Category:

Business

2022 Week 29

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

OPINION :: Labor Market have just begun, starting to see bleed over from tech startups to tech giants

- (Cramer) :: Alphabet’s (GOOGL) Google tapping the brakes on hiring. Like Meta, which laid off custodial staff

- (Seeking Alpha) :: Oracle considering ’thousands’ of layoffs, could happen as soon as August: report

- Oracle (NYSE:ORCL) has considered cutting costs as much as $1B and laying off “thousands” of employees, perhaps as soon as August

- Labor Market could “disproportionately impact” workers in the U.S. and Europe and occur in areas such as marketing for software applications in customer service and e-commerce.

- Potential job cuts come just weeks after Oracle (ORCL) closed its $28B acquisition of Cerner to give the company a deeper presence in the healthcare technology space.

- With the acquisition, Oracle acquired some 28,000 employees from Cerner, according to the company’s website.

Market

Buy When There’s Blood in the Streets - Nathan Rothschild (maybe?)

OPINION :: Tesla was a bubble stock, but is it THE bubble? I think TESLA valuation caused investors to look the other way

- (Smart Money Monday) :: Tesla Is the Bubble

- First, Tesla still has a $700 billion market cap. That makes the stock 60% larger than Facebook (META).

- The cult of personality around Elon Musk is the second telltale bubble sign

- Meanwhile, the rest of the auto industry is coming for Tesla

- Stellantis (STLA), formerly known as Fiat-Chrysler, says 100% of its European cars and 50% of its US cars will be electric by 2030.

- That’s 8 years away, but the company is aiming directly at Tesla.

- Stellantis (STLA), formerly known as Fiat-Chrysler, says 100% of its European cars and 50% of its US cars will be electric by 2030.

- Tesla is starting to feel the pinch. Deliveries of its flagship Model X and Model Y cars shrank 18% in Q2 2022 compared to Q1 2022.

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

OBSERVATION :: Gotta love the Cathie Wood quote ahead of the core CPI numbers; worse than anyone expected

- (Cathie Wood) :: ‘We believe the Fed has been making a mistake’

- Wood pointed to inventory build ups at places like Walmart (WMT) and Target (TGT) as support for her deflationary concerns.

- Copper prices offered another important signal, Wood said, noting the metal provides both a gauge of real activity and inflation.

- Wood highlighted that we are seeing a “huge breakdown… We’re at $3.29 now, that is down 25% month-to-month and it is down 25% year-over-year.”

- Wood argued that gold also does not support the widely accepted inflation story.

- The precious metal has traded within the $1,700-$2,075 for two years.

- Gold in Wood’s eyes has been “one of the most reliable inflation gauges out there."

- Gold has “broken down to the low end of its range. It is down 7% month-to-month, and on a year-over-year basis, it’s flat.”

- “Even oil is starting to break despite what’s going on in Russia because the global economy is in recession.

- (Cramer) :: June consumer inflation jumps 9.1% year over year, stronger than estimates, fastest pace since December 1981. Core, ex-food and energy, also advances a greater-than-expected 5.9%.

Real Estate

Equity feels good but at the end of the day I can’t eat my house

OPINION :: Rising interest rates will decrease demand because buyers can’t afford sky high prices

- (CalculatedRisk) :: Lawler on Demographics: Observations and Updated Population Projections

- The last official intermediate and long term population projections from Census was done in 2017, and (which I’ve written about before) those projections significantly over-predicted US births, significantly under-predicted deaths, and significantly over-predicted net international migration (NIM).

- (Sonders) :: Per @Redfin… roughly 60k home-purchase agreements fell through in June, equal to 14.9% of homes that went under contract that month; home sales are getting canceled at highest rate since start of pandemic

- (DiMartino Booth) :: Got cold feet?

- (Calculated Risk) :: Homebuilder Comments in June: “Someone turned out the lights on our sales in June!"

- #Austin builder: “Sales have fallen off a cliff. We’re selling 1/3 of what we sold in March and April. Trades are more willing to negotiate pricing since market has adjusted significantly past 60 days.”

- #Charlotte builder: “This recession is looking like and feeling like a big long five year depression.”

- #Nashville builder: “Scary times. Hoard cash and hang on for the ride! National builders are cutting staff and offering buyers incentives. Move-up buyers are now practically non-existent due to rising rates in comparison to their existing rate.”

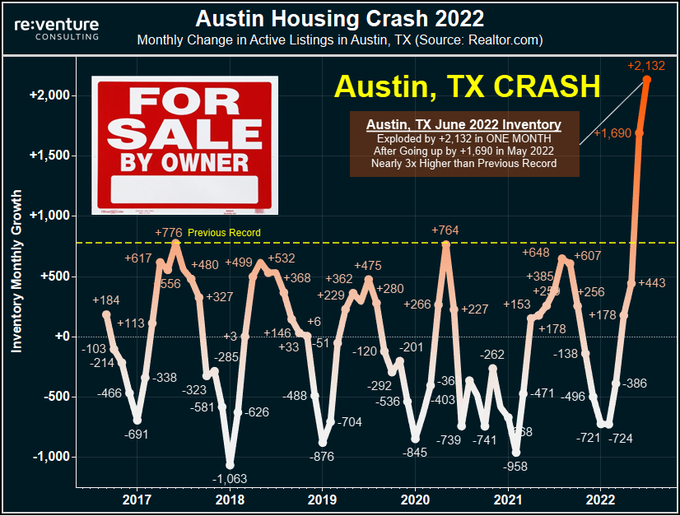

- (Nick Gerli) :: Housing Crash in Austin, TX is getting EPIC

No buyers. Selling liquidating. Inventory piling up in record fashion. June 2022 Inventory Gain of +2,132 was nearly 3x previous record. And it’s just getting started…

