2024 Week 5

Notes, thoughts and observations - Compiled weekly

Fall out from Biogen’s failed Alzheimer’s drug Aduhelm will hurt more than the company. The big loser is the reputation of the FDA.

Strategic thinkers are considering a potential collapse in global maritime shipping. To date shipping has remained operational, but mostly due to ‘ghost fleets’ via China, Russia and India. The great unknown is what happens to insured ships that are inevitably attacked.

Residential housing is not very affordable, but a recent trend in kids moving back in with parents possibly has multiple underlying reasons.

Meanwhile GM dealers are begging the manufacturer for hybrid vehicles instead of full EVs. Dealers claim that buyer are looking for a middle ground between ICE and EVs. Despite the feedback, GM CEO Mary Barra is doubling down on EV.

Evergrande finally goes out of business, or not. The Chinese company was ordered to liquidate by a Hong Kong court. What comes next will be either a bad situation for Chinese savings or for Hong Kong’s authority.

Consumers are running out of steam with nearly 30% of Americans behind on payments. “Buy now pay later” is soaring as wages fail to keep up with inflation for lower wage earners.

Layoffs continue with fresh announcements from Deutsche Bank and Zoom and job losses continue to bleed over from tech into other sectors. Despite a large number of layoffs, unemployment continues to remain at record low as the labor market is still in imbalance.

TOPICS

- Labor Market

- Consumer Credit Crunch

- Bankruptcy

- Automotive

- Residential Real Estate

- Globalization

- Bio Pharma

Labor Market

OBSERVATION - Continued reductions in finance and other non-tech sectors

- (CNN)

- Deutsche Bank to cut 3,500 jobs, or 4% of workforce, in effort to slash costs by $2.7B by 2025

- Zoom to lay off roughly 150 jobs, or nearly 2% of workforce

- More than 100 tech companies have laid off over 30,000 people since the start of 2024

OBSERVATION - Unemployment still at record lows

- (Seeking Alpha)

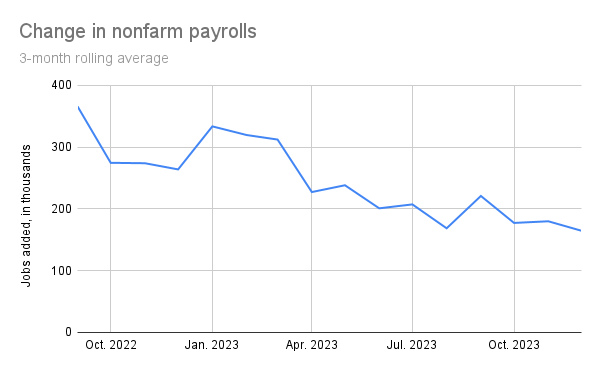

- Overall 3-month rolling average for nonfarm payrolls growth has been declining fairly steadily as seen in the chart below.

- “The labor market is still in imbalance - the labor demand exceeds the labor supply,

- There is a labor shortage, and it has to do with demographics and politics, but further analysis shows there are structural issues.

- See January Payrolls Preview: The Labor Market Is Still Tight, And That’s A Problem

- Overall 3-month rolling average for nonfarm payrolls growth has been declining fairly steadily as seen in the chart below.

OPINION - Likely scenario, long-term will hobble legacy companies. Employees will remember.

- (Pragmatic Engineer)

- Is an RTO ultimatum a predictor of cuts?

- IBM gave managers in the US an ultimatum: report to the office in-person immediately, or lose your job (source.)

- Managers need to be in-office at least 3 days per week, and anyone living more than 50 miles from the office has to relocate closer by August 2024.

- In the past, several companies did mass layoffs when not enough people quit voluntarily

OBSERVATION - Cuts b/c of over hiring but also banking on productivity gains

OBSERVATION - Fintech margins are getting squeezed

- (Seeking Alpha)

- PayPal starts round of layoffs in cost-cutting drive

- Layoffs will reduce staff across a range of teams, including research and development and engineering

- During the pandemic, tech companies, and especially fintechs, prospered as online commerce and work-from-home surged

- Some of tech’s biggest companies are now paring back staff as they adjust to the slower growth that has set in.

Consumer Credit Crunch

OBSERVATION - Spending running out of steam, at the bottom

- (Lending Tree)

- Nearly 30% of Americans in 100 Largest Metros Are Behind on Debt Payments

- 29.6% of Americans in the 100 largest metros were behind on their debt payments between July 1 and Sept. 30, 2023.

- Southern residents are particularly likely to be behind on a payment

- 27.3% of consumers across the 100 metros have debt that’s seriously delinquent (overdue by 90 days or more), while 26.2% have debt in collections

- By debt type, Greensboro, N.C., has the highest percentage of consumers behind on credit card payments (26.8%).

