Category:

Business

2023 Week 42

Notes, thoughts and observations - Compiled weekly

A mixed bag of news this week. Inflation remains on the radar, as do future fed hikes. The labor market remains strong but finance continues to shed jobs.

Services remain higher likely to due to higher wages

TOPICS

Real Estate

OBSERVATION - Mortgage rates stabilizing

- (Calculated Risk)

- 30-Year Mortgage Rates Hit 8.0%

OPINION - Existing homes are too expensive

- (Seeking Alpha)

- Re/Max Holdings - Number of homes on the market grew month over month for a sixth consecutive month in September

- Sales declined 13.8% from August and 17% from a year ago.

- 9.3% increase in inventory was the largest month-over-month increase in 14 months.

- Listings were down 1.8% from August and 7.8% Y/Y.

- Median sales price of $415,000 declined of 2.4% month over month

- Last September’s sequential drop was 1.2%

- Remained 2.5% higher than last September’s $405,000.

- Re/Max Holdings - Number of homes on the market grew month over month for a sixth consecutive month in September

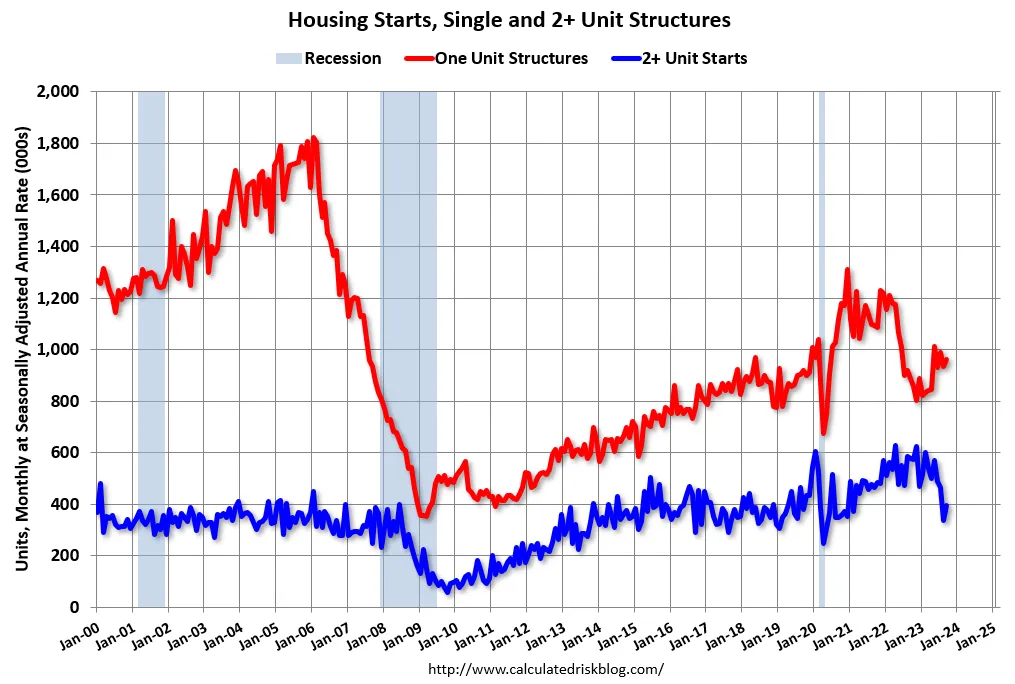

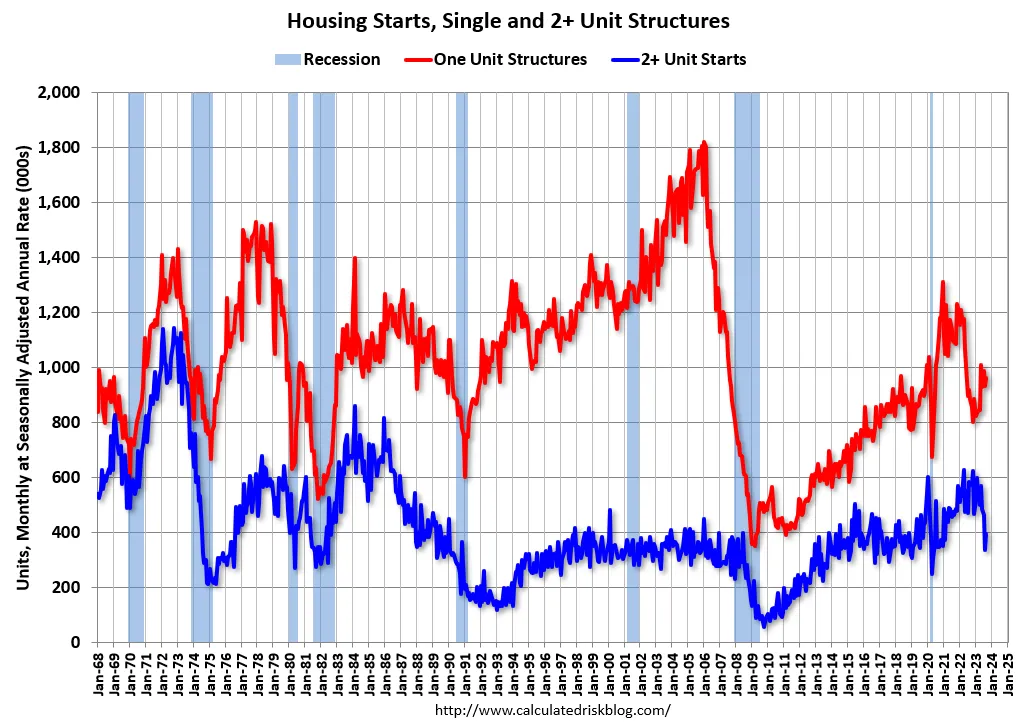

OBSERVATION - Housing starts took a dip but historically not as bad.

- (CalculatedRisk)

- September Housing Starts: Near Record Number of Multi-Family Housing Units Under Construction

- The first graph shows single and multi-family housing starts since 2000 (including housing bubble).

- The second graph shows single and multi-family starts since 1968. This shows the huge collapse following the housing bubble, and then the eventual recovery

Bankruptcy

