Category:

Business

2022 Week 51

Notes, thoughts and observations - Compiled weekly

TOPICS

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

- (Jason) :: As I mentioned two weeks ago, media companies will be contracting 20-50% in the coming weeks. The mighty Washington Post announced Q1 layoffs & an employee seems to have leaked the contentious video

- media company layoffs are going to be hard-core in the coming weeks/months CNN, http://Future.com (a16z’s media company that would change everything), The Recount shut down, Warner Bros, Protocol shutdown, Morning Brew 14%, & USA Today/Gannett another big RIF

- (Jim Cramer) :: Big layoffs coming at Club holding Salesforce (CRM).

- The stock is down nearly 50% year to date.

- We already know about some high-profile executive departures, including co-CEO Bret Taylor.

Fed Rate

To understand Modern Monetary Theory, understand why the banker in Monopoly can never run out of money. - MMT aphorism

- (Stay-At-Home Macro) :: Ban the Phillips Curve

- The stakes are too high to use the Phillips Curve with its unreliable tradeoff between unemployment and inflation. We don’t need millions of Americans out of work. We need investments in our future.

- Premise:

- The model created in 1958 says that to get inflation down, unemployment must rise.1 Low unemployment, as we have now, is a sign of a strong labor market, which fuels strong demand. Strong demand leads to high inflation. The Fed raising interest rates is the primary policy tool its believers call for to fight inflation.

- Alternatives:

- Want lower inflation? Want to solve the labor shortages? Start thinking about supply.

- Get every American health care and paid sick leave

- Good health leads to more productive workers

- Fix our deeply broken immigration system

- Backlog of green card applications is in the millions, including hundreds of thousands of workers

- Invest in our future

- Infrastructure Act, Inflation Reduction Act, and the CHIPS Act largely use tax incentives

- Taxes are not the only reason companies invest. Expected profits are important. High interest rates cut into profits.

- Invest in our children

- Restart the Child Tax Credit

- Invest in education with free pre-K

- Invest in our working parents with affordable child care

- Get every American health care and paid sick leave

- Want lower inflation? Want to solve the labor shortages? Start thinking about supply.

- (Wall Street Breakfast) :: Federal Open Market Committee increased rate by 50 basis points to 4.25%-4.50% on Wednesday, downshifted from 75 bps

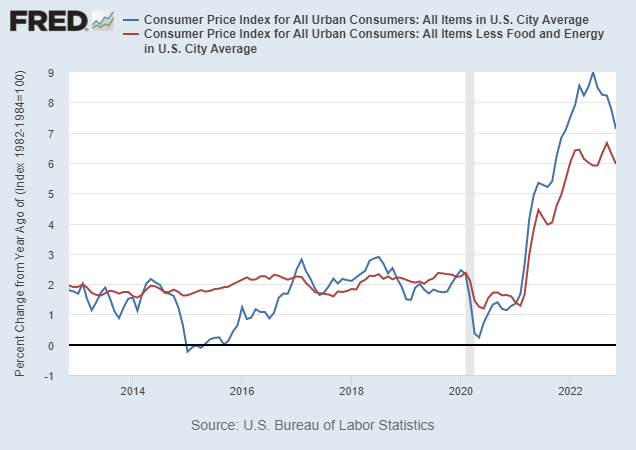

- “We need to be honest with ourselves that there’s inflation. 12-month core inflation is 6% CPI. That’s three times our 2% target.”

- Commentary: “The Federal Reserve’s decision to reduce the pace of rate hikes to 50 bps marks the beginning of the end of this rate hike cycle.. However, a reduction in pace of rate hikes is not a pivot” said SA contributor Ahan Vashi.

- (Clips That Matter) :: About That “Pivot…”

- The Fed is a long way from any kind of “pivot.”

- ..will no doubt happen at some point, but history says it’s probably not imminent

- The yield curve is inverting even more.

- Parts of the curve typically invert months or over a year before recession formally arrives.

- Core service prices are rising faster than core goods.

- Reveals deeper trends; a post COVID return to trend requires combination of lower goods prices and hihger service prices

- Gasoline prices are flat this year but still much higher than before COVID.

- OPEC maintained its lower output; higher fuel prices have a cumulative effect

- One reason an inflationary economy is so different

- OPEC maintained its lower output; higher fuel prices have a cumulative effect

- The Fed is a long way from any kind of “pivot.”

- (Over My Shoulder) :: Peter Boockvar: CPI Rundown

- Headline CPI was 7.1% in the year ended November, vs 7.7% a month earlier. Core CPI was 6% vs 6.3% the prior month.

