Category:

Business

2023 Week 12

Notes, thoughts and observations - Compiled weekly

Fallout from SVB, Credit Suisse and First Republic and the liquidity crisis. This is far from over, and may result in bailouts.

As I wrote about in Dot-Com Bubble 2.0 we are now entering phase 2 of the downturn when the broader market will reel from tech excesses. I did not anticipate that small regional banks, which lend to small business, could be the catalyst.

My other eye is on energy prices with two things in play. First oil prices are declining which is indicative of a recession but conceals the underlying supply shortage. The second are expiring subsidies on green energy which could have an impact similar to solar back in the late 2000s.

TOPICS

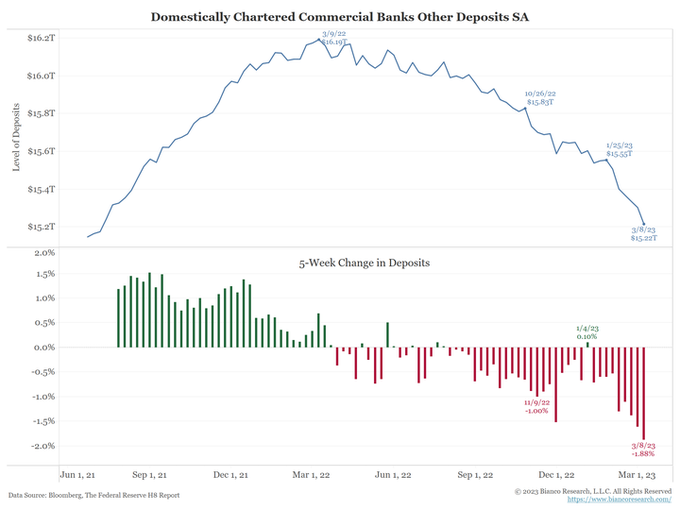

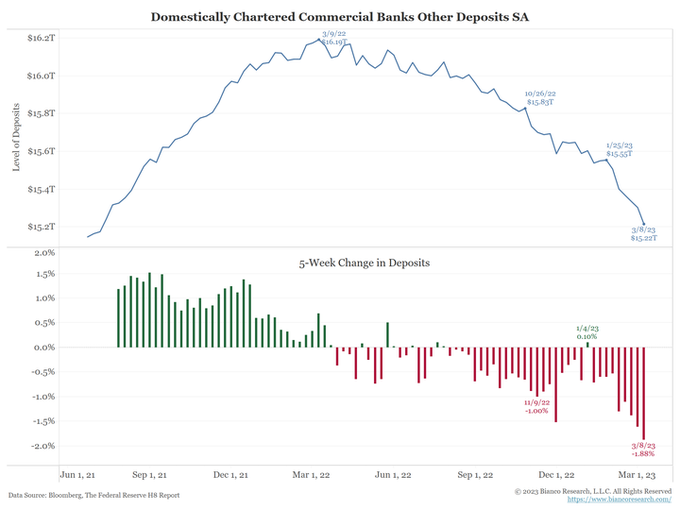

Deposit outflows were accelerating in the weeks before the failures

Financial

“Just a liquidity crisis”… this ends with bank bail outs 💸

- (DiMartinoBooth)

- Few appreciative we now have THREE large US banks that have tried & failed to raise capital. YES, THIS IS SERIOUS.

