Category:

Business

2022 Week 50

Notes, thoughts and observations - Compiled weekly

Much of this week’s notes are from Mauldin Economic’s Global Macro Update interview with Felix Zulauf. It’s a lot of content and I tried to summarize, but I recommend you watch the original video and check my math.

TOPICS

Fed Rate

To understand Modern Monetary Theory, understand why the banker in Monopoly can never run out of money. - MMT aphorism

OBSERVATION :: Everyone telling the Fed they are doing it wrong, but offer no solid alternatives

- (Global Macro Update) :: US markets: Systemic Calamity | Felix Zulauf

- Central banks have led us to an economic model where banks underwrite the economy

- Support the system with physical stimulus when there is an issue

- Possible while interest rates were low and central banks could underwrite

- High rates mean this is not an option

- In the UK, fiscal stimulus underwritten by high rate debt caused the bond market to react negatively

- (Five With Fitz) :: The Fed is fighting inflation all wrong

- “Pepsi’s layoffs and if more job losses further the Fed’s mission to boost unemployment.?”

- No. Unemployment will not go up measurably, no matter how much Powell raises rates, because companies desperately need workers.

- The Fed cannot fix inflation as long as the government continues to spend money. The very definition of inflation is when there is too much money chasing too few goods in the system.

- 2023 will catch many investors by surprise. They’re expecting the worst, but history suggests that the markets may be a lot closer to the end of this mess than another lurch to the dark side.

- TAKEAWAY :: Buy the best, ignore the rest.

- “Pepsi’s layoffs and if more job losses further the Fed’s mission to boost unemployment.?”

- (Claudia Sahm) :: The Fed is slowing down.

- Fed Chair Jay Powell said very clearly this week; THE FED IS SLOWING DOWN.

- Every 75 basis point hike in the Fed Rate this year had shaved percentage points off my soft-landing scenarios. No more.

Energy

The Stone Age came to an end, not because we had a lack of stones, and the oil age will come to an end not because we have a lack of oil. - Sheikh Ahmed Zaki Yamani

OPINION :: Energy is a critical input cost that can not be ignored, and we have the all the makings of some very difficult times

- (Peter Zeihan) :: Russian Oil Price Cap: Lasting Impacts

- The single global price for crude that we’ve all enjoyed for the last 85+ years…GONE. Meaning that global shipping becomes riskier and riskier by the day.

- In terms of energy, we are well on our way to how things were in the 1930s

- Crude oil is not fungible, different grade / different refineries

- Urals crude can freeze in the pipes and shut down pipes for years

- Shipped past unfriendly countries (Latvia, Finland, etc.)

- ESPO (Eastern Siberia Pacific Ocean) Oil Pipeline

- Mostly China and India

- Urals crude can freeze in the pipes and shut down pipes for years

- TAKEAWAY :: Single price and supply chain for oil is over; country specific supplies and prices will separate.

