2024 Week 23

Notes, thoughts and observations - Compiled weekly

Growth is slowing around the globe and central banks in Canada, Australia and the Eurozone are signaling rate increases. At some point that will bleed over into the US.

Union pressure ramps up at Amazon as ALU partners with the Teamsters. Hands on labor is still in demand even though office work has been in recession for over a year.

EVs continue to drag down automotive sales and a used car price correction is underway.

The real estate market is still hot, but inventories are starting to recover to pre-pandemic levels. This will create downward pressure on prices but don’t expect a major correction. The real relief will come from more starter homes being built.

A different kind of M&A with Dollar Tree looking to divest some Family Dollar stores. In truth there is likely a lot of footprints overlap between the two and consolidation by shutting down underperforming stores is in order.

Finally, folks are starting to question the massive spend on AI related tech. Chamath Palihapitiya has been very vocal about the value proposition of AI chatbots. He further speculates that eventually shareholders will demand a return on their investment from massive spend.

TOPICS

- Fed Rate

- Global Recession

- Domestic Recession

- Labor Market

- Energy

- Automotive

- Residential Real Estate

- Life Extending Technology

- Mergers and Acquisitions

- AI and ML

Fed Rate

OPINION - Global rate response to slowing economy

- (Seeking Alpha)

- ECB set for first rate cut in nearly five years, but future path remains cloudy

- European Central Bank is expected to cut its deposit rate by 25 basis points to 3.75% from a record 4.0% on Thursday.

OPINION - Global rate response to slowing economy

- (Seeking Alpha)

- Bank of Canada cuts rates for the first time in four years

- Target for the overnight rate was reduced to 4.75%, with the Bank Rate at 5% and the deposit rate at 4.75%.

OBSERVATION - Mostly right, but not an effective market timing tool

- (Seeking Alpha)

- Treasury yields have now been inverted for the longest stretch on record

- The second-to-last time the yield curve inverted was in August 2019, which happened ahead of the pandemic-induced recession

- The 2y10y inverted again in March 2022, just before a technical recession emerged in the second quarter of that year.

Global Recession

OBSERVATION - Australia showing signs of slowing economy

- (Brief.News)

- Australia’s economy shows a modest growth of 0.1% in Q1 2024, the slowest since 1992.

- The growth rate fell below expectations, marking the fifth consecutive decline on a per capita basis.

- Despite the soft growth, CBA maintains its interest rate forecasts, hinting at a potential rate cut in November if conditions worsen.

OPINION - Runaway inflation in the EuroZone is not good.

- (Brief.News)

- Turkey is experiencing a severe inflation crisis with annual consumer price inflation reaching 75.45% in May.

- Independent economists estimate the real inflation rate to be even higher at 120.66%.

- In response, the government has introduced a three-year austerity plan following a recent electoral defeat.

- The government is committed to maintaining the 50% interest rate until a significant and sustained reduction in inflation is achieved.

Domestic Recession

- (PiQSuite)

- Deere (and) Co said on Wednesday it would cut an unspecified number of production and salaried jobs to tackle a downturn in farm equipment demand.

Labor Market

OBSERVATION - Ramping up pressure on Amazon

- (Seeking Alpha)

- Amazon Labor Union is now affiliated with the International Brotherhood of Teamsters and will jointly negotiate with Amazon

- Despite organizing thousands of employees at the JFK8 facility in Staten Island two years ago, the ALU has been unable to gain concessions from Amazon as negotiations unraveled.

- “Our message is clear. We want a contract, and we want it now. We are putting Amazon on notice that we are coming. It is time to bargain,” ALU President Chris Smalls added.

OBSERVATION - Office work has been in recession for over a year

- (CNBC)

- Private payrolls growth slows to 152,000 in May, much less than expected, ADP says

- Nearly all the hiring came from the services sector, with goods producers contributing just a net 3,000 to the total.

- Trade, transportation and utilities led with 55,000 new jobs, while education and health services added 46,000, and construction contributed 32,000.

Energy

OBSERVATION - Target $80 per barrel

- (Yahoo)

- OPEC+ Plan to Restore Output Spurs Debate on Oil Trajectory

- Oil prices reflected these tensions on Monday, with crude swinging between gains and losses just above $80 a barrel in London.

