2024 Week 3

Notes, thoughts and observations - Compiled weekly

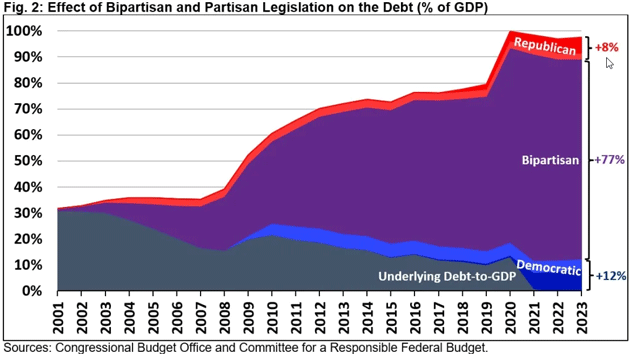

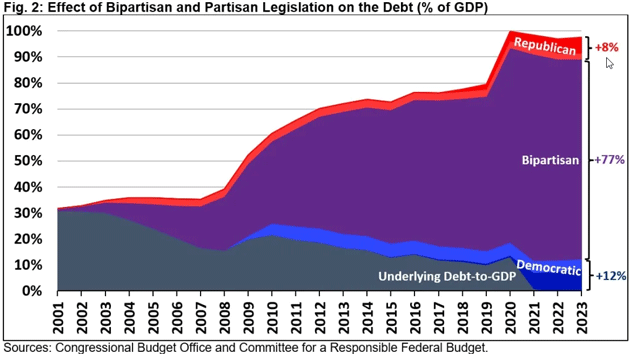

Populist political consequences and bipartisan, systemic big government spending are to blame. 77% of debt since 2000s attributed to legislation that passed with strong bipartisan support.

Understatement of the year: Commercial real estate is in trouble. Empty office buildings are setting cities in a doom loop. Even CBS 60 minutes has picked up on the trend.

Global shipping is under pressure. reducing container transport by over 50%. Shipping rates will impact the supply chain for Europe, which is already weak or in recession.

EVs don’t make a lot of economic sense right now and car buyers don’t want them. Only 6 Percent in the US want an EV for their Next Vehicle. Adoption rate is likely due to massive government subsidy programs.

CRFB finds 77 percentage points of the current 98% (122%) debt/GDP ratio

TOPICS

Labor Market

OBSERVATION - Layoffs in financial sector

- (CNBC)

- Citigroup said it was cutting 10% of its workforce in a bid to help boost the embattled bank’s results and stock price.

- In November, CNBC reported that managers and consultants involved in CEO Jane Fraser’s restructuring discussed job cuts of 10%.

- The company has since executed several waves of layoffs, with another round of cuts set for Jan. 22, according to a source.

OBSERVATION - Still cutting the fat.

- (Brief.News)

- Amazon and Google announce significant layoffs to improve efficiency and align resources.

- Primarily impact Amazon’s subsidiaries, including Prime Video, MGM Studios, and Twitch, and Google’s divisions like augmented reality, Assistant programs, and hardware teams.

- Google’s layoffs include around 1,000 positions in Voice Assistant, core engineering, and hardware teams such as Pixel, Nest, and Fitbit.

- Scale of the layoffs is unknown but represents only a small portion of Alphabet’s total workforce.

Inflation

OBSERVATION - leveled off in 2023

- (GRDecter)

- Probably nothing.

OPINION - Inflation influences elections; rapid reform can make things worse before better.

- (Brief.News)

- Argentina’s annual inflation rate for 2023 hit 211.4%, exceeding Venezuela’s for the first time in years.

- The increase in inflation was a result of shock measures implemented by right-wing President Javier Milei, including a 50% devaluation of the country’s currency.

- Despite the high inflation, the monthly rate of 25.5% in December was slightly below the government’s forecast of 30%.

- Milei plans to tackle hyperinflation with severe austerity measures and plans to dollarize the economy, but anticipates conditions could worsen before they improve.

National Debt

OBSERVATION - Bipartisan, systemic big government spending to blame.