OPINION - Eventually JNJ will go bankrupt

- (Seeking Alpha)

- J&J considers third bankruptcy attempt over talc claims

- J&J (JNJ) is appealing the New Jersey Bankruptcy Court’s decision in late July to deny subsidiary LTL Management’s filing.

- As part of its second bankruptcy attempt, LTL offered $8.9B to settle all current and future talc claims.

OBSERVATION - Not really news, Opioid fall out

- (CNN)

- US pharmacy chain Rite Aid to close 154 stores nationwide as part of its Chapter 11 bankruptcy

- The first tranche of stores to be sold — both leased and owned — is located in twelve states, according to A&G Real Estate Partners

- (Seeking Alpha)

- Rite Aid files for Chapter 11 bankruptcy protection, receiving $3.45 billion in new financing.

- Released a statement on Sunday night noting that it had filed for bankruptcy in New Jersey.

- Has received a commitment for $3.45 billion in new financing.

- The Philadelphia-based company listed both assets and liabilities in the range of $1 billion to $10 billion in the Chapter 11 petition.

- Announced the appointment of Jeffrey S. Stein as chief executive officer, chief restructuring officer and a member of the company’s board, effective immediately.

- Joins drugmakers Mallinckrodt (OTC:MNKTQ), Endo (OTC:ENDPQ), and Purdue Pharma, which declared bankruptcy due to opioid litigation.

Fed Rate

OPINION - This chart should make everyone stop in their tracks and reassess.

- (ChartStorms)

- We are living through most persistent rise in yields of the past half century

- it’s probably going to have to take some sort of exogenous shock or crisis to derail this kind of momentum.