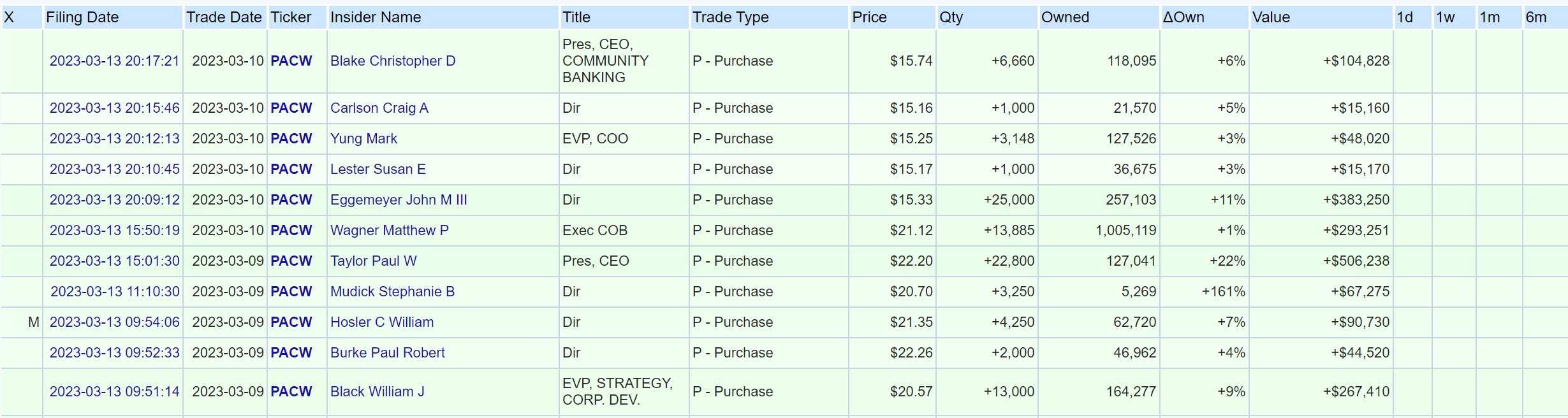

- $PACW uninsured deposits down to 35% from 52% in their 10K.

- (JackFarley96) Pacwest Bancorp ( $PACW) secures $1.4 Billion from ATLAS SP Partners

- $PACW insider trading purchases since the 9th.

- (dharmatrade) $PACW insider purchases since last Thursday. http://openinsider.com/search?q=PACW Thanks to @Akston_Capital who caught this one.

Click, click, withdrawl

- (biancoresearch)

- Janet it’s called mobile banking … do you own a smart phone? The game has now changed. The velocity of deposits is off the scales high now. An entire deposit base can leave in a few hours.

- *YELLEN SAYS DEPOSITS LEFT SVB AT PACE THAT WAS NOT SEEN BEFORE

I don’t know if American can stomach another round of bank bailouts, irrregardless if we made money last time.

- (unusual_whales) ::

- 84% of Americans, including strong majorities of Republicans and Democrats, think taxpayers should not have to pay to resolve problems caused by irresponsible bank management, per Reuters.

- In terms of failures, Credit Suisse bankers are now flooding recruiters with job inquiries ahead of the bank takeover. This comes as UBS Group AG is set to acquire the Swiss lender.

Long tweet thread but full of data

- (biancoresearch)

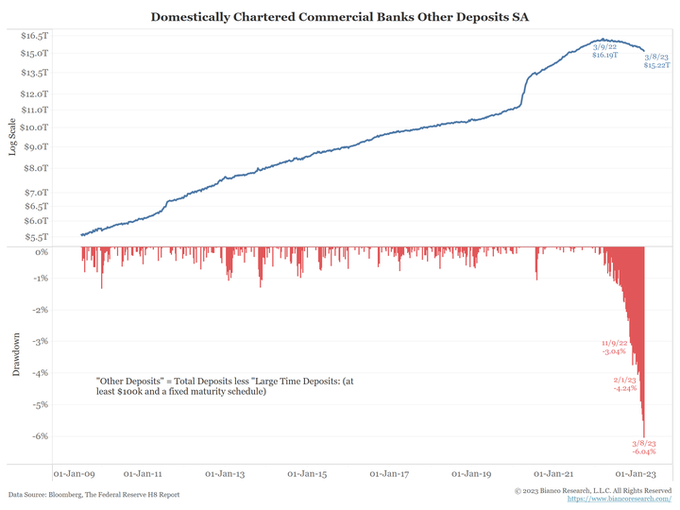

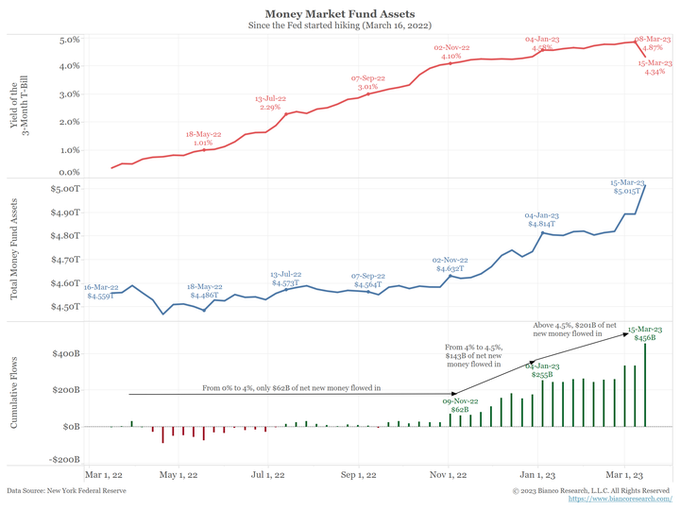

- This chart comes from the Fed H8 report. It is current through the latest data, March 8 … two days before Silicon Valley Bank failed. What has been the largest drawdown of deposits since the financial crisis? The weeks BEFORE the bank failures of the last few weeks.

