Category:

Business

2023 Week 14

Notes, thoughts and observations - Compiled weekly

Are we going to see the first layoffless recession? Similar to stagflation, we could go into a recession while there is a worker shortage because due to an aging labor force due to a lack of immigration

We technically go into a recession but there are plenty of jobs - Kim Khan

TOPICS

Financial

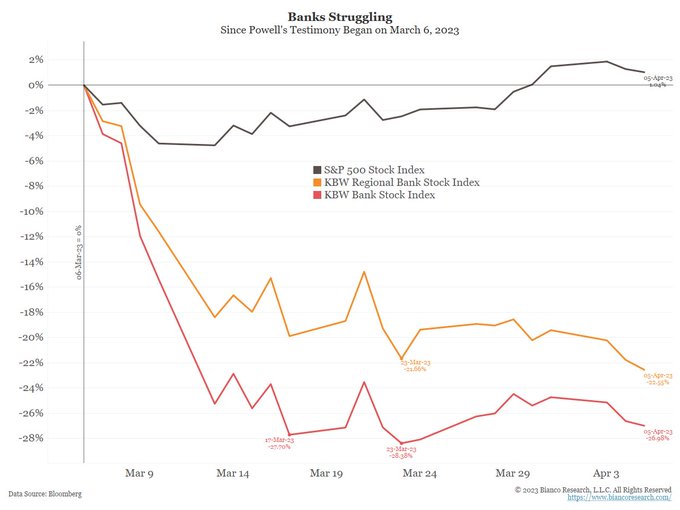

OBSERVATION - Market betting on future banking troubles

- (biancoresearch)

- The bank stocks continue to sink. Regional banks (orange) are now at a new closing low since the bank failures a month ago. Good thing the banking crisis has stabilized. Otherwise, the bank stocks might be in trouble … oh, wait! Seriously, I would argue the issue is profitability, they have to raise deposit rates to stop the outflows, and not solvency fears of more failures.

OPINION - Watch for price discovery on commercial real estate (office buildings and retail) to establish how underwater small bank balance sheets are.

- (EPB Research)

- Why the 2023 Banking Crisis is Just Getting Started

- US banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.

- Not a problem, unless customers pull their deposits

- If held to maturity, banks recoup their losses; only a problem if they have to sell now to create liquidity

- US banking system’s market value of assets is $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity.

- Fed opend the Bank Term Funding (BFT) and the Discound Window to help meet liquidity needs

- Rising interest rates put treasuries underwater, this mechanism allows banks to take a loan to pay back depositors

- Catch is that bank deposits were paying 1% interest, the BFT and Discount Window is 5%

- Interest paid will sky rocket, making them a zombie bank

- Small banks vs large banks

- Large banks are too big to fail, backstopped by the government

- Large banks are heavily regulated

- Small banks loans make up 65% of assets (vs 51% at large banks)

- Loans lean heavily toward commerical real estate

- Why the 2023 Banking Crisis is Just Getting Started

Real Estate

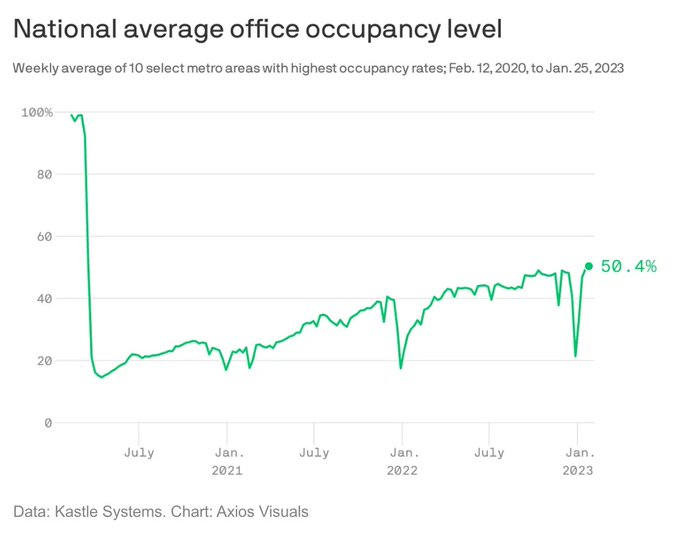

OBSERVATION - Smaller banks hold more commercial real estate loans

- (Clips that Matter)

- Offices are mostly empty space these days.

- It’s reasonable to think companies whose workers aren’t regularly in the office will probably reduce their office footprints

- This is bad news for the commercial real estate industry and, crucially, its lenders and investors.

- (rex_woodbury) - This is such a fascinating chart to me—looks like office occupancy is plateauing at ~50%. Interesting to think through the ripple effects on real estate, politics, and the types of jobs workers choose.

- Offices are mostly empty space these days.

OPINION - Don’t expect residential real estate prices to ease due to low supply

- (Mauldin Economics)

- Banking System at Risk? Housing Expert Barry Habib on the Return of MBS

- An outlook on 2023 housing prices and mortgage rates

- If prices fall to 5% it will cause price increases due to low inventory and high demand.