- We are living through most persistent rise in yields of the past half century

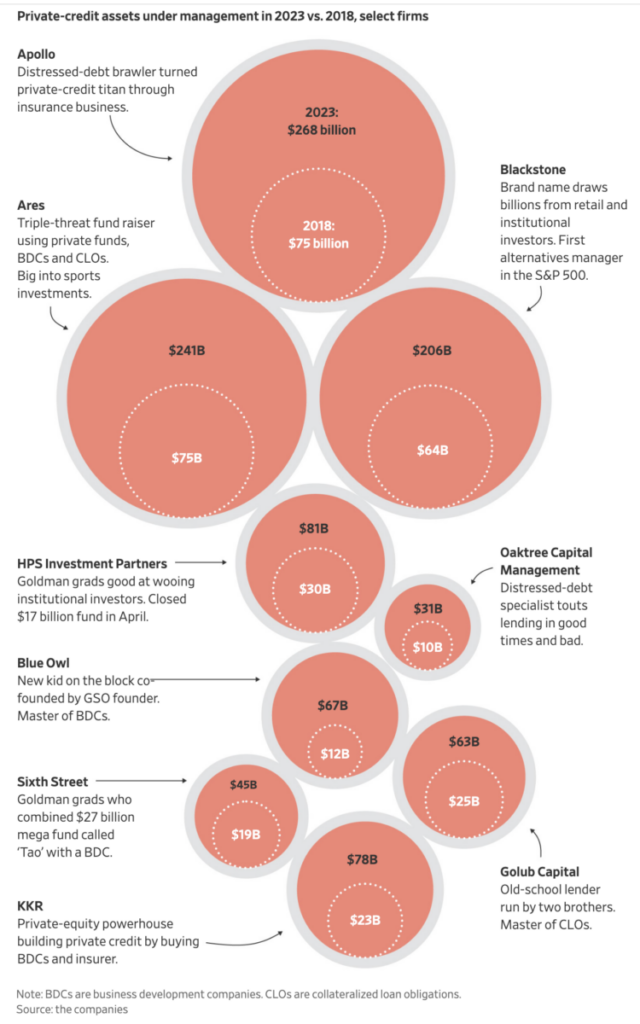

Finance

OBSERVATION - Howard Marks, of Oaktree Capital, is very vocal on this shift and has dubbed it “sea change”

- (Barry Ritholtz)

- The New Kings of Wall Street Aren’t Banks. Private Funds Fuel Corporate America.

