2023 Week 41

Notes, thoughts and observations - Compiled weekly

Commercial real estate seems to be stabilizing, while the housing market has gone cold. Meanwhile in China, Country Garden issues a dire warning and has missed loan payments. This could unlock a fresh hell of financial worries.

The speculative bubble in use cars continues to unwind and is shaking out weak companies like Shift Technologies who filed for Chapter 11 this week. Meanwhile Tesla continues to lower prices to both chase higher volumes and to also compete with BYD.

As soon as the Fed stopped raising rates everyone began speculating when rate cuts would begin. Some think higher for longer and others believe that history indicates cuts sooner. Either way a rate cut will be a temporary boost for borrowing. Long term, near-zero rates are gone, and the economy needs to adjust its risk-reward equation.

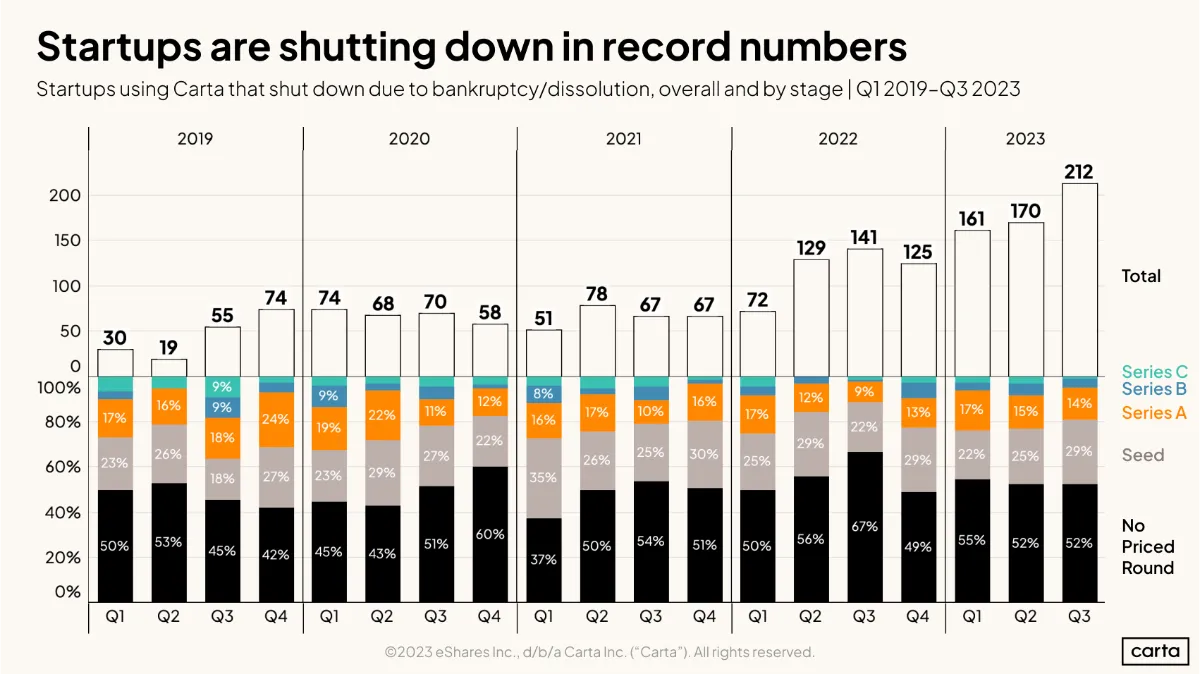

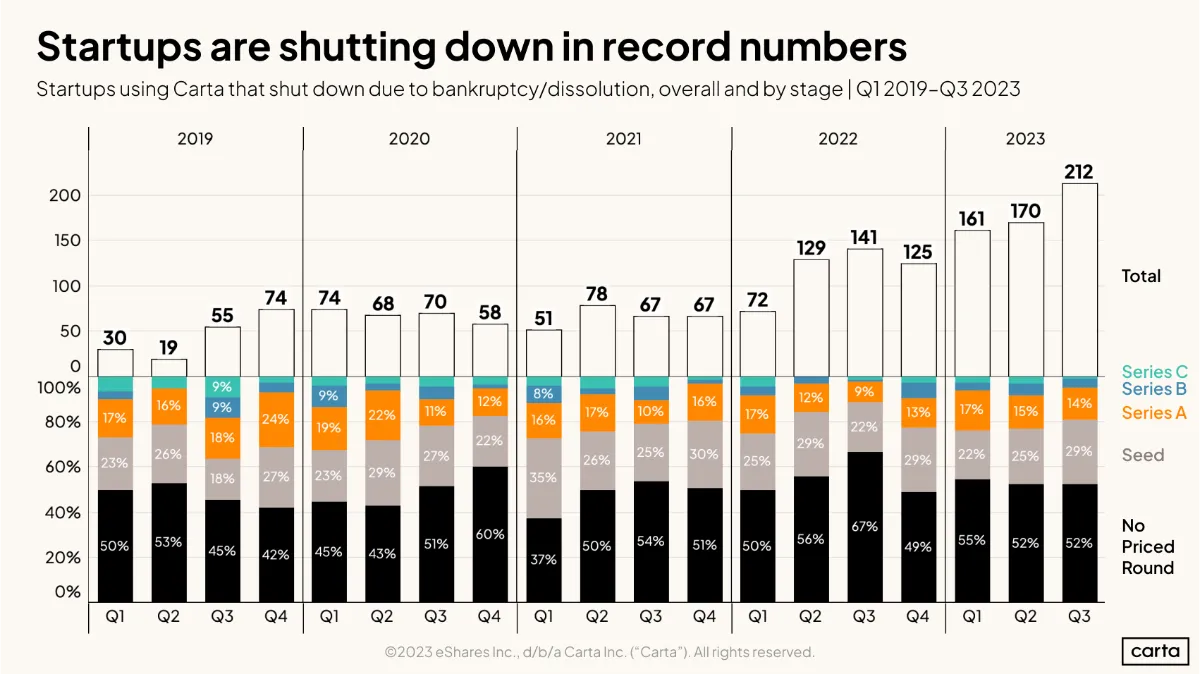

Profitability and debt reduction among companies is a high priority. Rising rates will ensure that weak and heavily indebted companies meet an end. Likewise high valued scaleups like Airtable need to mind the bottom line and show significant revenue to justify their valuations. All in all, the number of shutdown startups is rising as companies begin running out of money and are unable to raise.

