2023 Week 46

Notes, thoughts and observations - Compiled weekly

Wages are still going up for some and inflation continues to cool effects are sticky. Companies continue to cut costs and shut down money losing projects

Commercial real estate delinquencies are up but residential still looks OK.

Moody’s cuts United States credit outlook and precious metal are being pitched as a remedy to a calamity that may never materialize.

In the stock market retailers are seeing major drops in market value while shorts pile up on highflyers like TSLA and XOM. Meanwhile private equity that didn’t flee China is now stuck.

Finally, OpenAI is asking Microsoft for more money, Sam Altman stating “Training expenses are just huge.” Simultaneous Disney’s content well is running dry with consumers as “The Marvels” lowest opening for a Disney film in the MCU.'

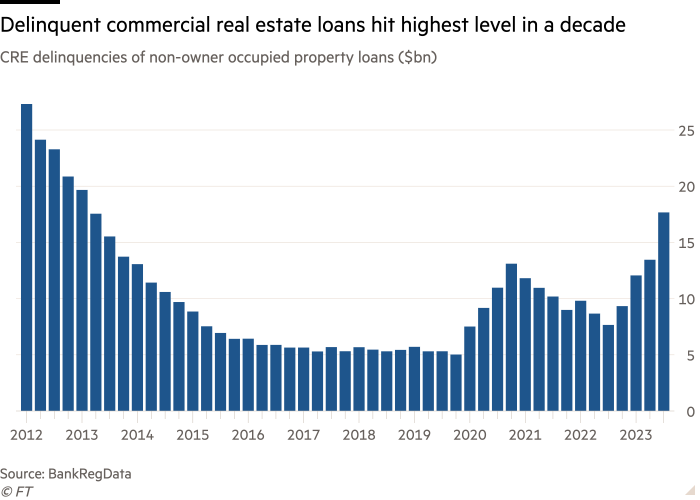

Delinquencies accelerating

TOPICS

- Labor Market

- National Debt

- Inflation

- Real Estate

- Currency Risk

- Stock Market

- Globalization

- Digital Media

- AI and ML

Labor Market

OBSERVATION - Voluntary wage increases to remain competitive

- (1440)

- Honda raises worker pay by 11%, one week after Toyota granted similar wage increases; moves are meant to keep pace with wages recently negotiated by the UAW and Ford, GM, and Stellantis.

OBSERVATION - Companies shutting down money losing projects

- (Pragmatic Engineer)

- Amazon Music tried to be a competitor to Spotify and Apple Music

- Amazon Amp, launched in May 2022. However, Amp was shut down a month ago.

- Now executed layoffs within its Amazon Music division

- Amazon Music tried to be a competitor to Spotify and Apple Music

National Debt

OBSERVATION - Further reputational damage, more call to action for Washington

- (Seeking Alpha)

- Moody’s cuts United States credit outlook to negative, reaffirms ratings

- Did affirm the country’s senior unsecured and long-term issuer ratings at Aaa.

- “The sharp rise in U.S. Treasury bond yields this year has increased pre-existing pressure on U.S. debt affordability. In the absence of policy action, Moody’s expects [United States] debt affordability to decline further, steadily and significantly, to very weak levels compared to other highly rated sovereigns.”

- Moody’s cuts United States credit outlook to negative, reaffirms ratings

Inflation

OPINION - Sticky inflation

- (Lisa Abramowicz)

- US consumers don’t believe the Fed will get inflation back to an average 2% in the next decade.

- They now expect prices to climb at an annual rate of 3.2% over the next five to 10 years, up from 3% a month earlier: University of Michigan survey

- US consumers don’t believe the Fed will get inflation back to an average 2% in the next decade.

Real Estate

OPINION - Will be seen as a reprieve, might drive a slight uptick in real estate activity

- (1440)

- US mortgage rates see biggest one-week decline in past year, average 7.6% for standard 30-year fixed rate loan; total application volume rises 2.5% week-over-week

OPINION - Delinquencies accelerating

- (jessefelder)

- ‘Delinquent commercial real estate loans at US banks have hit their highest level in a decade, as higher interest rates, an uncertain economy and the rise of remote working pile pressure on building owners.’

Currency Risk

OPINION - Wrong. Inflation is subsiding and risk of financial catastrophe is fearmongering at this point.

- (Seeking Alpha)

- Silver Reaching For Modern Record-Low Valuation Vs. Other Assets

- Relative valuation vs. other assets is incredibly low, making it an excellent long-term accumulation idea.

- Owning silver coins and bars is recommended as emergency money in case of financial catastrophe or collapse.

- Future fiat money creation by the U.S. Federal Reserve and borrowing by the Treasury should support both rising inflation and monetary metals pricing.

