2024 Week 17

Notes, thoughts and observations - Compiled weekly

I think we all learned an important lesson about stories from journalists who seek to sensationalize topics to generate clicks. The predicted Baltimore supply chain issues never materialized after shipping was shut down by the collapse of the Francis Scott Key Bridge.

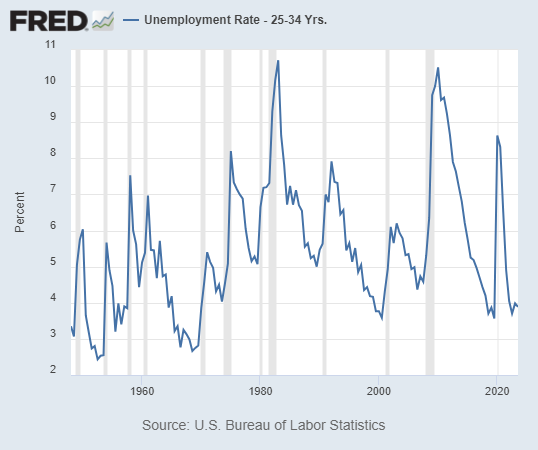

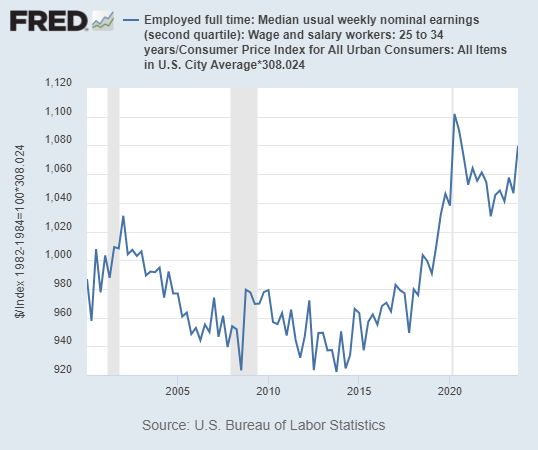

Young workers have the lowest unemployment rate since the 60s and weekly wages are higher than in the past. Again, this contradicts the prevailing narrative that Gen Z is doing worse than previous generations. Look past the commentary at the data.

Median weekly earnings, inflation-adjusted, for young people are the highest they have ever been

Wall Street wasn’t happy with META’s spending on AI. They’d rather the money be returned to the shareholders. We heard a very similar critique with Amazon as Bezos directed online retail profits into building what would become Amazon Web Services. The future of consumer AI will be through service providers, and companies like Meta and Microsoft will play a part.

The idea of natural gas as a bridge fuel is gaining mainstream support with the likes of Jim Cramer admitting as much. I’m still cautious that it will quickly bridge us to nuclear power which is the only reliable base load source that is carbon friendly.

Finally, the economy seems to be roaring ahead despite predictions of current or pending recession. GPD grew steadily but inflation also. Shelter costs and pending trade tariffs will only make inflation stickier. I see daily commentary on how indicators point toward future recession, but I’m mindful that while these indicators have a high correlation the timing is never consistent.

TOPICS

- Inflation

- Bankruptcy

- Energy

- Domestic Recession

- Labor Market

- Population

- Mergers and Acquisitions

- Globalization

- AI and ML

Inflation

OBSERVATION - A lot of contributors to long term inflation

- (Clips that Matter)

- Controlling inflation will be tough until housing prices break.

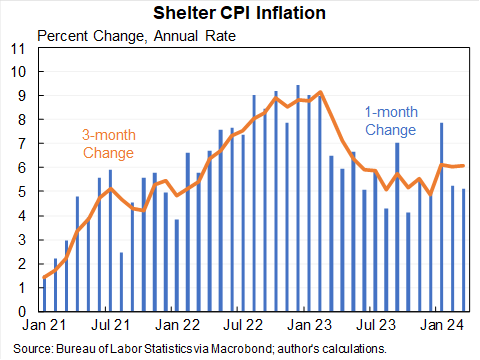

- The bottom-up forecasts of inflation coming down were premised on much larger reductions in shelter growth than we’ve seen. It has, as widely expected, come down from its 9% annual rate high but plateaued around 5.5% ar.

- This chart shows the “Shelter” portion of the Consumer Price Index, which accounts for about 36% of the benchmark. It helps illuminate recent events

- If over a third of the CPI keeps growing at that pace, bringing broad inflation down to 2% or even 3% will be tough.

Bankruptcy

OBSERVATION - Competition all around

- (Reuters)

- Express Files for Bankruptcy

- Portfolio includes menswear brand Bonobos and lifestyle brand UpWest

- Plans to shutter more than 100 of its roughly 530 stores nationwide

- An investor group led by management firm WHP Global, which owns Toys R Us, is potentially looking to purchase a majority of Express stores and operations

- Express, founded in 1980, has been seeing declining sales in recent quarters. The retailer’s bankruptcy comes a month after it was delisted from the New York Stock Exchange

Energy

OBSERVATION - Even Cramer repeating it “nat gas is a bridge fuel”

- (Cramer)

- GE Vernova is about natural gas and the grid and not about wind right now. Onshore wind is profitable but not big. The demand for electricity is very strong, and the hyperscalers are in need of as much power right now to run AI as they can get and will accept nat gas as bridge fuel.

