2024 Week 7

Notes, thoughts and observations - Compiled weekly

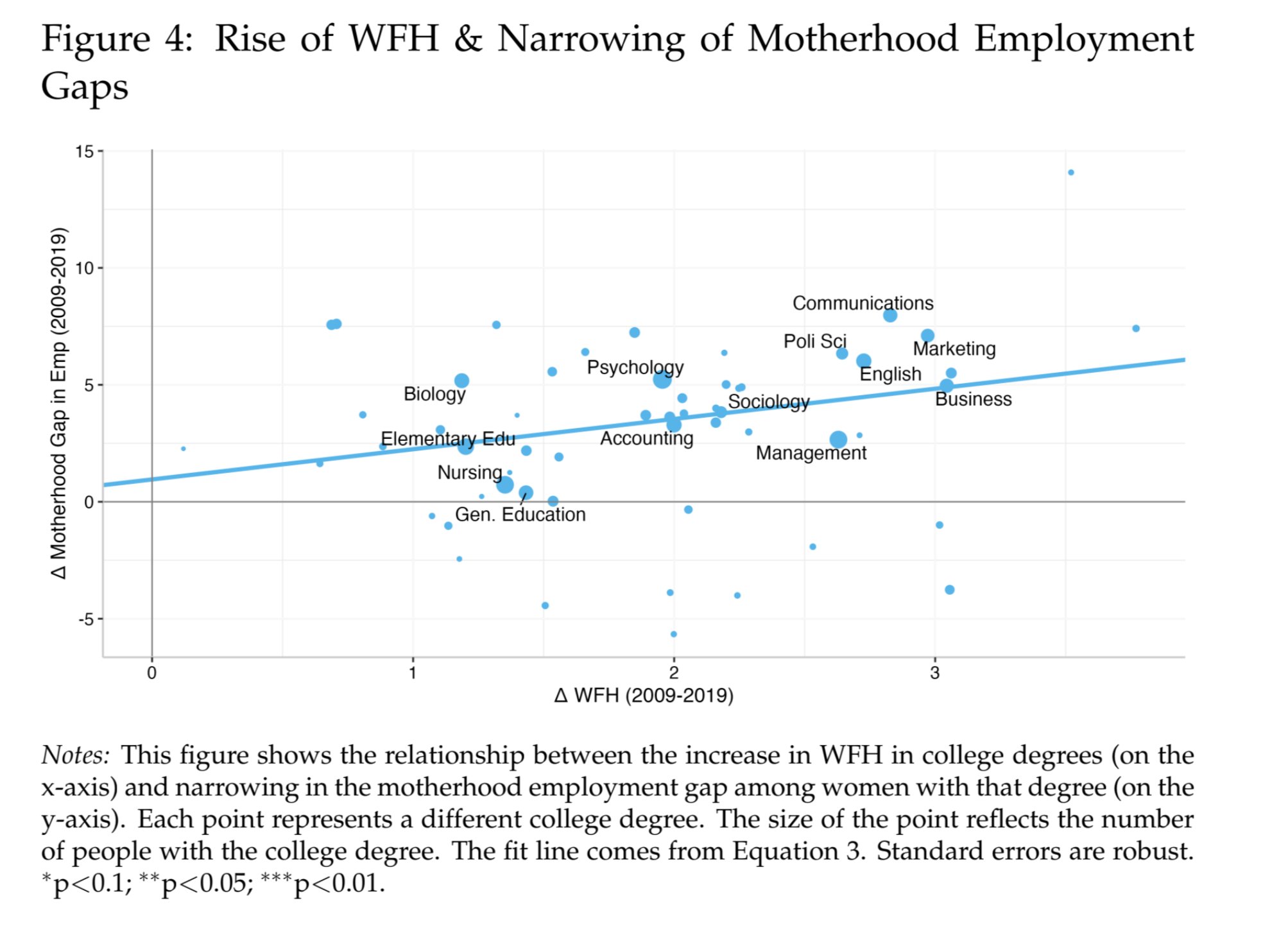

Interesting employment trend as the remote work trend (WFH) creates economic benefits in the labor market as we see a 1% increase in the labor participation of mothers. A couple of reasons why I think this is significant. First it creates a way for parents and caregivers to efficiently work part time as they balance other responsibilities.

