2024 Week 20

Notes, thoughts and observations - Compiled weekly

Long term thinking is the only low stress way to invest in the market, and not worry about what the Fed will do. Don’t worry about meme stonks.

Digital media remains in a state of consolidation. Comcast will partner with Peacock, Netflix, and Apple TV to offer bundles. Meanwhile Disney and Warner Bros announced a joint streaming service combining Disney+, Hulu, and Max. Either way the consolidation is starting to make streaming look more like linear TV.

Red Lobster is rumored to be going bankrupt and Under Armour is on the ropes. Corporate debt is less of a concern as businesses adjust to higher interest rates. Consumers, on the other hand, are taking out more debt. But looking beneath the numbers and debt has less to do with consumer spending. Income and wages are far more important.

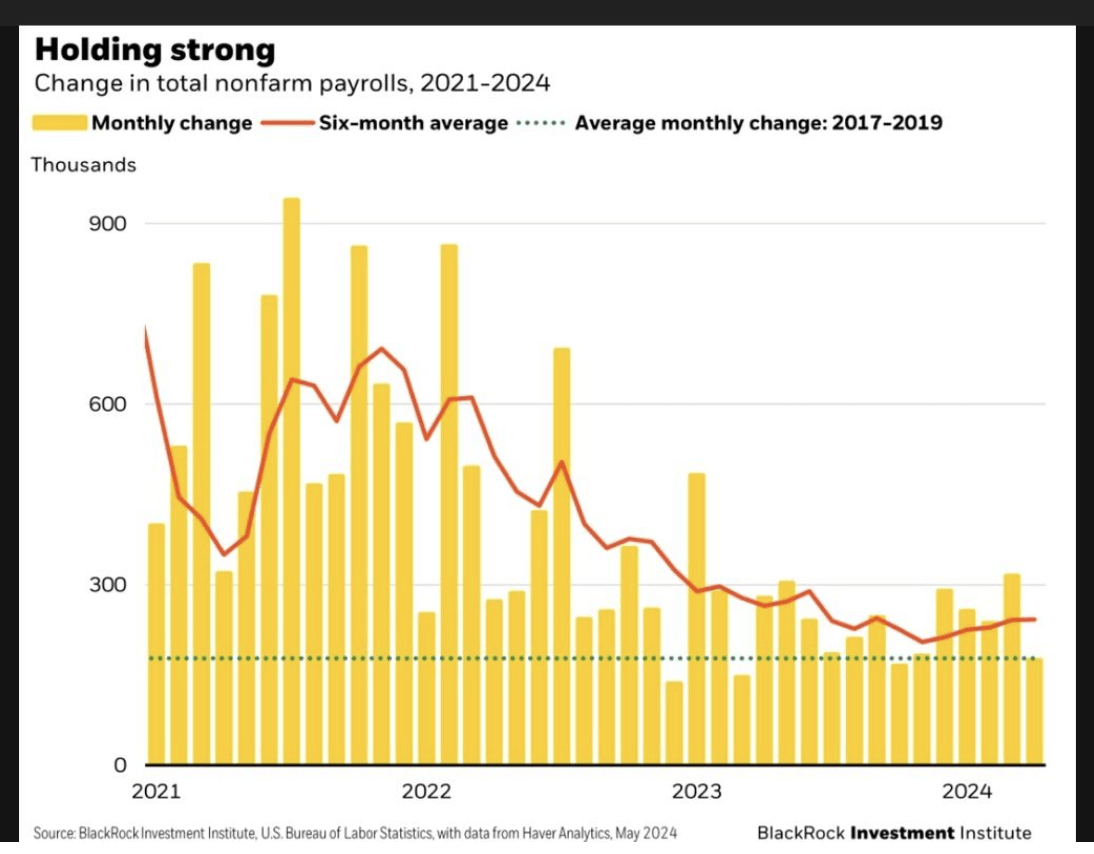

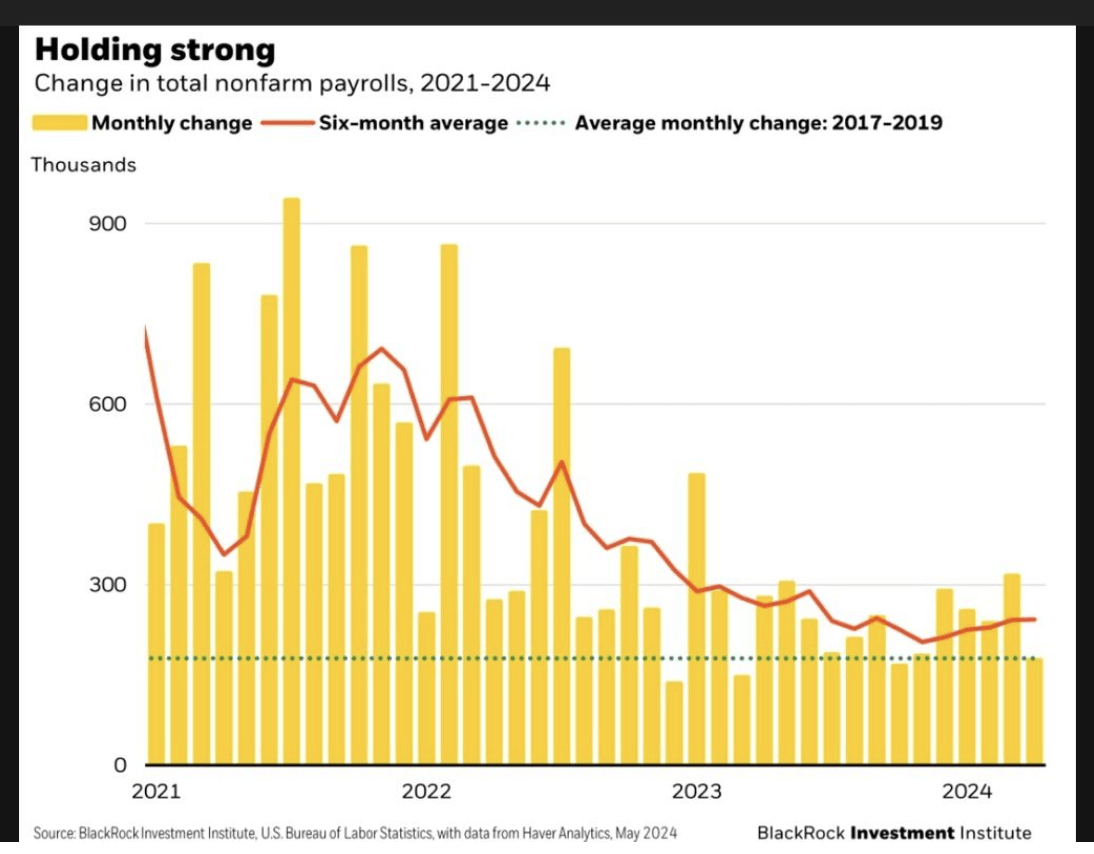

Labor market may be getting less tight

The labor market continues to struggle and we’re seeing layoffs outside of tech. We are also seeing an increase in unionization efforts which will make the southern US more expensive for manufacturing. Demand is high and with or without unions wages are likely to go up, and that will drive inflation.

TOPICS

Fed Rate

OPINION - Think long term, stay in the market

- (TKer)