- Over one-third of millennials (36.7%) and Gen Zers (36.2%) are late on at least one account payment.

- Nearly 30% of Americans in 100 Largest Metros Are Behind on Debt Payments

OPINION - Wages not keeping up with inflation, not unexpected.

- (profstonge)

- “Buy now pay later” soars 14% as poorer Americans borrow furiously to make up for lost real wages.

- One in four Americans have now taken out a buy-now-pay-later loan.

- Setting up a default catastrophe given loans don’t require credit checks and are used overwhelmingly by the poor and the uneducated.

Bankruptcy

OPINION - Portends an economic crisis in Asia

- (Brief.News)

- Evergrande Ordered to Liquidate, Stirring Fears in China’s Real Estate Market

- Ordered by a Hong Kong court to liquidate amid a $300 billion debt crisis

- Market responses have been varied with no immediate widespread negative impact on Chinese-related financial assets

- Analysts downplay the likelihood of a financial crisis akin to Lehman Brothers, but the event underscores the vulnerability of China’s real estate sector.

- Zeihan’s take: The Chinese Housing Crisis: Evergrande’s Bankruptcy

- Fallout is going to be massive

- Could go for pennies on the the dollar

- 70% of Chinese assets are wrapped up in real estate, take a 90% haircut

- CCP steps in and goes on a state drip

- Undermines Hong Kong’s authority, lead to exfiltration of remaining assets

- Could go for pennies on the the dollar

- Fallout is going to be massive

Automotive

OPINION - The economics of EVs includes consumer demand, and they are not in demand.

- (Mike Shedlock)

- Dealers Beg GM for Hybrid Vehicles, Can GM Do Anything Right?

- GM is stuck producing EVs that consumers don’t want with no hybrid models that consumers do want. What’s the solution?

- The dealers said they expressed concern that more customers are looking for a middle ground between conventional gas-engine cars and EVs, which are more expensive and require regular charging.

- The dealers’ pleas for the company to consider adding hybrid models show another dimension of the pressure facing GM Chief Executive Mary Barra

- Barra said at a Barclays investor conference in 2019. “We believe moving to electric vehicles as quickly as possible is the right thing to do.”

- Not only does GM make below average cars, it is on a path for EVs that consumers don’t want.

- On January 11, I noted Hertz Is Selling 20,000 EVs Due to Lack of Customer Demand

Residential Real Estate

OBSERVATION - Affordability doesn’t tell the entire story

- (Axios)

- Why millennials are moving back home

- Younger generations may be staying home to save on expenses like rent or a future down payment

- More young adults could also be choosing to care for family members

- Reality check: Plunging affordability hasn’t stopped some millennials from buying homes

- Nearly 55% of millennials (those aged 27–42) owned a home in 2023, up from 52% in 2022

- Adult Gen Zers’ (those aged 19–26) homeownership rate stagnated at just over 26%.

- Why millennials are moving back home

Globalization

OPINION - Inevitable and it will be quick. Key is the US response to an attack and what other nations do.

- (Peter Zeihan)

- The Collapse of Global Maritime Shipping

- Despite disruptions the maritime shipping system has not cracked yet:

- Ukraine War

- A drought impacting the Panama Canal

- Houthi attacks in Yemen

- Widespread piracy

- Mounting geopolitical tensions in the South China Sea

- The main thing propping up shipping in these more problematic regions is the emergence of ‘ghost fleets’ with alternative insurance policies.

- Older ships, mostly liquid or bulk carriers

- This insurance system is untested and unreliable, and as soon as one of the dominos falls, the entirety of the shipping system will follow.

- Chinese, Russian or Indian insurance policies

- Despite disruptions the maritime shipping system has not cracked yet:

- The Collapse of Global Maritime Shipping

Bio Pharma

OPINION - Real reputational damage was to the FDA

- (ArsTechnica)

- Biogen dumps dubious Alzheimer’s drug after profit-killing FDA scandal

- Data never appeared to support such lofty aspirations

- Small, early clinical trial showed the drug could reduce plaques in the brains of people with Alzheimer’s, it initially failed two identically designed Phase 3 trials

- The FDA voted resoundingly against Aduhelm’s approval. Ten of 11 committee members voted against the drug

- In June 2021, the FDA nevertheless granted approval of Aduhelm

- move that shocked and outraged the advisory committee members and outside researchers and drew attention from lawmakers

- Biogen moved forward with Aduhelm

- Hired consultants to help research the best price. Final report suggested:

- A price between $15,000 to $20,000 a year would maximize the number of patients who could get the drug

- A price of less than $40,000 would limit pushback.

- A price over $40,000, on the other hand, would allow for “revenue maximization.”

- Biogen set the list price at $56,000 a year.

- Hired consultants to help research the best price. Final report suggested:

- Biogen dumps dubious Alzheimer’s drug after profit-killing FDA scandal