Category:

Business

2022 Week 37

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

- (Cathie Wood) :: The Fed is basing monetary policy decisions on lagging indicators: employment and core inflation. Leading inflation indicators like gold and copper are flagging the risk of deflation. Even the oil price has dropped more than 35% from its peak, erasing most of the gain this year.

- Today’s COVID-supply-shock inflation is nothing like the ‘70s inflation that started with “guns and butter” in 1964, and accelerated after Nixon ended the gold-exchange standard in 1971.

- Volcker took charge in 1979, 15 years after the Vietnam War and Great Society began, did the Fed attack inflation decisively. In contrast, faced with a two year supply-related inflation shock, Powell is using Volcker’s sledgehammer and, I believe, making a mistake.

- Raised the Fed funds rate 10-fold from 0.25% to 2.50%, five times Volcker’s 2-fold increase from 10% to 20% in the early ‘80s when consumers and businesses had been adjusting to inflation for 10-15 years. In contrast, today they are in shock. Housing is unraveling.

- In the pipeline, inflation is turning into deflation. One of the best inflation gauges, the gold price peaked more than two years ago in August 2020 at $2075 and has dropped ~15%. Lumber prices have dropped more than 60%, copper -30%, iron ore -60%, DRAM -46%, and crude oil -35%.

- Retailers seem to be swimming in inventories which they could be forced to discount aggressively to clear the shelves for holiday merchandise. The surprise could be deflation in the CPI and PCE deflator by year-end.

NOTES: Long tweet thread on inflation, if Wood is correct this will be an interesting Q4

Real Estate

Buy When There’s Blood in the Streets - Nathan Rothschild (maybe?)

-

(Calculated Risk) :: Most homeowners have a significant amount of equity and will not be “underwater” if house prices decline.

-

(Calculated Risk) :: Recent home price reports actually suggest that “national” home prices may already have started to decline

- S&P/Case-Shiller “national” HPI – increased by just 0.3% a shocking deceleration from the 1.6% increase

- Shocking because the SPCS HPI is basically a three-month moving average measure, and such sharp growth changes in three-month moving average measures of home prices are exceedingly rare

-

(Calculated Risk) :: Annual home price growth still clocked in at 14.3%

- For the first time in 32 months, home prices saw a month-over-month dip in July, as growth tipped from deceleration to decline

- The median home price fell by 0.77% in July, the largest single-month drop since January 2011

-

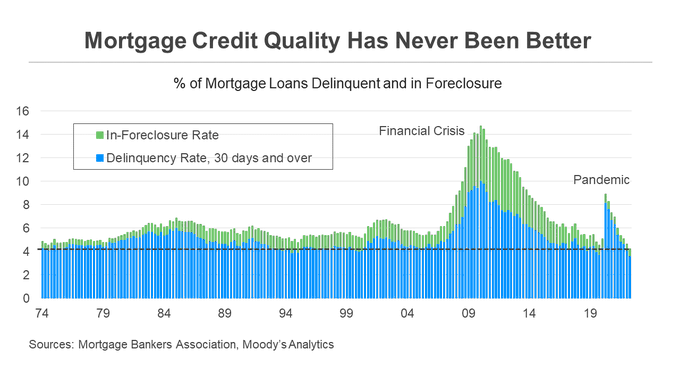

(Mark Zandi) :: Mortgage credit quality has never been better

- I often get asked why I expect U.S. house prices to correct (down by single digits peak-to-trough) but not crash (down >20%). Topping the list of reasons is that mortgage credit quality has never been better. The % of loans delinquent and in foreclosure is at record lows.

OPINION: Very different conditions from the 2008 mortgage crisis

- (Charlotte Ledger Podcast) :: Terry Shook - Suburban office campus has seen it’s heyday

- Pivot to offer the “convenience stack” for in person workers

- Convenience factor to working from home, but not for everybody

- Research Triangle Park continues to grow, but is pivoting

- Terry Shook is a “downtown guy”

- Those that are reinventing themselves will continue to be a value prop

- Pivot to offer the “convenience stack” for in person workers

OPINION: Long-term, campus style offices are out of fashion; expect smaller, more flexible office spaces (think WeWork)

Currency Trade

Change is good but dollars are better. - Tara daniels

-

(El-Erian) :: Some thoughts on the why and so what of the continuing appreciation of the US dollar, including the DXY index reaching a level last seen in 2001.