2023 Week 13

Notes, thoughts and observations - Compiled weekly

Continued questions and fall out from the bank liquidity bailouts. The market is rattled and there is enough FUD in the system that between credit and consumer pull back there is no way we can avoid a contraction.

That said, I think we are well on our way through this cycle and as historically the designation of a recession comes AFTER the event. Bottom line we are further through this contraction than we think.

Bemoan capitalism, but as The Sandbox Daily puts it:

It is important to remember that Bear Markets happen with reasonable frequency and are a feature of the economic cycle, not a bug.

TOPICS

Financial

When people on Reddit and Twitter can spot bank troubles before regulators, something is terribly wrong. - Senator Krysten Sinema

A lot of turmoil in the markets, the private sector and folks starting to ask why our federal institutions were unable to guard against banking failures.

REACTION - Wow! Called out for sure!!

- (unusual_whales) Senator Krysten Sinema says, “It’s gravely concerning that retail participants, literally everyday people, were able to figure out something was wrong with Silicon Valley Bank, before regulators took action.”

Fed Rate

PREDICTION - The official recession designation is coming..

- (Sandbox Daily)

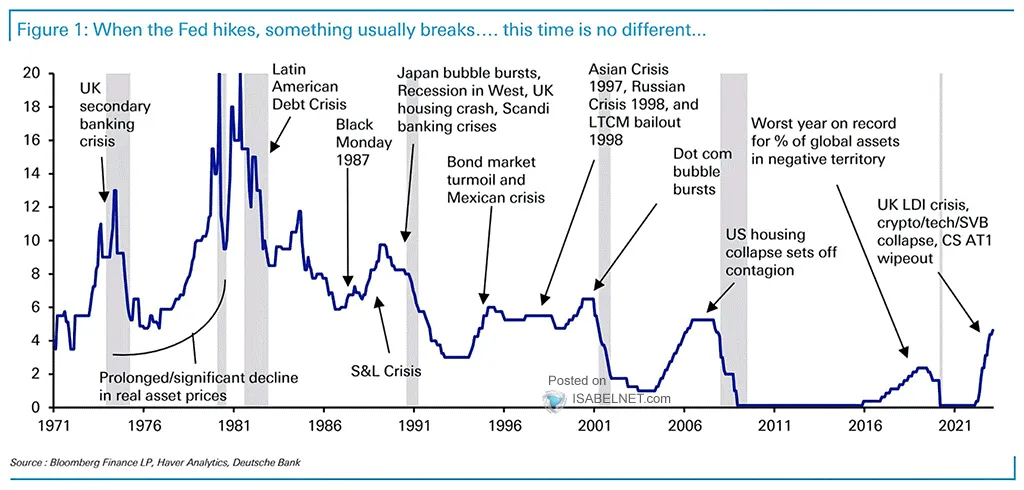

- History repeats itself over and over again, as Fed tightening cycles end with a major financial event.

This rate hiking cycle has “broken” a number of things: pensions in the United Kingdom, the decade+ tech boom, crypto, SPACs, regional banks, and the Credit Suisse Additional Tier 1 (AT1) bonds.

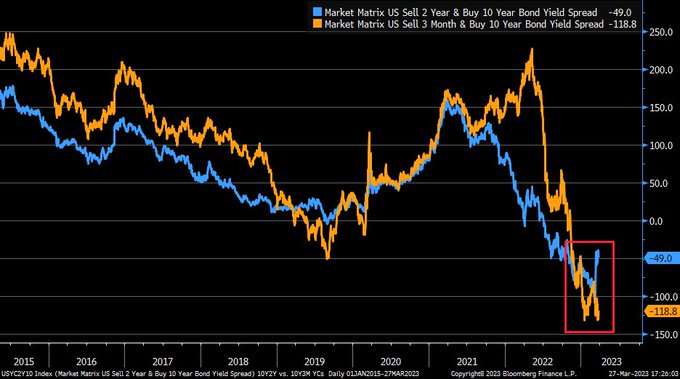

Large divergence forming between 10y2y yield spread (blue) and 10y3m yield spread (orange) as former has re-steepened considerably of late

