2023 Week 39

Notes, thoughts and observations - Compiled weekly

This week illustrated the disconnect between big business CEOs and everyone else. Whether it’s Moynihan’s recession denial or Dimon trotting out a classic Warren Buffet trope it’s clear than small and medium size business are seeing a completely different reality.

In the opposing corner we have big box retail on the decline and hard times hitting bottom lines indicating we’re already in recession. Meanwhile everyone is dealing with the painful unwinding of artificially low interest rates. The fed finally paused, but what does it mean?

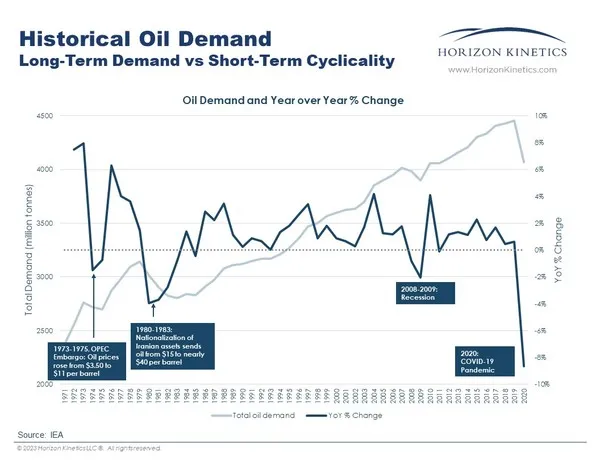

A major force in small business is the push toward profitability. Most everyone knows money is about to get tight and small companies need to get lean. Meanwhile everyone is paying the price of the unprecedented decline in demand during COVID. Organizations like OPEC are still whip-saw trying to deal with fluctuating demand plus the lingering impact of Russian oil embargo.