- Whether there’s any relief for homebuyers coming on the supply side

- Spike in birth rate 30 years ago leads to 2 million in home demand

- 1.4 built in next year, 100k homes retireed due to aging

Labor Market

OPINION - So similiar to the post dot-com era, tech shedding jobs but folks finding work in other sectors, for now

- (TKER)

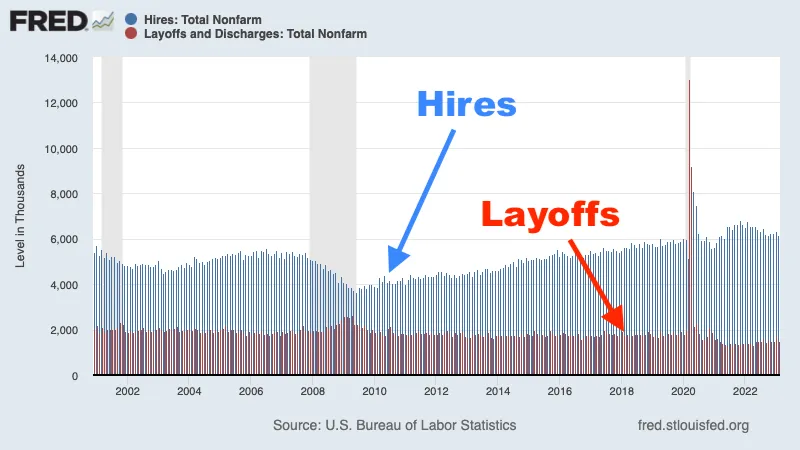

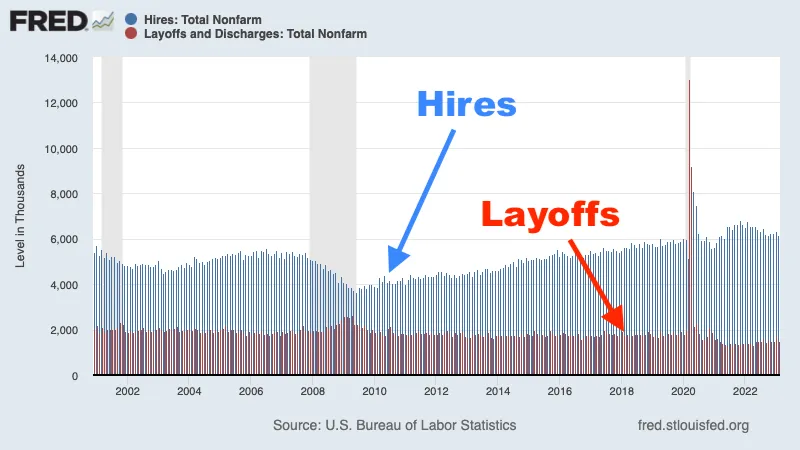

- Elevated hiring activity explains why layoffs haven’t led to higher unemployment.

- The numbers help explain why, despite heavy news coverage of layoffs, the unemployment rate remains low and claims for unemployment insurance remain depressed.

- As the economy cools, hiring activity will be a key metric to watch, because a hiring slowdown could force unemployment higher if laid-off workers are unable to land new jobs.

- Elevated hiring activity explains why layoffs haven’t led to higher unemployment.

OPINION - Small cuts, probably Wall Street driven. Will have a psychological impact on consumer spending. Layoffs spreading to services industry, phase 2 of the downturn

- (DiMartinoBooth)

- Let’s bundle the headlines:

- LendingTree to Cut 13% of Workforce; Sees $5.6M Charge

- Electronic Arts Cuts 6% of Its Workforce in Video-Game Slump

- Warner Music Group to Cut Headcount by ~270, or ~4%

- IBM Spinoff Kyndryl Cuts ‘Small Percentage’ of 90k Workforce

- Let’s bundle the headlines:

- (DiMartinoBooth)

- Gotta love verbiage from @business reporter in a story about @salesforce gearing up for another round of layoffs “After years of hiring & big acquisitions, the software company is newly focused on profitability” We’re in a hot mess if firms have NOT been run to generate profits

- (DiMartinoBooth)

- Severance is expensive! @Accenture plans to cut about 19,000 jobs, ~2.5% of its workforce, over the next 18 months, according to a 10-Q filing. Sees $1.5 BILLION total business optimization costs, consisting of $1.2B in employee severance and other personnel costs.

Resources

OPINION - Charging EVs requires more power.. there more demand for natural gas as a bridge fuel

- (BrianGitt)

- Rapid electric vehicle growth could increase electricity use by up to 25%. “If most EVs continue to charge at night, then the state will need to build more generators, likely powered by natural gas, or invest in expensive energy storage.”

- Stanford study warns against charging electric cars at home overnight

- The study has recommended that the practice should change, with more EV owners charging their cars during the day at work or at public charging stations.

- COUNTERPOINT - This energy still has to be generated, even with optimal solar and wind production