Dot-Com Bubble 2.0 - Tech Worker Impact

A brief summary of Dot-Com Bubble 2.0: How Did We Get Here? by Prithvi Raj Chauhan posted on Hacker Noon

Overview

The bubble repeated, for different underlying speculative reasons but effectively the same boom-bust cycle. What happens next to employment and the broad economy is likely a replay of the early 2000s.

@Prcwrites does a great job covering the technical aspects, I’d like to add some perspective from the employment.

As a Tech Worker

Technologists who remember the furor and hype of the late 90s Dot Com bubble probably recognized the new hype cycle of Bubble 2.0. What really freaked us out was when we started to see the cracks emerge and eventually the hyped companies begin to fall. We tried to warn our younger colleagues who had no professional memory of the time.

I see a lot of similarities between the tech bubbles. If history repeats, it’s worth keeping in mind three distinct phases that we lived through. Keep in mind, by the end of the cycle new tech companies and technologies were born.

Phase 1 (2000-2001)

The first phase was a crisis of confidence. Years of burning investor money with the sole goal of growing let companies into excess. Wall Street convinced retail investors, who had just gained access to platforms like E-Trade that profitability didn’t matter, until it did. When Dot Com companies realized that the next round of funding wasn’t coming, or it would be smaller, they began to panic and laid off thousands.

It happened fast and it was like contagion. Companies that needed to reduce costs for survival laid off first, and then everyone else got nervous and followed suit. Bankruptcies started but didn’t really accelerate until after the stock market had fallen. Office equipment and server racks were on the sidewalks as companies could no longer pay rent and were evicted.

During the initial phase many were laid off in waves. The first were often able to receive severance, but later waves found themselves without a safety net and worse their stock / stock-options worthless. During this period FuckedCompany was founded as a site for employees to explain why their companies were going out of business.

Phase 2 (2001-2002)

The second phase unfolded began in 2001 around the time of Sept 11th and quickly deteriorated into a broad economic recession. Here layoffs spread beyond technology and most companies instituted a hiring freeze. This was especially challenging for new graduates who faced a vastly different employment picture in the fall of 2001.

Fraud was a major undoing in several industries including Enron (energy) and WorldCom (telecommunications). The flameouts were rapid, and I remember the day my WorldCom calling card stopped working, only to find out hours later than the company was defunct. People feared terrorism and were afraid of losing their jobs.

Rounds of layoffs continued, but savvy companies made large cuts immediately. If you were unlucky your company made a series of smaller, more frequent rounds of layoffs increasing your personal existential dread. This reached a peak by the end of 2002.

The worst was ahead.. 2002 was a bloodbath for the rank and file

Phase 3 (2002-2004)

The third and final painful chapter began in 2002 and ran through sometime in 2004. People continued to lose their jobs, and businesses continued to close their doors. Unemployment peaked in June 2003 at 6.3%. During the later stage US manufacturing companies began to succumb to a decade of globalization, closing factories or simply going out of business.

Underfunded pensions were a huge liability for older manufacturing companies. In my area Pillotex Corporation famously went bankrupt and dissolved their pension plans that had supported retired workers for years. In other industries pensions were frozen and replaced by 401Ks forcing more of the retirement burden on employees.

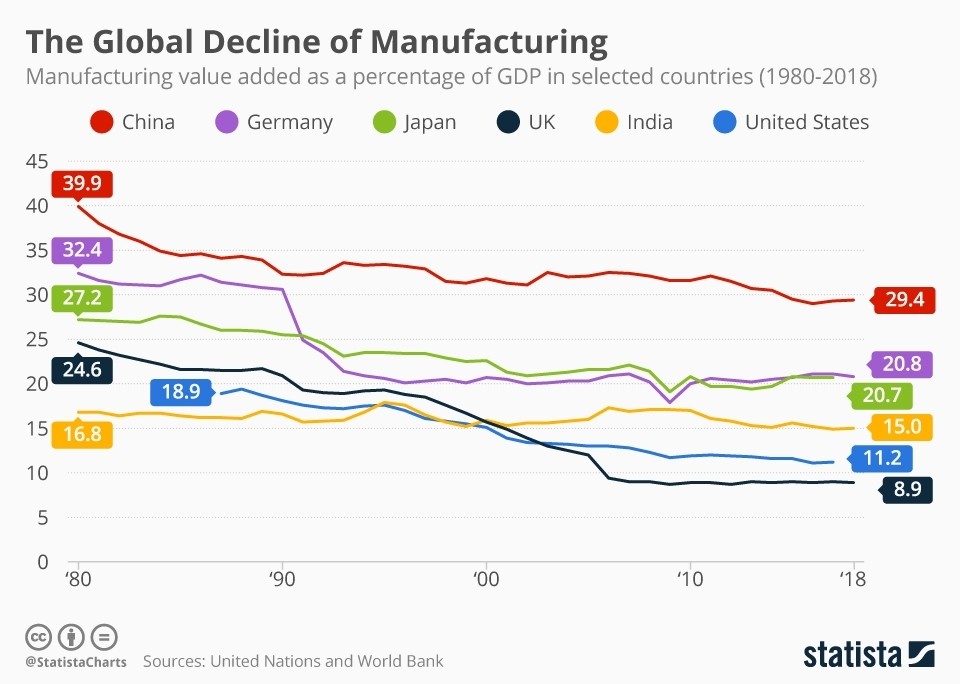

Manufacturing declined, as a portion of GDP, everywhere

During this time getting a job was difficult but not impossible. Work experience was certainly a plus and new graduates continued to struggle to find entry level positions. During this time H1B workers and offshoring became a concern, and many jobs were shipped to lower cost countries like India (tech) and China (manufacturing). In some cases, laid off employees were expected to train their replacements.

In the aftermath interest rates remained low, borrowing was easier and new companies were born. Homeownership became easier, but eventually lead to the 2008 mortgage crisis which was much worse recession in hindsight. Offshoring would accelerate and reach a peak during the next recession.

Takeaway

First, I am not implying that a second, worse recession will automatically follow this one. Each cycle is different, but the outcome (and advice) is always the same. Don’t overspend, save money and be smart about who you work for.

If your employment deal seems too good to be true, it probably won’t last. If your company isn’t profitable and depends on someone or something else for money be wary. It’s important to target working for companies in boring but profitable industries. As one VC put it “prioritize survival”.

Above all chase work experience, not titles or money. No one cares about your title, and money often comes with strings attached. Experience you take with you, and no one can take it from you. And above all trust the experience of your mentors and older colleagues who have lived through this. You’ll get through it, we always do.