Category:

Business

2023 Week 25

Notes, thoughts and observations - Compiled weekly

An interesting trend in household mobility due to an interest rate driven and still stalled real estate market. Contraditions abound between an inverted yield curve and a surging S&P 500. But the greatest contradiction is in the acceleration of fossil fuels as emerging economies ramp up energy needs.

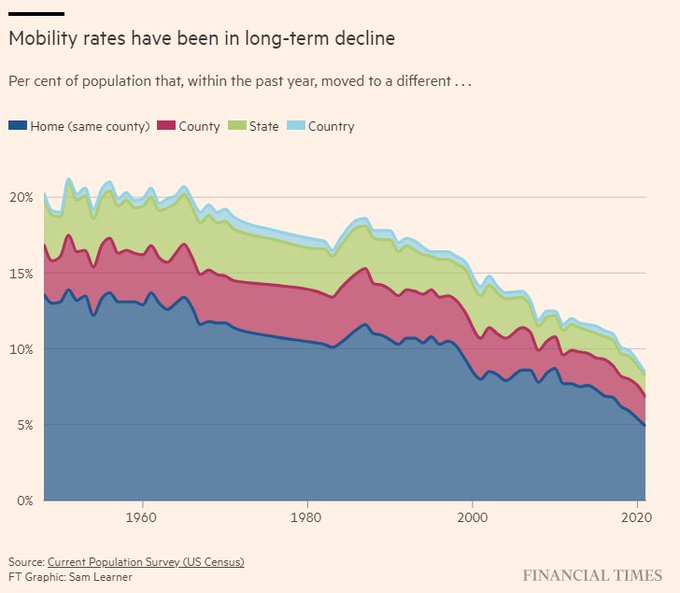

Americans are less willing to move

TOPICS

Real Estate

OBSERVATION - Interesting trend, driven by interest rates?

- (LizAnnSonders)

- Staying put: Americans are less willing to move per latest update from @uscensusbureau … thru 2021, American mobility rate fell to record low; exact figures vary by survey, but citizens are moving at roughly half rate they were in middle of 20th century

Energy

OPINION - Look past the bluster, green energy shift is a long way off

- (BrianGitt)

- Contrary to headlines we’re NOT transitioning away from fossil fuels. Harnessing new energy sources did not replace the energy sources we used before. We burn more wood today than in 1800 when it powered 100% of society. The world will use more fossil fuels in 2050 than today.

Recession

OBSERVATION - Massive yield curve inversion.. portends future troubles

- (Seeking Alpha)

- The closely-watched yield curve inversion on Tuesday widened to a four-decade high, reaching 97 basis points for the 2Y10Y

Stock Market

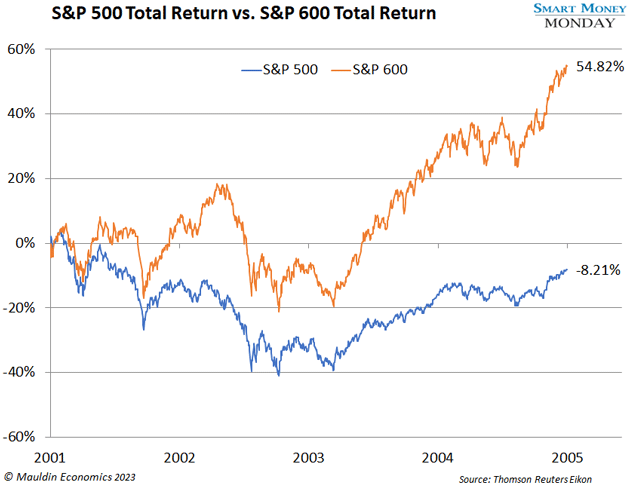

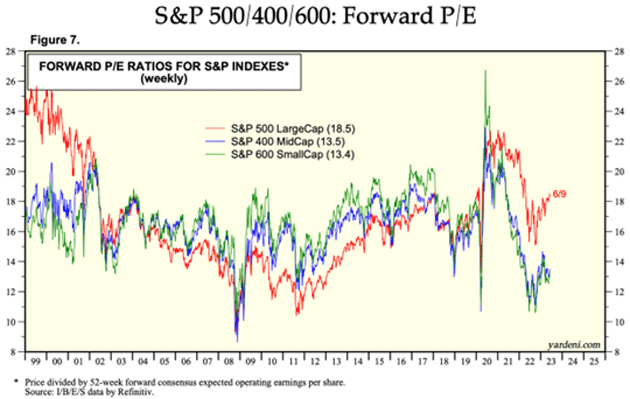

OBSERVATION - Big cap topped out for this cycle, everyone pitching small cap

- (Mauldin Econ)

- Small Caps Are Starting to Work—and We’re Likely Still Early

- Small caps are still cheap—on both a relative and absolute basis.

- Following the dot-com bust, small caps outperformed large caps in a dramatic fashion:

- Small Caps Are Starting to Work—and We’re Likely Still Early