Category:

Business

2023 Week 8

Notes, thoughts and observations - Compiled weekly

TOPICS

Only eight endowments in the entire country made money on a nominal basis last year and zero

Energy

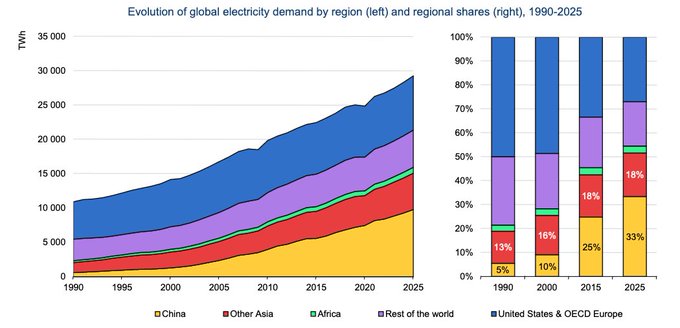

OPINION - Only way this declines is if China’s economy contracts

- (BrianGitt)

- China will consume 33% of global electricity by 2025. Currently, 63% of its electricity comes from coal. It built more new coal power plants in 2021 than the rest of the world combined.

OPINION - Will see a resurgence of oil & gas exploration in the next decade

- (BrianGitt)

- US energy companies are making plans to go public at the fastest rate in 6 years. Finally, investors are recovering from a hangover of debt-fuelled drilling that racked up huge losses. Oil & gas will play an important role in the energy system for decades to come.

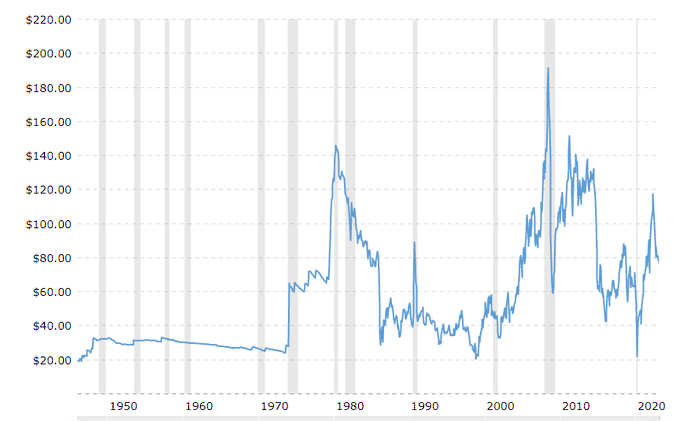

TAKEAWAY - Despite the spikes, best way to visual how $80 per barrel is priced into the oil market.

- (chigrl)

- Fun chart - Crude oil prices since 1946 adjusted for inflation (source: macrotrends)

Real Estate

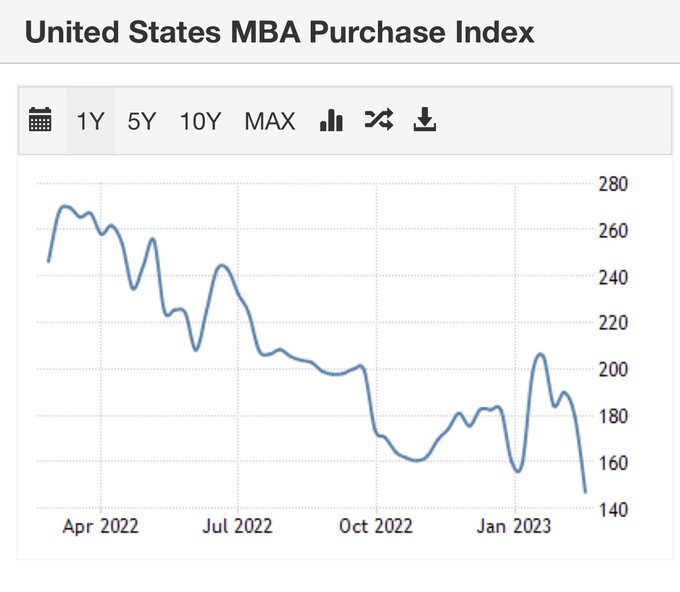

OPINION - Housing has a long way (down) to go, but could take years. Maybe next cycle?

- (EPBResearch) ::

- A housing “bottom” was a big part of the soft landing story. The confluence of longer leading variables never picked up off decade lows so it was never a sustainable bottom. Another economic headfake.

- New low. No, housing has not bottomed.

- US MBA Mortgage Applications Feb 17: -13.3% (prev -7.7%) - US MBA 30-Yr Mortgage Rate Feb 17: 6.62% (prev 6.39%)

OPINION - This is havoc for real estate availability, seniors borrowing against their property means they are STUCK and won’t likely downsize.

- (DiMartinoBooth)

- Perhaps the most salient chart I’ve seen all day.

- Econimica - survey sez…# of 65+yr/olds who outright own their home is falling pretty fast.

Stock Market

OBSERVATION - Bold opinion, let’s see how this plays out

- (biancoresearch) ::

- Andy’s chart is crude, but I think it is accurate. QT until the S&P 500 falls below ~2,500 (down ~35% from here), then we can start talking about QE.

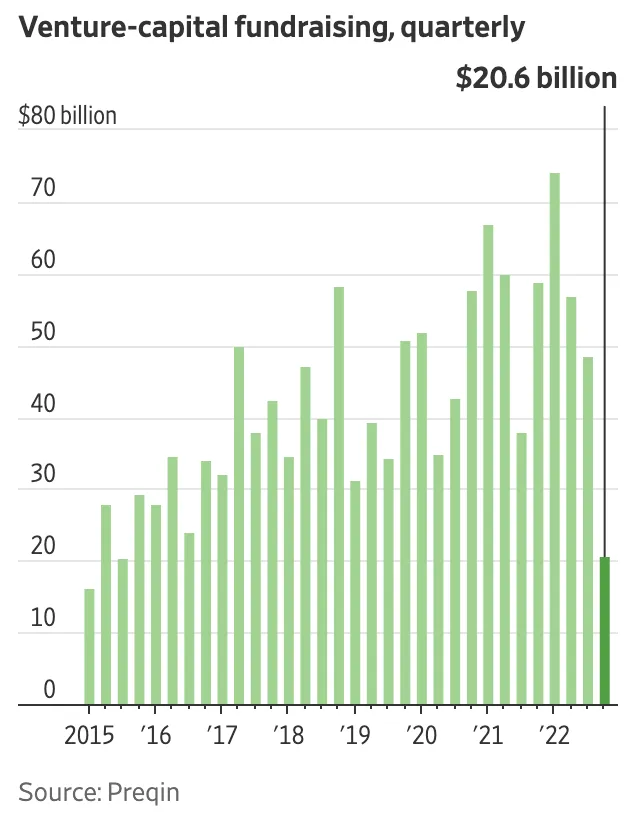

OPINION - Will be a problem for firms that need to raise, could cause down rounds or liquidation preference

- (The Pomp Letter)

- Funding for venture capital funds has fallen off a cliff

- One cause of this nine-year low in venture fundraising is LP’s risk aversion at the current moment, but a larger cause is likely to be fewer venture funds trying to raise capital during tumultuous times.

- “Venture firms raised $20.6 billion in new funds in the fourth quarter. That was a 65% drop from the year-earlier quarter and the lowest fourth-quarter amount since 2013, according to data firm Preqin Ltd.,"

- Funding for venture capital funds has fallen off a cliff

- 2022 results for university endowment financial returns has been published and the picture is not pretty.

- Only eight endowments in the entire country made money on a nominal basis last year and zero — yes, you read that right….zero! — endowments made any profit on a real return basis.