OBSERVATION - More confirmation that LNG is the bridge fuel

- (IBKR)

- Adults Are Taking Over The Energy Transition

- JPMorgan just published research acknowledging that transitioning our energy systems is incredibly expensive, slow and inflationary.

- Forecasts that don’t assume “Zero by 50” are immediately seized upon by climate extremists

- Jamie Dimon has recently been critical of the Administration’s pause on new LNG permits

- Has said it’s impractical to think we can suddenly stop using fossil fuels, which currently provide 82% of the world’s primary energy.

- “One of the best ways to reduce CO2 for the next few decades is to use gas to replace coal.”

- Wells Fargo also noted, “a growing realization that a confluence of factors could drive significant growth in US natural gas demand over the next 5+ years.”

- LNG exports, increased domestic manufacturing and demand from AI centers were the reasons cited.

OPINION - US energy security will fuel future economic growth

- (Sandbox Daily)

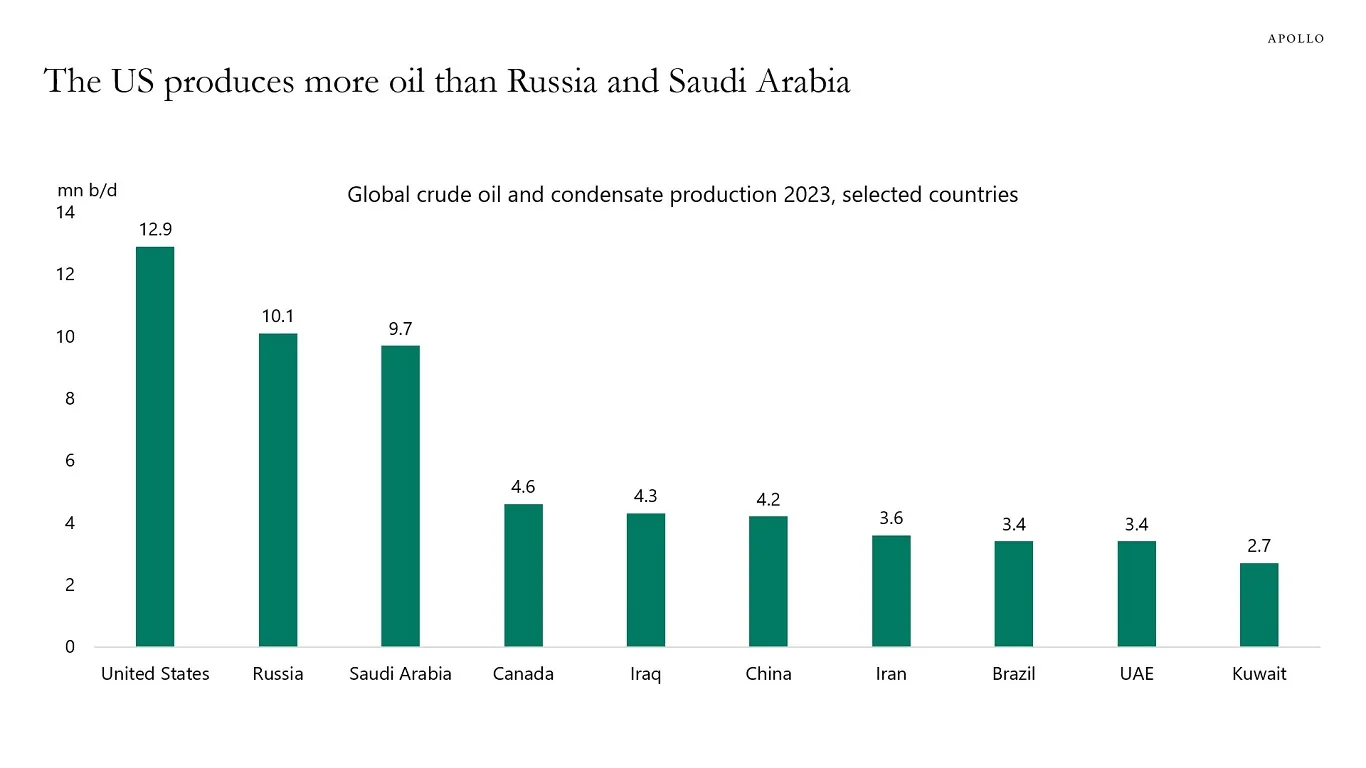

- Record U.S. oil output, the U.S. produced more crude oil last year than any nation at any time.

