2024 Week 21

Notes, thoughts and observations - Compiled weekly

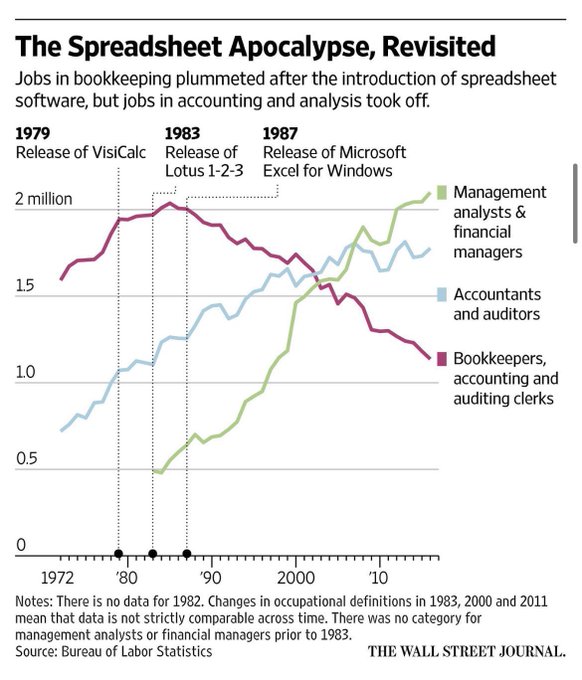

Global pressure once again calls into question the possibility of a Fed rate cut. Either way the world is seeing the demographic decline play out in Japan and need to take heed of their own issues.

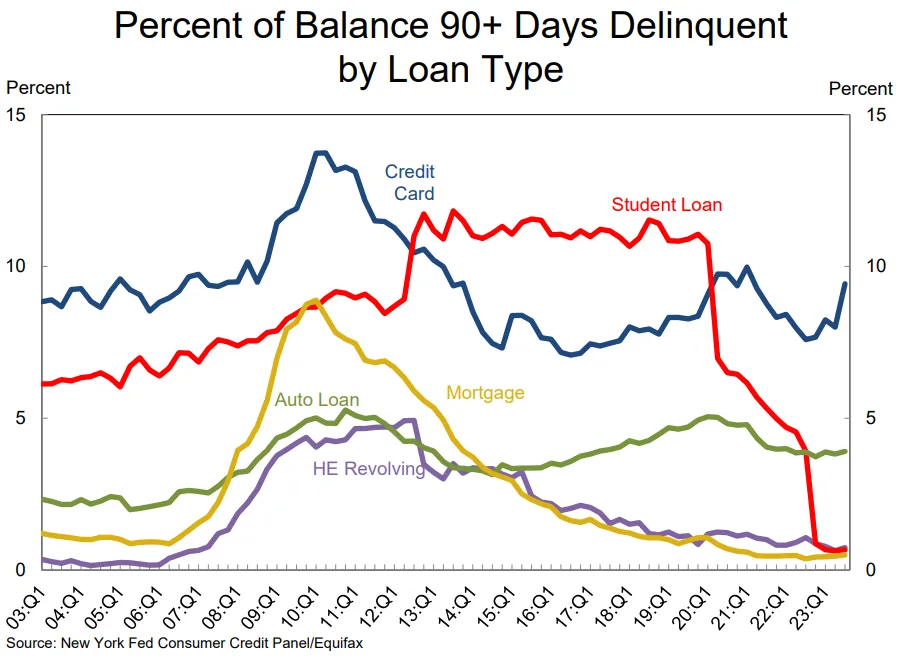

Canceling student debt might have mixed popularity, but it’s hard to ignore the economic impact of freeing prime age consumers from the shackles of debt payments. Will it have an impact, hard to say? Again, either way the real reform needs to focus on the cost of college.

Companies are still trying to figure out how to goose results to please Wall Street. Disney, once again under Bob Iger, is reducing head count and refocusing on major box office releases rather than streaming platform releases. Seems like a solid strategy, short term, but long-term Disney faces a lot of challenges.

Meanwhile DuPont is following in the footsteps of GE and others by planning to break up its business units into multiple stand-alone businesses. While it’s easy to imagine that DuPont wants to divest from slower growing business, the reality is likely that each business will focus on the metrics that Wall Street cares about to maximize stock prices.