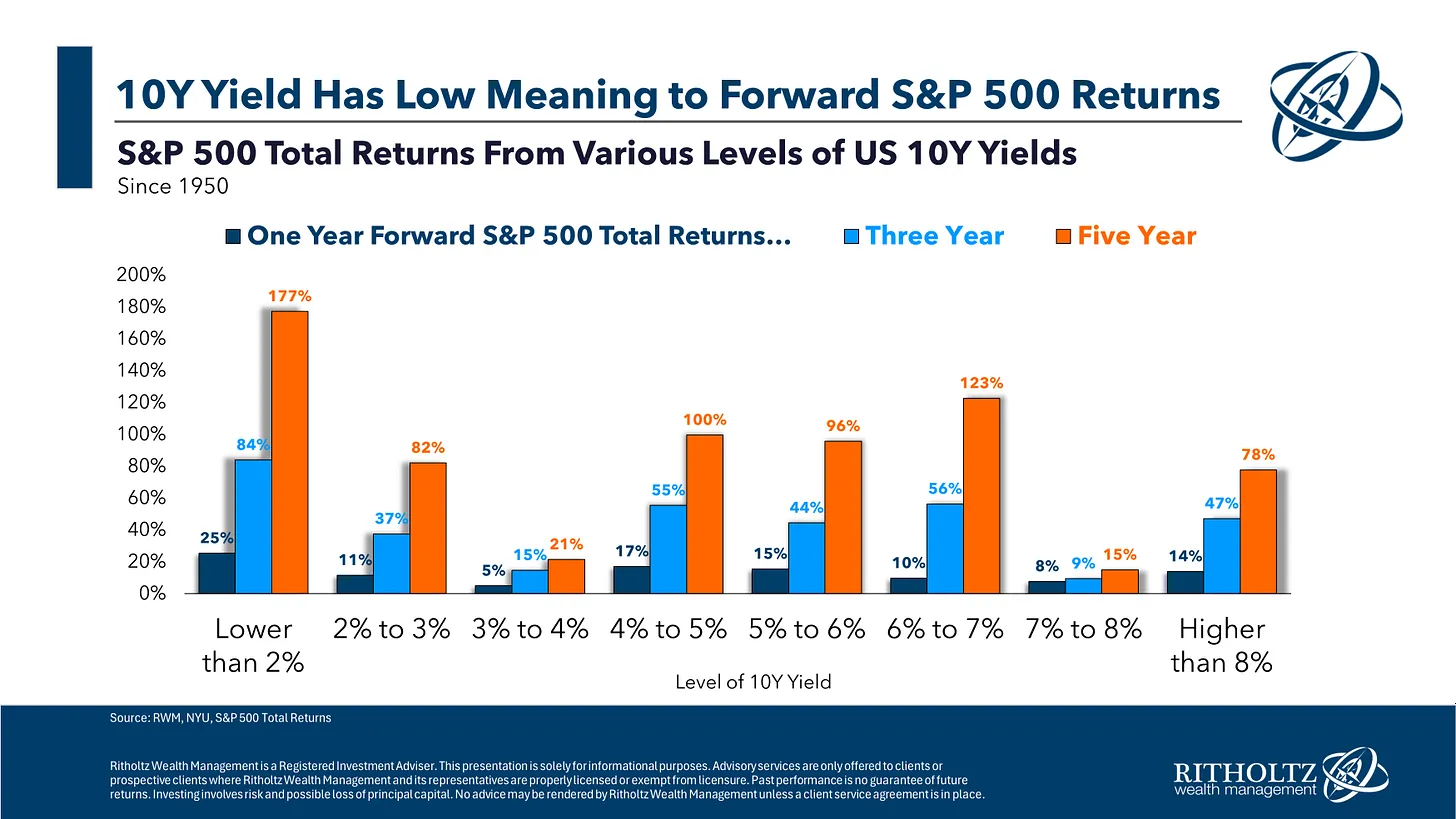

- “The relationship between interest rates and stock market performance is murky at best…”

- at the 4% to 6% range, which is where we are now. The returns have been pretty good

Bankruptcy

OPINION - This apparel brand’s star has faded

- (Keith Fitz-Gerald)

- Under Armour may not survive

- Once traded as high as ~$50 a share back in 2015 if memory serves

- Now, it’s trading at $6 a share and management has warned North American sales will plunge.

- Under Armour is laying off workers as retailer says North America sales will plunge this year

- Sales in its largest market, North America, fell 10% and the retailer expects them to get worse during its current fiscal year.

