2024 Week 27

Notes, thoughts and observations - Compiled weekly

A combine notes because of time off an holidays

Big themes around the direction of the economy, the labor market and the Fed’s next move. As Keith Fitz Gerald notes: “Trying to anticipate the Fed is a fool’s errand.”

Inflation is close to target, but the Eurozone is clearly in the throes of deindustrialization. Regardless of monetary movements in other countries, US data and corporate results continue to surprise to the downside. Is something big coming, or is it simply a bump in the road?

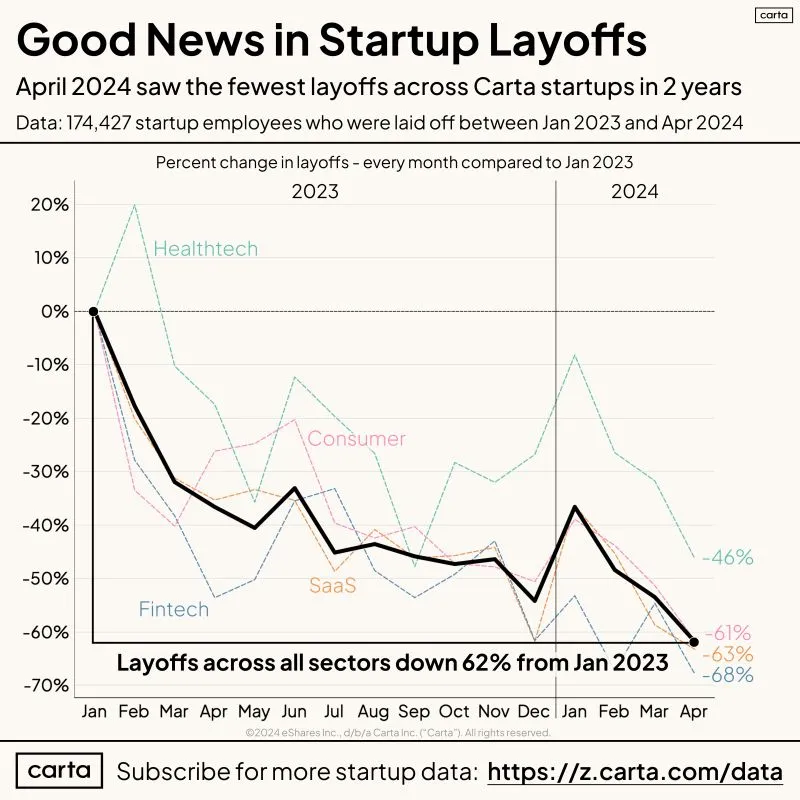

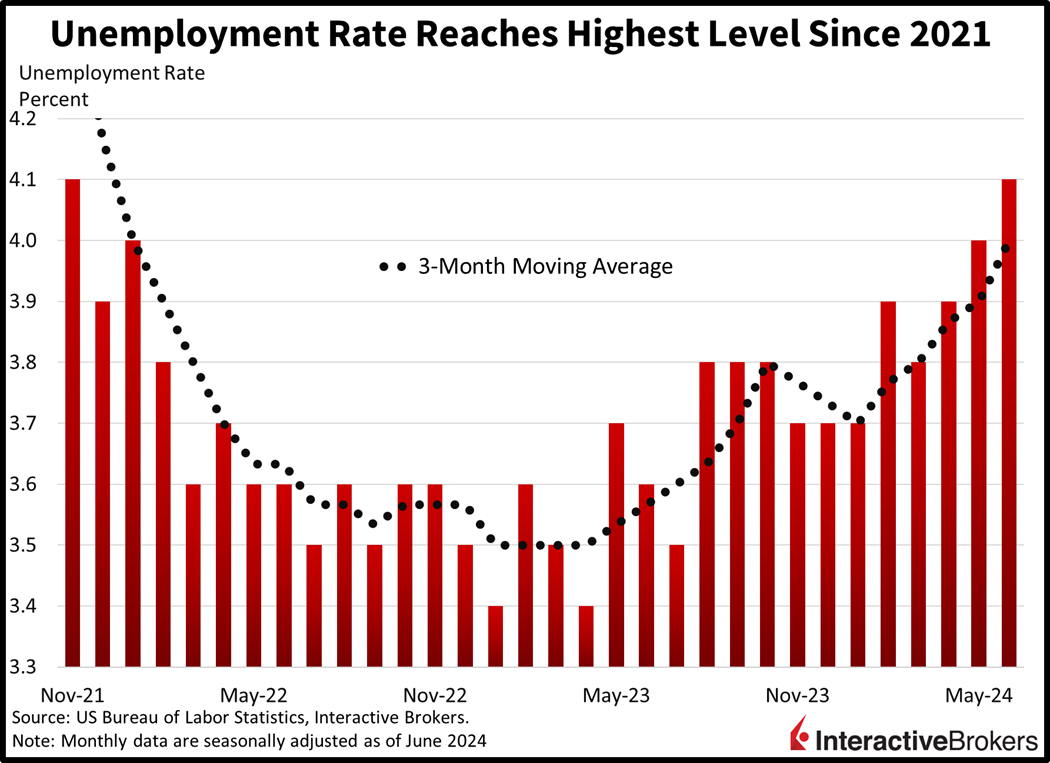

Labor market headlines are often worse than reality. While we’ve reached a high point, since 2021, the rate is still historically low. The expansion is slowing but we aren’t seeing a crash like in 2008. On the flip side, startup layoffs are down 62% since January 2023 per Carta. It’s been steady since early 2022 and may be ending.

Darkest days for startups coming to a close?

The rest of the economy is going through the cycle. Weak companies continue to seek acquisition, or bankruptcy. Financial companies might be in a weakened position but in the near term the 2008 regulations are doing their job.

The biggest headwinds for the economy are the commercial real estate market that has a 20.1% vacancy rate, not seen since the 80s. No indication of how or when this will impact real estate, finance or local governments. Another headwind is the increasing damage from cyberattacks, which impact company bottom lines. However, it’s also an opportunity for companies like Micrsoft to benefit from increased security spending.

TOPICS

- Global Recession

- Domestic Recession

- Fed Rate