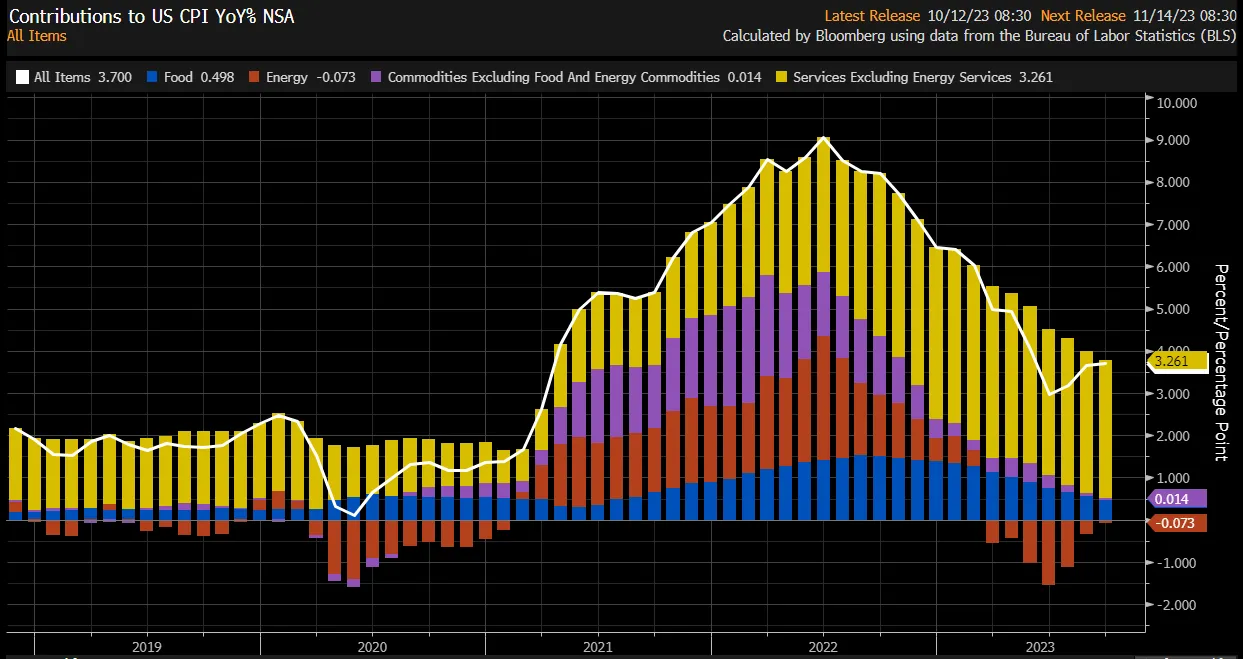

Inflation

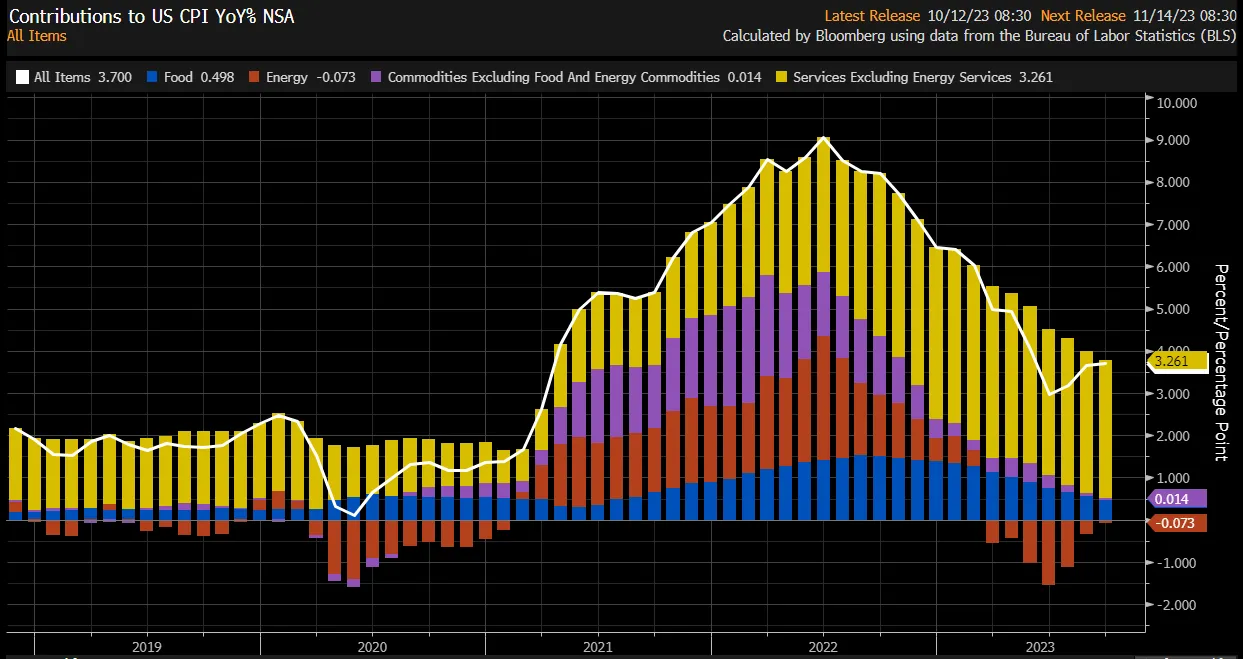

OPINION - Services remain higher likely to due to higher wages

- (TKer)

- CPI in September was up 3.7% from a year ago. Adjusted for food and energy prices, core CPI was up 4.1%, the lowest since September 2021.

OPINION - CPI sticky, making case for “higher for longer”

- (Seeking Alpha)

- Consumer price index comes in a touch hotter than expected in September

- Growth in the Consumer Price Index slowed to 0.4% M/M in September from +0.6% in August, but still exceeded the +0.3% expected.

- +3.7% Y/Y vs. +3.6% expected and +3.7% prior.

Labor Market

OPINION - Can make up the different with productivity gains

- (Clips that Matter)

- Percentage of people in the “prime age” (25-54) cohort who hold full-time jobs.

- The two peaks represent sharply different demographic situations

- When the ratio peaked near 73.5% in the year 2000, the entire Baby Boom generation was still in its prime age.

- Now, prime age consists of the smaller Gen-X and Millennial cohorts. To generate the same output, they would need to work at much higher rates than the Boomers did at their peak.

OBSERVATION - More cost cutting in finance

- (Charlotte Ledger)

- Wells Fargo chief financial officer Mike Santomassimo said Friday that more job cuts are coming

- “We still have additional opportunities to reduce headcount, and attrition has remained low, which will likely result in additional severance expense for actions in 2024. I would say that there are very few parts of the company that we would say are optimized at this point.”

- Wells Fargo chief financial officer Mike Santomassimo said Friday that more job cuts are coming