- Announced a broad restructuring plan that will include an unspecified number of job cuts.

- “I don’t think the company survives, at least not as we know it today.”

- “Might make a great bottom fishing candidate, particularly if Nike, Lululemon or even Adidas steps up.”

OBSERVATION - End of the COVID hangover

- (Seeking Alpha)

- Red Lobster said to plan bankruptcy filing next week; restaurants being auctioned off

- Largest ever restaurant liquidation through its online auction marketplace, auctioning off more than 50 locations and their equipment.

- Has been struggling with financial troubles for some time, on account of less foot traffic during the COVID-19 pandemic, higher interest rates and leasing costs, and rising material and labor costs.

- Seafood-based food producer Thai Union Group, which picked up a minority stake in Red Lobster in 2020, said earlier this year that it would exit the chain due to “prolonged negative financial contributions” and wrote down its $530M stake.

Digital Media

OPINION - Consolidation in the streaming business

- (The Dispatch)

- Comcast CEO Brian Roberts announced on Tuesday that the cable giant will partner with Netflix and Apple to offer a new streaming bundle that includes Peacock, Netflix, and Apple TV+ at a discounted price.

- Has become an increasingly familiar joke about streaming services: The new model for watching television is beginning to look a lot like the cable packages of yesteryear.

- Netflix and Apple are looking to gain additional subscribers who are less likely to cancel their subscriptions—or churn, to use industry lingo.

- (Seeking Alpha)

- Comcast is launching a new cable-like streaming bundle that’ll include Peacock, Netflix, and Apple TV, at a “vastly reduced price to anything in the market today.”

- “And that’s an everyday pricing, not an introductory pricing,” he said at MoffettNathanson’s 2024 Media, Internet and Communications Conference in New York. “And we’ll reveal all that and it’ll be available this month.”

- The new bundle, called StreamSaver, will be available to all Comcast (CMCSA) broadband and TV customers. “If you’re an Xfinity broadband customer, Xfinity TV customer, StreamSaver works for you. If you’re a NOW customer, there’ll be a NOW StreamSaver,” said Roberts.

- (Brief.News)

- Disney and Warner Bros. Discovery have announced a joint streaming service combining Disney+, Hulu, and Max with content from networks and studios including ABC, CNN, DC, Discovery, Food Network, FX, HBO, HGTV, Marvel, Pixar, and Searchlight.

- The new streaming platform is scheduled to launch in the US in the summer, offering both ad-supported and ad-free subscription options, with pricing details yet to be revealed.

- An additional partnership with Fox will introduce a sports streaming platform named Spulu, targeting a late 2024 launch.

- Disney’s streaming services, particularly Disney+, have demonstrated significant growth, with a more than 6% rise in core subscribers in the second quarter, signaling a robust trajectory for Disney in the streaming market.

Stock Market Bubble

OBSERVATION - Meme stonks still a thing

- (Keith Fitz-Gerald)

- Roaring Kitty may have created an entirely new generation of bag holders

- Net retail investor inflows – meaning how much money came rushing into yesterday’s buzzsaw – are down significantly from 2021 when meme-mania last captured the investing public’s fancy.

- Roaring Kitty’s musings turned markets upside down.

- AMC and GameStop – were halted 34 times because conditions were so nuts

- Situations like this make it abundantly clear why risk management should be an integral part of the purchasing process, not an afterthought which is how most investors think about it if they think about it at all.