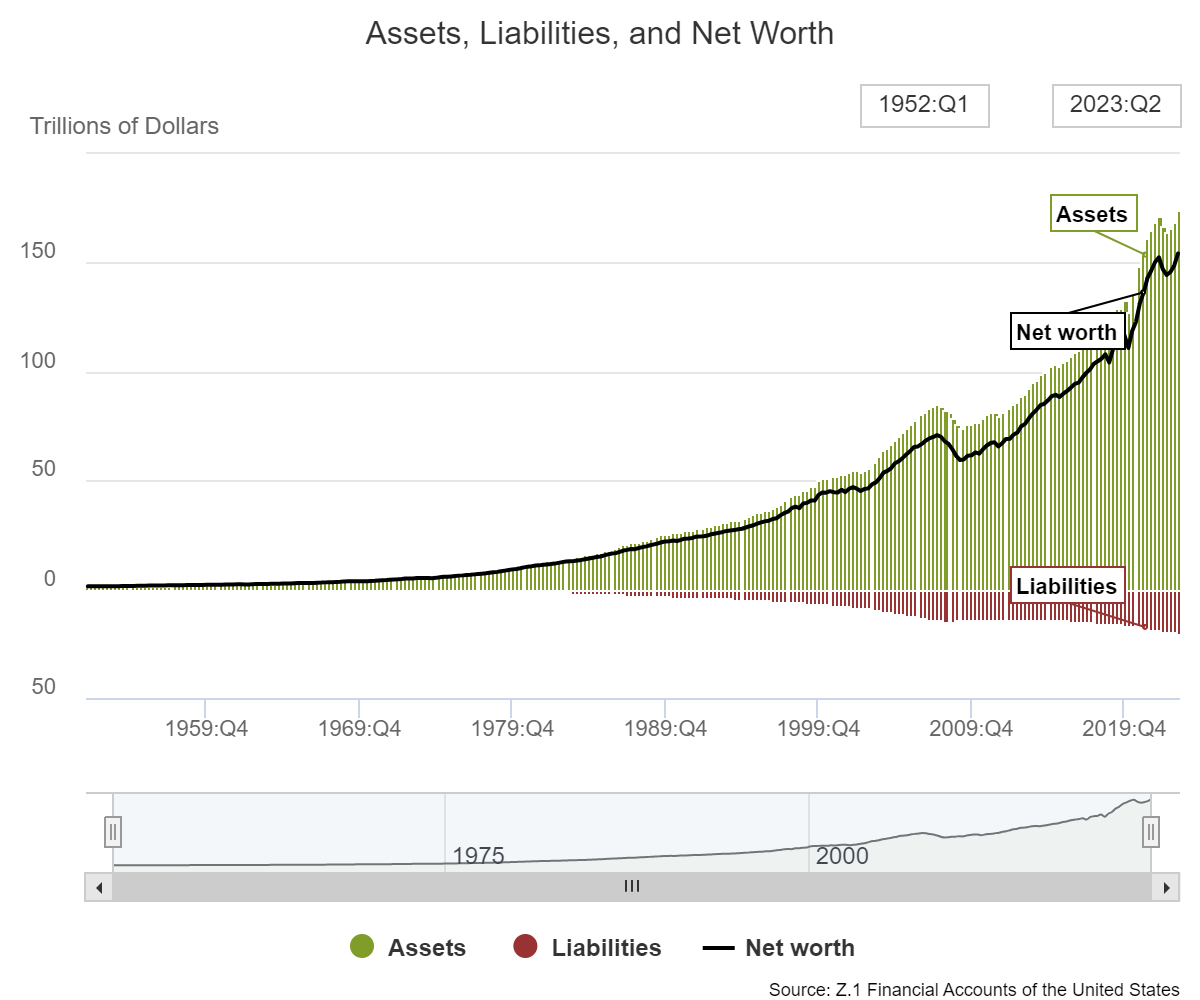

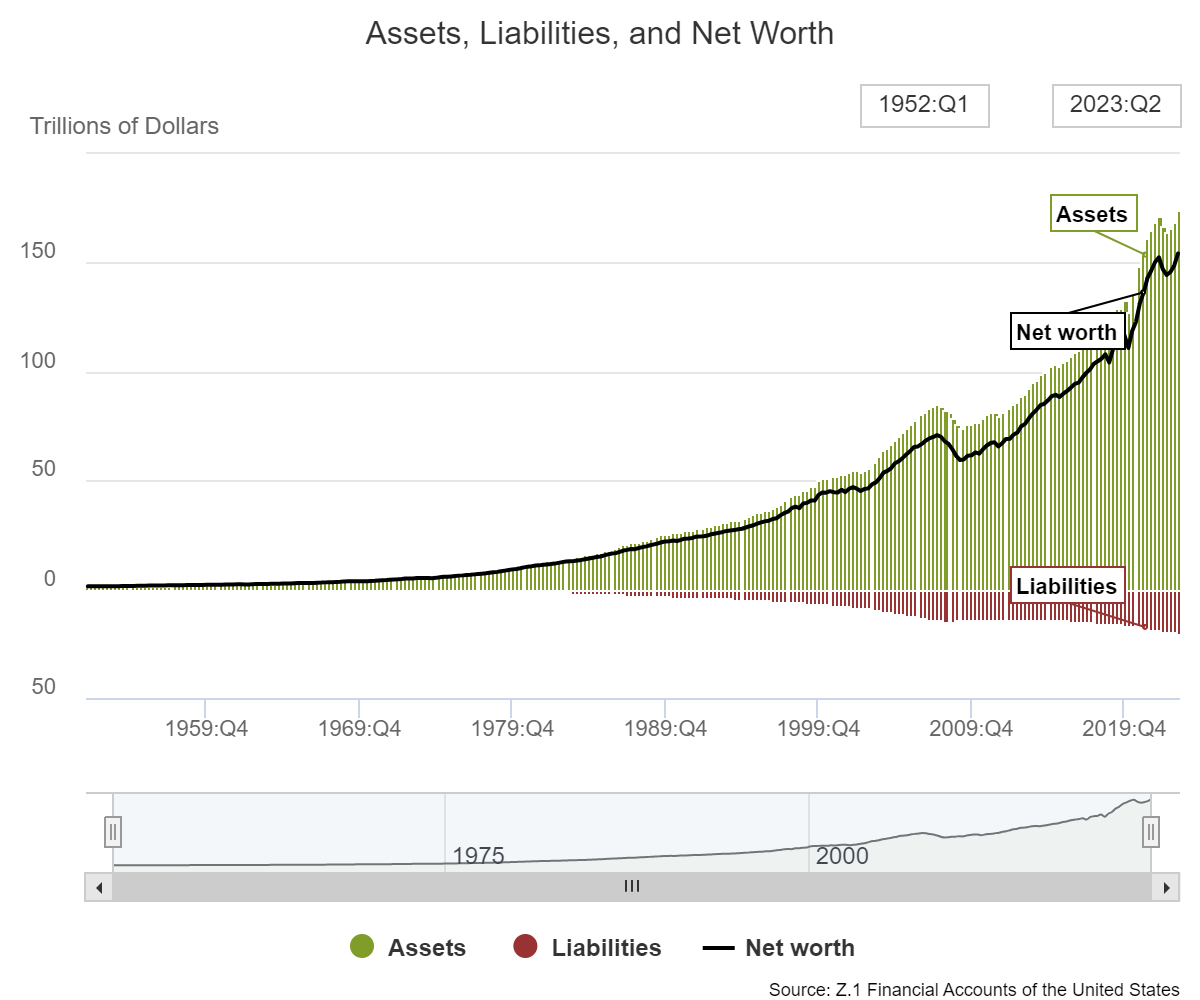

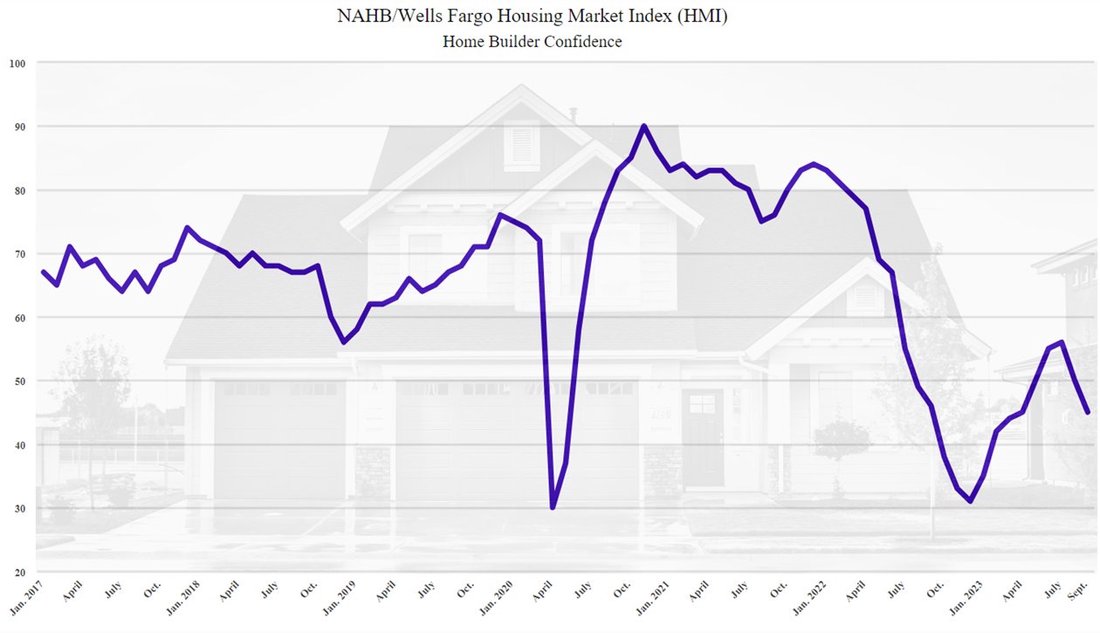

Despite the gloom, at a high level the consumer debt to net worth ratio paints a different picture. Americans are still far better off as net worth climbs faster than debt and that’s good for everyone. On the flip side of high lending rates, the lack of new home construction will continue to prop up residential real estate prices. Supply and demand still alive and well.

Paints a very different picture, net worth is climbing

TOPICS

Recession

OPINION - Big bank chiefs WRONG again. Consumer is not strong, everyone is seeing slowdowns.

- (Seeking Alpha)

- “We won’t have a recession,” Moynihan

OBSERVATION - Big box retail on the decline

- (Seeking Alpha)

- Costco in charts: Adjusted comparable sales growth continues to slow

OBSERVATION - Hard times hitting bottom lines

- (Seeking Alpha)

- Target (TGT) will shutter nine underperforming stores in the U.S. on Oct. 21 due to increased violence and organized retail crime at the locations.

- Retail theft has been on the rise in the U.S., climbing nearly 20% last year, according to the National Retail Federation.

- The top five areas that were affected were Los Angeles, San Francisco/Oakland, Houston, New York and Seattle.

- Other retailers such as Dick’s Sporting (DKS), Lowe’s (LOW) and Macy’s (M) have also pointed to a rise in crime as a factor in reduced earnings and expect the trend to continue.

Fed Rate

OPINION - Unwinding artificially low rates will be painful; expect a lot of pushback from big business

- (Seeking Alpha)

- World not ready for Fed rate rising to 7%, warns JPMorgan’s Jamie Dimon

- The banking chief called on clients to be prepared for that kind of stress. “Warren Buffet says you find out who is swimming naked when the tide goes out. That will be the tide going out,” Dimon warned.