- Commercial Real Estate

- Labor Market

- Bankruptcy

- Finance

- Mergers and Acquisitions

- Cybersecurity

Global Recession

OPINION - Eurozone deindustrializing

- (Brief.News)

- Industrial production in Germany fell by 2.5% in May 2024, the largest drop since late 2022.

- France experienced a 2.1% decline in industrial production during the same period.

Domestic Recession

OBSERVATION - Economic data continues to surprise to the downside

- (Blake Millard)

- Initial jobless claims stayed in a rising trend, housing deteriorated again, and manufacturing is still struggling.

- Reports align with other economic data that continues to come in below expectations

- Indicating our economy is gradually cooling.

- Likely suggests the economy is starting to feel the effects of Fed tightening.

Fed Rate

OPINION - Still inflation, closer to target

- (Keith Fitz Gerald)

- Eurozone inflation has dropped to 2.5% according to the EU’s statistics agency.

- Policy wonks the world over are watching because the data certainly suggest that a pause or at least a reduced interest rate outlook would be prudent.

- POV: Trying to anticipate the Fed is a fool’s errand. The path to profits is clearly defined by what’s likely to happen and which companies will get the job done.

Commercial Real Estate

OPINION - Eventually this problem comes home to roost.

- (BIll McBride)

- Office Vacancy Rate at New Record High

- Moody’s Analytics reported that the office vacancy rate was at 20.1% in Q2 2024, up from 19.8% in Q1 2024. This is a new record high, and above the 19.3% during the S&L crisis.

Labor Market

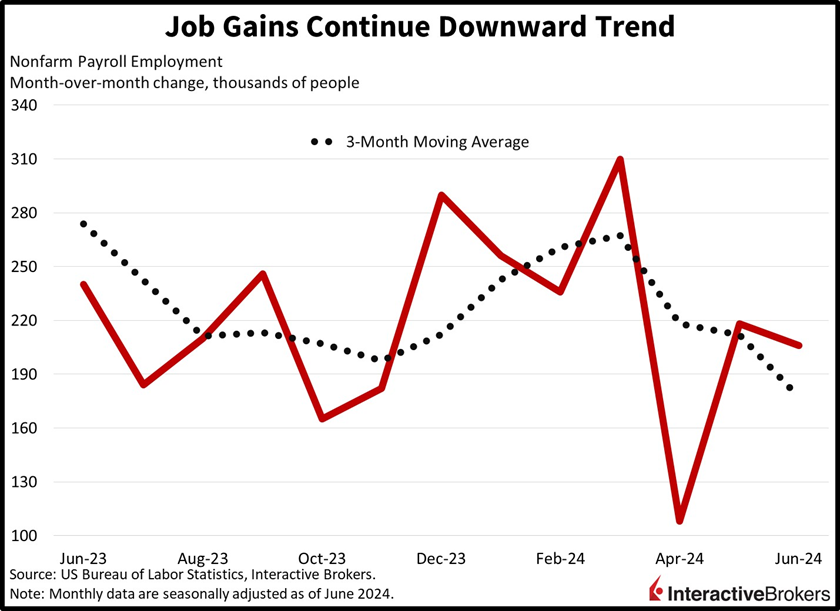

OBSERVATION - Slowing but not dramatically changing; demographics at play.