- (John Mauldin)

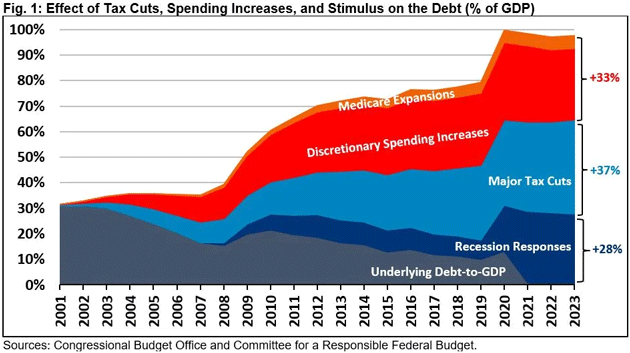

- “Absent any two of these sets of policies, the debt-to-GDP ratio would be near the FY 2001 level. Absent these tax cuts, spending increases, and recession responses, debt would be fully paid off.”

- Bipartisan Debt

- CRFB finds 77 percentage points of the current 98% (122%) debt/GDP ratio can be attributed to legislation that passed with strong bipartisan support.

OPINION - Populist political consequences

- (Over My Shoulder)

- In 2001, the CBO estimated then-current policies would eliminate the national debt by the end of 2009. Instead, debt went from 32% of GDP to today’s 98%.

- CRFB finds that of this 98%

- 37 percentage points came from major tax cuts

- 33 points from discretionary spending increases and Medicare expansion

- 28 points from response measures to the Great Recession and COVID-19 pandemic

- Had revenue and primary spending both remained at 2001 levels, the national debt would have been paid off by 2011.

- Bottom Line: CRFB’s estimates don’t account for dynamic economic effects of tax and spending policies.

Real Estate

OBSERVATION - Understatement of the year: Commercial real estate is in trouble

- (danjmcnamara)

- How empty office buildings are setting cities on a doom loop | 60 Minutes - CBS News

- remote and hybrid work hardening from trend to new normal, office occupancy rates are at an all time low

- Real estate professor Stijn Van Nieuwerburgh (Columbia Business School) calls it a “train wreck in slow motion.”

- “And this is just the beginning. And the reason it’s just the beginning is because there’s a lot of office tenants that have not had to make an active space decision yet,”

- Office building troubles bleed into the banking sector; mostly about these smaller and medium size, maybe regional banks

- About 30% of all their loans are commercial real estate loans.

- The “urban doom loop”

- In the long run, property taxes on those buildings will also fall by 40%

- How empty office buildings are setting cities on a doom loop | 60 Minutes - CBS News

Globalization

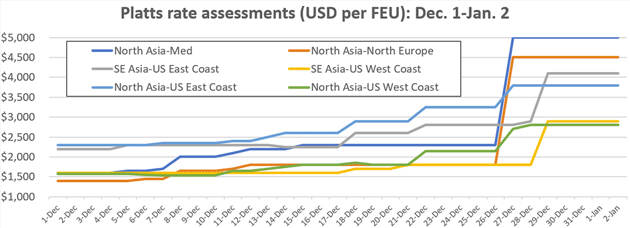

OBSERVATION - Shipping rates will impact supply chain for Europe, already weak or in recession.

- (Brief.News)

- Ongoing Houthi rebel attacks in the Red Sea have disrupted global trade and shipping, reducing container transport by over 50%.

- Efforts to address the attacks have so far been unsuccessful, leading to calls for the reopening of the Bab-el-Mandeb strait for safe passage.

- Several shipping companies have suspended operations due to the situation, causing potential supply chain disruptions.

OPINION - Investors starting to pick up on the trend

- (Ed D’Agostino)

- Global shipping is under pressure.

- Houthis are disrupting shipping through the Suez Canal, a critical artery for ships traveling between the Middle East and Europe.

- Around 30% of global container traffic flows through the Suez Canal.

- As global shipping grows more difficult and dangerous, it also grows more expensive.

- Shipping rates for the North Asia-Mediterranean route had more than tripled since early December.

- Unfortunately, today’s level of global tension could be our new baseline. That is contributing to a realignment of global trade patterns.