Automotive

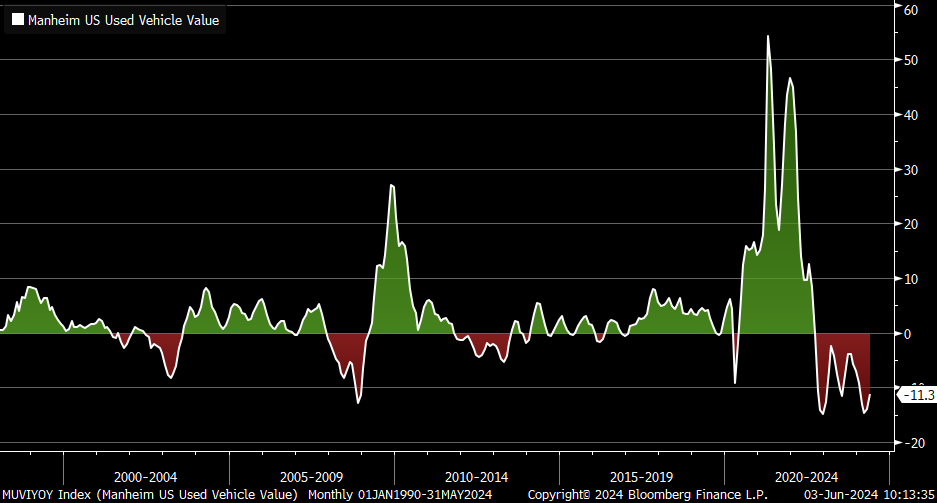

OBSERVATION - Prices starting to decline as vehicles sit on lots

- (carlquintanilla)

- The 2020-2022 surge was far greater, with year-over-year increases in the Manheim Used Vehicle Index exceeding 50% at one point.

- This happened in part because supply chain snags restricted the new vehicle supply

- CPI but now as a deflationary factor, down 11.3% in the last year

- The 2020-2022 surge was far greater, with year-over-year increases in the Manheim Used Vehicle Index exceeding 50% at one point.

OPINION - Could be an economic distraction, or possibly politically motivated.

- (Seeking Alpha)

- Japan’s transport ministry raided the headquarters of the automobile giant.

- Raid came just one day after Toyota chairman Akio Toyoda apologized to customers for the scandal over false safety data.

- Japanese automaker said it has temporarily halted shipments and sales of the Corolla Fielder, Corolla Axio, and Yaris Cross in Japan due to its investigation into the process for model certifications.

Residential Real Estate

OPINION - Argument of affordability breaks down when you examine real estate by price per

- (Sandbox Daily) square foot. Modern houses are twice as large, and not surprising the inflation adjusted price is twice as high.

- Home payments have gotten expensive

- An increase of +7.3% from 2023, +23% increase from 2022, and +78% increase from 2021, per data from Redfin.

- As a result of higher rates, the average monthly mortgage payment is consumed mostly by interest now, as opposed to servicing the underlying principal.

- Housing affordability is becoming a real issue.

