2024 Week 20

Notes, thoughts and observations - Compiled weekly

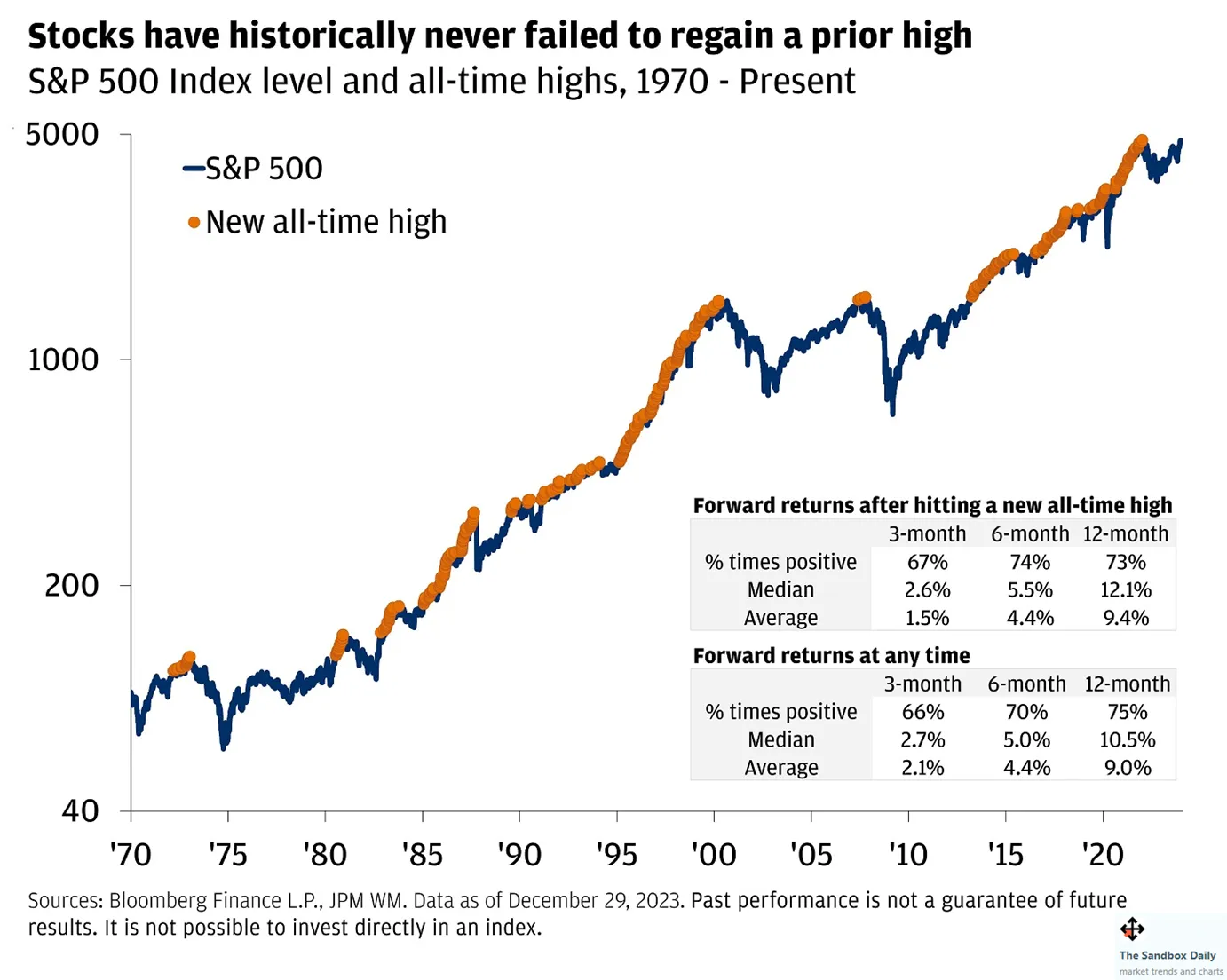

Long term thinking is the only low stress way to invest in the market, and not worry about what the Fed will do. Don’t worry about meme stonks.

