2024 Week 15

Notes, thoughts and observations - Compiled weekly

Speculation continues on when the next Fed rate move will be, personally I don’t guess. But it’s possible that the source of an interest rate move may come from global forces rather than internal pressure. This hasn’t stopped top CEOs from sharing their opinion. Predict calamity long enough eventually it might become true

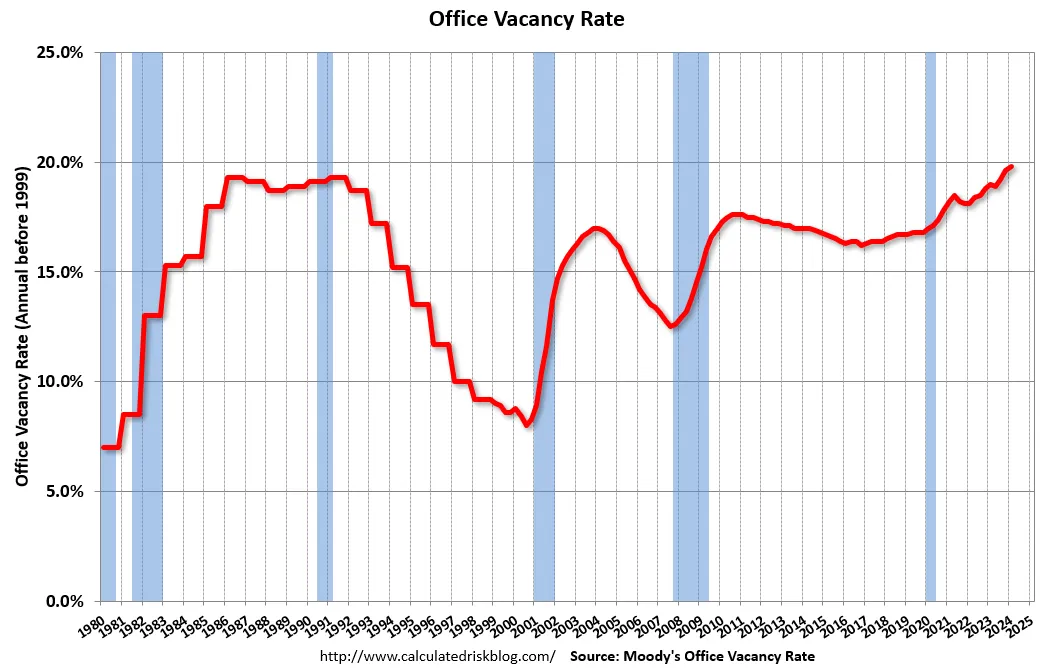

Work from home is still to blame for office vacancies, but I’m increasingly thinking that weak business fundamentals are a contributing factor. We are now higher than in 1986 and 1991. Global oil prices are also seeing weakness, though $80 per barrel is priced into the model and seasonal gasoline demand in the US is within historical trends.

It’s either a stock market bubble or a recession depending on which article you read. Someone pointed out the necessary recovery time for the NASDAQ 100 bought at the peak of the dot com bubble. Sure it took 16 years to recover, but if you held it until today, you’d still be up 276%. Also worth noting that the more diversified S&P 500 only took 7 years to recover.

Fear is ruling the day with folks buying gold from Costco and everyone penning articles about whether we are in a bubble and if it will pop. Sure semiconductors and tech may be VERY overpriced, fundamentals in other sectors could indicate we are on the cusp of a huge expansion in other market areas. Point being diversify and plan for the long-term are a better strategy.

Speaking of semiconductors, it looks like we might be on the verge of a second chip war around purpose-built AI processors. To date Nvidia has leveraged GPU designs but recent announcements by Intel, Meta and Alphabet may create a race to reduce training and inference processing costs. One thing is for certain: current AI processing costs are too high to be sustainable.

Another consideration for AI, EVs and chips is the impact of government incentives, tax breaks and spending programs. These act as fuel for expansion but when they expire it can often cause a rash of business failures. Look no further than the solar industry of the 2000s.

NOTE: Week 15 is a two week combination due to some well deserved time off.

TOPICS

- Fed Rate

- Commercial Real Estate

- Energy

- Stock Market Bubble

- Domestic Recession

- Consumer Credit Crunch

- Labor Market

- Automotive

- Domestic Semiconductor

- Deleverage Globalization

- AI and ML

- EV Battery Technology

Fed Rate

OPINION - I don’t speculate about interest rates, but this might be a legit observation.

- (The Sandbox)

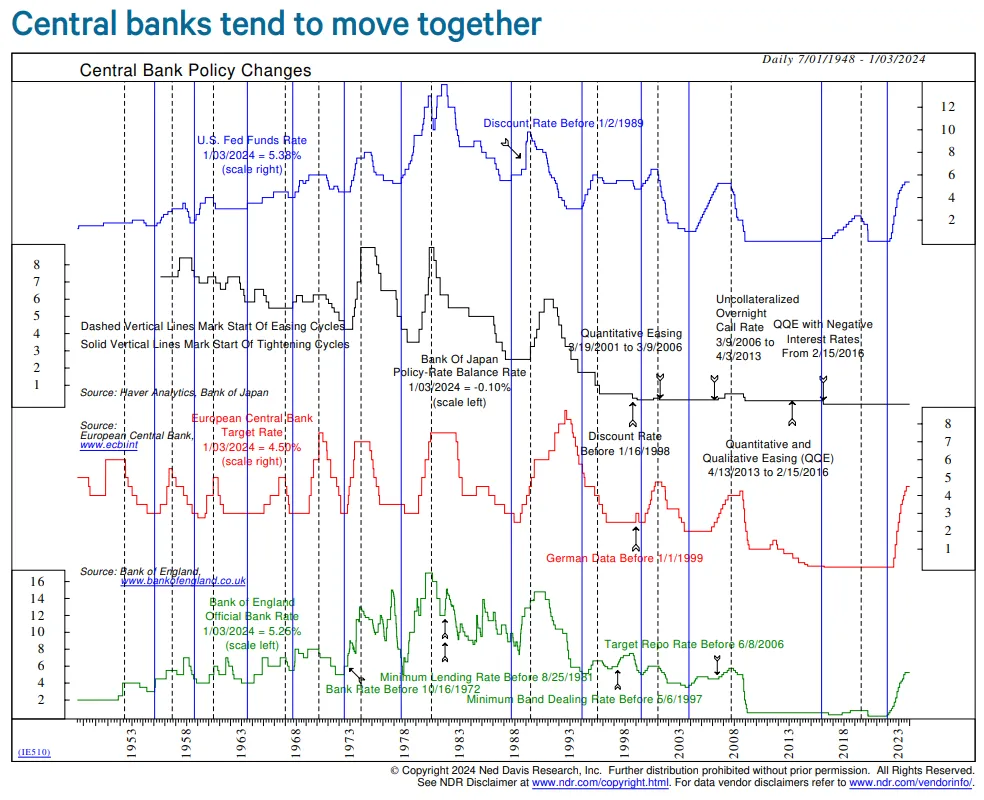

- Follow the leader - central banks tend to follow each other closely, reflecting the strong interrelationship of the global economy.

- Central banks tend to follow each other closely, reflecting the strong interrelationship of the global economy.

OPINION - Soft landing, no rate cuts

- (Over My Shoulder)

- A third straight month of rising CPI convinced many investors to dial back their rate cut expectations.