Corporations Debt

OBSERVATION - Corporate debt is becoming less of a concern

- (TKer)

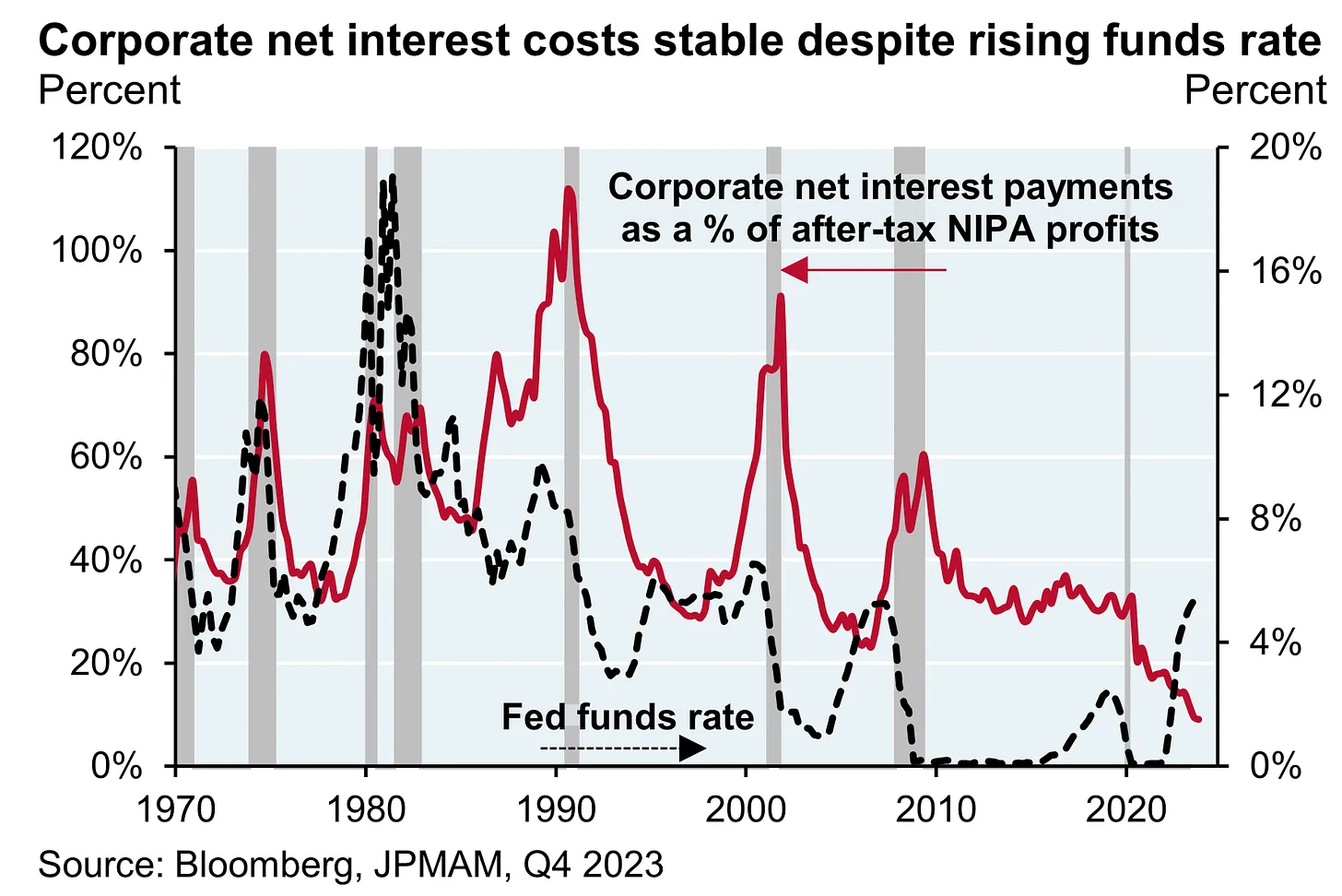

- Despite tight monetary policy and elevated interest rates, corporate net interest costs remain low.

- Thanks to a combination of debt that’s largely locked in low rates and elevated cash balances earning more interest.