Second, and more critically, it allows full-time workers to provide part-time childcare for school-age children. By eliminating the commute, parents can drop kids off at school, attend events and generally support their children WITHOUT the need to take time off. This is a huge productivity boost and allows parents to stay fully in the workforce.

WFH is benificial to the participation rate of parents and caregivers

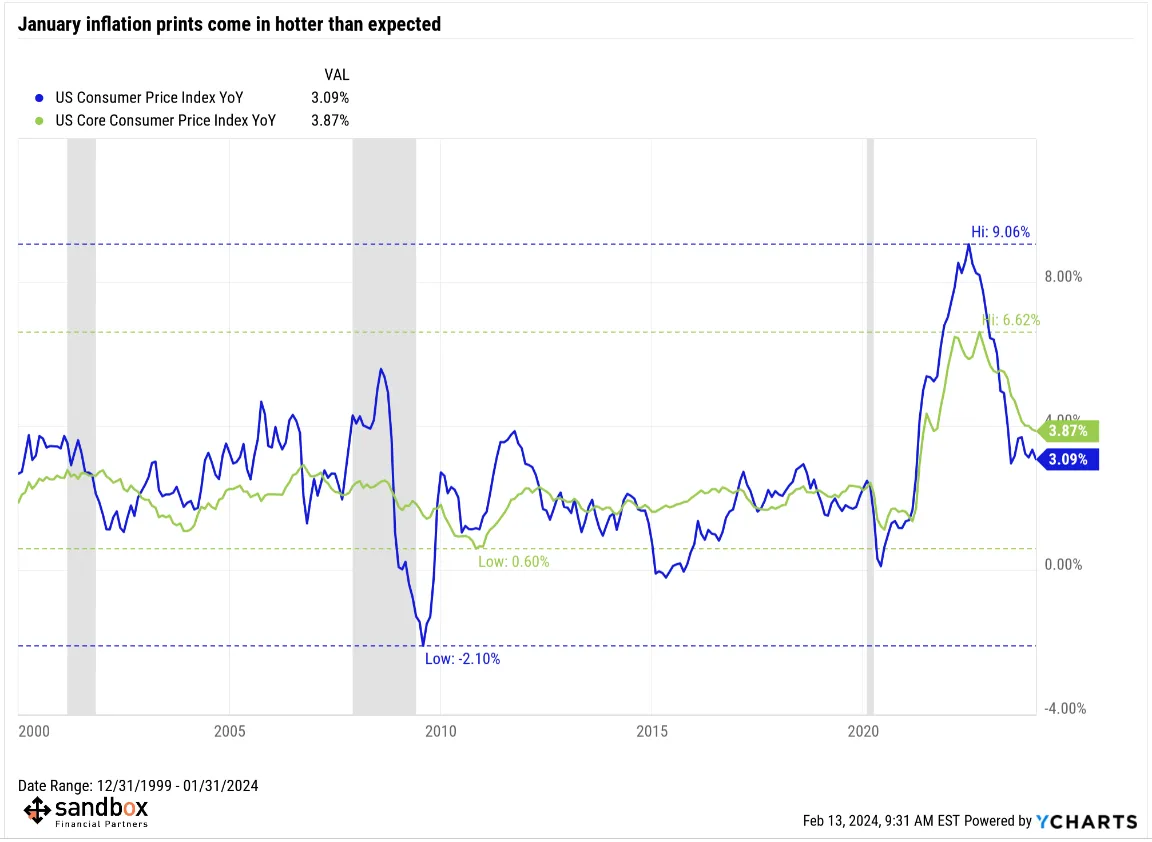

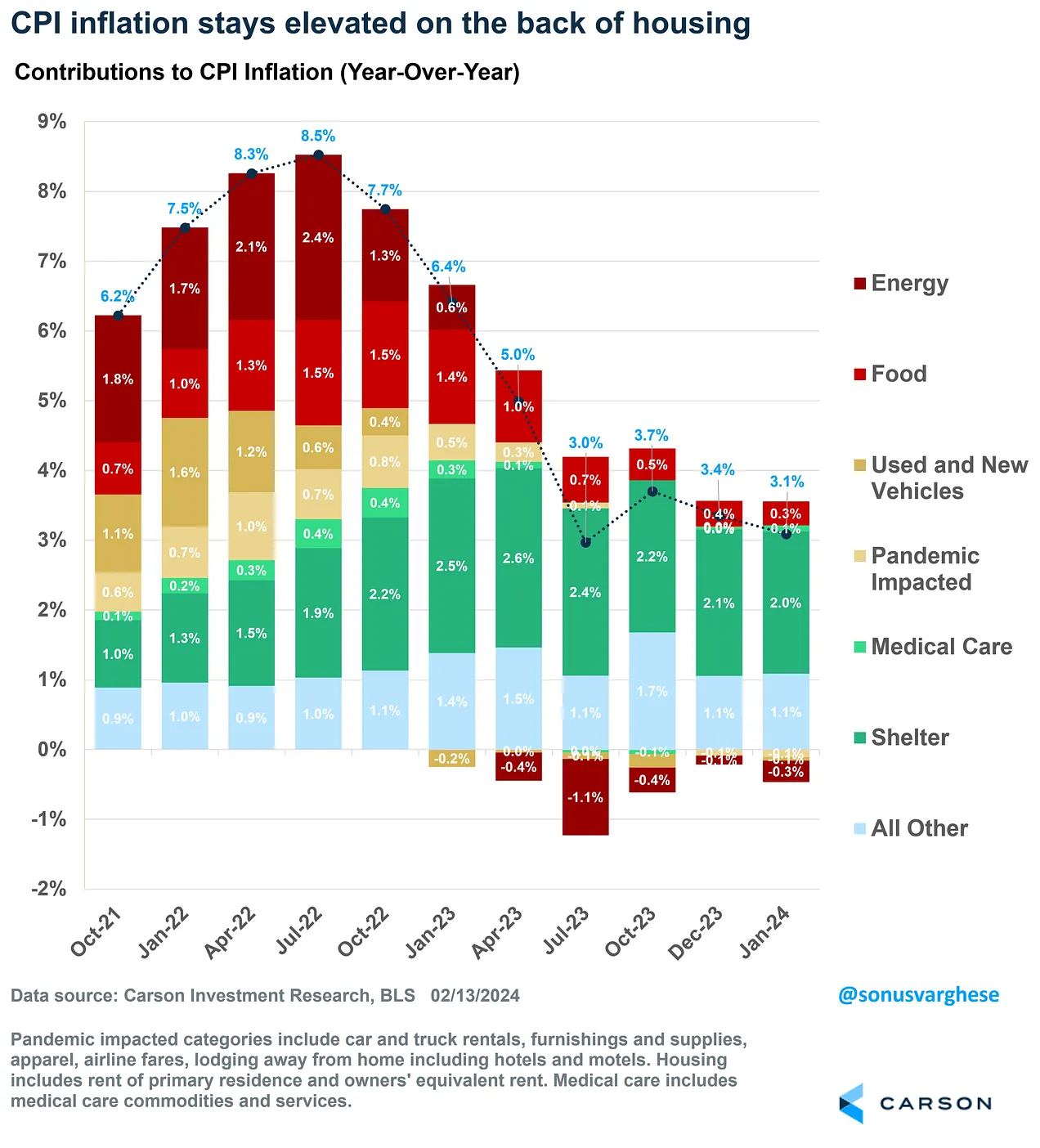

Meanwhile inflation remains sticky as the Shelter category continues to drive CPI. Despite interest rates, a shortage of available residential real estate still exists. All of this led me to think that the prospect of a Federal Reserve interest rate cut is wishful thinking.

