2023 Week 37

Notes, thoughts and observations - Compiled weekly

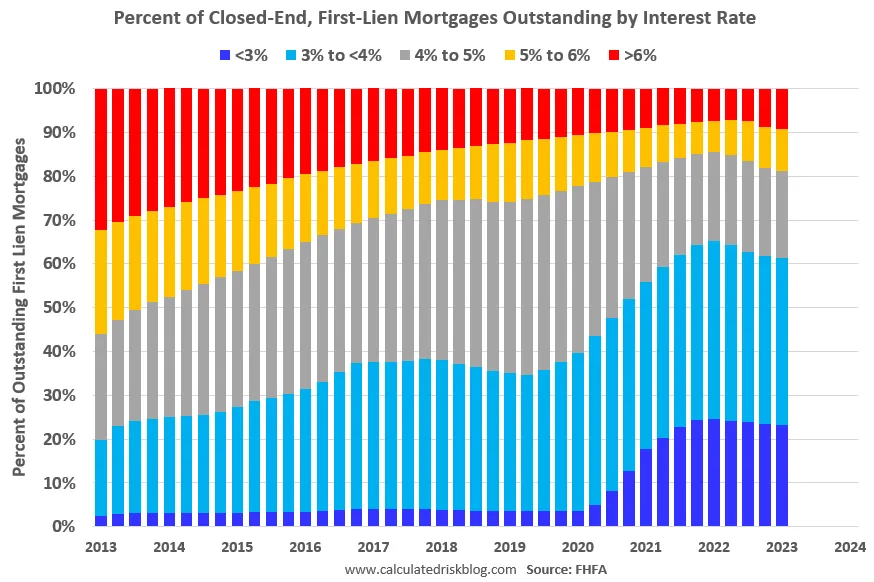

First the bad news: Real Estate continues to trouble everyone, but a couple of things to point out. The number of delinquencies and foreclosures isn’t high which is good. Add to this more loans are locked in below 6%, far better than 2013. Over time this will shift as folks move.

Unfortunately inflation is sticking around. Concern about energy prices driving further inflation as it increases costs throughout the value chain. Likewise job losses are continuing to spill over into non-tech areas specifically finance ,both Citi and Truist.

But again on the brighter side worker shortages will buoy the labor market for years. 47% of Gen Zs were interested in pursuing a career in a trade. It might mean fewer office workers, but more plumbers, electricians, etc.

Finally a bit of good news as McDonald’s announced it was getting rid of self-serve soda machines citing less dining room traffic and more mobile orders. This is probably a godsend for service workers but also a rising trend in order ahead, customer prepayment merchant solutions. We saw this technology blossom during the pandemic and it’s confirmed to be a long term trend

TOPICS

Real Estate

OPINION - Residential housing isn’t a serious concern right now; mortgage rate distribution tells a less troubling narrative than the media

- (Calculated Risk)

- Q2 Update: Delinquencies, Foreclosures and REO

- Only 2% of homeowners with a mortgage were in negative equity as of the second quarter (number of underwater U.S. homes peaked at nearly 26% in 2009)

- U.S. homeowners with a mortgage saw year-over-year equity losses of $8,300 in the second quarter of 2023, but quarterly gains added almost $13,900 (average U.S. homeowner now has about $290,000 in equity)

- Distribution of interest rates on closed-end, fixed-rate 1-4 family mortgages outstanding

- Currently 23.3% of loans are under 3%, 61.3% are under 4%, and 81.2% are under 5%

- With substantial equity, and low mortgage rates (mostly at a fixed rates), few homeowners will have financial difficulties.

- Q2 Update: Delinquencies, Foreclosures and REO

Inflation

OPINION - Inflation is not over

- (Over My Shoulder)

- Anatole Kaletsky: Why This Week’s CPI Could Be Decisive

- ..this could be a signal investors don’t believe inflation is yet under control.

- We will learn this week whether rising energy prices are feeding into core inflation.

- Wednesday could be a decisive day for the markets, triggering a breakout from recent trading ranges.

- Anatole Kaletsky: Why This Week’s CPI Could Be Decisive

Labor Market

OBSERVATION - Layoffs hitting Finance sector next

- (WSOC) ::

- Truist to cut $300M in jobs:

- Charlotte-based Truist Financial Corp. plans “sizable” job cuts and a consolidation of its leadership team as it seeks to lower costs through the first quarter of 2024.

- The bank aims to trim approximately $750M, with a reduction in its workforce contributing to about $300M in savings, a $200M reduction in technology and $250M in leadership consolidation.

- (DiMartinoBooth)

- From “No job cuts in my @Citi” to full metal jacket reversal for Fraser

- “Citi preparing for wave of job cuts as CEO Jane Fraser restructures the Wall Street giant to operate from 5 main businesses”

- Spokesperson had me at “As Citi swiftly transitions to this new model…” SWIFTLY

OPINION - Still far fewer Gen Z than prior generations, so this will wreck office work if AI productivity gains don’t play out.

- (rex_woodbury)

- One interesting trend: Gen Z’s migration to skilled trades (plumber, electrician, etc).

- A survey found that 47% of Gen Zs were interested in pursuing a career in a trade.

- One potential reason: 74% say they believe skilled trade jobs won’t be replaced by AI.

Automation

OPINION - Pandemic accelerated this trend to mobile orders

- (CNN)

- McDonald’s is getting rid of self-serve soda machines

- Consumer behavior has changed since the pandemic, and the chain has experienced a surge in business through its drive-thru and delivery services, with fewer people choosing to eat in its dining rooms, reducing the need for the machines.

- McDonald’s future includes restaurant designs with smaller or no dining rooms (and high-tech drive thrus) to reflect that new reality.

- Digital sales (i.e. orders made on its app or through its partners like Uber) now make up 40% of its total sales, according to its most recent earnings report.

- McDonald’s is getting rid of self-serve soda machines