2024 Week 9

Notes, thoughts and observations - Compiled weekly

Rough times for gaming as budgets are slashed and employees let go. Both Sony and Electronic Arts announced major changes. Given the strength of PC and mobile gaming, you must wonder about the future of consoles.

Apple throws in the towel on self-driving cars. Does this signal capitulation that the technology is nowhere close to road ready? Another interesting point is why Apple is reassigning employees from the car division to AI. Is this a FOMO move or was Apple already working on its own AI for vehicles?

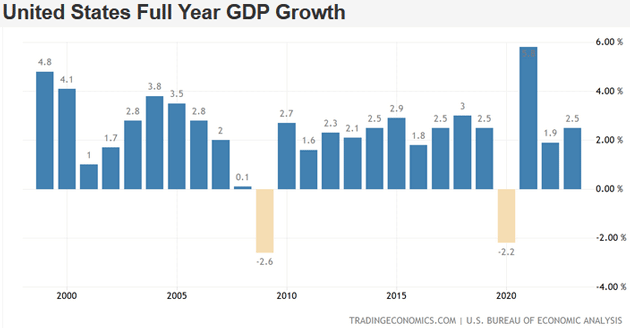

Regarding a US recession the data doesn’t indicate that. In fact, many believe there is no imminent danger despite some conflicting metrics. What is a risk is further bankruptcies, like for Macy’s who is closing 150 stores nationwide. The move is due to decadelong underperformance and investors looking for ROI. Things look dark for the retailer if the company can’t pull out of the dive.

The US economy’s statistical vital signs are, if not healthy, at least stable.

The guys on the All-In Podcast had a great discussion about the structure of Nvidia’s business and a breakdown of recent results (worth a watch/listen). A couple of big questions: Are these results based on a sustainable revenue model or are they simply due to a one time build out? Second who spends $22 billion? Big tech companies with lots of cash and not a lot of investment options. But at some point, investors will look for ROI and that could be bad for everyone involved.

