Category:

Business

2022 Week 47

Notes, thoughts and observations - Compiled weekly

Big gap since the last weekly notes posting, so I’ll attempt to summarize the big movers.

TOPICS

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

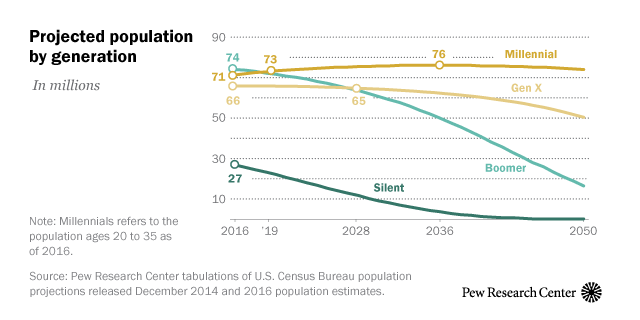

THOUGHT :: Boomer demographic shift is largely over, not enough Zoomers to replace them. Labor will remain tight. Immigration is our only way out

- (Over My Shoulder) :: Baby Boomers are exiting the economy at an accelerating pace.

- By 2040, the oldest Millennials will be about the same age as the youngest Boomers are today

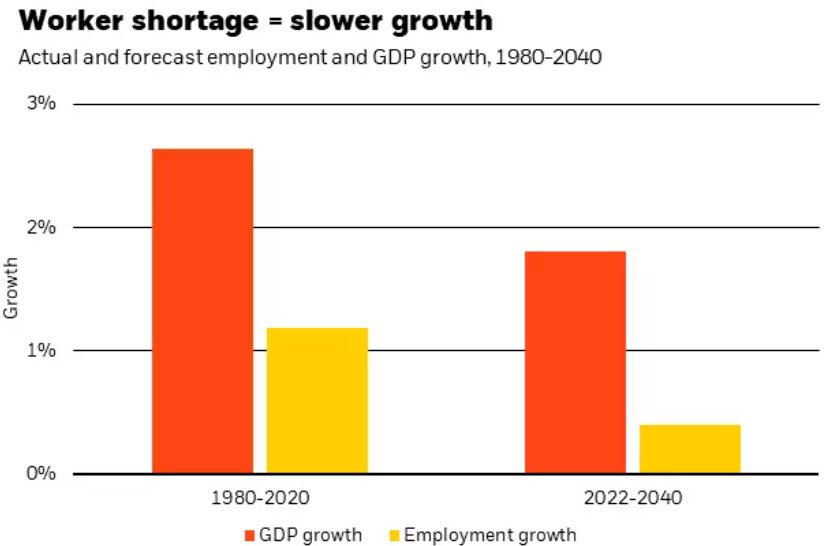

- (DiMartino Booth) :: As @profplum99 has long warned, a worker shortage is poised to impair the potential for long-term U.S. economic output. At some point, a critical mass of politicians must recognize this & aim to push through immigration reform that reinvigorates demographics as a driver of GDP.

Fed Rate

To understand Modern Monetary Theory, understand why the banker in Monopoly can never run out of money. - MMT aphorism

OPINION :: Fed will continue raising rates until it hurts, will buy some extra rate in advance of the next crisis.

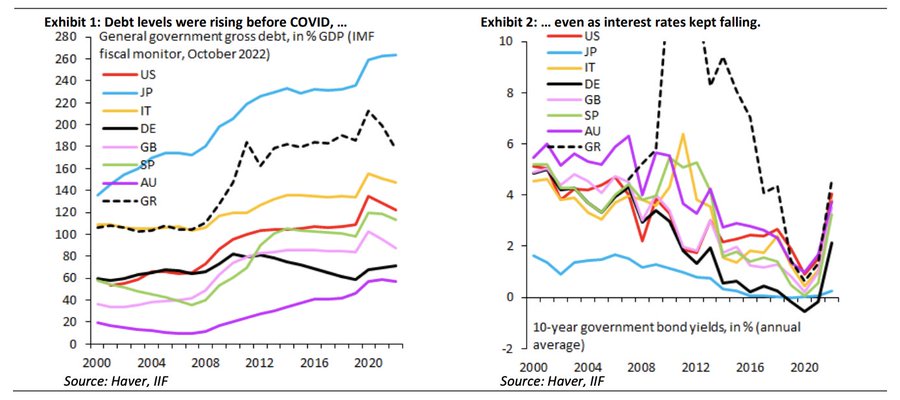

- (Holger Zschaepitz) :: End of #MMT illusion in one chart: Modern Monetary Theory was at its zenith 2yrs ago when global interest rates were low amid record fiscal deficits. Feeding illusion that #debt space is limitless. This illusion has ended abruptly in recent mths w/UK & Japan in turmoil. (via IIF)

- (Peter Zeihan) :: Implications of Rising Interest Rates

- Not all of us have adult-experience with a period of high interest rates…I’m talking about millennials

- Guess who is responsible for the majority of the demand across the world…millennials.