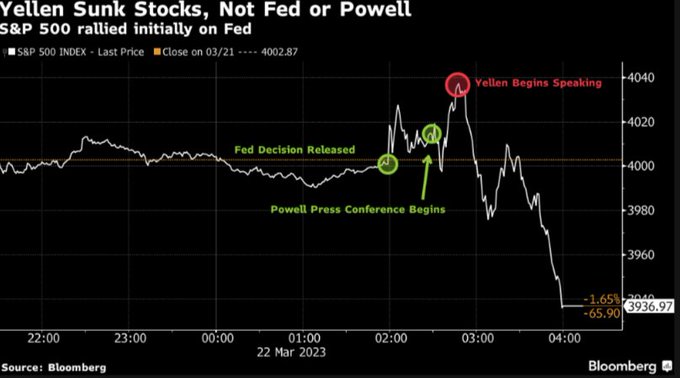

OPINION - Counter point, the market is so rattled that ANYTHING will shake confidence. It’s been a rough couple of years.

The pessimistic turn in US stocks began within a minute of Janet Yellen starting to speak Her comments to the Senate began at 2:47pm, and the S&P 500 fell more than 2.5% over the subsequent 72 minutes

Debt

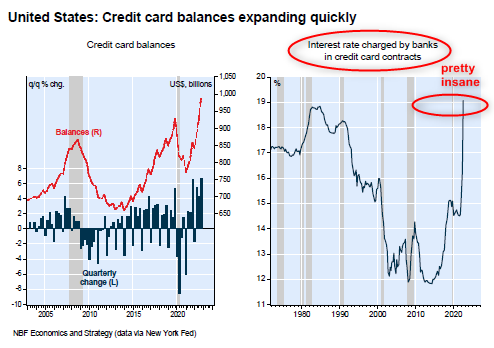

OBSERVATION - Yeah, that’s not sustainable

- (chigrl)

United States: Credit card balances expanding quickly

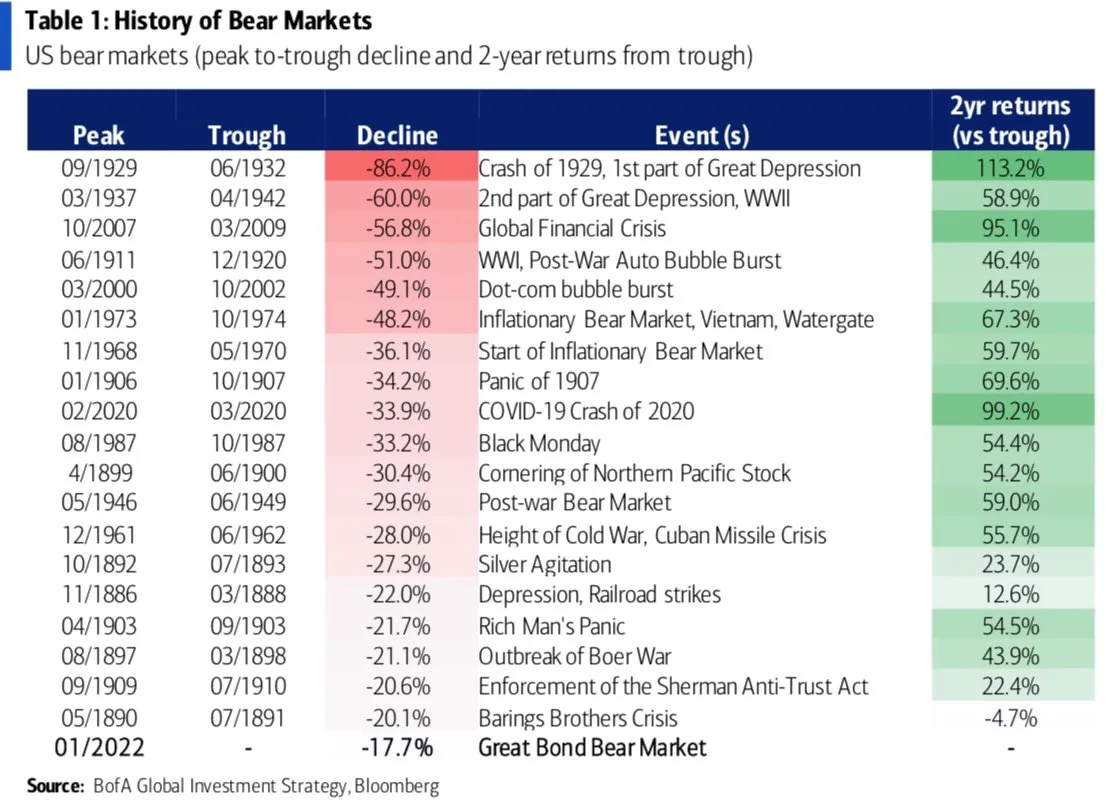

Although coming from historically low levels, credit card delinquency rates are on the rise. This is probably a chart you want to keep an eye on.