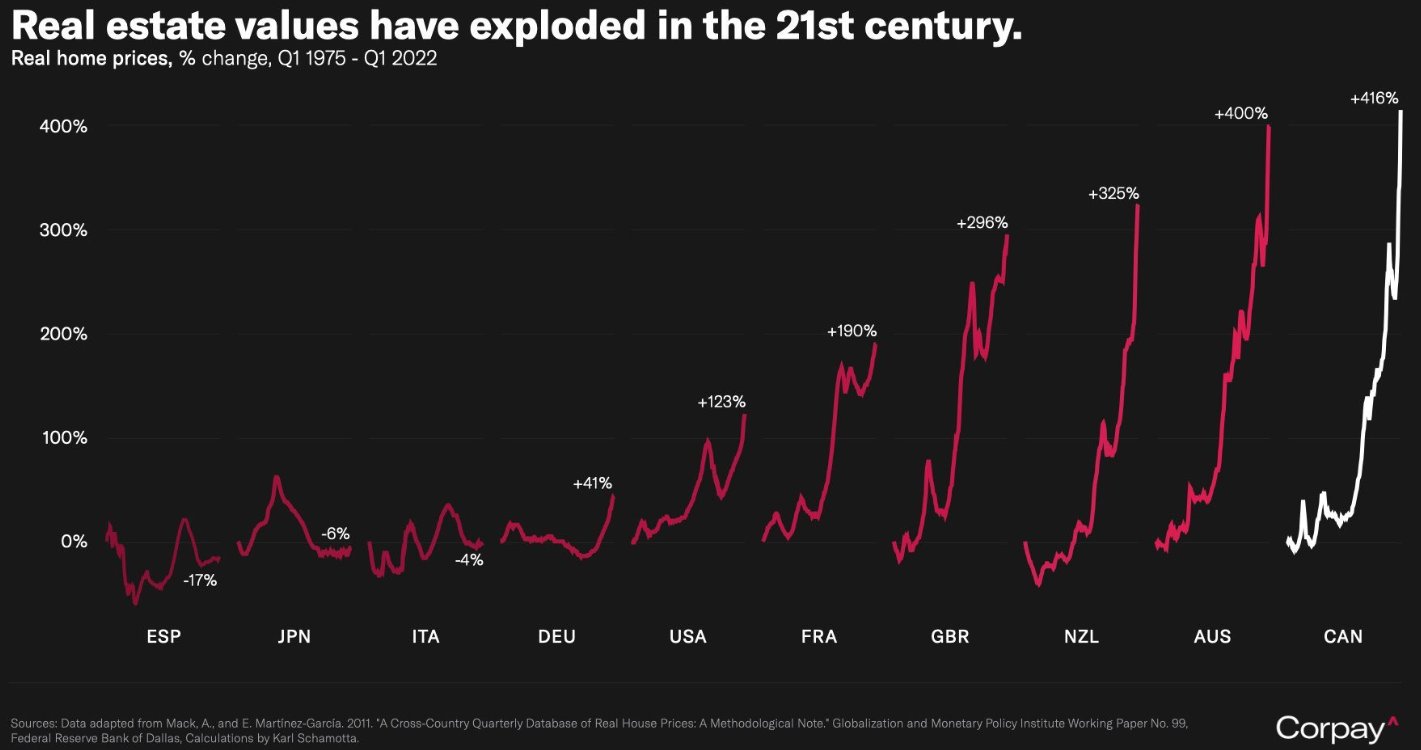

Real estate and energy continue to hum along. Home sales are slightly down, but prices are not. It should be noted that long-term inflation accounts for most of the rise in home prices. Meanwhile energy prices remain low in the US because of the shale gas revolution. To quote: “We’ve found almost three Saudi Arabia between oil and natural gas.”

Finally, an interesting tertiary observation about the expansion of AI chips and data centers which generate a lot of heat. Folks are beginning to pay attention to the water usage, for cooling, that these data centers demand. It brings into question the location of data centers in drought-stricken areas, but it also opens the door for alternative cooling technology that Intel and other startups are working on.

TOPICS

- Labor Market

- Path to Profitability

- Domestic Recession

- Bankruptcy

- Domestic Semiconductor

- Residential Real Estate

- Energy

- AI and ML

Labor Market

OBSERVATION - R&D/development budgets are being slashed

- (Brief.News)

- Electronic Arts is cutting 5% of its workforce, impacting around 670 employees.

- Cancelling several projects, including a highly anticipated Star Wars shooter game

- Shifting its focus to developing and supporting its own brands like Apex Legends and an Iron Man project.

- Response to industry trends favoring owned IP and online communities over licensed IP development.

- Layoff is part of a larger industry trend, with over 8,000 gaming industry jobs cut in early 2024.

OPINION - We are well beyond the heyday of console games. PCs are strong, but mobile gaming is more popular with under 25

- (CNBC)

- Sony to lay off 900 workers from PlayStation division, or 8% of unit’s global workforce

- PlayStation’s London studio will close in its entirety, with several other studios due to be affected.

Path to Profitability

OBSERVATION - Capitulation that self-driving cars are a technological dead end, for now

- (TechCrunch)

- Apple cancels its autonomous electric car project and is laying off some workers

- Likely cutting hundreds of employees from the team and all work on the project has stopped

- Some remaining employees will be shifted to Apple’s generative AI project

- QUESTION - Does this make sense??

- Comes at a time when major automakers are reevaluating their investments in electric vehicles, and amid increased scrutiny on autonomous vehicle projects

Domestic Recession

OBSERVATION - No imminent danger

- (Mauldin Econ)

- No Imminent Danger - The US economy’s statistical vital signs are, if not healthy, at least stable.

- We see the COVID effect in 2020‒2021 and the Great Recession in 2008‒2009. But otherwise, the 2.5% growth in 2023 is in the normal range compared to recent years.

- US GDP is doing well against other large economies

- The labor market also looks healthy.

- Frustrating Data

- Perhaps the most frustrating to me personally is the inverted yield curve.

- An inverted yield curve doesn’t cause a recession, it simply indicates something is wrong

- Industrial production is down, yet the economy seems to be doing fine.