Running out of money and unable to raise

TOPICS

Real Estate

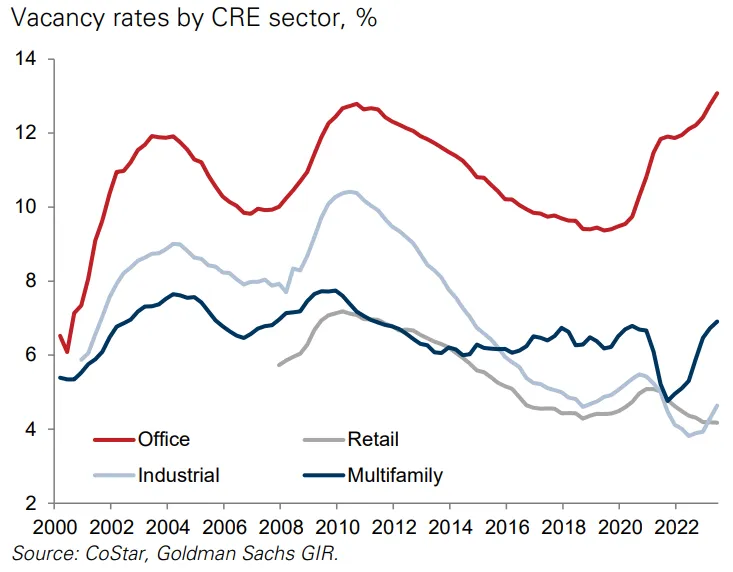

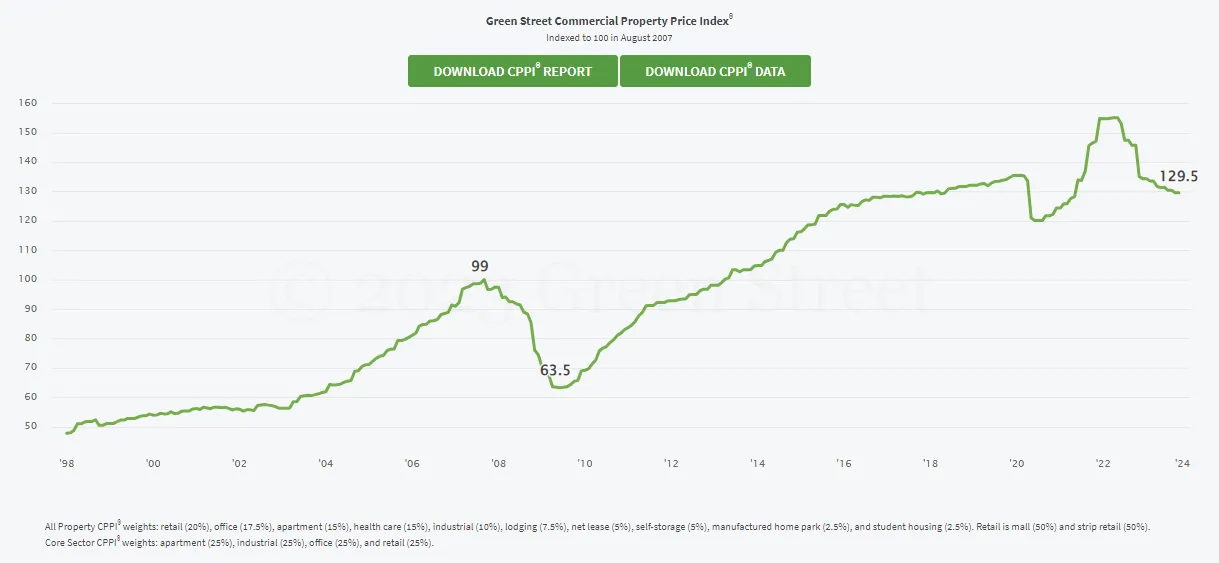

OBSERVATION - Commercial seems to be stabilizing

- (Sandbox Daily)

- Commercial real estate prices stabilizing, for now

- According to the Green Street Commercial Property Price Index, prices are down by 11% over the past year.

- small improvement from the summer when the index was in a 16% drawdown

- Over the past 6 months, the change in commercial property values is only down 1.5%.

- Vacancy rates are ticking higher across multiple sectors, with office vacancies above 25-year highs.

