Category:

Business

2023 Week 11

Notes, thoughts and observations - Compiled weekly

TOPICS

Why was everyone yelling on Twitter this week!?

Special Edition

I created my first tweet thread.. I feel like a silicon valley VC or tv-star economist 🙃

- (brianwaustin) - As I mentioned over the weekend:🤡s will be revealed. https://world.hey.com/brian.austin/sunday-bank-run-fraud-the-real-sbf-d80b4f57 #economy #financial

- I’m not a speculative investor, but I’ve seen enough of this clown car advice on social to say “I told you so”. So-called experts hocking intrinsically worthless assets, claiming that it only goes up, and giving folks FOMO enough to throw common sense out the window.

- On the flip side you have historically low interest rates causing everyone to take on too much risk and saying dumb stuff like “debt doesn’t matter”.

- Love or hate capitalism, but the rules haven’t changed. I have no sympathy for the institutions involved, the hack YouTubers and TikTok gurus who shiested peoples money with fraud.

- My heart goes out to anyone who go caught up in crypto, NFTs, or trusted a bank with your money. We as a nation need to do more to protect consumers, particularly of financial products and services.

- We also need to demand accountability of our elected officials who are supposed to be looking out for us, but are secretly trading against us. /rant

Note: Unusual Whales has a entire page devoted to Political Trading

Financial

OBSERVATION - SVB chaos, so we memed..

Energy

OPINION - “Conventional wisdom” in oil and gas has us believe that we’re at Peak OiI except the price is falling again

- (Sandbox Daily) Crude oil crashes

- Crude oil traded below $70/barrel this morning for the 1st time since December 2021. The commodity is now down 47% from last year’s peak of $130/barrel.

Source: Charlie Bilello

OPINION - The literally dirty little secret is that developing nations rely on fossil fuels during industrialization

- (chigrl) :: “It is all about energy security right now. It is every country for themselves.”

- If you missed this here is a highlight:

- China relied on coal to generate 56.2% of its electricity last year, an increase over 2020 and 2021

- Oil 19.5%

- Wind 4%

- Solar 2%

- Putting this in terms of terrawatt hours

- 43.5K terrawatt hours = total consumption

- 24,000 coal

- 856 solar

- 1720 wind

- China emitted over 27% of the world’s greenhouse gases according to the Global Carbon Project that tacks global data, exceeding all developed nations combined.

- If you missed this here is a highlight:

Inflation

OBSERVATATION - Supply & Demand, talked to many Gen Z that is deferring college or choosing to start a business instead

- (Clips that Matter) College inflation seems to be on hold

- Prices for college tuition and fees increased 4.7 percent from February 2020 to February 2023. This increase was less than the increase of 15.7 percent in prices for all items over the same period.

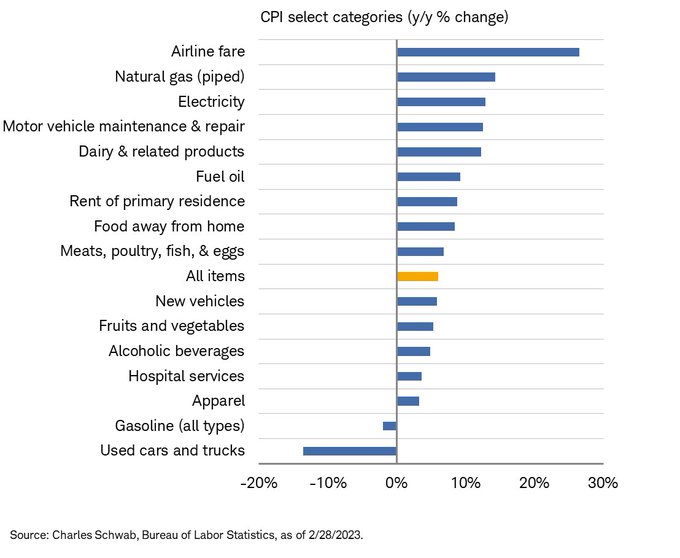

TAKEAWAY - Natural gas not surprising, auto repair maybe because of supply chain? Airfare b/c it’s fuel intensive

- (LizAnnSonders) Airfare on top; used cars/trucks on bottom