- And, as the bottom panel shows, the deposit outflows were accelerating in the weeks before these failures.

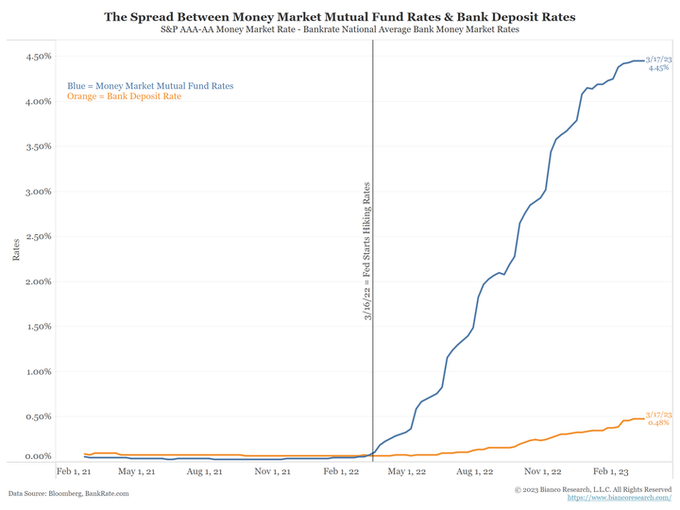

- So why was their a big deposit flight out of banks before the failures? As rates went from 0% to 4% between March and November 2022, inflows into money market mutual funds were a paltry $62 billion. This changed when rates crossed above 4%. $143 billion flowed into money market funds as rates rose from 4% to 4.5%. Another $201 billion flowed into money market funds as rates rose above 4.5%. Again, the public’s attitude about moving money changed when rates crossed above 4%.

- So, if the Fed hikes tomorrow, they WIDEN this spread even further. And the yield-seekers will have even more incentive to leave. The banks will bleed, and bleed, and bleed deposits. Why should the yield-seekers stop moving their money? The already downloaded the app, they reset their password, they figured out how to move money. They are not going to unlearned it. The only thing that stops the constant bleed is to close the saving rate to market rate gap. With the Fed hiking tomorrow, the only way to close this is for banks to hike deposit rates. But that kills profitability. —- Why does it matter if the regional banks bleed deposits? Goldman Small, Medium Banks Account For 50% Of C&I Lending 45% Of Consumer Lending 80% Of All Commercial Real Estate Lending If regional banks keep bleeding deposits, even it is slow enough that they don’t fail, it will lead to a credit contraction for these sectors. That will hurt. This is a liquidity crisis (everyone wants their money), not a solvency crisis (banks lost money). But the scars are so deep from 2008 that we must change this to a solvency crisis .. via the lack of duration hedging. This is not the problem! The problem is the record bleed out of deposits and mobile banking making the velocity of deposits much higher than any previously imagined. The risk is a credit contraction. The solution is to close the savings rate/market rate spread to remove the incentive to leave.

Fed kept interest rates too low for too long

- (Seeking Alpha)

- The Banking System - The Heat Is On

- Our banking system is in crisis mode. The effects of this will be wide-ranging, including real estate loans, corporate loans, personal loans, mortgages, credit card interest rates, the U.S. Prime Rate, and every other type of lending that you can consider.