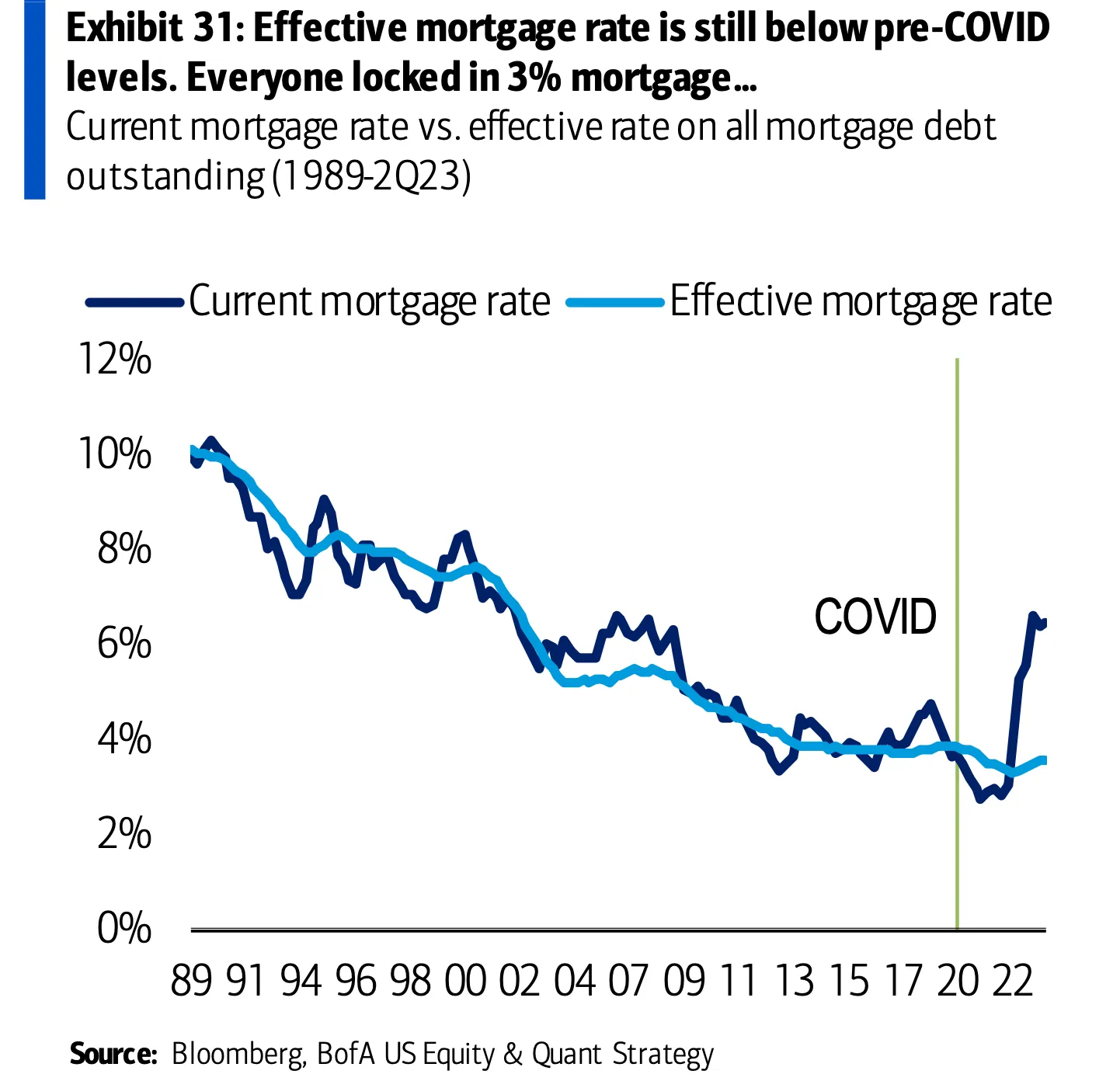

The U.S. housing market has gone cold 🥶

- (TKer)

- Mortgage rates continue to rise

- According to Freddie Mac, the average 30-year fixed-rate mortgage rose to 7.49%, the highest level since December 2000

- Remember, this is the market rate. Most borrowers borrowed when rates were much lower, and so the effective average rate among all outstanding borrowers remains low.