- The US consumer price index rose 3.5% in the year ended March, and 3.8% in the core reading that excludes food and energy.

OBSERVATION - “..a cut by July quite difficult IMO”

- (Seeking Alpha)

- Odds of rate cuts at Fed meetings decrease, with the chance of a quarter-point cut in June now at 20%.

- Treasury yields shot up, with the 10-year (US10Y) hitting 4.55% and the 2-year (US2Y) up more than 20 basis points close to 5%.

- Skyler Weinand, chief investment officer, Regan Capital expects “a 6% yield on 10-year bonds, 5% on 2-year bonds and the Fed eventually cutting short-term rates to 4%.

OPINIION - Predict calamity long enough eventually it might become true

- (Seeking Alpha)

- Jamie Dimon says rates could spike to 8%, AI akin to the printing press

- Dimon cast doubt on the confidence that the U.S. economy will see a soft landing - and the corresponding equity valuation.

- “These markets seem to be pricing in at a 70% to 80% chance of a soft landing

- “I believe the odds are a lot lower than that,”

- 6 months ago: JPMorgan Chase CEO Jamie Dimon warns this is ‘the most dangerous time’ for the world in decades

- “I shouldn’t ever use the word hurricane, but I said it was, there were storm clouds. those storm clouds could be a hurricane.” - Jamie Dimon, January 10, 2023

OPINION - Soft landing, no rate cuts

- (Brief.News)

- U.S. Stocks Surge on Stellar Jobs Report, Defying Interest Rate Worries

- Strong employment data with the addition of 303,000 jobs in March, surpassing expectations, helped fuel the market surge.

- Major indices including the Dow Jones rose 0.80%, Nasdaq increased by 1.24%, and the S&P 500 climbed 1.11%

Commercial Real Estate

COUNTER OPINION - Vacancies are a result of weak business fundamentals rather than work from home.

- (Calculated Risk)

- Office Vacancy Rate at Another Record High

- Sitting at 19.8% in Q1 2024, this new record high vacancy rate is 50 bps above the recessionary peaks recorded in 1986 and 1991.

- This is a new record high, and above the 19.3% during the S&L crisis.

Energy

OPINION - $80 per barrel is priced into the model

- (TKer)

- Gas prices rise. From AAA: “Despite ominous overseas news, a pop in domestic gasoline demand, and oil prices rising to the mid-$80s per barrel, the national average for a gallon of gas climbed just three pennies to $3.56 since last week.”

Stock Market Bubble

OBSERVATION - Replicates the NASDAQ-100 Index; bought at the height of 2000 took 16 years to recover; if held would be up 276%; S&P 500 only took 7 years

- (Seeking Alpha)

- Ray Dalio’s method for identifying bubbles includes a total of 7 signs.

- 1. High Prices Relative to Traditional Measures

- 2. Influx of New and Inexperienced Investors

- 3. Widespread Bullish Sentiment

- 4. Unsustainable Growth Expectations

- 5. Debt-Fueled Buying

- 6. Speculative Purchases

- 7. Does tightening risk popping the bubble?

- Invesco QQQ Trust ETF is showing 6 of these signs in my view, including high valuations, broad bullish sentiment, and popping risks if tightening continues.

- Ray Dalio’s method for identifying bubbles includes a total of 7 signs.

Domestic Recession

OPINION - On the cusp of the largest expansion in 20 years

- (TKer)

