2024 Week 27

Notes, thoughts and observations - Compiled weekly

A combine notes because of time off an holidays

Big themes around the direction of the economy, the labor market and the Fed’s next move. As Keith Fitz Gerald notes: “Trying to anticipate the Fed is a fool’s errand.”

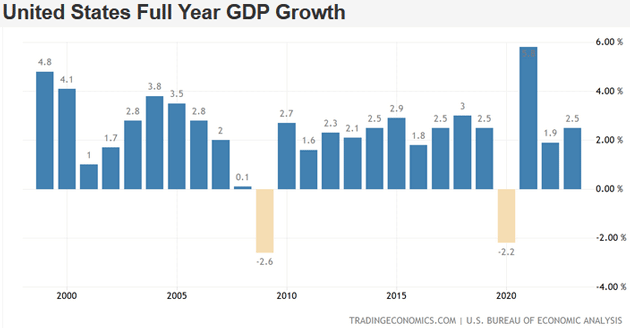

Inflation is close to target, but the Eurozone is clearly in the throes of deindustrialization. Regardless of monetary movements in other countries, US data and corporate results continue to surprise to the downside. Is something big coming, or is it simply a bump in the road?

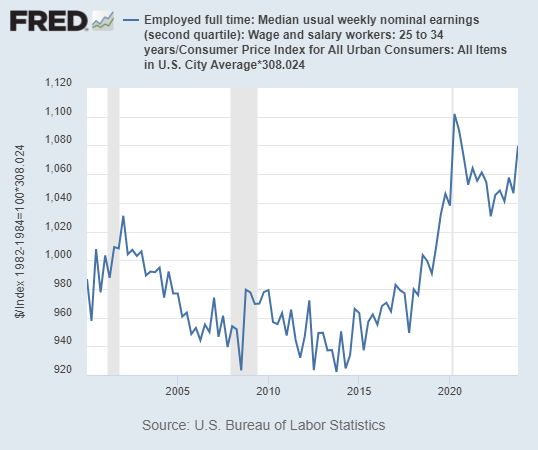

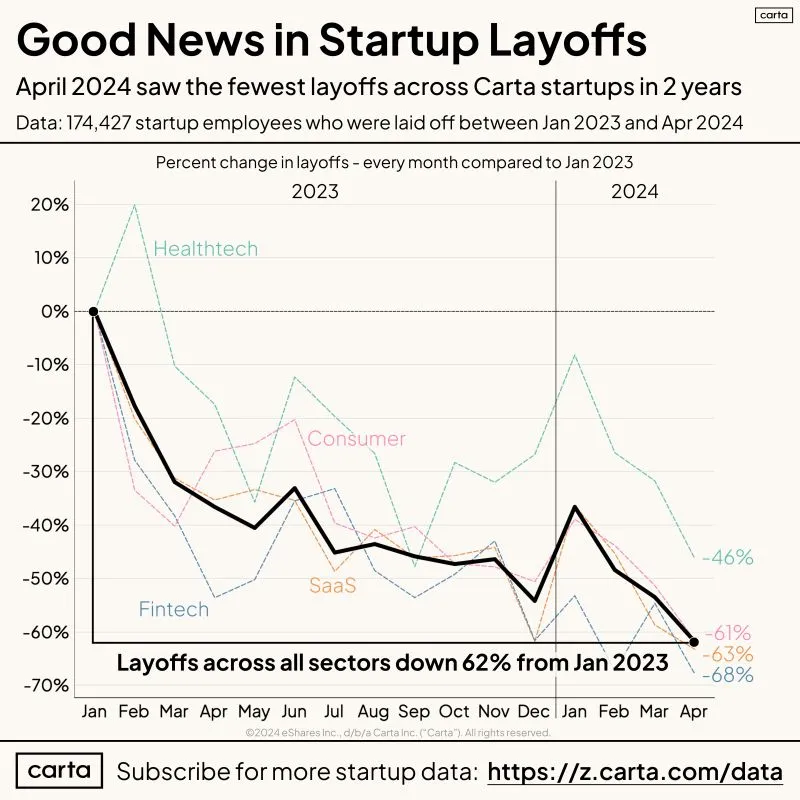

Labor market headlines are often worse than reality. While we’ve reached a high point, since 2021, the rate is still historically low. The expansion is slowing but we aren’t seeing a crash like in 2008. On the flip side, startup layoffs are down 62% since January 2023 per Carta. It’s been steady since early 2022 and may be ending.

Darkest days for startups coming to a close?

The rest of the economy is going through the cycle. Weak companies continue to seek acquisition, or bankruptcy. Financial companies might be in a weakened position but in the near term the 2008 regulations are doing their job.

The biggest headwinds for the economy are the commercial real estate market that has a 20.1% vacancy rate, not seen since the 80s. No indication of how or when this will impact real estate, finance or local governments. Another headwind is the increasing damage from cyberattacks, which impact company bottom lines. However, it’s also an opportunity for companies like Micrsoft to benefit from increased security spending.

TOPICS

- Global Recession

- Domestic Recession

- Fed Rate

- Commercial Real Estate

- Labor Market

- Bankruptcy

- Finance

- Mergers and Acquisitions

- Cybersecurity