- Mortgage rates continue to rise

Automotive

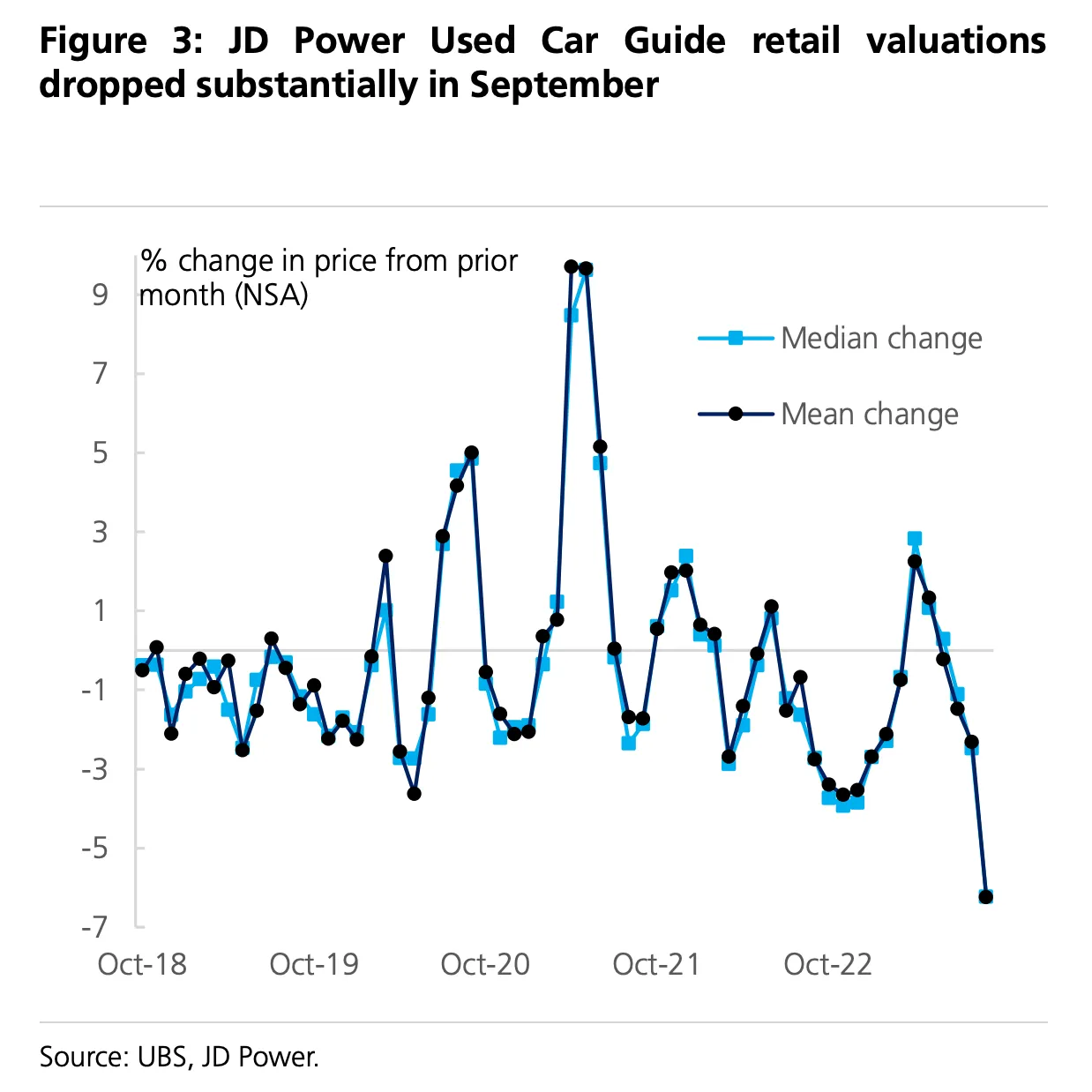

OPINION - Speculative bubble in unwinding, how will it hurt CarMax who overpaid for many vehicles?

- (TKer)

- JD Power Used Car Guide retail valuations dropped substantially in September.

OPINION - Tesla proactive against risk of lower cost EVs from China

- (CNBC)

- Tesla cut the price of some Model 3 and Model Y versions in the U.S. after the company reported third-quarter deliveries that missed market expectations.

- The starting price for the Model 3 is listed at $38,990 on Tesla’s website, down from $40,240 previously.

- The latest round of price cuts comes just days after Tesla reported third-quarter deliveries of 435,059 vehicles, missing analyst expectations and marking a decline from the previous quarter.

- Elon Musk, CEO of Tesla, has made no secret of the carmaker’s desire to chase higher volume over bigger margins this year.