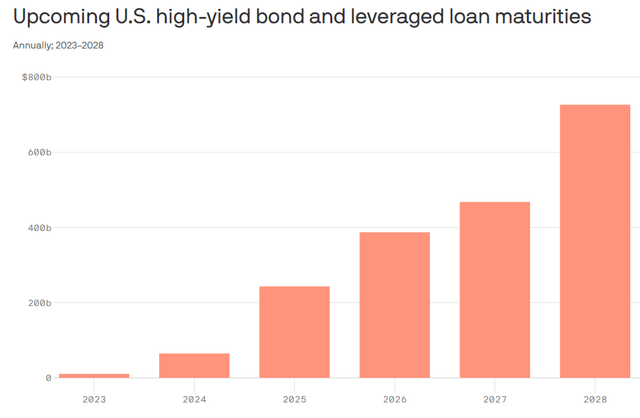

Speaking of interest rates, there are a lot of hullabaloo about the so called “wall of maturity”, but if you look at the maturities, you’ll notice more of a ramp from 2025 through 2028. Still a risk, but also not everything at once. I would expect a protracted period of pain. This along with ongoing CRE risks will hang a heavy cloud over debt markets for quite some time.

Wrapping up with Artificial Intelligence we are seeing two important trends. First a repatriation of high-end chips due to global supply concerns (Taiwan) and technological advances (Extreme ultraviolet lithography) which are expected to leapfrog domestic chip production by Intel. Second Nvidia chip supply issues are causing companies like OpenAI to spend an enormous amount ($7-9B) on GPUs per year. Long term this will influence companies (Apple, Tesla, Samsung) to design their own purpose-built chips.

TOPICS

Labor Market

OPINION - Getting profitable to court an M&A partner.

- (Seeking Alpha)

- Paramount to lay off about 800 employees in a bid to reduce costs

- imminent layoffs was reported in the media, which boosted its stock

- CEO Bob Bakish called for reducing costs as the company makes earnings growth its “top priority” in 2024.

- As of December 31, 2022, the company employed about 24,500 full- and part-time employees in 37 countries

- Paramount is set to reports on Feb. 28; expected to earn $0.13 per share on revenue of $7.89 billion

- In the midst of potential merger/acquisition activity

- A report suggested that private equity firm Apollo Global considering making a bid for National Amusements, the Redstone family company that controls Paramount.

- In December, there were reports that Warner Bros. Discovery’s CEO David Zaslav held talks with Paramount to discuss a potential merger

- Paramount to lay off about 800 employees in a bid to reduce costs

OBSERVATION - Time saved for working parents who also need to provide part-time child care (think school age children)

- (i_am_nickbloom)

- WFH is creating economic growth (by bringing more women into the workforce).

- A 10% increase in WFH is shown to increase mothers employment by 1%.

- A brilliant counter to what politicians and the press would like us to believe. Would love to see this replicated for the UK:

- WFH is driving faster economic growth by increasing the labor-supply of mothers.

- WFH supports children’s development by allowing parents to spend more time with them.

- WFH is creating economic growth (by bringing more women into the workforce).

