

- Walt Disney CEO Bob Iger in July confirmed that Disney’s intent is to buy Comcast (CMCSA) out of its remaining stake in Hulu, with an eye toward combining Hulu and Disney+.

- In December, NBCUniversal chief Jeff Shell said he saw “no indications that anything else is going to happen other than Disney writing us a big check” for Hulu in 2024.

- Comcast gains as CEO says Hulu sales process will start Sept. 30

Stock Market

OPINION - This cycle is nearly done; what comes next?

- (Sandbox Daily)

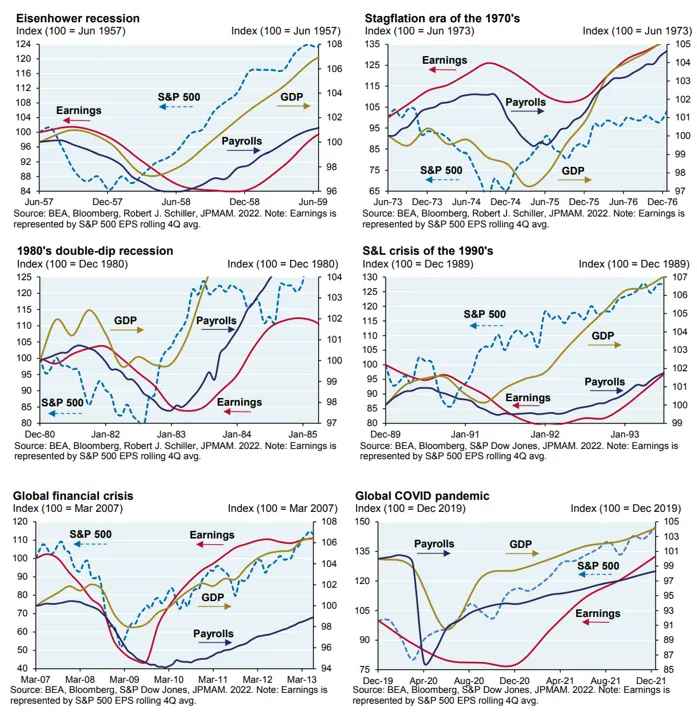

- Stocks usually bottom before earnings-per-share growth (EPS), jobs, and gross domestic product (GDP) start to improve.

- The stock market is a forward-looking mechanism in which stocks sniff out better times and rally in the face of bad news.

- Last year stocks took their drubbing during the bear market, bottoming in June and completing the retest in October.

- U.S. GDP dipped negative for two consecutive quarters in the 1st half of 2022

- The earnings valley has lasted three consecutive quarters (4Q22 – 2Q23).

- The surprisingly unshakable labor market, is all that remains.