- (IBKR)

- Hiring Expansion Continues Slowing

- US labor market decelerated last month, but June job gains still sported an impressive 206,000 figure, slightly above projections calling for 200,000

- Average hourly earnings rising 0.3% month over month and 3.9% year over year

- Unemployment Hits Multi-Year High

- The steady rise in unemployment, which rose for the third consecutive month to 4.1%, the loftiest level since November 2021.

- Hiring Expansion Continues Slowing

OBSERVATION - Payrolls are cooling, likely accelerate as company results continue to disappoint.

- (CNBC)

- U.S. economy added 206,000 jobs in June, unemployment rate rises to 4.1%

- Highest level since October 2021.

- Average hourly earnings increased 0.3% for the month and 3.9% from a year ago, both in line with estimates.

OBSERVATION - Darkest days for startups coming to a close?

- (Gergely Orosz)

- Fewer layoffs at startups, finally?

- Unfortunately, news of startups slashing headcounts has been pretty constant since early 2022. But new data from equity platform Carta suggests this trend may finally be cooling.

- It’s not just numbers of layoffs which are falling; more people are leaving jobs by choice, instead of being let go.

- Around 60% of workers in Carta’s figures left by choice, versus 40% being let go.

Bankruptcy

OPINION - Disrupted by streaming

- (AP)

- Redbox owner Chicken Soup for the Soul files for Chapter 11 bankruptcy protection

- $414 million in assets and $970 million in debts

- Shares for the public company have fallen more than 90% over the last year.

Finance

OPINION - Chinese companies are not capitalist companies

- (Seeking Alpha)

- Chinese fast-fashion platform Shein may scrap an initial public offering in London over how the retailer is being recently portrayed in the UK.

- A series of criticisms levelled at Shein has annoyed some in the upper parts of the Chinese government

- Beijing authorities may now put pressure on Shein to list in Hong Kong instead of London

- Some major shareholders of the Shein are said to have lost patience with the firm’s fundraising plans and are asking Shein to consider buying back their shares

OPINION - Not a big deal or near term risk 2008 regulations doing its job

- (Brief.News)

- Major U.S. Banks’ Living Wills Found Deficient; Citigroup Faces Severe Criticism

- The primary issues involve the banks’ ability to unwind their derivatives portfolios during times of distress, with deficiencies in trade-level characteristics and financial results compilation.

- Citigroup was specifically noted for more severe deficiencies, particularly in stress scenarios and data reliability.

- The FDIC and Federal Reserve differed in their assessment of Citigroup’s weaknesses, with the FDIC viewing them as more serious.

- Banks have until July 1, 2025, to address the identified shortcomings and submit updated plans.

- Other major banks such as Bank of New York Mellon, Morgan Stanley, State Street, and Wells Fargo did not face any issues with their resolution plans.

- Resolution plans were mandated following the 2008 financial crisis to ensure a swift and orderly resolution in case of financial distress or failure.

Mergers and Acquisitions

OBSERVATION - Further consolidate in the streaming game

- (Brief.News)

- Paramount Global is in discussions with Barry Diller’s IAC for a potential deal.

- IAC is considering a bid to take control of Paramount Global, with talks of a potential joint venture with Warner Bros Discovery.

- Market saturation concerns are driving media companies to explore mergers to attract streaming customers.

- Paramount+ has over 71 million subscribers, but a potential joint venture with Warner would not likely be a 50-50 split.

- Paramount is seeking new ownership to address financial struggles after failed talks with Skydance Media, leading to CEO Bob Bakish’s departure.

- The company’s streaming service has shown subscriber growth but also significant losses, prompting cost-cutting measures and possible asset sales.

OBSERVATION - Horse trading in shipping

- (Seeking Alpha)

- United Parcel Service announced on Sunday that it has entered into an agreement to sell its Coyote Logistics business unit to RXO for $1.025 billion.

- “UPS positions itself to become the premium small package provider and logistics partner in the world”

- RXO will be the third-largest provider of brokered transportation in North America.

- Addition of Coyote’s customer base is anticipated to diversify RXO’s vertical mix

- The acquisition is seen providing both immediate and long-term opportunities

Cybersecurity

OPINION - Microsoft is in a great place to benefit from increased security spending.

- (Seeking Alpha)

- Microsoft has a ‘hidden’ $100B opportunity inside. And it’s all about cybersecurity.

- All of Microsoft’s cybersecurity offerings add up to a $100B business.

- Security is likely to add 1% to 1.5% to growth through 2027,

- If Microsoft were to take “sustained market share” then it could add more than 2% to growth

- “If share growth is maintained, security revenue could double between 2023 and 2027 Gartner estimates”

- Six buckets of security

- Three focus areas: identity, endpoint and cloud.

- The six areas are Defender, Sentinel, Entra, Purview, Priva and Intune