Consumer Credit

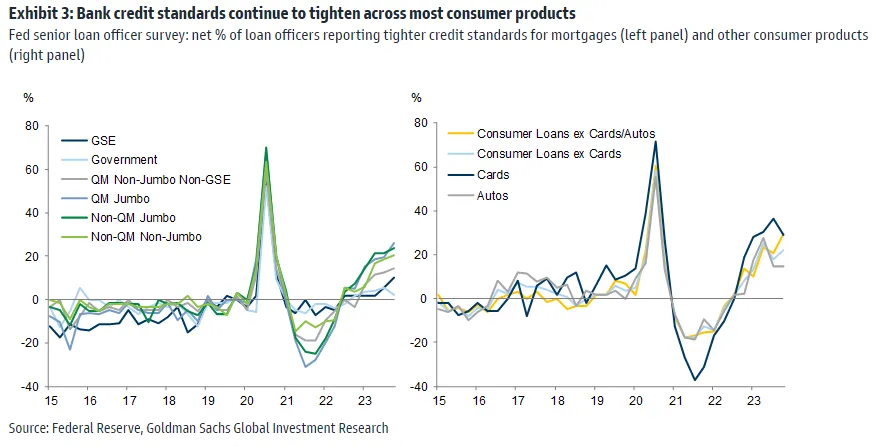

OBSERVATION - Consumer delinquency and default rates reflect interest rate normalization.

- (Sandbox Daily)

- Consumer credit standards are consistently tighter than pre-Covid levels

- Expectation that delinquency rates should normalize as interest rates recede over the coming 12 months.

Inflation

OPINION - Shipping troubles are inflationary to EU, not the US

- (Seeking Alpha)

- Will the shipping disruptions in the Red Sea be inflationary?

- A.P. Moller-Maersk just warned customers of a deteriorating situation in the vital waterway responsible for a sixth of world trade.

- Latest announcement shows growing uncertainty across the region and poses fresh questions for the global supply chain.

- “Unfortunately, we don’t see any change in the Red Sea happening anytime soon,” said Charles van der Steene

- Will it be inflationary? Spot and near-term shipping rates have doubled in response to the situation, while extra vessel capacity has led to additional operational costs.

- Most cargo that is transported to and from multinationals is carried at longer-term contracted rates; those are the costs that eventually get passed on to the consumer.

- Logistical reshuffling to air and rail hasn’t yet meaningfully hurt the price per mile in the U.S. intermodal freight transport network

OBSERVATION - Housing prices still driving inflation, but it’s a supply problem.

- (Seeking Alpha)

- Inflation rises more than expected in January, still hanging over 3%

- Housing prices remained sticky, hampering progress in tamping down inflation.

- Inflation in shelter costs remained stubborn, rising 0.6% in January and contributing more than two thirds of the headline increase.

- Hotter-than-expected indicates the Federal Reserve will be in no rush to cut interest rates from its current 5.25%-5.50% range

Growth too strong to achieve that last of disinflation, going from 3% to 2%; will require the Fed to remain higher-for-longer

- (Sandbox Daily)

- Inflation’s bumpy ride: January CPI report comes in hotter than expected

- January’s CPI print surprised to the upside, largely driven by persistent shelter price growth.

- The stickiness in the data continues to largely reside within the Shelter category, as you can see in the green bars below. While the large majority of categories contributing to inflation have receded, housing has not.

- Housing accounted for more than HALF of inflation in January. Shelter CPI increased 0.6%, the most in 11 months.

OPINION - Wishful justification for a rate cut that won’t come

- (Brief.News)

- US inflation rate forecasted to decelerate, prompting potential Federal Reserve interest rate cuts.

- Core CPI in the US likely to see a 3.7% rise in January, marking the smallest year-over-year increase since April 2021.

Corporate Debt

OBSERVATION - Less of a “wall” and more of a ramp of pain

- (Seeking Alpha)

- It appears that the Fed could be keeping the interest rates higher for a little longer until the economy slows

- The Fed needs to cut aggressively in 2024 before the maturity wall refinancing needs in 2025, and 2-3 cuts are not sufficient, as many companies would have a difficult time refinancing even with the Federal Funds rate at 4%.

- Here is the maturity wall:

Commercial Real Estate

OBSERVATION - Risks remain

- (Seeking Alpha)

- According to the St. Louis Fed, two-thirds of CRE loans are held by community or regional banks, meaning if things go sour, the sector can fall under immense pressure.

- Moody’s Investors Services downgraded New York Community Bancorp’s (NYSE:NYCB) credit rating to “junk” late Tuesday (just after Yellen’s testimony), citing “financial, risk-management and governance challenges.”