Bankruptcy

OBSERVATION - Likely outcome, 34% layoff was a last ditch attempt to save business

- (Seeking Alpha)

- Shift Technologies intends to file a voluntary petition for relief under Chapter 11 of the U.S. Bankruptcy Code in the United States Bankruptcy Court.

- In July 2023, Shift terminated 34% of workforce, ended investment into dealer marketplace business

Fed Rate

OPINION - Signaling higher for longer, no pivot in sight; but what does history tell us?

- (Seeking Alpha)

- The bulk of Federal Reserve officials favored keeping rates unchanged at 5.25%-5.50% at the September 19-20 meeting

- Policymakers wanted rates to be kept sufficiently restrictive to achieve the central bank’s price-stability mandate

- Fed minutes reflecting a shift away from focusing on incremental rate hikes and more toward keep restrictive policy for some time

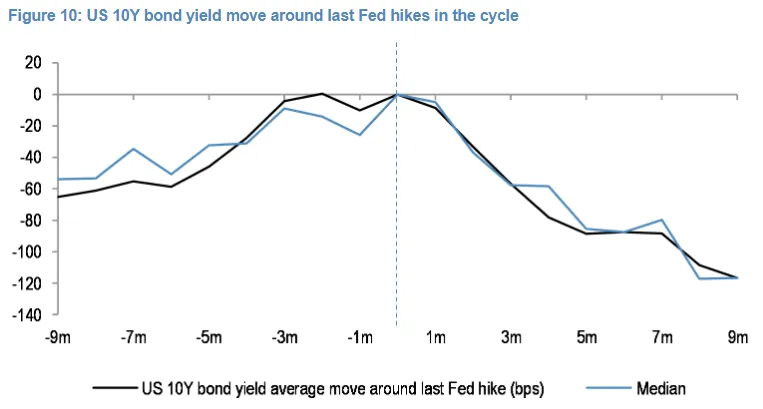

OPINION - Rate cuts are just around the corner

- (Sandbox Daily)

- Fed cuts rates rather quickly following that final hike, down over 50 bps after 3 months and 100 bps after 8 months

- Yields at present are trading much above the inflation forwards and above the levels of economic activity, with growth at risk of softening post the strong Q3 prints.

“Should all this change your investment playbook?”

- (Global Macro Update)

- Another thing to consider is why bond yields are rising. There are several theories, but here’s one contributing factor that deserves more attention:

- This is the US House of Representatives. Regardless of your political persuasion, ask yourself… Does this group inspire confidence? Enough confidence that you’d want to invest with them at near-zero rates?

- Another thing to consider is why bond yields are rising. There are several theories, but here’s one contributing factor that deserves more attention:

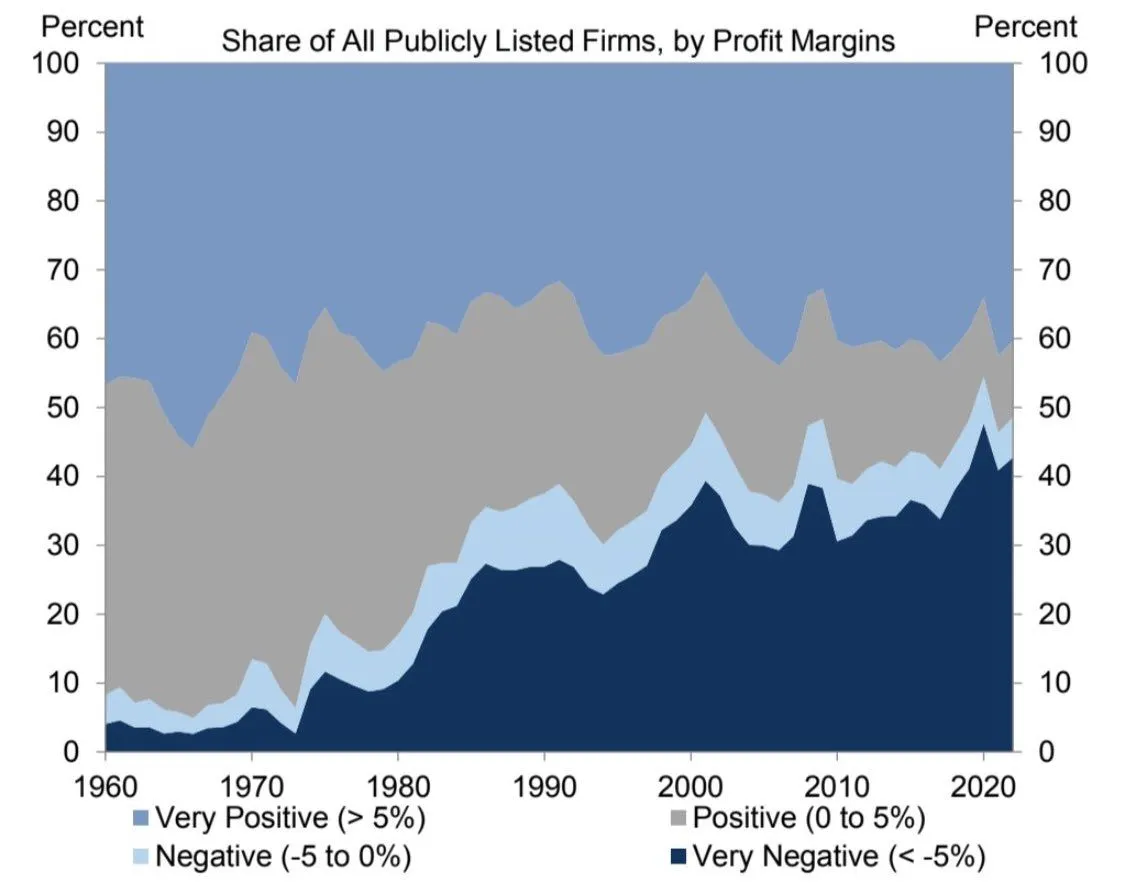

Profitability

OPINION - Long overdue shake out with minimal economic impacts

- (Sandbox Daily) ::

- Almost half of publicly listed U.S. corporations have negative profit margins, with the number of unprofitable firms having risen each decade since the 1960s.

- Been able to survive in artificially low interest rates and ample liquidity environment.

- In respect to market risk contagion, their share of overall revenues remains economically insignificant at just 10%.

Corporate Debt

OBSERVATION - More Chinese real estate worries, could spark a fresh round of financing concern

- (Wall Street Breakfast)

- Country Garden warns of potential debt restructuring and tight liquidity position, causing stock to drop 9.5%.

- Country Garden on Tuesday warned it may not meet all of its offshore debt obligations and could be in for debt restructuring.

- Country Garden’s Hong Kong-listed shares dropped 9.5% on the news.

- China’s largest private property developer, sales have been under “remarkable pressure,” with its September sales down 80.7% Y/Y at ~RMB 6.17B ($860.5M).

- As of Tuesday, the cash-strapped company failed to make a HK$470M (~$60.1M) loan payment.

- Also missed coupon payments on some dollar bonds since last month.

- Country Garden warns of potential debt restructuring and tight liquidity position, causing stock to drop 9.5%.

Stock Market

OBSERVATION - It’s all about revenue

- (The Pulse)

- Airtable announced a 27% layoff, and that it is shifting focus to enterprise customers.

- Previously let go of around 25% of staff in December 2022, meaning that in less than a year Airtable has let go of around half of employees.

- The unfortunate reality for scaleups valued at billions of dollars is that they need to show significant revenue to justify their valuations.

- For Airtable to be valued at $11B, it would need to earn at least $1B in revenue, perhaps more.

- Airtable announced a 27% layoff, and that it is shifting focus to enterprise customers.

OBSERVATION - Startups running out of money and unable to raise

- (The Pulse)

- Startup shutdown stats, from data on Carta’s platform. Data source: Carta

- 543 startups using Carta’s platform closed up shop in the first 9 months of this year