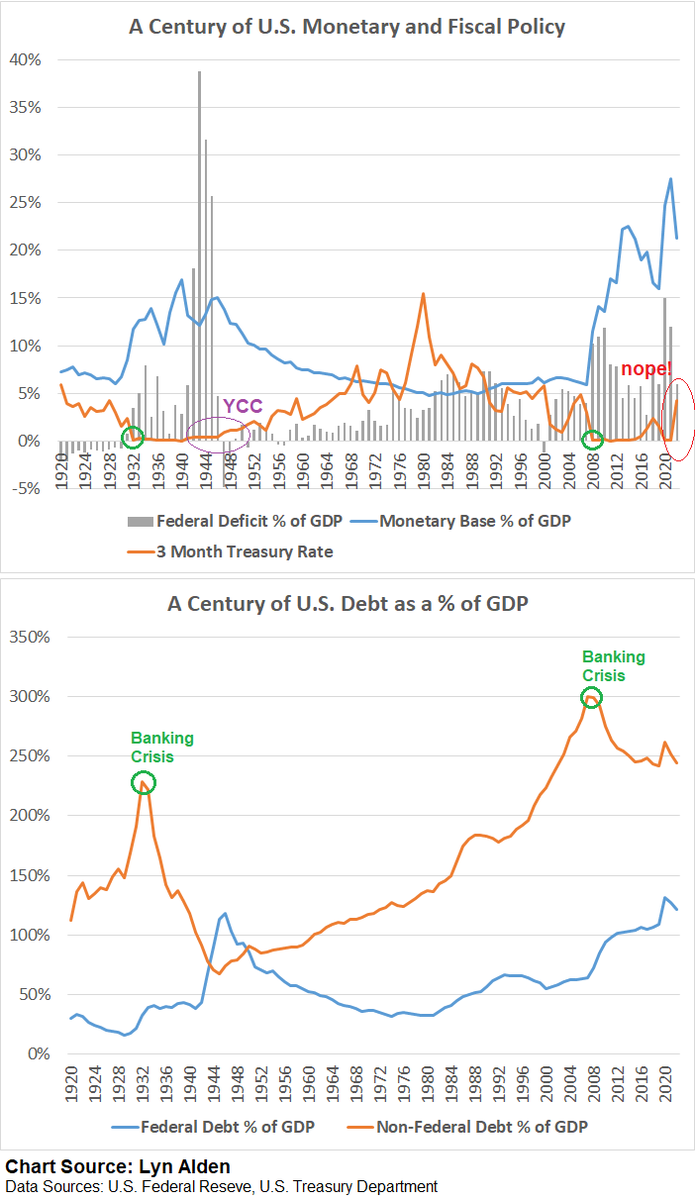

- The Fed kept interest rates too low for too long, and then, in their fight against inflation, they have raised rates far too quickly.

- American banks tapped the Federal Reserve’s emergency facilities for a record amount of money, eclipsing the money that was borrowed during the 2008/2009 financial crisis. In fact, U.S. banks have borrowed a combined $164.8 billion from the two backstop facilities provided by the Fed.

- The Banking System - The Heat Is On

Credit Suisse kaput 💀

- (elerianm)

- A blunt fact remains when you step back from all the details on @CreditSuisse @UBS deal #Switzerland’s second-largest bank–a bank that opened its doors for business in 1856 and was one of the 30 systemically important #banks around the world–will no longer exist as a standalone

- (unusual_whales)

- The Swiss National Bank has reported an annual loss of $141.54 billion, which is the largest in the central bank’s 115-year history.

- The central bank lost $147.3 billion (141 billion Swiss francs) on its foreign currency positions, and $1.1 billion (1.1 billion Swiss francs) was lost in Gold holdings.

- BREAKING: US Fed says Fed and central banks of England, Canada, Japan, ECB and Switzerland announce coordinated action to enhance the provision of liquidity via the standing USD liquidity swap lines.

First Republic was the one we were worried about at the begining of the week 👀

- (Five with Fitz)

- 11 banks bailing out First Republic to the tune of $30 billion in deposits

- Emergency liquidity is still an emergency.

- 3 easy ways to capitalize on chaos:

- Hedges up (again)

- Tactical putskies for speculative trades

- Play offense for core investment holdings

- MyPOV: The regulators who were asleep at the switch and the leaders of all who were supposedly providing oversight should be held accountable. Criminally, if necessary. Certainly fired.

Fed Rate

Yield curve is still inverted, and the Fed won’t back down.

- (unusual_whales)

- BREAKING: The Federal Reserve increases rates by 25BPS.

Small & Medium size banks, and by proxy business, are getting wrecked in phase 2 of this down cycle

- (Clips that Matter)

- The 10-year/2-year spread now at the widest negative reading since the 1980s.

- The inverted yield curve is historically pretty reliable in calling recessions, but it’s also historically early. Inversion can precede recession by a year or more.

- When they try to raise rates and suck out liquidity too quickly when debts are this high, chaos ensues. Can’t fight 1940s-style inflation with 1970s-style policy.

- Going forward, the Fed can either damage the currency or damage the long tail of small and medium banks.

Energy

Oil below $80, at least we can refill the strategic reserve (Biden get’s lucky)

- (Clips that Matter) - WTI crude oil dropped below $70 for the first time since late 2021.

- The White House said it intended to buy crude oil to refill the Strategic Petroleum Reserve when prices are “at or below” a $67-$72 range.

China is enjoying cheap Russian oil… while it lasts

- (Seeking Alpha)

- Russia tops Saudi Arabia as China’s biggest oil supplier

- Imports rising 23.8% to 1.94M barrels per day in the first two months of 2023.

- General Chinese-Russian trade has also soared since the invasion of Ukraine