- Interest rates are also likely to remain high with the Fed taking a March cut off the table, while the long inversion of the yield curve isn’t helpful for banks that borrow short to lend long.

- A full contagion and CRE crisis could see thousands of banks fail under a worst-case scenario

Globalization

OPINION - Investment in high-end chips is a no-brainer for GPU dependent companies.

- (Brief.News)

- OpenAI CEO Sam Altman is actively seeking a substantial investment of $5 to $7 trillion to address the global shortage of GPUs, which are essential for developing advanced AI technologies.

- Funding aims to significantly enhance semiconductor manufacturing capabilities to meet the growing needs for AI-specific chips.

- Engaged with various potential investors, including sovereign wealth funds, government entities, and key industry players like TSMC

- Involvement of the UAE as a potential investor introduces geopolitical considerations, highlighting the strategic value of semiconductor manufacturing

- Biden administration’s initiatives to boost domestic chip production through subsidies and regulation reflect the US’s strategic emphasis on maintaining technological sovereignty.

AI

OBSERVATION - Reinforces the “bubble” aspect of NVDIA as companies scramble to buy existing GPUs. Re: Cisco in 2000s

- (The Pragmatic Engineer)

- OpenAI’s GPU bottleneck

- Most AI startups are probably spending more of the capital they raise on GPUs, than on software engineering salaries.

- This will definitely be true for companies like OpenAI, and might even be the case at Meta, which will probably spend $7-9B on NVIDIA GPUs alone this year, and then more on building its own chips.

OBSERVATION - Either way high-end chips are getting out of Taiwan

- (Peter Zeihan)

- The Bleeding Edge of Semiconductors: A Tale of Three Companies || Peter Zeihan

- New EUV down to 2 nm from ASML

- INTEL fabs in Phoenix and Columbus

- The Bleeding Edge of Semiconductors: A Tale of Three Companies || Peter Zeihan

OBSEVATION - Gen AI theme is heavily influencing the SPY, but can continue

- (Seeking Alpha)

- SPY is up by almost 5% YTD, in about 5 weeks. The rally has been led by Communications (XLC) up by almost 9%, and Technology (XLK) up by 6.5%.

- Individual stock performance within SPY, the performance has been led by NVIDIA Corporation (NVDA) up 40% and Meta Platforms, Inc. (META) up 32%.

- Obviously, the GenAI theme is heavily influencing the SPY performance YTD.

- Only thing that’s working right now for the broader stock market

- Given the big tech leadership, SPY is currently trading at a P/E ratio over 22, and the dividend yield is at 1.46% - this is expensive,

- Chart of Nvidia, which is the 3rd largest stock in the S&P 500 with 4% weight in the Index

OPINION - Short term losses in cloud will be absorbed by growing need for processing and storage of AI applications.

- (David Linthicum)

- Why companies are leaving the cloud; most common motivator for repatriation I’ve been seeing is cost:

- Cloud is a good fit for modern applications that leverage a group of services, such as serverless, containers, or clustering. However, that doesn’t describe most enterprise applications

- Cloud providers may be losing workloads and data sets that never should have been on a public cloud in the first place

- Losses from repatriation will be quickly replaced by the vast amounts of infrastructure needed to build and run AI-based systems.

- Includes new applications as well as existing applications that will be AI-enabled.

- Enterprises are also expanding their use of the cloud because AI systems are processor and storage pigs and need state-of-the-art frameworks, genAI ecosystems, and large language models that cloud providers are happy to host.

- Why companies are leaving the cloud; most common motivator for repatriation I’ve been seeing is cost:

OBSERVATION - Advantage to companies that can build full stack: chip, data, model, training (ex. Apple, Tesla, Samsung)

- (All In Podcast)

- VCs are split into three camps on how to approach AI investing

- “Picks and shovels companies” that make their own chips can make money

- Proprietary data holders who train models can make money

- Open source data models will be crushed the economic value to models

- VCs are split into three camps on how to approach AI investing