Category:

Business

2023 Week 33

Notes, thoughts and observations - Compiled weekly

Combine weeks due to slow news and stuff to do.

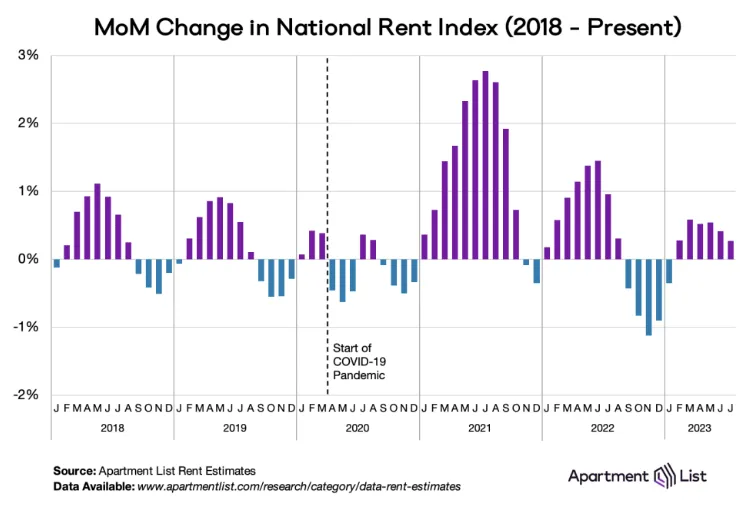

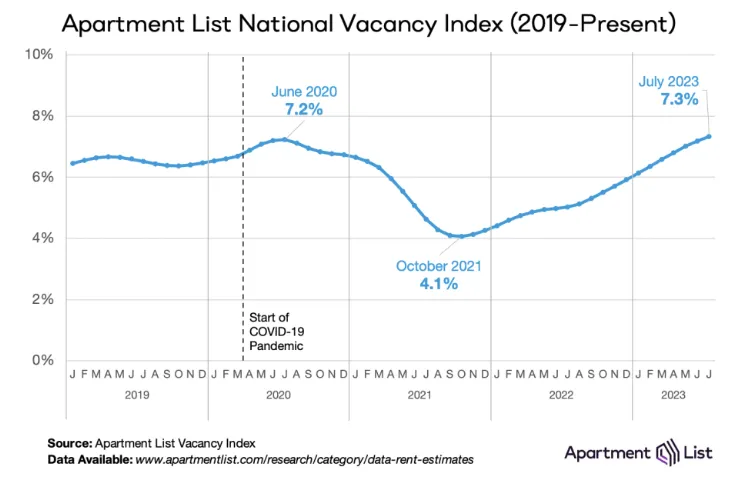

Mortgage rates are at a 20 year high and there is no way it won’t negatively immpact the housing market. Meanwhile rents are in decline, but why? Whatever the reason many are concerned about over built multi-family construction and construction loans that will need to be converted to high interest loans.

Inflation numbers look better but under the covers energy continues to be a huge upward pressure on CPI.

The labor market continues to struggle as some workers strike for more money and others are getting pink slips. The average job seeker is spending between 3-6 months looking for a new job.

TOPICS

Real Estate

OBSERVATION - Highest in 20 years, will negatively impact the real estate market

- (Calculated Risk)

- The impact of 7% Mortgage Rates

- 30-year mortgage rates are at 7.11% today for top tier scenarios.

- It will likely impact closed sales in the August through October timeframe.

- There will likely be less of an impact on new home sales since homebuilders will offer various incentives and mortgage rate buydowns

- (Calculated Risk)

- Asking Rents Negative Year-over-year

- Apartment List: Asking Rent Growth Negative Year-over-year

- Apartment List: Asking Rent Growth Negative Year-over-year

- Asking Rents Negative Year-over-year

OPINION - Risk to real estate, and market, due to WFH is over stated. Will be bad for older, less desirable office buildings.

- (Mauldin Econ)

- Significant different between offices (like doctors or industrial) and office buildings that people don’t want to go to

- Wouldn’t want to be exposed to high rises

- WFH can hurt real estate but won’t tank wall street

- Other real estate type are cell towers

- Wireless carriers not doing well, slowing down 5G roll out

- Significant different between offices (like doctors or industrial) and office buildings that people don’t want to go to

Inflation

OBSERVATION - Energy still a primary driver of inflation and it touches several CPI sectors.

- (Over My Shoulder)

- The US Consumer Price Index rose 3.2% in the 12 months through July, according to this morning’s release. That’s a remarkable decline from 9% just over a year ago. Yet the index has some quirks we should keep in mind.

Labor Market

OPINION - Workers deserve pay raises due to inflation, but unions often ignore the health of their industries.

- (MishGEA)

- AW Declares War on Corporations, Seeks 46 Percent Wage Hike, September Strike Looms

- The UAW contract with GM, Ford, and Stellantis expires on September 14. The UAW demands are outright ludicrous. A strike appears likely.

- (Seeking Alpha)

- Salesforce said to lay off more employees after January’s purge

- Reportedly laid off more employees after it let go 10% of its workforce in January.

- co-CEO Marc Benioff said the company hired “too many people” leading into an economic downturn

- Salesforce said to lay off more employees after January’s purge

- (Seeking Alpha)

- Job openings drop slightly and quits rate ticks down in June JOLTS report

- June Job Openings: 9.582M vs. 9.650M consensus and 9.616M prior (revised from 9.824M).

- Job opening rate of 5.8% was unchanged, while the quits rate of 2.4% vs. 2.6% in May.

- The number of layoffs and discharges fell slightly to 1.527M from 1.546M in May, according to the U.S. Bureau of Labor Statistics.

- Job openings drop slightly and quits rate ticks down in June JOLTS report

Recession

OBSERVATION - China is in trouble as a global economy

- (Seeking Alpha)

- Exports, manufacturing activity and property prices are sliding in China, which has decided to stop reporting the country’s rising youth unemployment rate, while a worsening debt crisis and deflationary spiral are threatening growth.

- A collapse in commodity-based export revenues and extensive military spending have also weighed on sanctioned Russia, which just saw the ruble fall past the psychologically important level of 100 to the dollar after tumbling 37% YTD.

- The gloomier outlook means China might miss its annual GDP growth target of 5% this year as it looks to sort out its economic problems.

- The first thing that needs to be addressed is the concern of growing financial contagion, and debt problems that span from local authorities to the central government.

- Declining domestic demand means shortfalls in tax revenue, while weakness in finances could harm Beijing’s fiscal policy toolkit to help support the economy.

- Exports, manufacturing activity and property prices are sliding in China, which has decided to stop reporting the country’s rising youth unemployment rate, while a worsening debt crisis and deflationary spiral are threatening growth.

OPINION - Bellicose rhetoric from the president, totally unnecessary. China is facing some serious economic and demographic headwinds for sure.

- (Seeking Alpha)

- Biden calls China a ’ticking time bomb’ amid deflationary spiral, economic woes

- “So they got some problems,” he said. “That’s not good because when bad folks have problems, they do bad things.”

- Biden calls China a ’ticking time bomb’ amid deflationary spiral, economic woes