- Companies are looking to de-risk. And for US companies, that often means reshoring and nearshoring production.

- Pandemic-era supply disruptions accelerated it,

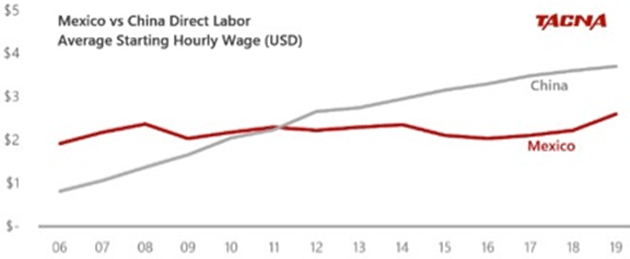

- China much more expensive in recent years.

- Mexico now offers the second-cheapest manufacturing labor in the world.

- Helps that you don’t need to move things made in Mexico via ship.

- Earlier this year, Mexico became the top US trading partner. Canada comes in at number two.

Environment

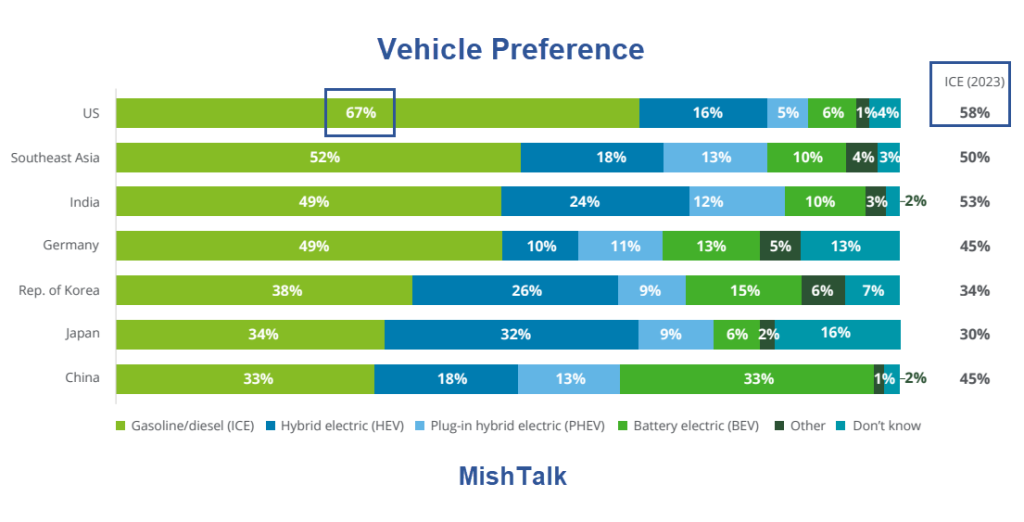

OPINION - Might be seen as a partisan issue, but EVs don’t make a lot of economic sense right now and car buyers don’t want them.

- (Mike Shedlock)

- Only 6 Percent in the US want an EV for their Next Vehicle

- Four Key Trends

- Slowing EV momentum may be putting current decarbonization timelines in jeopardy.

- A significant number of consumers may be thinking about switching vehicle brands.

- Interest in connectivity features may not fully translate into revenue and profit.

- Younger consumers are interested in vehicle subscriptions, as a growing number of them question if they need to own a vehicle going forward.

OPINION - Adoption rate likely due to massive government subsidy programs.

- (Brief.News)

- Renewable energy saw its fastest growth in 25 years in 2023, largely due to China’s solar energy expansion.

- China is anticipated to surpass hydropower with wind and solar power this year, and outdo coal by 2025.

- Despite this, the International Energy Agency (IEA) predicts renewable energy will not meet the United Nations’ tripling target due to insufficient clean energy funding in developing nations.

OBSERVATION - Dumping EVs

- (Seeking Alpha)

- Hertz Global said it would cut its EV adoption losses by offloading a third of its global fleet to buy gasoline-powered cars.

- That’ll put 20,000 EVs up for sale, including those from Tesla in response to weak take-up and elevated repair costs.

- The decision adds to growing EV demand worries, which were already amplified by pullbacks on production targets.