- Getting back to the 1930s style energy supply model

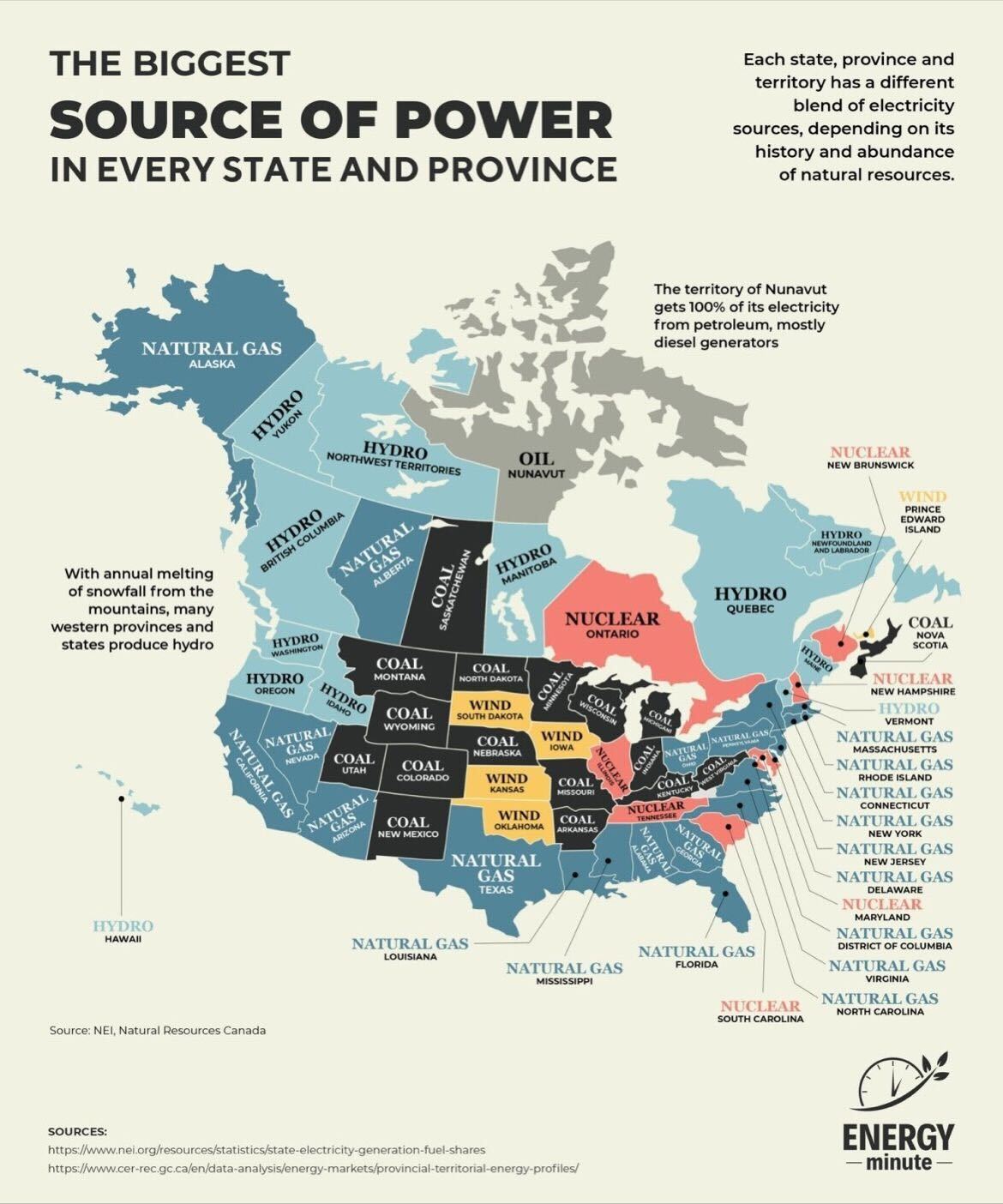

- (margot_rubin) :: The biggest source of power in every state and province

- Great visual… The thing this ignores is that all of the states need natural gas capacity for demand fluctuations. It’s the only truly flexible supply of energy due to the on-demand capabilities of Gas Turbines. Which with CHP can reach over 90% efficiency. No replacement exists

Recession

It’s a recession when your neighbor loses his job; it’s a depression when you lose yours. - Harry S Truman

GLOBALLY :: Expect a big shake out as new economic trading alliances emerge and challenge the US led system. Cold War 2 may be economic.

- (Global Macro Update) :: US markets: Systemic Calamity | Felix Zulauf

- Outside of the US we are facing a serious recession in EuroZone, UK, China

- China is in a deeper crisis than in 2008

- Lockdowns are a camouflage for how structurally weak China’s economy has become

- Japan hit the same point in 90s

- Credit boom is over, can’t stimulate for higher growth

- If they try to stimulate they will cause a currency crisis

- Could generate a debt crisis like in 90s.

- Trapped, but will support the system to avoid catastrophe

- Potentially takes 10 years to recover (Japan 20 years, crisis not as deep)

- (Over My Shoulder) :: Joseph Politano: Russia’s Recession

- Western economic sanctions on Russia has caused suffering, but country is more resilient than expected.

- After initially forecasting an 8.5% drop in Russian GDP this year, the IMF now expects only a 3.4% contraction.

- Russia still has major problems like capital flight, annual inflation over 12.5%, and low consumer confidence.

- Sanctions succeeded in hobbling Russian credit conditions and manufacturing activity.

