2022 Week 36

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

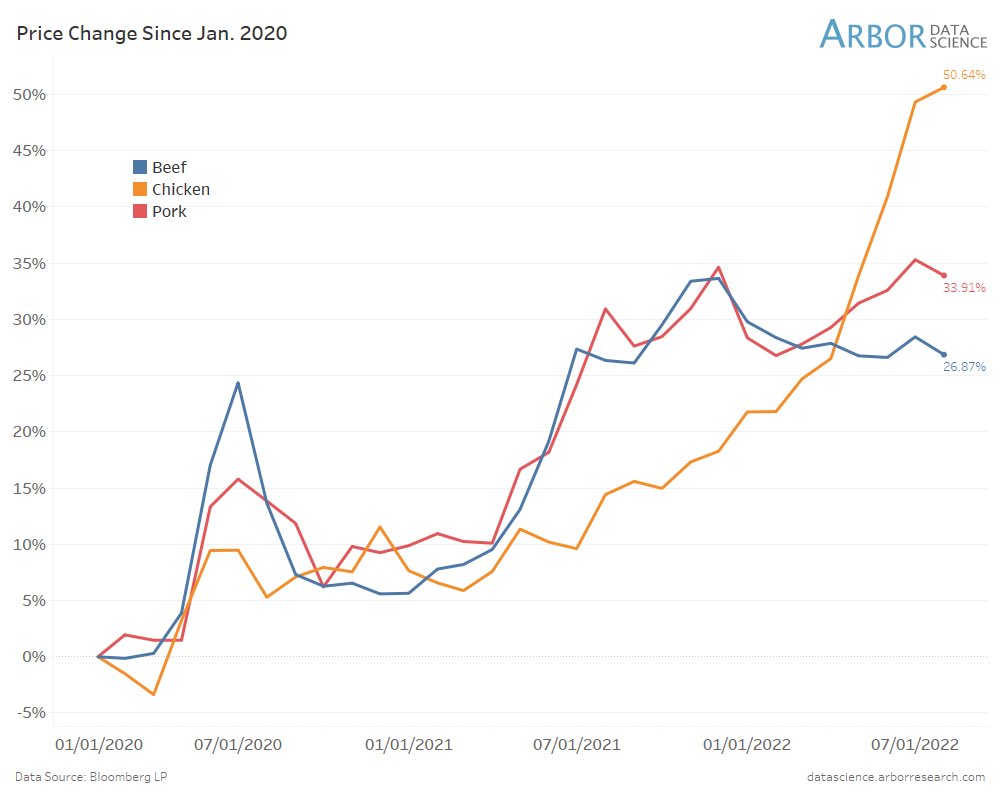

(Sonders) :: Since beginning of 2020, meat prices have soared; chicken has led way with 50.6% gain, followed by pork (33.9%) and beef (26.9%)

OBSERVATION: Once past the initial sticker shock we tend to normalize price increases, but loss of buying power still hurts

Stock Market

Buy When There’s Blood in the Streets - Nathan Rothschild (maybe?)

(John Ellis) :: Superbubble - Burning beds.

- Superbubbles are events unlike any others.. one of those features is the bear market rally after the initial derating stage of the decline but before the economy has clearly begun to deteriorate.

- In all three previous cases recovered over half the market’s initial losses, luring unwary investors back just in time for the market to turn down again, only more viciously, and the economy to weaken.

- The U.S. stock market remains very expensive and an increase in inflation like the one this year has always hurt multiples.. but now the fundamentals have also started to deteriorate enormously and surprisingly.

- Each cycle is different and unique – but every historical parallel suggests that the worst is yet to come.

- GMO: Entering the Superbubble’s Final Act

Blood in the streets for sure ARK Innovation ETF getting hammered

Energy

Gimme fuel, gimme fire Gimme that which I desire - Metallica

(Peter J. Hasson) :: Officials will ask Californians not to charge electric vehicles if conditions worsen.

- This message comes after California regulators moved last week to require all new vehicles in the state to run on electricity by 2035.

- California heat wave to stress power grid, cause potential blackouts, officials say

(Stay-At-Home Macro) :: Winter is coming

- As prices skyrocket and shortages loom, big multinationals are, to an extent, putting people ahead of profits. In Germany, large manufacturers, which are the engine of their economy, are substantially reducing the use of natural gas

- What does all this mean for the European economy? A recession. Here’s a simple illustration: if a manufacturer uses less energy, it almost always manufactures less. If it has less to sell, then it makes less money.

- Who benefits from Europe going into recession? We do. The United States, as the largest economy in the world, the largest producer of oil and natural gas, and with one of the strongest recoveries, should be able to weather the storm in Europe.

OBSERVATION: Gas prices on the decline as summer wraps up, but.. energy prices

Resources

Two out of every five people on Earth today owe their lives to the higher crop outputs that fertilizer has made possible. - Bill Gates

(Seeking Alpha) :: Fertilizer Stocks Surge

- Soaring natural gas prices have prompted companies like Yara International (OTCPK:YARIY) and chemical company Azoty, large producers of nitrogen and ammonia mineral fertilizers in the EU, to reduce output.

- Nitrogen is one of the most common non-hydrocarbons in natural gas, whereas ammonia is produced from natural gas.

- Agricultural Sentiment Remains Bullish

OBSERVATION: Natural gas impacts more than home heating in Europe, also impacts fertilizer production

Famine

Every society is three meals away from chaos - Vladimir Lenin

(Stay-At-Home Macro) :: Starvation. The war in Europe and the Fed fighting inflation have consequences for countries with no seats at the powerful table.

- Especially true for developing countries that import their food and, especially those that have tied the currency to the U.S. dollar.

- The war in Ukraine—involving two of the world’s largest wheat exporters—sent grain prices through the roof.

- With every increase in the federal funds rate, the U.S. dollar rises in value relative to other currencies. It has risen a lot this year.

- In addition to the cost of food imports, a strong dollar is crushing for poorer countries that must make their debt obligations in dollars.

- Inflation and shortages and debt and starvation.