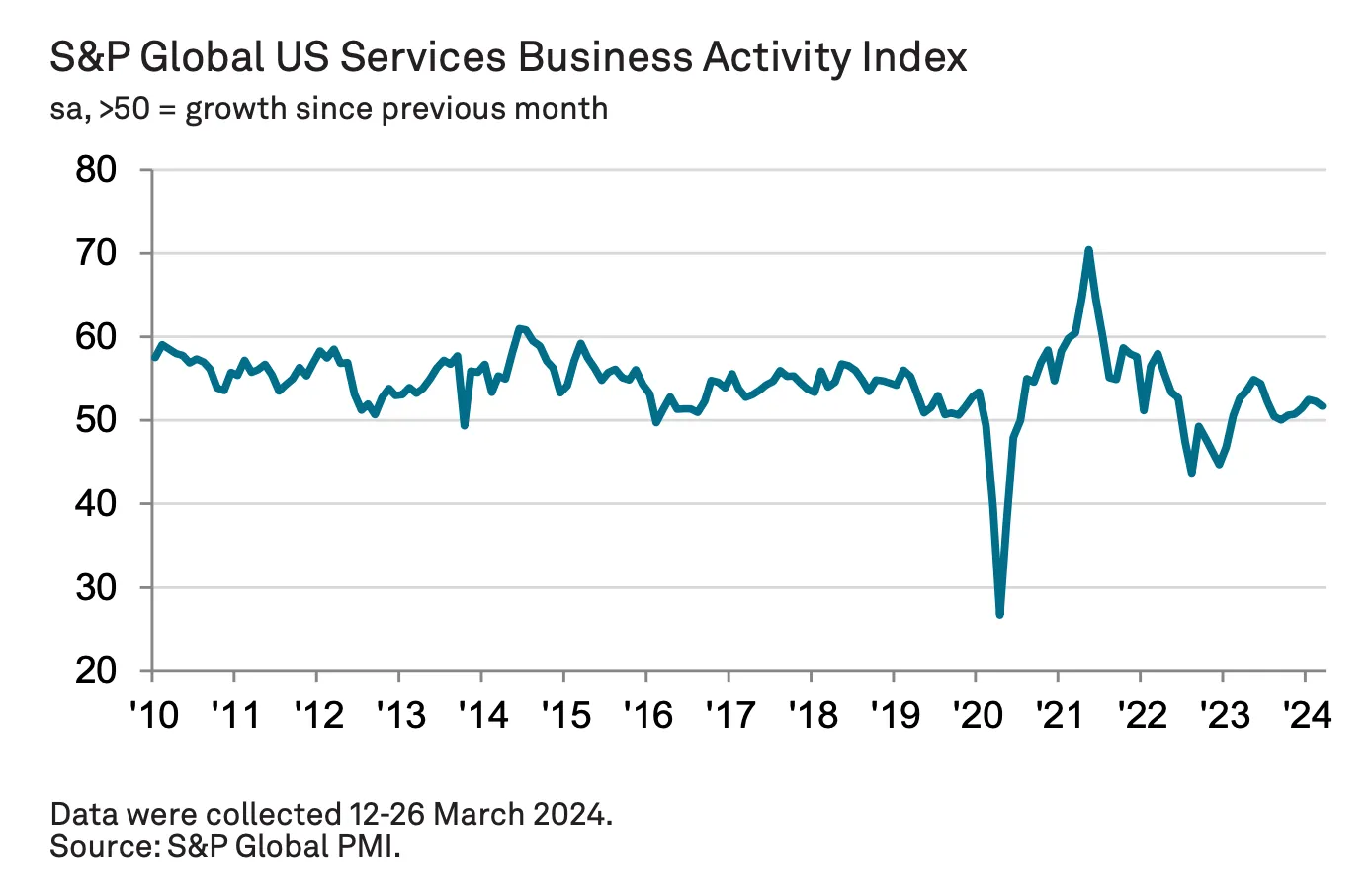

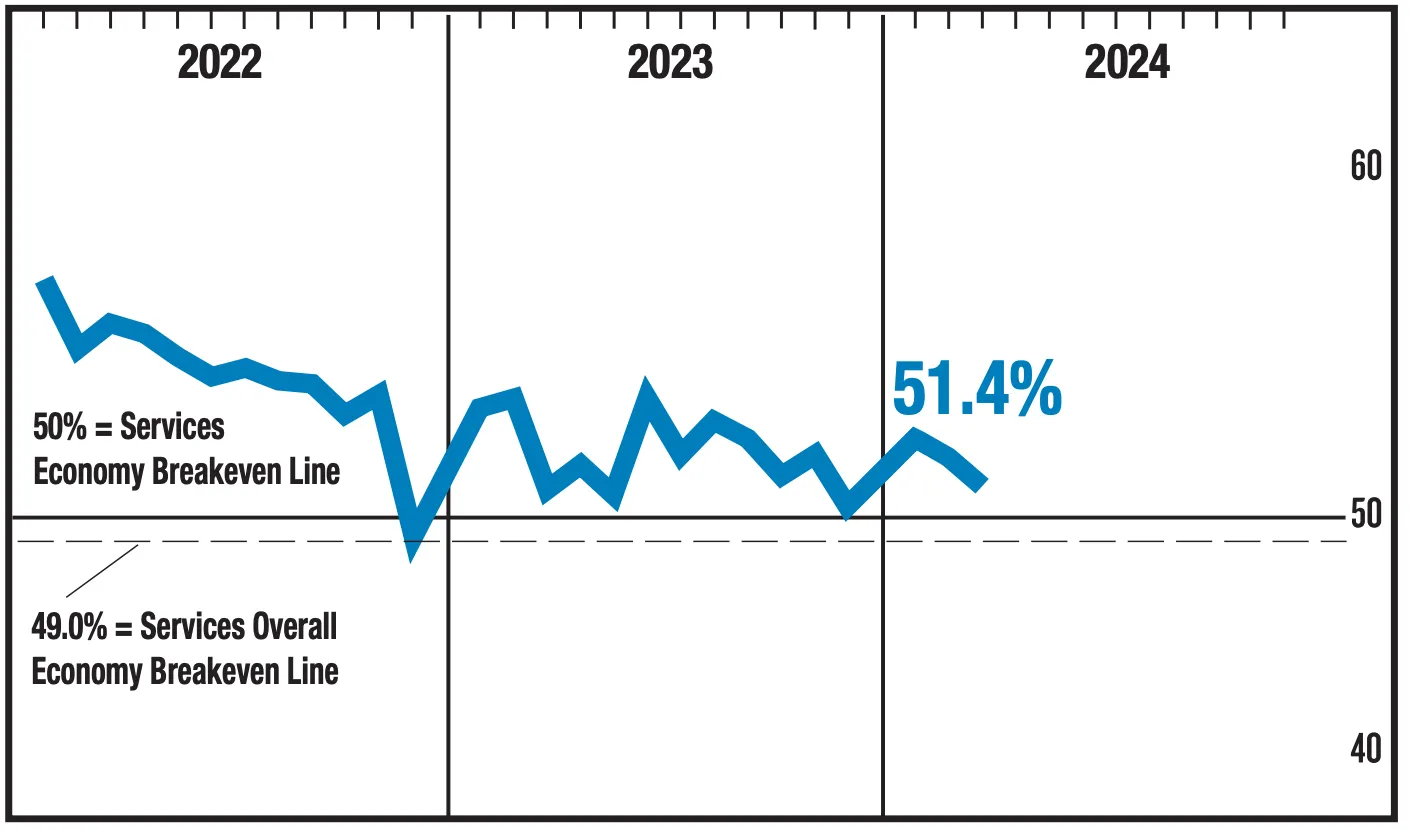

- Services surveys signal growth is cooling. From S&P Global’s March U.S. Services PMI: “The U.S. service sector reported a further rise in business activity in March, adding to signs that the economy enjoyed robust growth in the first quarter.

- The ISM’s March Services PMI also signaled growth, albeit cooling growth.