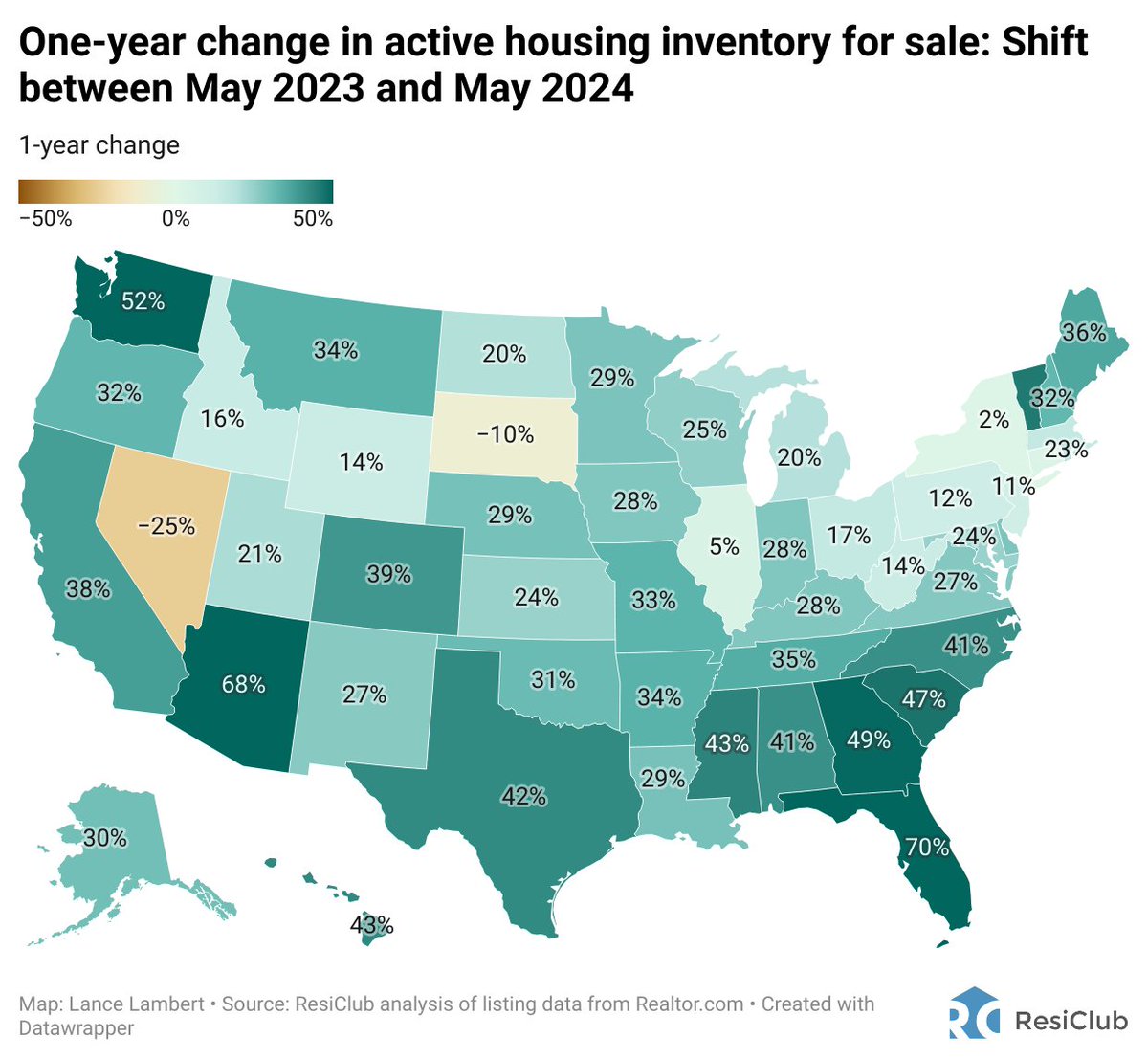

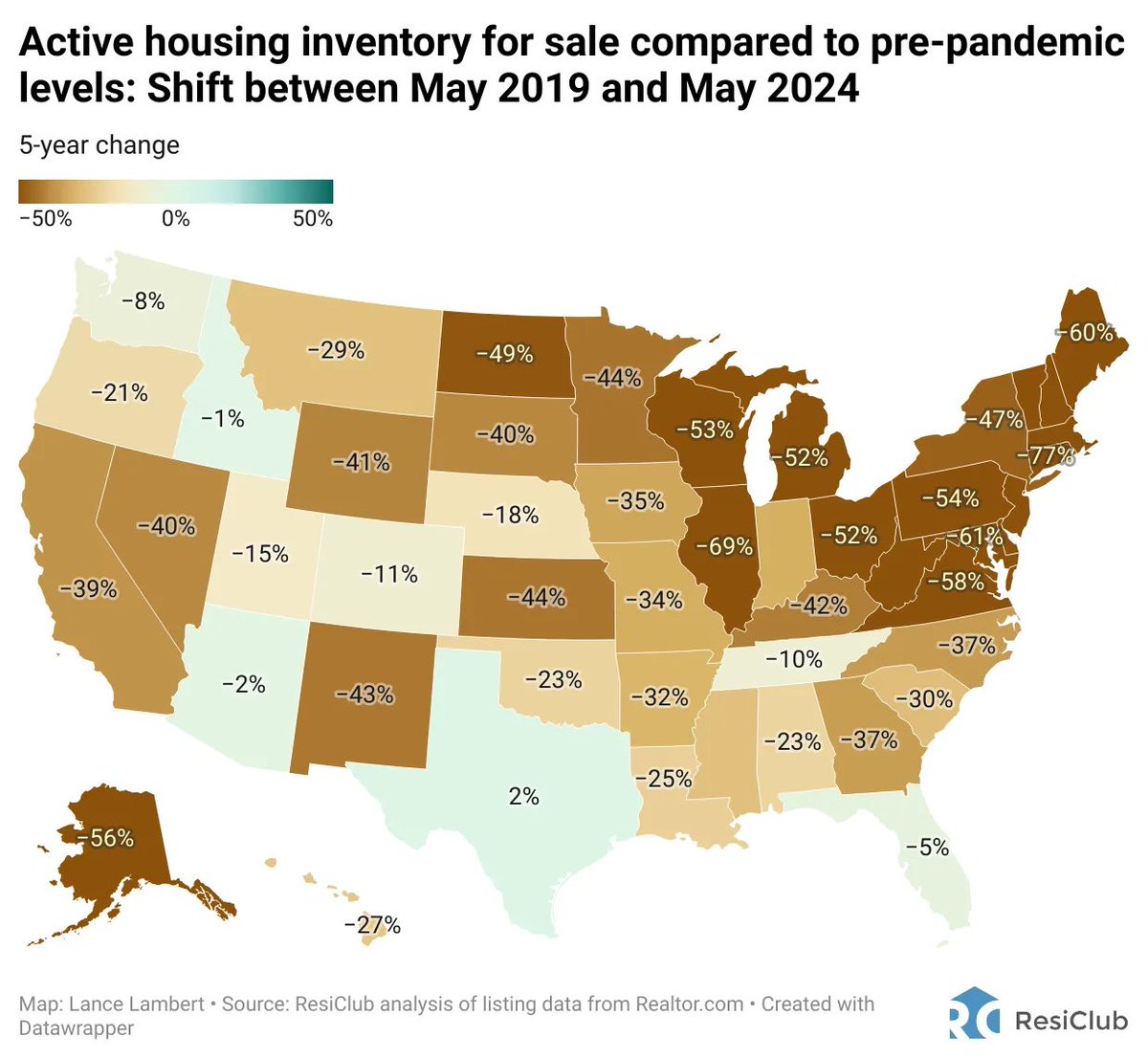

OPINON - Downward price pressure, not declines.

- (DiMartinoBooth)

- DESPITE inventory being well below 2019 the growth in inventory from last year is accelerating. If inventory gets close to 2019 we can expect significant price declines.

Life Extending Technology

OBSERVATION - Additional use of mRNA tech

- (Brief.News)

- Moderna and MSD’s personalized skin cancer vaccine, mRNA-4157, combined with Keytruda therapy, has shown a 96% overall survival rate in a recent trial involving 157 patients.

- The vaccine, also known as V940, triggers an immune response against cancer cells using mRNA technology similar to COVID-19 vaccines.

- Patients who received the vaccine had a 49% lower risk of recurrence or death compared to those on Keytruda alone.

Mergers and Acquisitions

OPINION - A lot of footprint overlap between the two

- (Seeking Alpha)

- Dollar Tree confirms that it is exploring a sale of the Family Dollar business

- Has retained JPMorgan Chase to explore options including a potential sale or spinoff of Family Dollar

- Acquired the Family Dollar chain in 2015 in a roughly $9B deal.

- Has struggled to generate sales lately and required more investment for its turnaround plans.

- Earlier this year, the retailer said it would close around 1,000 Family Dollar stores over the next few years as it grapples with merger indigestion, inflation and store theft.

AI and ML

“We’re not in an AI bubble” at the same time companies spending $26 billion per quarter on AI with no increase in revenue. Sus🫤

- (Chamath Palihapitiya)

- The AI revolution is already losing steam as investors are becoming more cautious about generative AI, recognizing that the current spending doesn’t match its near-term potential to drive returns.

- The pace of improvements in large language models is slowing as companies exhaust all the available data on the entire Internet, resulting in models and applications becoming commoditized over time.

- While chatbots serve as useful assistants, they still struggle to replace the specialized knowledge of human experts, leading to a more tempered outlook on the mass adoption of AI applications and their near-term profitability.

- “You can not spend this kind of money and show no incremental revenue potential.”

- “If you do not start seeing revenue flow to the bottom line of these companies that are spending $26 billion per quarter the market cap of NVIDIA is not what the market cap should be and all of these companies are going to get punished for spending this kind of money.”