2023 Week 15

Notes, thoughts and observations - Compiled weekly

A couple of takeaways for the week. First, we are seeing signs that the liquidity crisis may not be over, the huge draw down in deposits may still cause problems. Consumer debt is also a concern as it’s more difficult to get credit than one year ago.

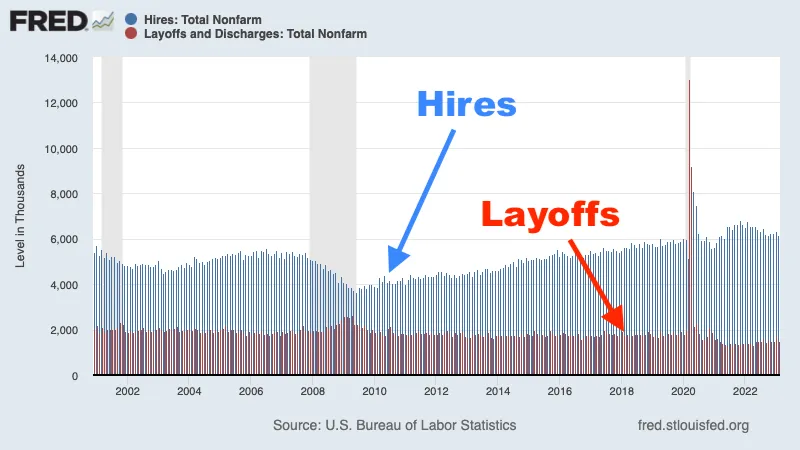

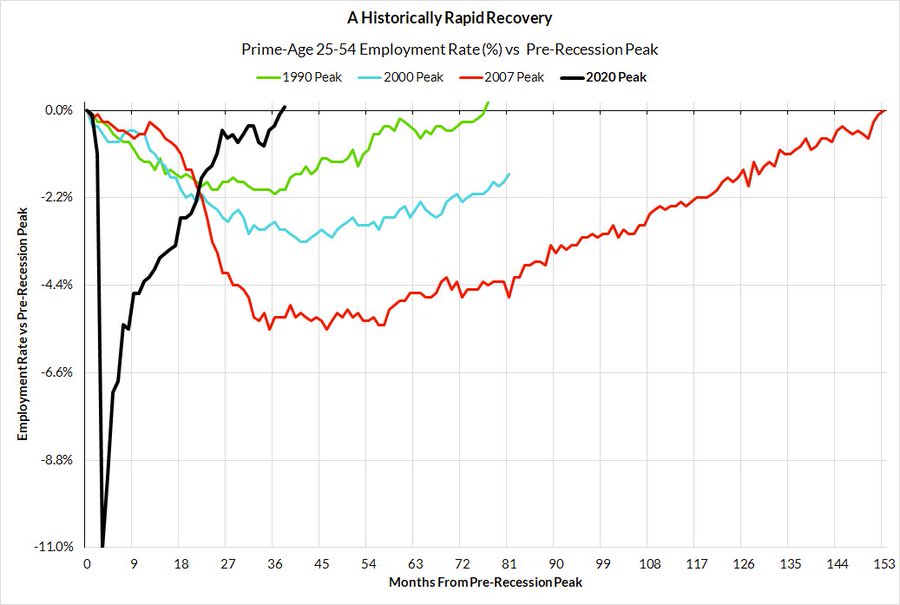

Second, increasing number of economist speculating that we are in, or are entering a recession. Recessions are notoriously hard to identify until after the fact, and a lot of contributing factors that may make this one double difficult to spot. For example, the labor market is looking very peculiar with the prime-age employment recovering in record time.

Last, the hype cycle continues on both the end of oil and the end of the US dollar. In my opinion both are long term risks but can be mitigated. Beware of snake oil and fear mongering, it takes a long time to systemically change a global economy. Just as COVID was a challenge for the global supply chain, it did not end overnight.

Is long term demographic trend (boomers retiring) a contributing factor?