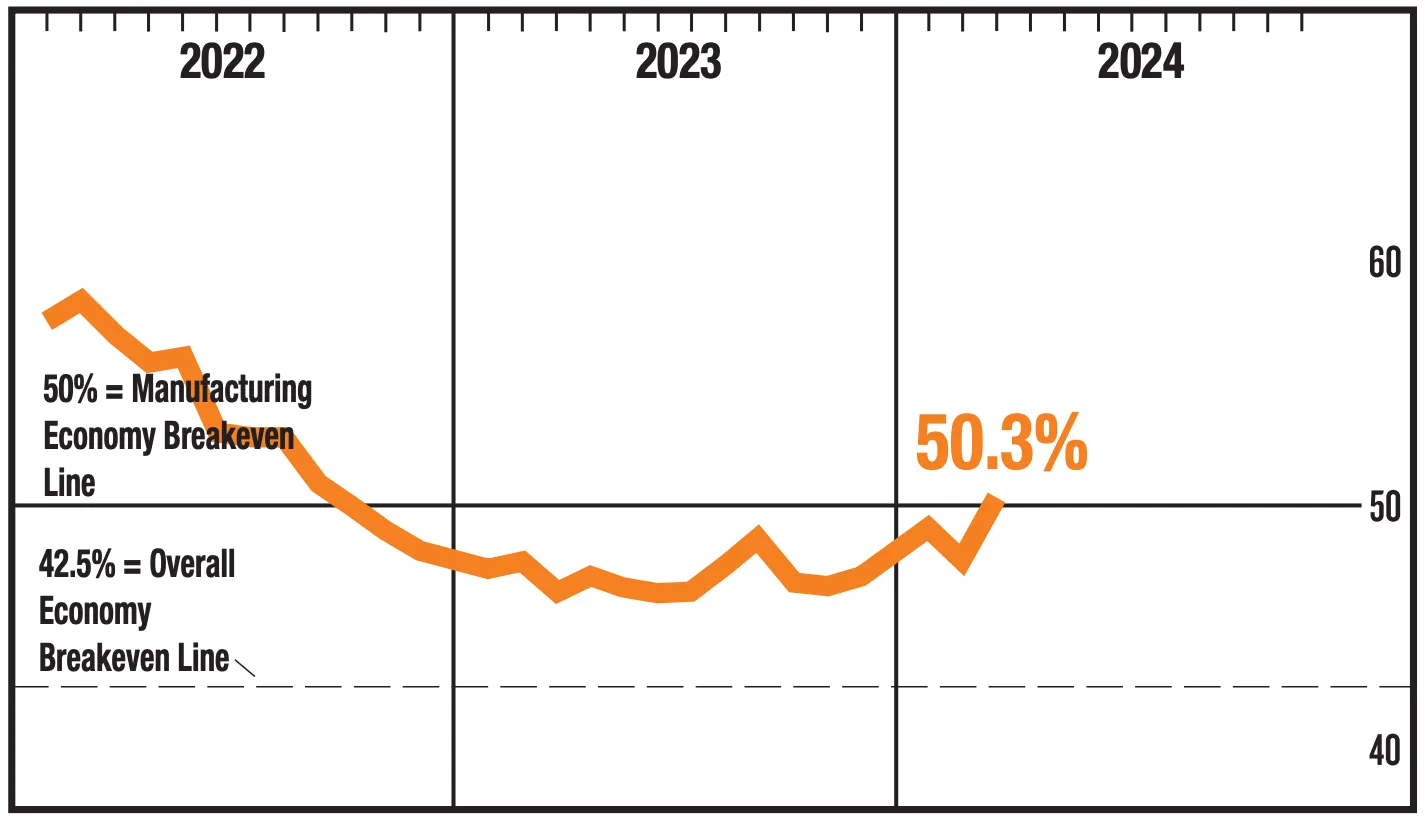

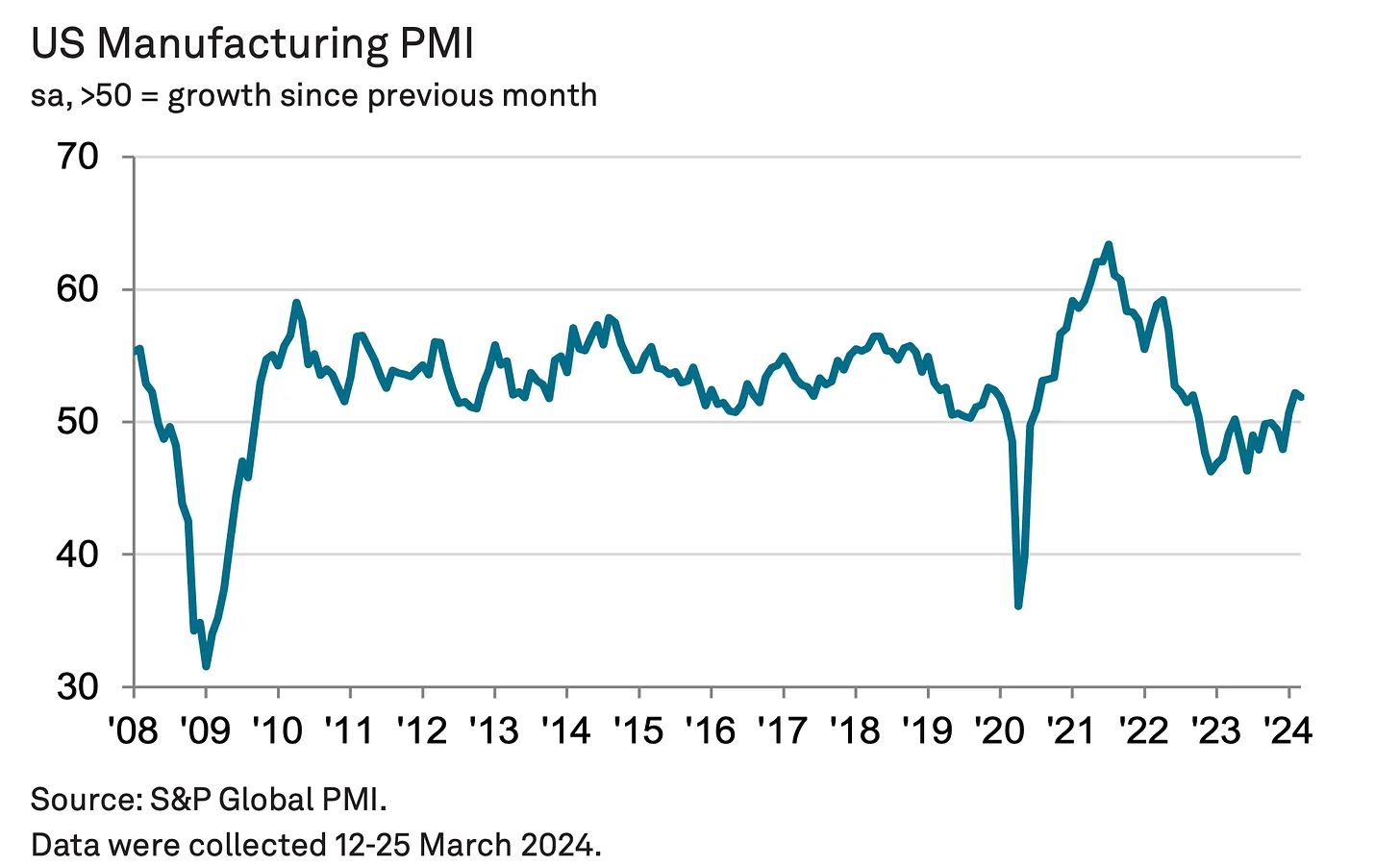

- Manufacturing surveys look good. From S&P Global’s March U.S. Manufacturing PMI:

- Jobs growth has also picked up as firms boost capacity to meet demand. Rising capex spending has likewise buoyed orders for machinery and equipment, in a further sign of firms gaining confidence in the outlook.“

- The ISM’s March Manufacturing PMI also signaled growth with new orders and production showing significant improvements.

- Construction spending ticks lower. Construction spending declined 0.3% to an annual rate of $2.1 trillion in February.

- Most U.S. states are still growing.

- From the Philly Fed’s February State Coincident Indexes report: “Over the past three months, the indexes increased in 43 states, decreased in three states, and remained stable in four, for a three-month diffusion index of 80.

- Services surveys signal growth is cooling. From S&P Global’s March U.S. Services PMI: “The U.S. service sector reported a further rise in business activity in March, adding to signs that the economy enjoyed robust growth in the first quarter.

Consumer Credit Crunch

OBSERVATION - Strain on consumers, could be headwinds for consumer discretionary.

- (Seeking Alpha)

- Credit card delinquencies hit series high in Q4, new mortgages appear riskier - Philly Fed

- Highest levels on record since the Federal Reserve Bank of Philadelphia started tracking the data in Q3 2012

- 3.5% of credit card balances were at least 30 days past due as of Q4-end

- While the share of accounts making full balance payments ticked up 8 bps in Q4, the 3.1% increase in revolving balances implies higher card balances among a smaller group of revolvers.

- Mortgage originations declined to a series low in Q4 as market headwinds continued to stifle demand, and the data hinted at a possible change in the risk approach of firms.