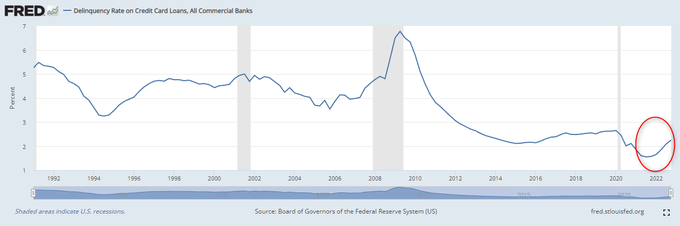

Stock Market

OBSERVATION - A recent, recurring 2 year cycle

- (Sandbox Daily)

- The biggest Bear Market declines have historically preceded the biggest Bull Market recoveries.

Since 1880, the S&P 500 averages a +40% 1-year return and +54% 2-year return off major Bear Market lows.

Labor Market

OPINION - Small cuts, probably Wall Street driven. Will have a psychological impact on consumer spending

- (DiMartinoBooth)

- Let’s bundle the headlines:

- LendingTree to Cut 13% of Workforce; Sees $5.6M Charge

- Electronic Arts Cuts 6% of Its Workforce in Video-Game Slump

- Warner Music Group to Cut Headcount by ~270, or ~4%

- IBM Spinoff Kyndryl Cuts ‘Small Percentage’ of 90k Workforce

- Let’s bundle the headlines:

- (DiMartinoBooth) :: “We’re in a hot mess if firms have NOT been run to generate profits”

- Gotta love verbiage from @business reporter in a story about @salesforce gearing up for another round of layoffs “After years of hiring & big acquisitions, the software company is newly focused on profitability” We’re in a hot mess if firms have NOT been run to generate profits

OBSERVATION - Layoffs spreading to services industry, phase 2 of the downturn

- (DiMartinoBooth)

- Severance is expensive! @Accenture plans to cut about 19,000 jobs, ~2.5% of its workforce, over the next 18 months, according to a 10-Q filing. Sees $1.5 BILLION total business optimization costs, consisting of $1.2B in employee severance and other personnel costs.

- (ArsTechnical)

- Amazon is laying off another 9,000 workers

- The job cuts would come in four parts of the company:

- Amazon Web Services or AWS;

- “People Experience and Technology Solutions”;

- advertising;

- game-streaming platform Twitch, which has been owned by the Internet behemoth since 2014.

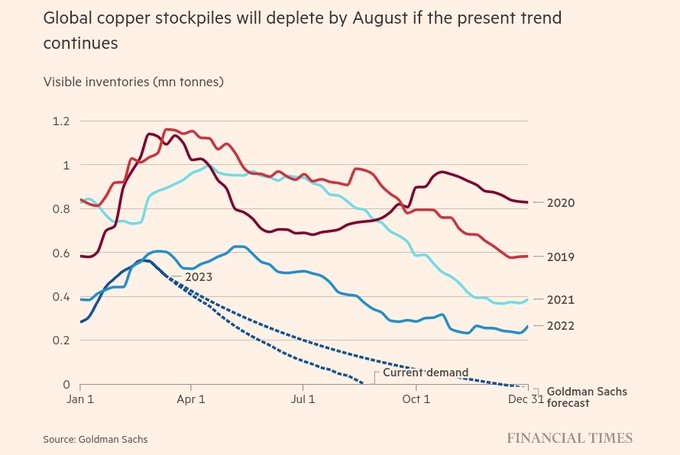

Resources

OPINION - Get ready for inflation round 2, thanks to raw materials prices

- (chigrl)

Global copper stockpiles will deplete by August if the present trend continues