No buyers. Selling liquidating. Inventory piling up in record fashion. June 2022 Inventory Gain of +2,132 was nearly 3x previous record. And it’s just getting started…

Energy

Gimme fuel, gimme fire Gimme that which I desire - Metallica

OPINION :: I think this was due to speculation, which didn’t pan out when Europe didn’t efficiently ban Russian imports. Further, the US is willing to do business with the Saudis despite our social disagreements

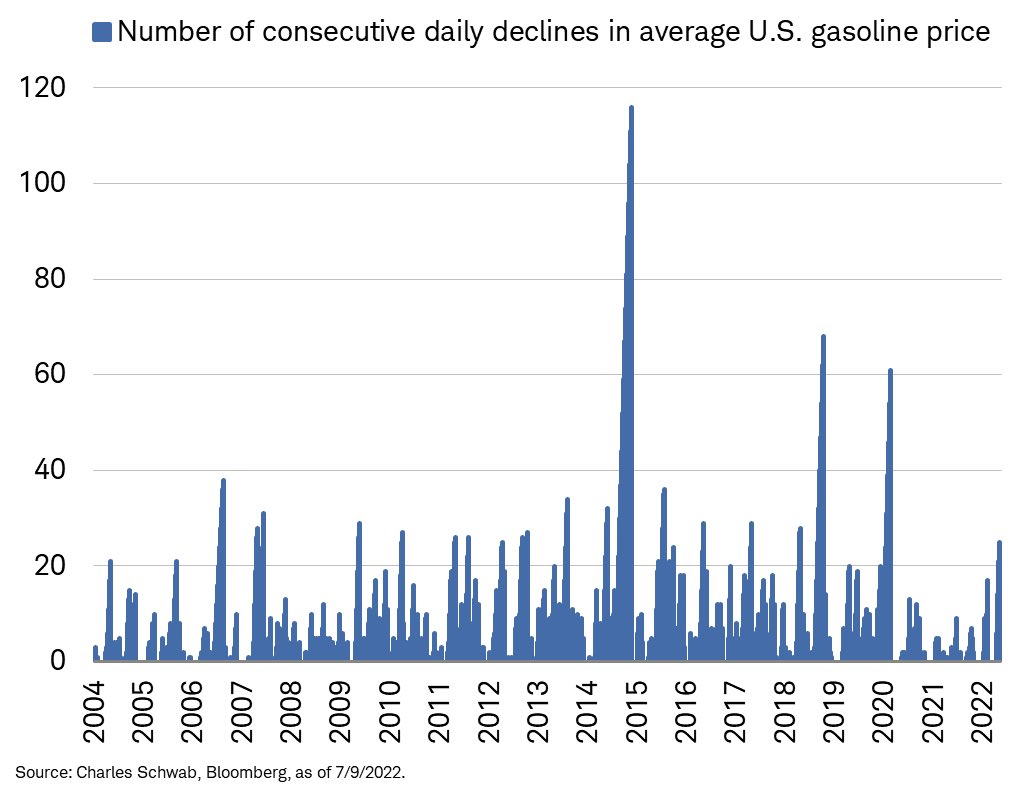

- (Sonders) :: Average U.S. gasoline price has been falling for 25 consecutive days … not longest streak on record, but step in right direction and largest drop since pandemic erupted

Debt

When a man is in love or in debt, someone else has the advantage - Bill Balance

OBSERVATION :: Feels like the Asian debt crisis to me

- (1440) :: Crisis in Sri Lanka

- Has been gripped by a month long economic crisis spurred by a combination of tax cuts, significant public spending, and a pandemic-induced drop in tourism revenue.

- In May, Sri Lanka defaulted on $50B in foreign debt and now seeks an aid deal with the International Monetary Fund—an agreement that would come with significant curbs to public programs.

- Its default may signal a broader trend of nonpayment among developing countries, as experts warn (paywall, Bloomberg) the number of at-risk nations has doubled in six months.

- Sri Lankans have faced severe shortages of food and fuel, among other necessities. See video of protesters storming the presidential compound here.

- (RadioGenova) :: Probably nothing

- Citizens storm the Bank of China in Zhengzhou over bank account freezes. Banks froze millions of dollars in deposits last April, simply explaining to savers that they need to upgrade their internal systems. Since then, customers have not received any kind of communication.

- (Jennifer Zeng 曾錚) This is huge. Don’t know how this will end. Henan bank is NOT the only one that is having problems with liquidity. All four Chinese banks are having the same issue. Some depositors found they can save and can NOT withdraw money with their bank cards.