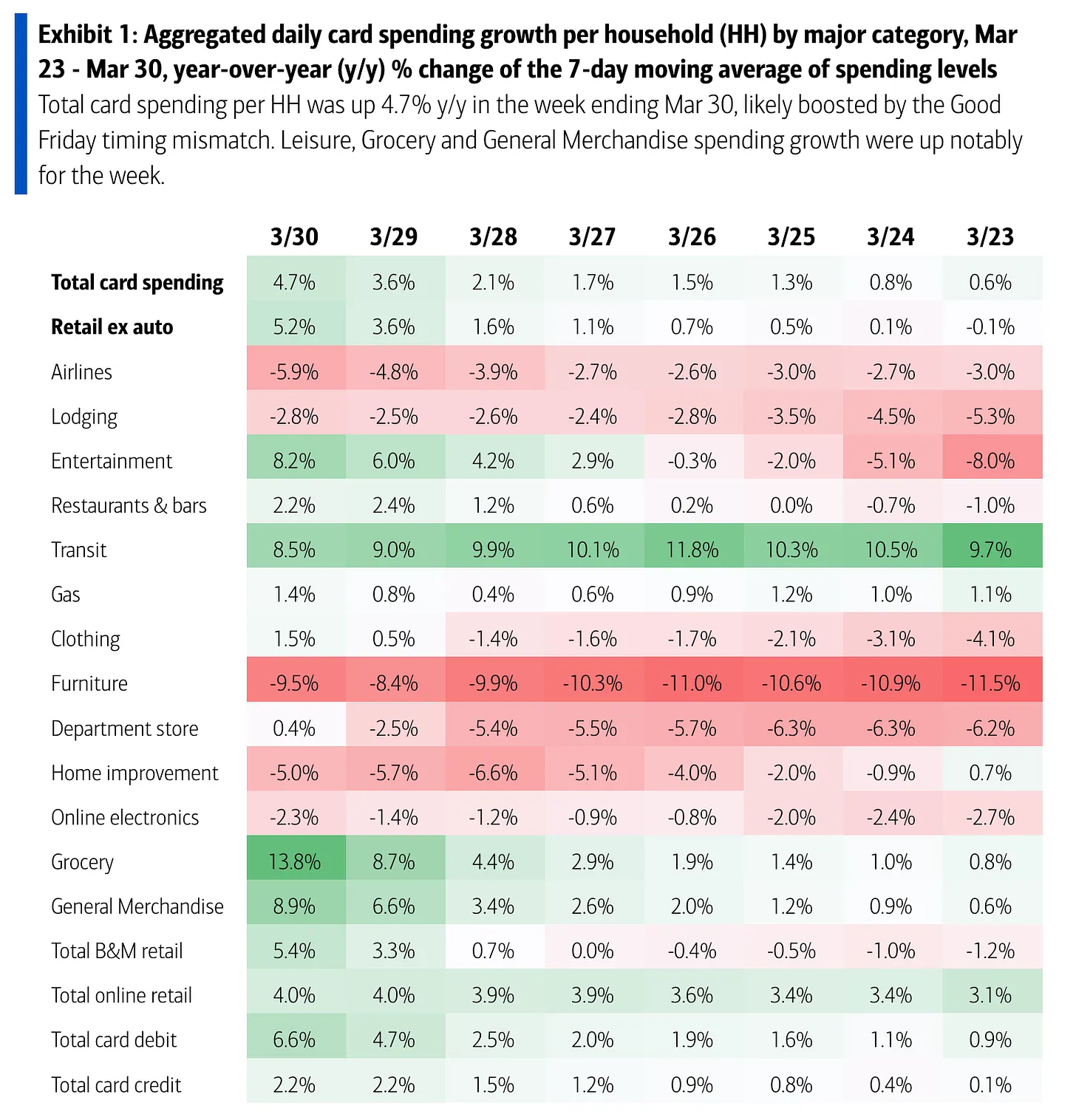

OBSERVATION - Consumer spending still strong

- (TKer)

- Card data suggests spending is holding up. From JPMorgan: “As of 27 Mar 2024, our Chase Consumer Card spending data (unadjusted) was 2.3% above the same day last year.

- Based on the Chase Consumer Card data through 27 Mar 2024, our estimate of the U.S. Census March control measure of retail sales m/m is 0.47%.“

- From Bank of America: “Total card spending per HH was up 4.7% y/y in the week ending Mar 30, according to BAC aggregated credit & debit card data. Retail ex auto spending per HH surged at 5.2% y/y in the week ending Mar 30.”

- Card data suggests spending is holding up. From JPMorgan: “As of 27 Mar 2024, our Chase Consumer Card spending data (unadjusted) was 2.3% above the same day last year.

Labor Market

OBSERVATION - Despite headlines, the labor market is strong.

- (TKer)

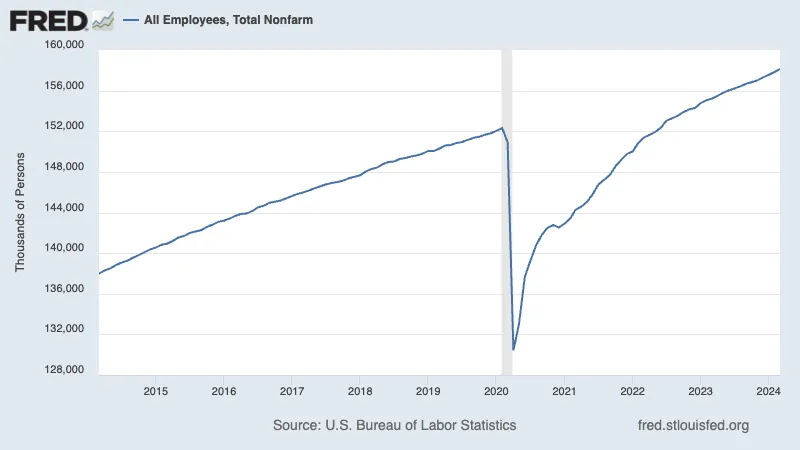

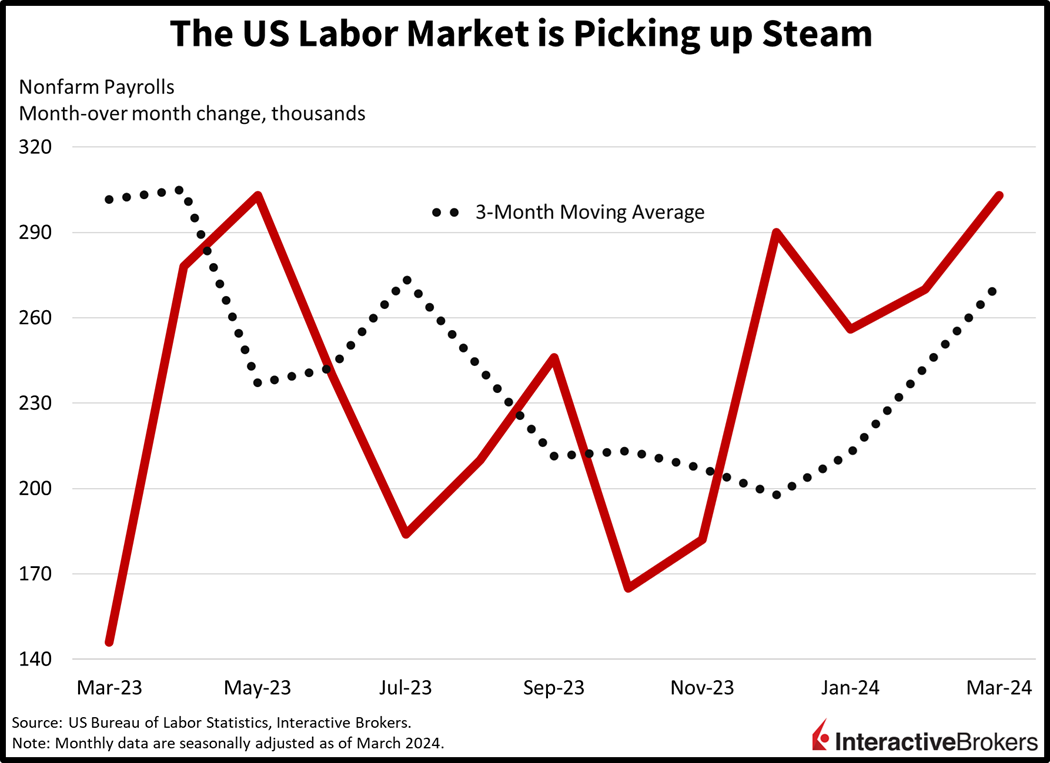

- The labor market continues to add jobs. According to the BLS’s Employment Situation report released Friday, U.S. employers added 303,000 jobs in March.