Stock Market

- (Seeking Alpha)

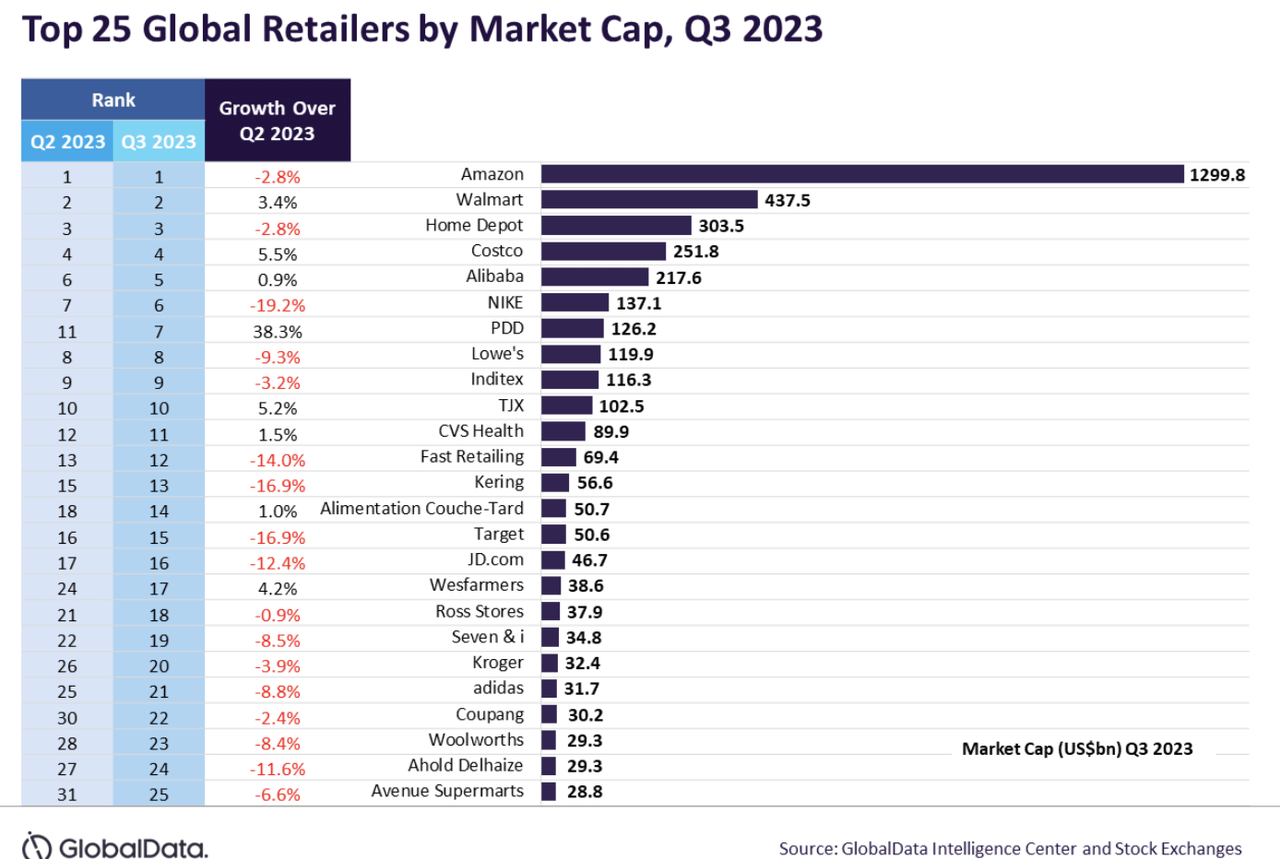

- Nike (NKE), Target (TGT), and Kering (OTCPK:PPRUF) were the retailers that saw the biggest percentage drops in market value in Q3 compared to the prior-year period.

- Overall, the top 25 publicly traded retailers lost a combined $80B in Q3, according to data and analytics firm GlobalData

- Amazon (NASDAQ:AMZN), Walmart (NYSE:WMT), and Home Depot (NYSE:HD) retained their rankings as the three largest worldwide retailers in Q3 based on market cap.

OPINION - Wall street short term bets on a near term prices correction

- (Seeking Alpha)

- Exxon Mobil (NYSE:XOM) was the most-shorted large-cap stock in the S&P 500 in October, replacing Tesla (TSLA), which had been most shorted for four straight months

- Other large-cap stocks: Apple (AAPL), Charter Communications (CHTR), Broadcom (AVGO), Rivian Automotive (RIVN), US Bancorp (USB), SNAP (SNAP), Ford (F), and Airbnb (ABNB).

- Three most-shorted names in the mid-cap sector, according to the BI report, included SOFI Technologies (SOFI), American Airlines (AAL), and Lucid (LCID).

Globalization

OPINION - Everyone was warned, but few took the risk seriously

- (MishTalk)

- Private Equity Firms Trapped in China, Struggle to Sell Assets

- Suddenly we have gone from everyone wants to invest in China to no one does. Those who did, now want out.

- Bloomberg reports PE Firms Trapped in China After $1.5 Trillion Betting Spree

Digital Media

OPINION - Disney’s content mill is running out of steam

- (1440)

- “The Marvels” brings in $110M at global box office in its opening weekend, the lowest opening for a Disney film in the Marvel Cinematic Universe franchise

AI and ML

OBSERVATION - Microsoft’s deep pockets

- (Seeking Alpha)

- OpenAI pursues more Microsoft money to build ‘magic intelligence in the sky’

- the latter is seeking even more cash from the tech giant

- “Training expenses are just huge,” OpenAI CEO Sam Altman told the FT in an interview.

- Altman also framed the partnership with Microsoft (MSFT) as one where “we both make money on each other’s success, and everybody is happy.”

- OpenAI pursues more Microsoft money to build ‘magic intelligence in the sky’