- Fed officials have signaled that rates will likely stay higher for longer, with some projecting one more rate hike this year.

OBSERVATION - The long awaited pause, what does it mean?

- (The Dispatch)

- Central bankers at the Federal Reserve held interest rates steady following their meeting this week, maintaining a 5.25 percent and 5.5 percent rate as they did in June.

- The Fed’s quarterly projection for 2024 has rates remaining tight and inflation returning to its 2 percent target in 2026.

Consumer Debt

OBSERVATION - Paints a very different picture, net worth is climbing

- (Ben Carlson)

- The Federal Reserve has tracked household balance sheet data going back to 1952.

- This data doesn’t tell us where the economy is heading but it can help understand how Americans are generally positioned for whatever happens next.

- As of June 30th this year, American households have their highest levels of assets, liabilities and net worth ever:

Real Estate

OPINION - Building slow down and low residential inventory will support real estate prices, despite interest rates

- (TKer)

- The two-month decline in builder sentiment coincides with when mortgage rates jumped above 7% and significantly eroded buyer purchasing power.

- On the supply-side front, builders continue to grapple with shortages of construction workers, buildable lots and distribution transformers, which is further adding to housing affordability woes.

Bankruptcy

OBSERVATION - Fallout of opioid epidemic

- (Fox Business)

- Rite AId will reportedly close 400 to 500 stores as it plans to file for bankruptcy, the Wall Street Journal reported

- ..could see a significant number of its more than 2,100 drugstores permanently close

- Plans to file for bankruptcy protection (Chapter 11) as the company faces more than $3.3 billion in debt and over a thousand federal lawsuits over its alleged role in the opioid epidemic.

- Rite AId will reportedly close 400 to 500 stores as it plans to file for bankruptcy, the Wall Street Journal reported

Path to Profitability

OBSERVATION - Money about to get tight, small companies about to get lean

- (Sandbox Daily)

- Higher costs of capital are top priority in C-suite circles

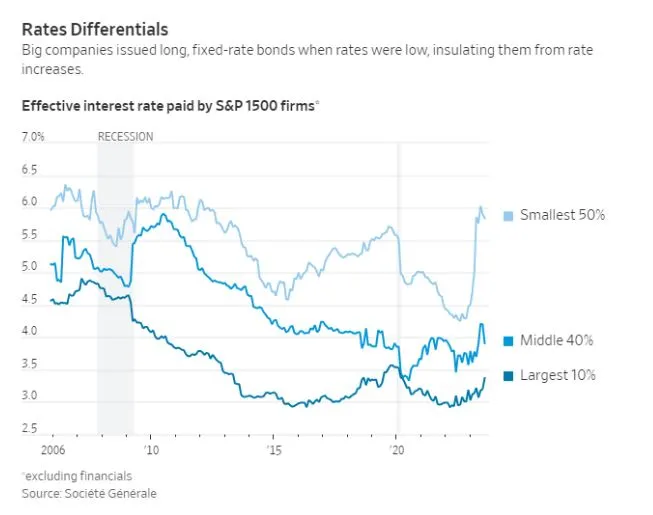

- Large multi-national corporations have more robust balance sheets, bridge financing, access to capital markets, and a myriad of other levers to pull when financial conditions tighten.

- Smaller companies do not enjoy these same luxuries. Often times, these companies access credit through variable interest rate loans. When financial conditions tighten, these companies have few levers to pull.

- Petco (WOOF), a company with a $1B market cap (i.e. small-cap), took out a $1.7B loan two years ago at an interest rate ~3.5%. Now it pays almost 9%.

Energy

OPINION - Still paying for unprecedented decline in demand during COVID

- (Sandbox Daily)

- Most assume that oil demand declines during an economic contraction

- demand typically simply fails to grow in all but the most severe recessions

- Global oil demand has only materially contracted four times in the past 55 years.

- Most assume that oil demand declines during an economic contraction

OBSERVATION - Prepare for higher gas prices, and all that it entails

- (Yahoo)

- WTI jumped more than 3% to settle at $93.68 per barrel following a drop in stockpiles to just below 22 million barrels at the Cushing, Okla., hub.

- The rise in prices has fueled speculation of $100 per barrel oil in the coming months.

- “we estimate the last moves in the price of oil, if sustained, would damp annualized global GDP growth by 0.5%-point over two quarters,” - JPMorgan