- Impairing Russia’s industrial output was key to hurting the war effort and it seems to have worked.

- Steel and iron production, fertilizer manufacturing and mining output are all down from a year ago.

- Russian energy revenues have declined as it is forced to sell oil at discounted prices.

DOMESTICALLY :: Everyone is obsessed with the stock market, but it looks likely we’ll have a mild recession now and a much larger one in a few years.

- (Global Macro Update) :: US markets: Systemic Calamity | Felix Zulauf

- US is in for a roller coaster in the next 10 years

- We are facing a domestic recession in 2023 Q2-Q3

- Remainder of 2023 and 2024 will be good

- If commodity prices peak in 2025 (think crude oil at $200) would trigger another down cycle

- Risk of the next big market reset

- Real Estate (3 trillion global), triggered by bond rates rising

- Banking and household balance sheets, based on borrowing costs

- Currencies go away (think BRICs trading zone currency)

- US is in for a roller coaster in the next 10 years

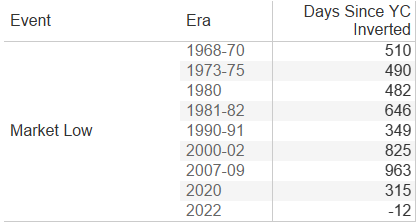

- (LynAlden) :: The summary of the data below is that the stock market bottom tends to come between 1 year and 2 years after the Treasury yield curve inverts. Rarely much before or after that timeframe. This time could be different, but these are the historical numbers.

- Unfortunately, since the closest macro analogue to this period is probably the 1940s, I am not sure how informative the data from the 1960s to the present will be in this regard. And the yield curve was completely controlled by the Fed in the 1940s.

- IF Oct 13 actually marks the low, it would be the closest market floor to a yield curve inversion (3m10y) uh…ever? It would beat the 2020 record by over 300 days, and be the first time the curve flipped after the low in price. Anyone betting this time is different?

- ..

- TAKEAWAY :: Based on the Fed/S&P theory, looking at a market bottom in June 2023

- That’s technically 182.5 days, but the QE unwind is abnormal

- TAKEAWAY :: Based on the Fed/S&P theory, looking at a market bottom in June 2023

- (Claudia Sahm) :: The hawks are the problem now. Stand down.

- Policymakers, families, businesses, and communities are making decisions based on the views about next year.

- People look to macroeconomist for answers

- They (inflation hawks) were wrong about why inflation shot up and lasted as long as it did.

- Being right for the wrong reason makes someone dangerous.

- More importantly, _the inflation hawks were wrong that we needed high unemployment and low wage growth to slow inflation.

- WE DO NOT NEED TO CRUSH WORKERS TO GET INFLATION DOWN.

- Policymakers, families, businesses, and communities are making decisions based on the views about next year.

Deleveraging Globalization

Globalization is a fact of life. But I believe we have underestimated its fragility. - Kofi Annan

OPINION :: Weaponization of the monetary system (US Dollar & SWIFT) set about a global realignment of trading systems. These will likely be big factors in monetary and economic systems

- (Global Macro Update) :: US markets: Systemic Calamity | Felix Zulauf

- Risk to the US Dollar as a reserve currency

- The World in 2000 everyone in the world traded with the US (China, North Korea outliers)

- World in 2022 all of Asia, Africa, South America and half of Europe trade with China

- US, Canada, Mexico, Great Britain, Netherlands

- The west is still looking at things through the lenses 2000, with dollar as dominate currency

- Realignment of the Saudis from the US to China

- Oil still priced in dollars, for now

- US used SWIFT and Dollar as a political weapon (re: Ukraine)

- Countries not aligned with US have seen that their assets can be frozen

- Status as a reserve currency will decline over the 20-30 years

- No alternative yet.. but will accelerate when an option is available

- China effort for new currency in BRIC states, not a fiat currency

- BRICS explores creating new reserve currency

- Countries like Chinese, Russians, India, Saudis will store reserves in commodities

- Can store within your own borders, can not be frozen

- We are emerging form a 12 year bear market in commodities, underinvestment, shortages

- China is a large producer of a lot of those commodities, can control supply as a economic lever

- Risk to the US Dollar as a reserve currency