Digital media remains in a state of consolidation. Comcast will partner with Peacock, Netflix, and Apple TV to offer bundles. Meanwhile Disney and Warner Bros announced a joint streaming service combining Disney+, Hulu, and Max. Either way the consolidation is starting to make streaming look more like linear TV.

Red Lobster is rumored to be going bankrupt and Under Armour is on the ropes. Corporate debt is less of a concern as businesses adjust to higher interest rates. Consumers, on the other hand, are taking out more debt. But looking beneath the numbers and debt has less to do with consumer spending. Income and wages are far more important.

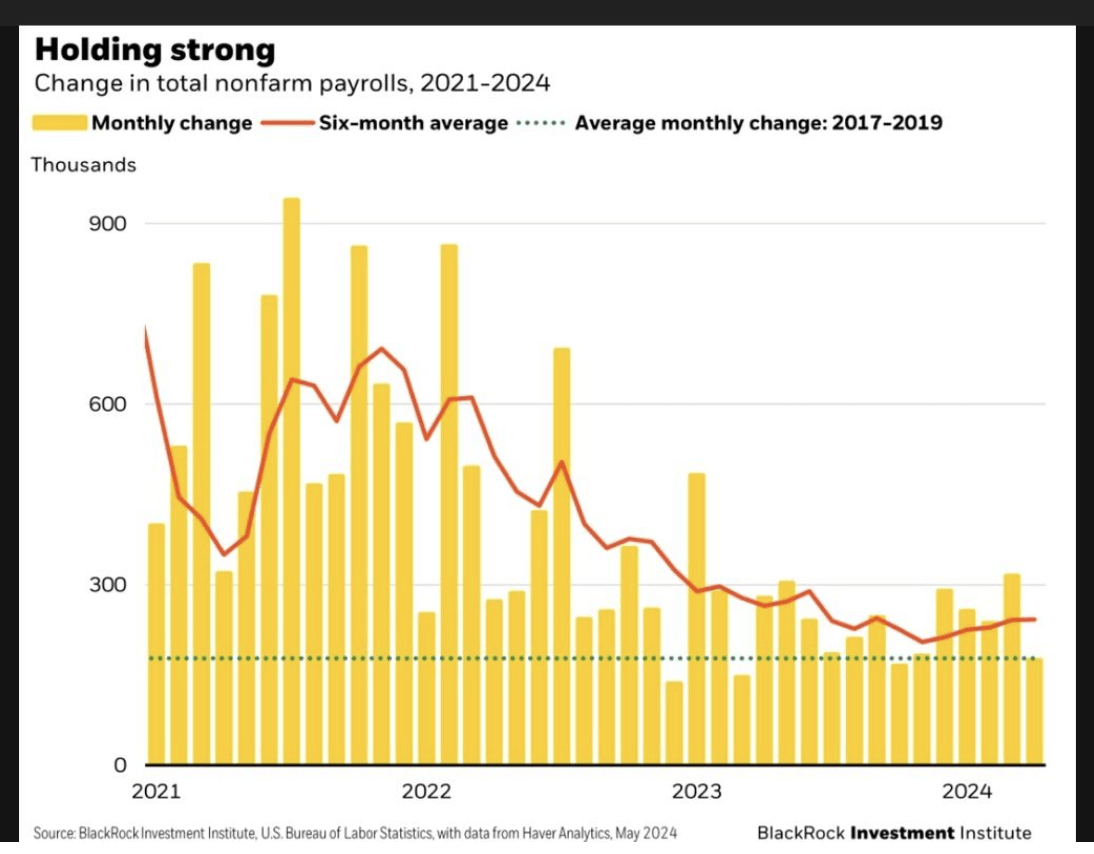

Labor market may be getting less tight

The labor market continues to struggle and we’re seeing layoffs outside of tech. We are also seeing an increase in unionization efforts which will make the southern US more expensive for manufacturing. Demand is high and with or without unions wages are likely to go up, and that will drive inflation.