- The 39th straight month of gains, reaffirming an economy with robust demand for labor.

- Total payroll employment is at a record 158.1 million jobs, up 5.8 million from the prepandemic high.

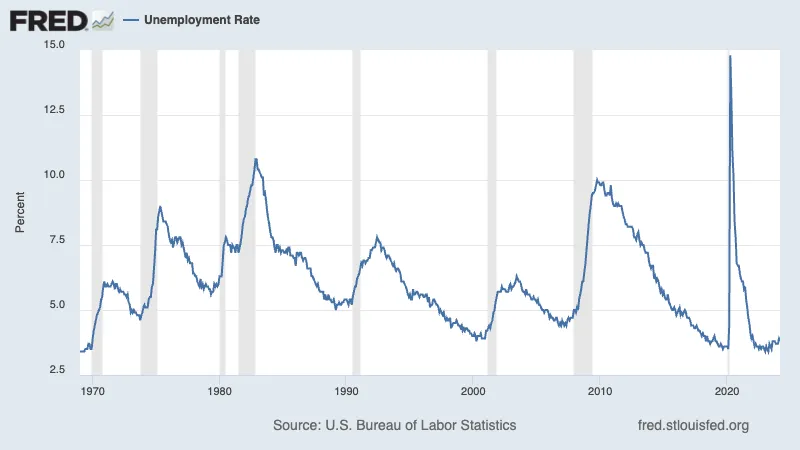

- The unemployment rate declined to 3.8% during the month. While it’s above its cycle low of 3.4%, it continues to hover near 50-year lows.

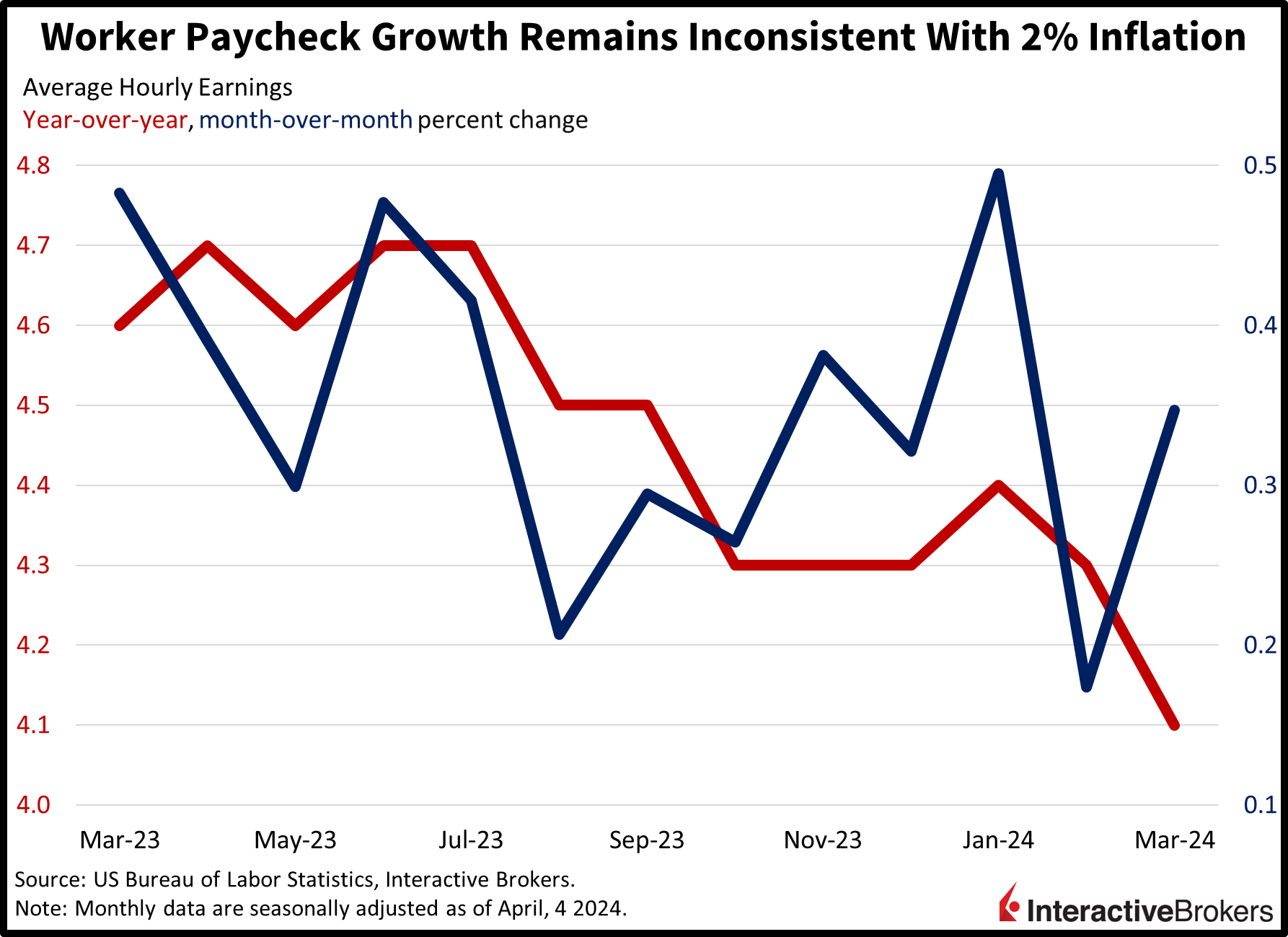

- Wage growth stays cool. Average hourly earnings rose by 0.3% month-over-month in March, down from the 0.2% pace in February.

- On a year-over-year basis, this metric is up 4.1%, the lowest rate since June 2021.

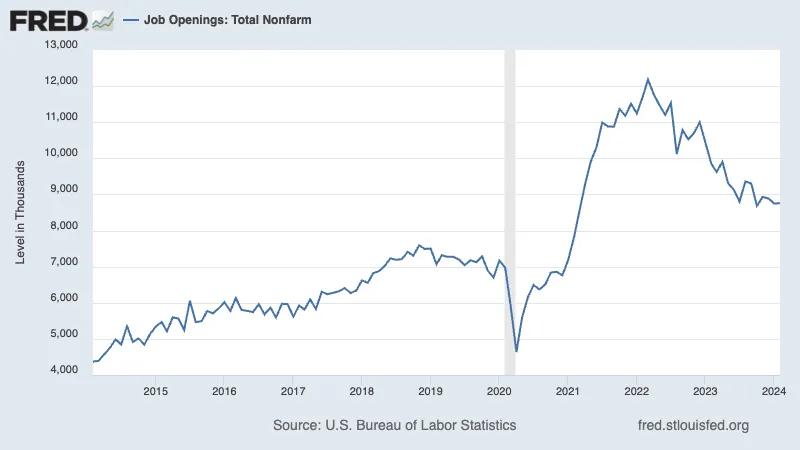

- Job openings tick higher. According to the BLS’s Job Openings and Labor Turnover Survey, employers had 8.76 million job openings in February, up from 8.75 million in January.

- While this remains elevated above prepandemic levels, it’s down from the March 2022 high of 12.03 million.