- Crude oil production in the United States averaged a staggering 12.9 million barrels per day in 2023

- Together, the United States, Russia, and Saudi Arabia accounted for 40% (32.8 million bpd) of global oil production in 2023.

Domestic Recession

- (IBKR) :: OBSERVATION - Not soft, not really a landing at all

- Q1 GDP expected at 2.5%; steady growth reflects no hard or soft landing.

- Goldman Sachs projects 3.1% growth, buoyed by housing and manufacturing recovery.

- Wall Street analysts are forecasting a deceleration in growth, with expectations set around a 2.5% increase in GDP, adjusted annually, from the previous quarter.

- “That would be the seventh consecutive solid reading for real GDP. That certainly isn’t a hard landing and hardly a soft one,” veteran investor Ed Yardeni commented in a note.

- Atlanta Fed GDPNow forecasts a 2.9% surge.

- Model suggests that real personal consumption expenditures and first-quarter real gross private domestic investment are expected to grow at 3.4% and 3.7%, respectively

- Could The US Economy Continue To Defy Soft-Landing Scenarios?

- Goldman Sachs presents a more optimistic view, projecting a 3.1% growth rate.

- In the last advance estimate for Q4 2023 GDP the U.S. economy expanded by 3.3%, exceeding forecasts of a 2% increase.

Labor Market

OBSERVATION - Refutes the narrative that younger generation isn’t doing as well

- (Clips that Matter)

- The unemployment rate for young people is the lowest it has been since the 1960s. Median weekly earnings, inflation-adjusted, for young people are also the highest they have ever been (other than 2020, when data isn’t comparable)

- The line shows inflation-adjusted median earnings for workers aged 25-34.

Population

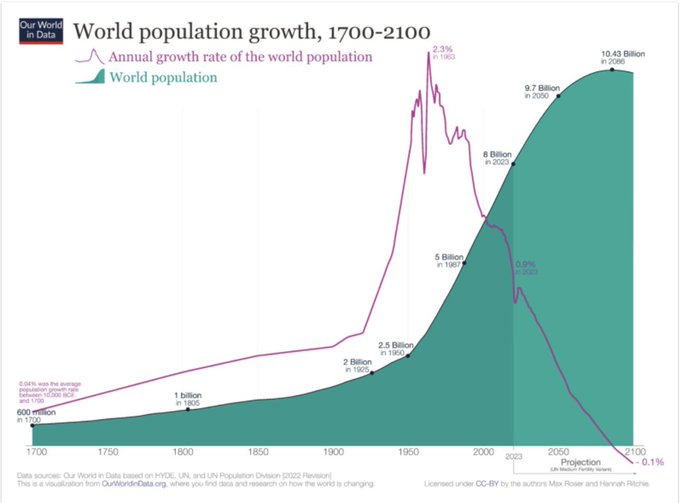

OBSERVATION - Growth rater is a lagging indicator; most of remaining growth is sub-Saharan Africa

- (Clips that Matter)

- Four interesting figures about demographics and the environment; 8 takeaways. DRAW YOUR OWN CONCLUSIONS.

- The annual global population growth rate peaked 60 years ago

- The current growth rate hasn’t been this low for a Century.

- “Africa is the only world region projected to have strong population growth for the rest of this century”

- “These gains will come mostly in sub-Saharan Africa, which is expected to more than triple in population by 2100”

- Four interesting figures about demographics and the environment; 8 takeaways. DRAW YOUR OWN CONCLUSIONS.

Mergers and Acquisitions

OBSERVATION - Companies positioning to make this deal happen.

- (Reuters)

- Supermarket chains Kroger and Albertsons to sell 166 more locations as they seek regulatory approval of their $25B merger; the Federal Trade Commission sued to block Kroger’s acquisition of Albertsons earlier this year

Globalization

OPINION - Don’t listen to journalist that pitch stories but don’t understand how stuff works.

- (The Dispatch)

- The Baltimore Accident and Other ‘Supply Chain Crises’ That Keep Not Happening

- The global economy is far more dynamic—and resilient—than you think.

- Francis Scott Key Bridge, resulting in the bridge’s collapse spawned a litany of hand-wringing about widespread damage to our supposedly brittle, globalized economy.

- New York Times’ Peter Goodman proclaimed that the “wayward container ship” yet again “shows world trade’s fragility”

AI and ML

OBSERVATION - Wall Street wasn’t happy with META, but they weren’t happy with Amazon back in the day either.

- (Seeking Alpha)

- Meta Platforms (META) slumped 15.1% to $418.85/share AH on Wednesday despite the company topping expectations with its Q1 earnings report, as its revenue guidance for the current quarter came in on the light side.

- Investors also appeared to be irked by Meta’s forecast of heavy spending on artificial intelligence, amid concerns that these huge investments could take years to pay off.

- “we should invest significantly more over the coming years to build even more advanced models and the largest scale AI services in the world.” - CEO Mark Zuckerberg