2024 Week 4

Notes, thoughts and observations - Compiled weekly

Companies are still cutting the fat, but it begs the question of whether this is all due to pandemic over hiring or does it indicate retail bracing for declining consumer spending?

Bankruptcies continue to occur, but companies are also closing money losing stores. Walmart closed 24 last year and retail pharmacies plan to close hundreds this year.

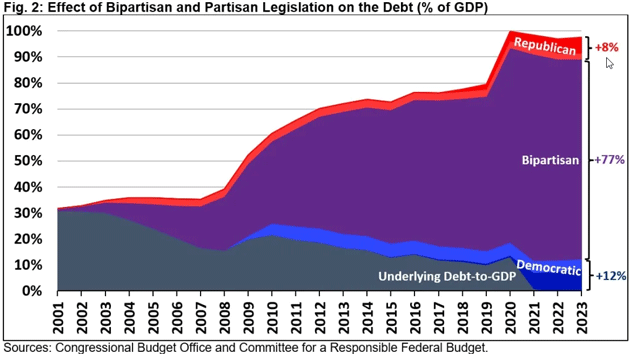

The national debt continues to grow, but the real concern is the increasing budget deficit which will exacerbate the issue.

Globalization continues to contract over security concerns leading to a short-term spike in shipping rates. Long term this will be a threat to global supply chains and particularly bad for European countries that heavily depend on contested shipping lanes.