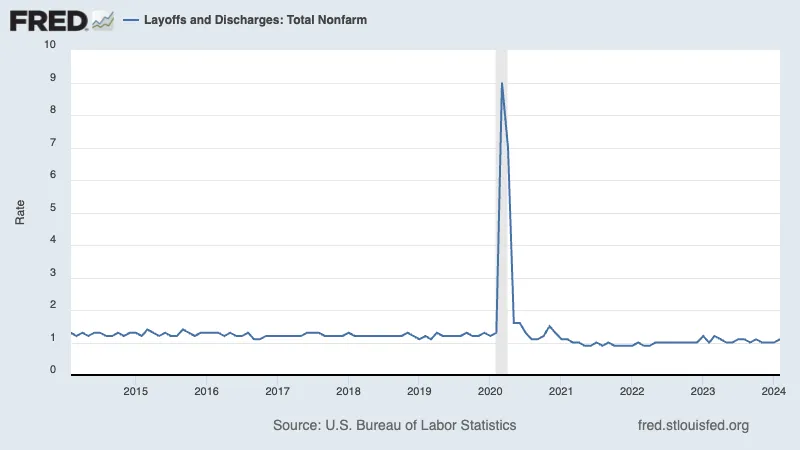

- Layoffs remain depressed, hiring remains firm. Employers laid off 1.72 million people in February.

- While challenging for all those affected, this figure represents just 1.1% of total employment.

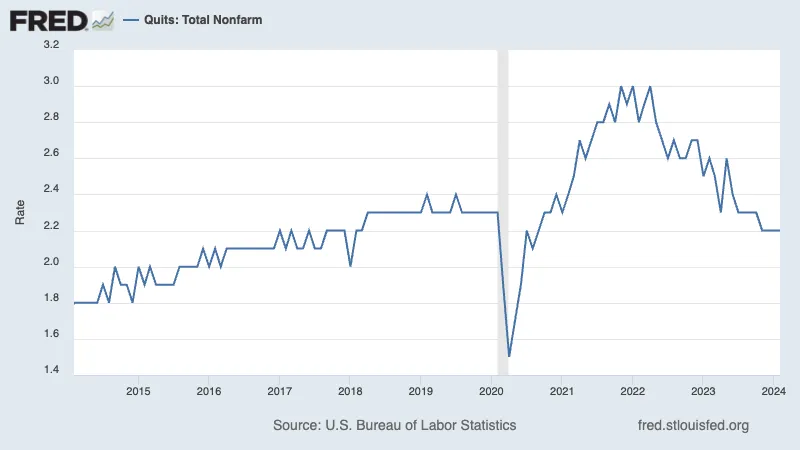

- People are quitting less. In February, 3.48 million workers quit their jobs.

- This represents 2.2% of the workforce, which is below the prepandemic trend.

- A low quits rate could mean a number of things: more people are satisfied with their job; workers have fewer outside job opportunities; cooling wage growth; productivity will improve as fewer people are entering new unfamiliar roles

OPINION - Apple struggling to find the next big thing

- (Brief.News)

- Apple Axes 700 Jobs Amid Shift to AI and Robotics Ventures

- Primarily from the Micro-LED display division and the defunct Apple Car project.

- Part of a broader trend in the tech industry, with companies like Amazon, EA, Sony, Cisco, and Snap also reducing their workforces.

- In a strategic pivot, Apple has shifted 2,000 employees from its car project to focus on artificial intelligence, indicating a new direction for the company’s innovation efforts.

- Apple is rumored to be venturing into the development of personal home robots as it explores new product categories.

- Apple Axes 700 Jobs Amid Shift to AI and Robotics Ventures

OBSERVATION - Labor continues to be strong, despite prevailing narrative

- (IBKR)

- Jobs Report Points to Overheating Economy: Apr. 5, 2024

- Report was so strong that the Fed Funds rate curve started to price in the odds of a hike this year.

- The significant shift in expectations is hard to ignore

- March payrolls increasing at the fastest rate in 10 months.

- US economy added 303,000 jobs last month, trouncing expectations of 200,000 and accelerating from February’s 270,000.

- Economy Shows Signs of Higher Inflation

- Market players are in agreement, with coinflip odds for a cut in June while the door to more hikes has been opened

- Geopolitical Turmoil Spikes

- Geopolitical risks have increased with tension between Iran and Israel escalating and the US alleging that China is engaging in unfair labor practices.

- Ukraine’s drone strikes against Russian refineries are stoking fears of potential shortages of the energy commodity.

OBSERVATION - Labor continues to be strong, despite prevailing narrative

- (CNBC)

- Job growth zoomed in March as payrolls jumped by 303,000 and unemployment dropped to 3.8%

- Nonfarm payrolls increased 303,000 for the month, well above the Dow Jones estimate for a rise of 200,000.

- The unemployment rate edged lower to 3.8%, as expected, even though the labor force participation rate moved higher to 62.7%.

- Wages rose 0.3% for the month and 4.1% from a year ago, both in line with Wall Street estimates.

- Health care led with 72,000 new jobs, followed by government (71,000), leisure and hospitality (49,000), and construction (39,000).

Automotive

OBSERVATION - Prices comparable enough that consumers can make choices on why type of power plant fits their needs.

- (USA Today)

- Another roadblock to convincing Americans to buy an EV: plunging resale values

- The average price for a used electric vehicle fell by up to 32% while the average for a gas model slipped by 3.6%.

- “Consumers didn’t used to be worried about the resale value of an EV, but Musk cutting prices made people feel like they owe $50,000 on their Tesla and now, it’s only worth $40,000,”

- The average price for a used EV stood at $30,904 in February, compared with $31,153 for a used gas car

- “Used car shoppers with a $31,000 budget have access to the majority of models today, regardless of drivetrain,”

Residential Real Estate

OPINION - Only way out of housing shortage is to build new units

- (TKer)