- In the stock market, more stocks are down than up

- A few big names account for most of the growth

- The S&P 500 index is knocking on 30% gains over the last 12 months

- Perhaps the most frustrating to me personally is the inverted yield curve.

- No Imminent Danger - The US economy’s statistical vital signs are, if not healthy, at least stable.

Bankruptcy

OBSERVATION - Decadelong underperformance, and investors are looking for ROI

- (NBC News) ::

- Macy’s is closing 150 stores nationwide as it seeks ‘bold new chapter’ with greater focus on luxury

- The pivot will leave about 350 Macy’s locations plus Bloomingdale’s stores and the Bluemercury beauty and skin care brand.

- A “bold new chapter” that will involve shuttering “underproductive” locations, including approximately 50 by the end of the company’s current fiscal year.

- Macy’s has been under pressure from investor activists seeking an outright sale of the company due to its decadelong underperformance, with Macy’s real estate considered its most valuable asset.

Domestic Semiconductor

OBSERVATION - Really great break down of Nvidia’s business and prospective future.

- (All-In Podcast)

- Nvidia smashes expectations again

- Blew revenue numbers out of the park

- When you over earn it invites competition

- Who will step up to compete for those profits?

- Bezo moment “Your margins are my opportunity”

- Are these results sustainable?

- CISCO comparison, market crash end of 2000s and never recovered

- NIVDIA is different, multiples are no where near the same

- Has a competitive moat, CISCOs was easier to copy and commoditize

- Who spends $22.1B? Big companies with a lot of cash?

- Revenue is coming from big cloud providers (Google, Amazon, Microsoft)

- Build out is booked as a CapEx that can be depreciated over 7 years

- Big tec is struggling to grow through acquisitions; Not a lot of small companies; Anti-trust issues

- At some point all the spend has to make money

- Investors demand a rate of return

- NIVDIA needs to generate $45B of revenue to justify valuation

- Revenue is coming from big cloud providers (Google, Amazon, Microsoft)

- One time build out vs. sustainable revenue

- Intel / CPU was the fundamental workhorse until now

- $180 B market, created a $3-5 trillion economy

- If Nvidia is a $4-5T market cap, will it support a $100T economy?

- That is what is required to support the valuation

- Intel / CPU was the fundamental workhorse until now

Residential Real Estate

OBSERVATION - Inflation accounts for most of the home price appreciation.

- (Over My Shoulder)

- Observe that the 123% US price gain is way too low for an almost 50-year period. That’s because these are “real” inflation-adjusted prices.

- Home price increases occurred in the last 20 years or so. This coincides with generally low interest rates

- Have the effect of making leveraged assets more valuable

OBSERVATION - Slight slow down

- (Brief.News)

- New home sales in the US slightly increased by 1.5% in January to 661,000 units, falling short of the expected 680,000.

- December sales figure was revised down to 651,000 units.

- Median sales price of new homes rose to $420.7K

- Inventory levels grew to an 8.3 months’ supply

- New home sales still showed a 1.8% year-on-year increase

Energy

OBSERVATION - Oil & Gas is vilified but still important

- (Mauldin Economics) ::

- The future of oil and gas investing

- “We’ve found almost three Saudi Arabias between oil and natural gas”

OBSERVATION - Good news for consumers and energy-consuming businesses, but could mean higher prices down the road

- (Over My Shoulder)

- Natural gas prices have been falling because production has been climbing steadily in the post-COVID era.

- With production exceeding demand, gas producers are being incentivized to reduce output. Energy executives are saying that will likely be their next move.

AI and ML

OBSERVATION - Opportunity for innovation, but is it investable?

- (Over My Shoulder)

- Giant data centers that drive AI systems are packed with heat-generating processor chips that need cooling

- Requires large and growing amounts of water.

- Companies all say they recycle and otherwise try to minimize their water use. Newer chips may generate less heat

- With drought affecting more and more areas, this new source of water demand could become a problem.

- Giant data centers that drive AI systems are packed with heat-generating processor chips that need cooling