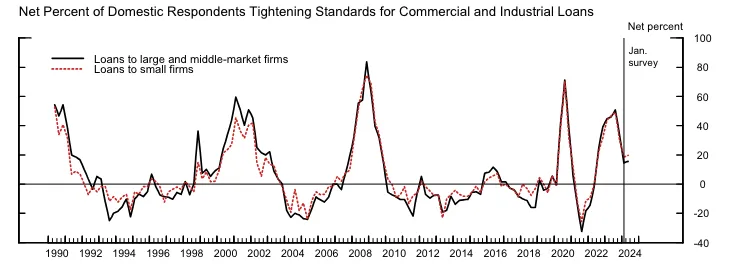

- Banks have gotten tighter. According to the Federal Reserve’s April Senior Loan Officer Opinion Survey, lenders tightened standards for commercial and industrial loans…

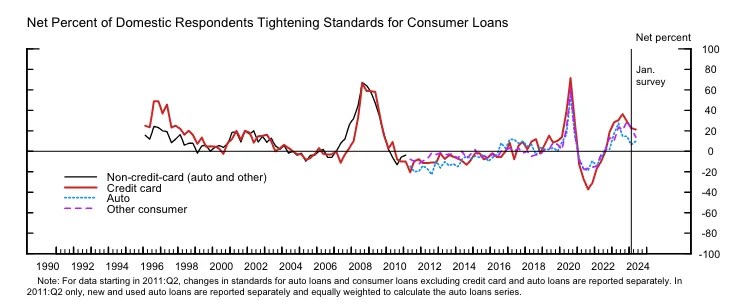

- … and for consumer loans.

Consumer Debt

OBSERVATION - Less about credit and more about income

- (TKer)

- Consumers took on more debt. According to Federal Reserve data, total revolving consumer credit outstanding increased modestly to $1.33 trillion in March.

- Revolving credit consists mostly of credit card loans. Nonrevolving credit, which includes auto loans and student loans, increased to $3.72 trillion.

- “We keep hearing about consumers stretching themselves and taking on too much credit, but this really isn’t the case." - Renaissance Macro’s Neil Dutta

- Credit hasn’t hurt, but it is not the main driver of consumption in the last few years. This is about income.

- Consumers took on more debt. According to Federal Reserve data, total revolving consumer credit outstanding increased modestly to $1.33 trillion in March.

Labor Market

OPINION - Stealth layoffs

- (Seeking Alpha)

- Walmart to cut corporate jobs, relocate staff

- Plans to lay off hundreds of corporate jobs and is asking most remote workers to move to offices

- Workers in small offices in Dallas, Atlanta and Toronto are being asked to move to other central hubs like Walmart’s corporate headquarters in Bentonville, Ark., as well as Hoboken, N.J., or Northern California

- The company has been trying to reduce its workforce over the past year and had said in April last year that it expects about 65% of its stores to be serviced by automation by the end of its fiscal year 2026.

- Announcement comes ahead of Thursday’s super-anticipated earnings report which - given how these things are usually timed

OBSERVATION - Labor demands more of a cut from massive corporate profits.

- (The Hill)

- Apple employees in Maryland vote to authorize strike

- Employees at an Apple store in a Baltimore suburb

- Location was the first Apple store to form a union in 2022 of over 270 retail locations nationwide.

- The labor activity comes amid a wave of strikes across the country in the last year.

- Workers at Starbucks stores and Amazon warehouses have also moved to unionize, though they have faced fierce pushback from the companies.

OBSERVATION - Unionization coming to the south

- (Seeking Alpha)

- United Auto Workers faces key vote among Mercedes workers in Alabama

- A victory in the state is considered significant for the UAW, which has worked to overcome resistance to unionization in the Deep South.

- Vote comes after the UAW last month succeeded in a vote by workers at a Volkswagen car factory in Chattanooga, Tennessee.

- A majority of more than 7,300 UAW workers at Daimler Truck ratified a labor contract that includes a minimum 25% pay raise over four years.

- The agreement covers hourly workers at four factories in North Carolina and warehouses in Georgia and Tennessee.

OBSERVATION - Official statistics indicate labor stability

- (Seeking Alpha)

- Labor market may be getting less tight