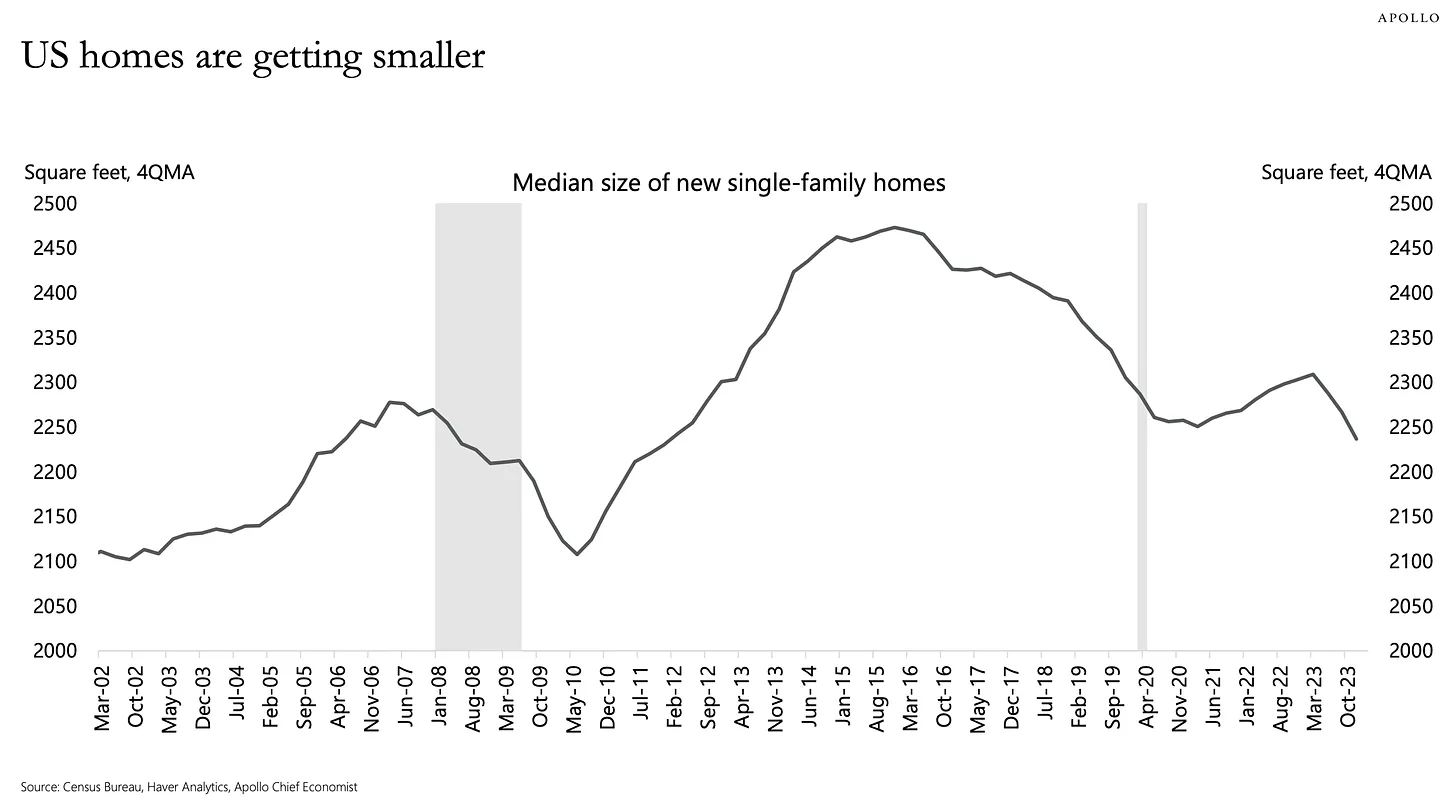

- Newly built homes are getting smaller. From Apollo Global’s Torsten Slok: “The median size of new single-family homes peaked at 2,473 square feet in 2016. Today, the size of new homes being built is 2,237 square feet.“

- Mortgage rates tick higher. According to Freddie Mac, the average 30-year fixed-rate mortgage fell to 6.82% from 6.79% the week prior.

- Since the start of 2024, the 30-year fixed-rate mortgage has not reached seven percent but has not dropped below 6.6 percent either.

- Newly built homes are getting smaller. From Apollo Global’s Torsten Slok: “The median size of new single-family homes peaked at 2,473 square feet in 2016. Today, the size of new homes being built is 2,237 square feet.“

OBSERVATION - Stabilization in rents

- (Calculated Risk)

- Moody’s: Apartment Vacancy Rate Unchanged in Q1

- National multifamily vacancy stayed flat at 5.5%

- Near 7% mortgage rate and ramp-up of single-family housing prices locked many potential first-time home buyers out of homeownership

Domestic Semiconductor

OPINION - Opening shots in the new chip war

- (Brief.News)

- Intel and Meta Unveil Cutting-Edge AI Chips, Nvidia Shares Rebound Amid AI Market Frenzy

- Intel introduced its new AI accelerator Gaudi 3 and a groundbreaking AI chip QuantumX at the Vision 2024 conference.

- Meta Platforms Inc. announced the MTIA v2, an AI chip with 3x the performance and 1.5x the power efficiency of its predecessor, and designed to outperform Nvidia’s top offerings in performance per watt.

- The MTIA v2 consumes significantly more power but provides up to 7x the floating point performance compared to the previous model.

- Meta is employing the PyTorch framework and Triton compiler to enhance AI application development flexibility across various GPU hardware.

- Both Intel and Meta are actively pushing the boundaries in the AI chip market, signaling a period of robust competition and innovation.

OPINION - Competition will drive prices down

- (Seeking Alpha)

- Meta reveals its latest custom-made chips for AI workloads

- Announced its latest custom-made chips designed to support generative artificial intelligence products and services on Wednesday.

- Just one day after Intel unveiled its Gaudi 3 accelerator for enterprise gen AI. Coincidentally, on the same day, Alphabet’s Google showcased its latest in-house chips, Axion, to help the tech giant address rising computing costs, handle more AI-related workloads and cut its reliance on outside vendors such as Nvidia.

- Meta’s latest generation of the Meta Training and Inference Accelerator, MTIA, designed for AI-workloads, are intended to power its ranking and recommendation ads models.

- Meta also updated the software stack, PyTorch, associated with the upgraded MTIA chips.

- The company also created Triton, an open source language and compiler for writing highly efficient ML compute kernels, to maximize hardware utilization.

OPINION - Opening shots in the new chip war

- (Seeking Alpha)

- Samsung to get $6B chip subsidy next week to boost U.S. production

- The Biden administration is expected to award more than $6B to Samsung Electronics next week to support the expansion of its chip production facility in Texas.

- Expected to be the third largest of the recent grants under the CHIPS and Science Act

- Taiwan Semiconductor secured up to $6.6B in grants

- Intel received up to $8.5B

Deleverage Globalization

OPINION - Negative investment trend, which companies rely on sales to China?

- (Ed D’Agostino)

- Tim Cook Isn’t the Only One with a China Problem

- The bigger issue is that decoupling is a process, not an event. And I don’t anticipate a total split.

- A company like Walmart, where an estimated 70%–80% of the products on its shelves come from China.

- As long as China makes cheap goods, Walmart will buy them

- At this stage, I’m far more concerned about companies that rely on China for revenue.

- Apple’s heavy reliance on China appears to be dragging it down. Who’s next?

PREDICTION - Will cause the UK to become increasingly dependent on North American trade.

- (Over My Shoulder)

- Of the many reasons people favored Brexit, immigration was high on the list. But now the UK has even higher immigration, mostly from non-EU countries.

- Brexit also cost the UK favorable trade terms with seven of its ten largest trading partners.

- The UK has since landed new trade agreements only with Canada, Australia and New Zealand, gaining nothing it didn’t already have through the EU

- A resulting lost of economic momentum has placed UK living standards well below those of the EU and US.

- Bottom Line: In Jensen’s view this is all so obvious the UK will eventually seek to re-enter the EU, but he thinks reaching consensus will take 10-15 more years.

AI & ML

OPINION - Government spending is the next round of funding hype for AI

- (Seeking Alpha)

- Canadian Prime Minster Justin Trudeau on Sunday said the country’s budget includes C$2.4 billion ($1.77 billion) to support investment in artificial intelligence.

- The measures include a C$2 billion investment to build and offer access to computing and technological resources for Canada’s AI researchers, start-ups and scale-ups, according to an announcement.

EV Battery Technology

OPINION - What every car guy saw coming a mile a away (facepalm)

- (Seeking Alpha)

- Eyes on General Motors after Ford downshifts EV plans

- Ford Motor Company scaling back or delaying some of its electric vehicles and saying it would make more hybrid models.

- Morgan Stanley now expects Ford’s EV volume to be closer to 100K units than 200K units.

- What General Motors will do about its electric vehicle strategy. GM is noted to have spent more time and money developing a vertically integrated in-house EV/battery platform?

- Stellantis has already gone public with its call for lighter electric vehicles due to the massive costs of materials for current-generation battery technology.