- The US has enough millennial-backed demand to get them through this recession, the rest of the world will quickly show how important it is to have a full quiver of monetary regulation tools at their disposal.

- As this economic crisis unfolds across the globe, expect plenty of whining from your favorite crypto-bros, millennials and Germans.

- TAKEAWAY :: Fed will over tighten to prepare for the next major financial crisis

Energy

The Stone Age came to an end, not because we had a lack of stones, and the oil age will come to an end not because we have a lack of oil. - Sheikh Ahmed Zaki Yamani

IMPACT :: Energy prices will remain high, and beneficiaries will be private equity operations.

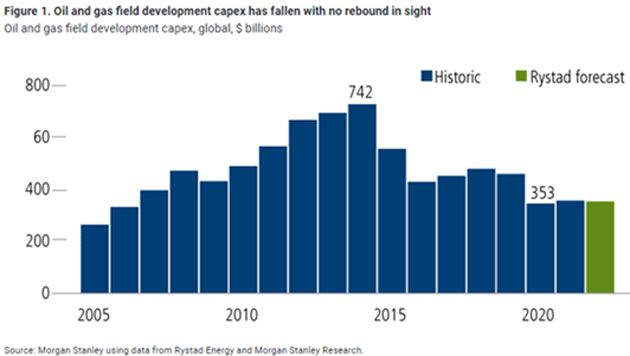

- (Global Macro Update) :: Oil & Gas CapEx Likely to Stagnate

- Before the price of oil shot up this year, the last time it broke through $100 per barrel was in 2014. But by year-end of 2015, it had plummeted below $35 per barrel… a roughly 65% decline. Will history repeat itself?

- Chart below suggests that it won’t. In 2014, over $740 billion went into oil and gas field development. That led to higher production, which in turn led to a greater supply and lower oil prices.

- The past two years and 2022 estimates show CapEx won’t even climb above the $400 billion mark.

- Before the price of oil shot up this year, the last time it broke through $100 per barrel was in 2014. But by year-end of 2015, it had plummeted below $35 per barrel… a roughly 65% decline. Will history repeat itself?

- Michael McKee on Bloomberg reported when he was looking at the last month’s jobs report that oil and gas, there’s no CapEx happening in oil and gas relative to history

- In fact, there was only 400 jobs added in that sector—at a time when you’ve got the president basically screaming from his pulpit that energy prices need to come down.

- 90% of the potential offshore leases are right now shut down

- Right now, 60% of the drilling that’s going on, it’s private money. It’s not the Pioneers or the Chevrons. It’s not the big guys. It’s not even the medium-sized public guys. It’s private money.

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

OPINION :: Agree, inflation will stick around as long as energy prices are high

- (Over My Shoulder) :: Charles Gave: No, US Inflation Has Not Peaked Yet

- Significant US inflation peaks have always occurred during a recession or just after.

- That means either the US is in recession right now, or October wasn’t the inflation peak many think it was.

- Inflation has almost never peaked when energy prices are rising faster than the S&P 500, as they are now.

- (Global Macro Update) :: John Mauldin: Hyperinflation. I don’t think it will get to that. Not in the US, not in Europe

- I’m one of the few people that are now still arguing that Powell has to drive a stake in the heart of inflation, that he can’t back off and pause or start cutting.

- Supply chain-driven problems are going to be resolved

- It’s gone from $15,000 or $20,000 a container to $2,000 a container to ship from what little we’re getting from China now.

Bright Spots

Deleveraging Globalization Winners :: Real estate, urban renewal, US based manufacturing, Mexican based industries

NOTE :: Emerging markets require a strong youth class (businesses, homes, economic activity)

- (Peter Zeihan) :: United States is in the midst of its greatest period of industrialization since WWII…

- Why the US?

- Security and supply chain speed

- Lowest energy cost in the world

- Existing manufacturing base

- Where?

- Detroit

- Integration with southern Ontario’s manufacturing hub

- Access to inland waterways (cheap transport)

- Existing manufacturing base

- Detroit

- Why the US?

- (Peter Zeihan) :: American Electronics: A Texas Sized Problem

- Need roughly 2 million manufacturing jobs in the US just to handle electronics

- Normally offshored to East Asian countries

- With Germany and China facing headwinds, manufacturing needs to return to US

- Failure to do so means Americans will have less electronics to available to buy

- Electronics have a very different supply chain than normal manufacturing

- Each component is a specialized process, hundreds of parts

- Each has their own supply chain, workforces, cost structures

- Rare for all these components to be present in the same political structure

- US labor cost differential is not large enough, enter Mexico

- Skilled, lower wage workforces for lower-end tech

- Proximity north of the border with south of the border.

- Where?

- San Antonio

- El Paso

- San Diego

- Tucson Arizona

- Need roughly 2 million manufacturing jobs in the US just to handle electronics