Category:

Analysis

Automotive - It's Electric

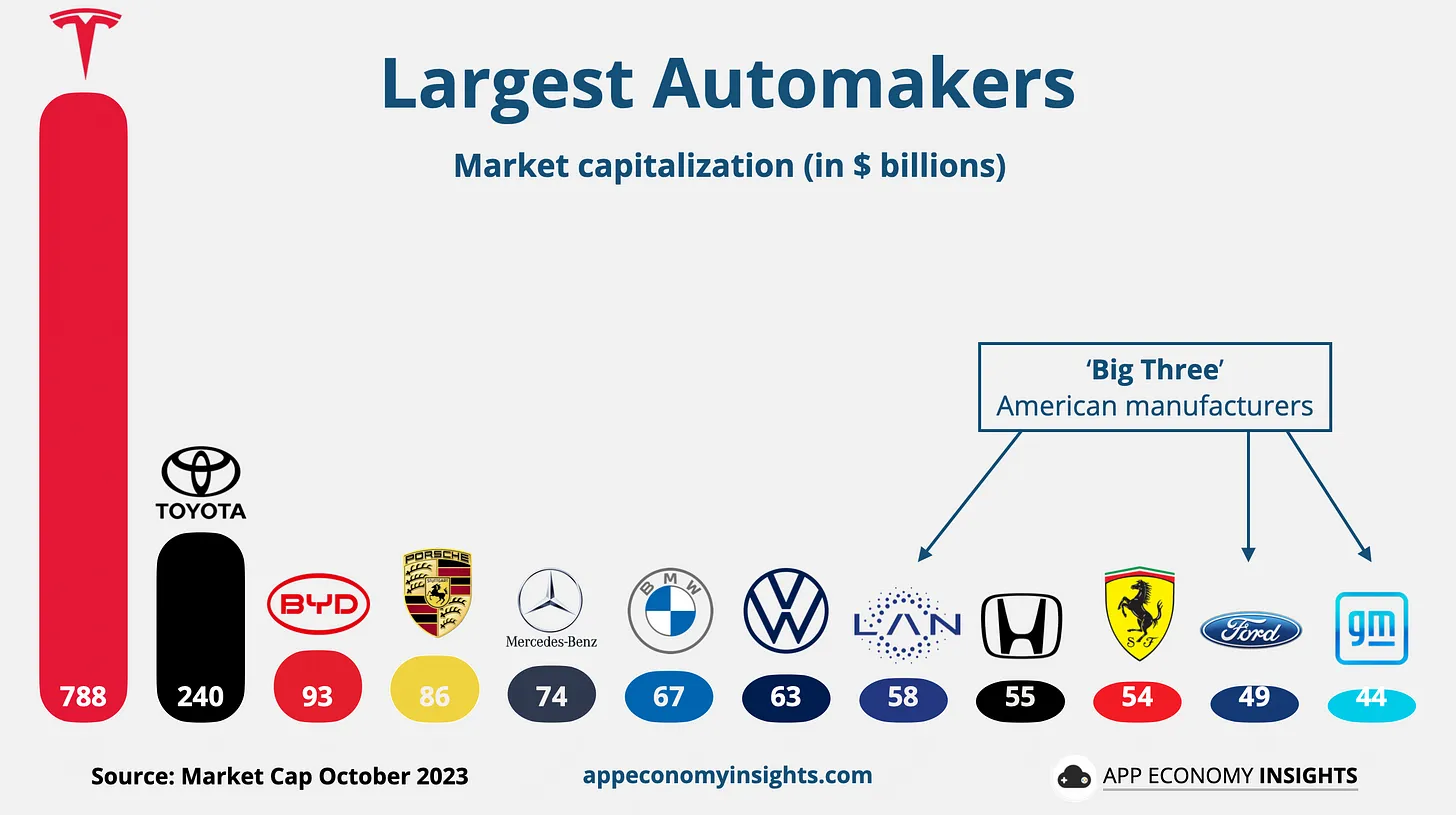

Once-dominant Big Three are now facing fierce competition

A stark reminder of where the “big three” auto makers rank by market cap. If the future of automotive is electric, Tesla obviously has an early advantage. Toyota takes a slightly different track with hybrids. Maybe you’ve never heard of BYD, but the Chinese manufacturer has already seen success with exporting vehicles.

Chart via App Economy Insights