- Weaker energy prices helped the headline rate, but a rebound is likely with China on the road to fully reopening.

- Housing prices are still rising, with Rent of Primary Residence up 7.9% year-over-year.

- Core goods price increases moderated, helped by another decline in used car prices.

- The Fed will still raise rates tomorrow but this sets up the possibility of a smaller 25 basis point hike at the February meeting.

- Bottom Line: Boockvar believes the Fed is close to ending its rate hikes but will continue with QE. He thinks the 2023 focus will shift to the economic consequences of higher capital costs as the Fed holds rates at this elevated level to keep inflation at bay.

- (elerianm) :: Expect the #FederalReserve this week to Hike rates by 50 basis points; Combine the downshift with signaling a higher peak rate; and Avoid undue precision regarding February. Less clear to me: The extent to which their economic forecasts will finally become more realistic.

Energy

The Stone Age came to an end, not because we had a lack of stones, and the oil age will come to an end not because we have a lack of oil. - Sheikh Ahmed Zaki Yamani

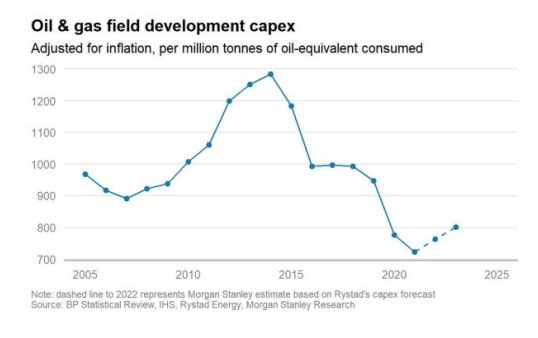

- (chigrl) :: O&G Capex (adjusted for inflation) On the supply side, investment remains low

- (EuroIntelligence) :: Nuclear fusion is possibly of even a bigger scale. It constitutes a cheap supply of unlimited energy.

- Its development would constitute the single biggest step forward in our efforts to reduce greenhouse gas emission.

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

- (Five with Fitz) :: Don’t get too excited about a single inflation report

- Inflation’s raging, not abating, and that means continuing to play defensively

- I suggest companies with three things in common:

- Best in class

- Make “must have” products and services, not “nice to haves”;

- Still putting up excellent numbers

- Translation: Companies that will be there, companies that can protect margins, and companies that will generate the profits you need long after the current mess passes

- (LynAldenContact) :: The disinflation cycle continues. I think 2024/2025 will risk another inflationary cycle, but for the time being, the month-over-month and year-over-year growth rate of prices is cooling off.

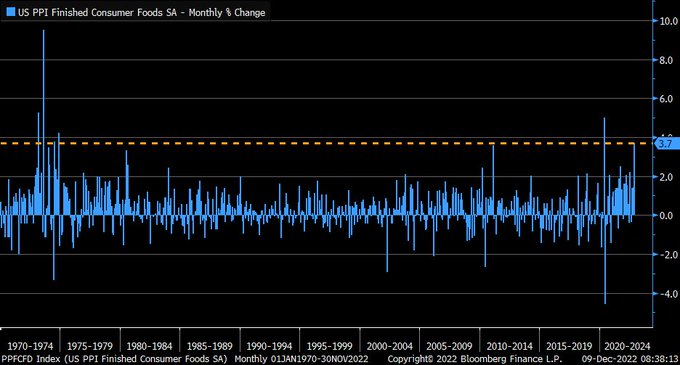

- (LizAnnSonders) :: Yikes: consumer foods component of PPI #inflation jumped by 3.7% in November; fastest increase since May 2020 and before that, since 1974

Future

We live in the future - This Week in Startups / Jason Calacanis

- (Peter Zeihan) :: The Fusion Breakthrough: 70 Years in the Making

- FUSION. The clean energy of the future. No carbon footprint. Bottomless. Cheap. Sound too good to be true?

- Monumental this step is. It’s taken 70 years to achieve what has just been done, so slow clap for the team that got us here.

- Don’t go buying those fusion lamps just yet.

- We still need a few more “breakthroughs” before fusion becomes the energy of the present. Think scale, transmission, and materials. It took us a long time to get here, so what’s another half-century…right?

- Scale - Requires a huge amount of energy to turn on, a city the size of New York would need a generator the size of Albany

- Fuel - Tritium, unstable version of hydrogen. Must be produced in same the facility

- Transmission - Need to transmit power hundreds of miles, requires room temperature superconductors

- Best case in 10 years we get a commercial grade reactor, 10 more to solve the trinitium problem and 10-30 years to produce at scale (2050s - end of century)