2023 Week 24

Notes, thoughts and observations - Compiled weekly

Concerns abound and uncertainty is high, but one thing is certain we will not return to 2018 levels of any time soon. Banks are getting the double-whammy because of commercial real estate and continued deposit outflows. Spin it how you’d like, but this will bring more banking sector pain.

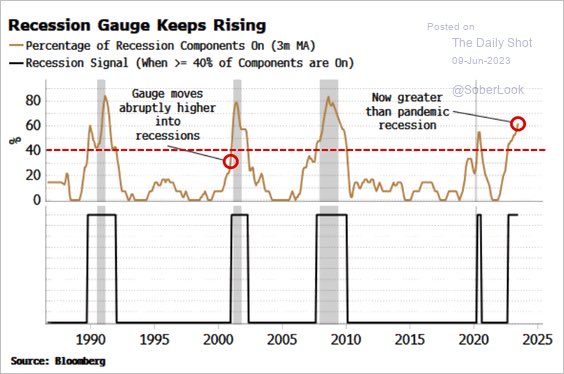

On the recession front, consumer credit continues to deteriorate, trucking is struggling and and consumer “revenge spending” is expected to peter out by fall. On the other hand the economy is way better than doomsters like to admit and the markets are placing bets on a quick recovery.

Either way fear, uncertainty and doubt abound. Sounds like a great time to shop for names that don’t show up on CNBC or Twitter. 😉

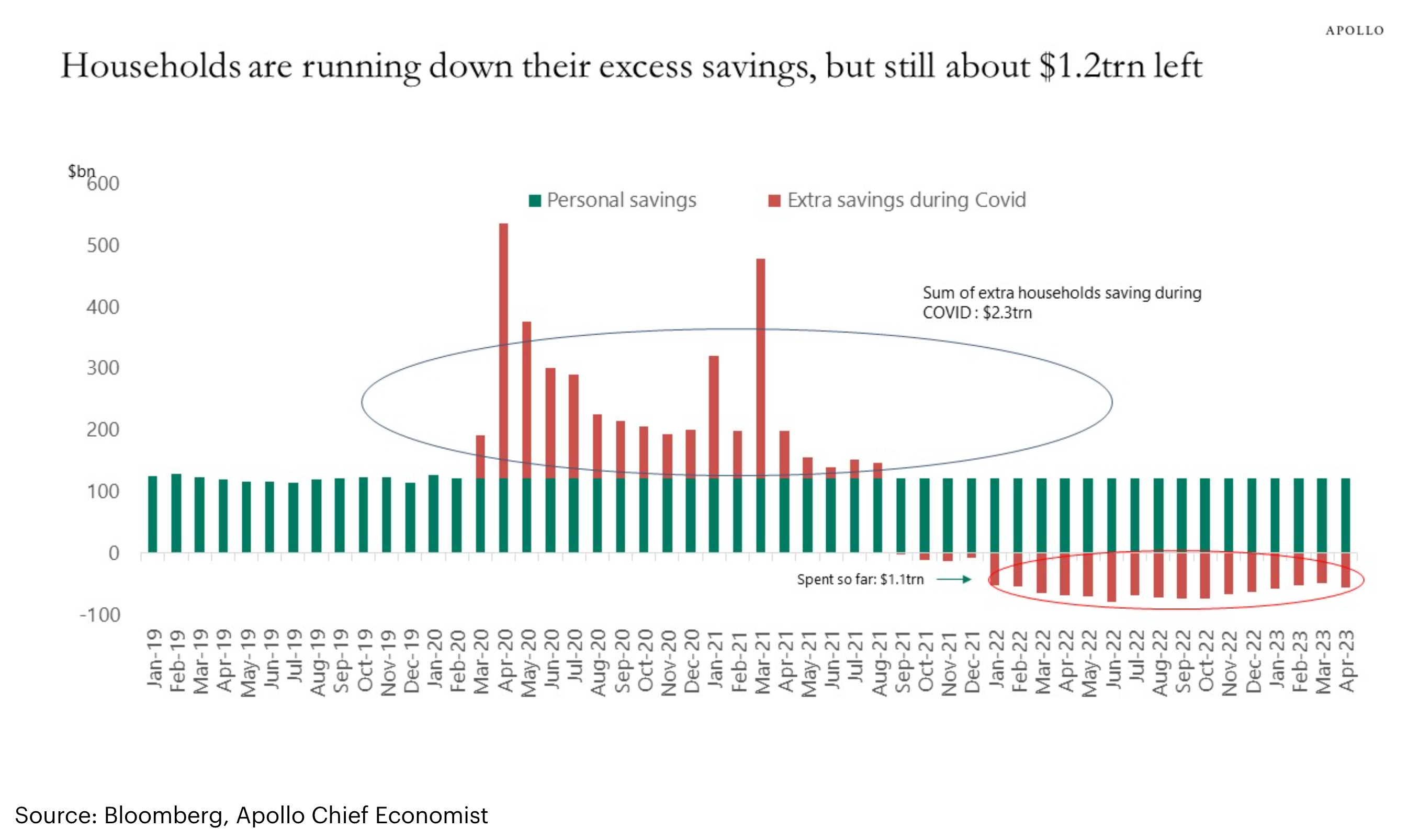

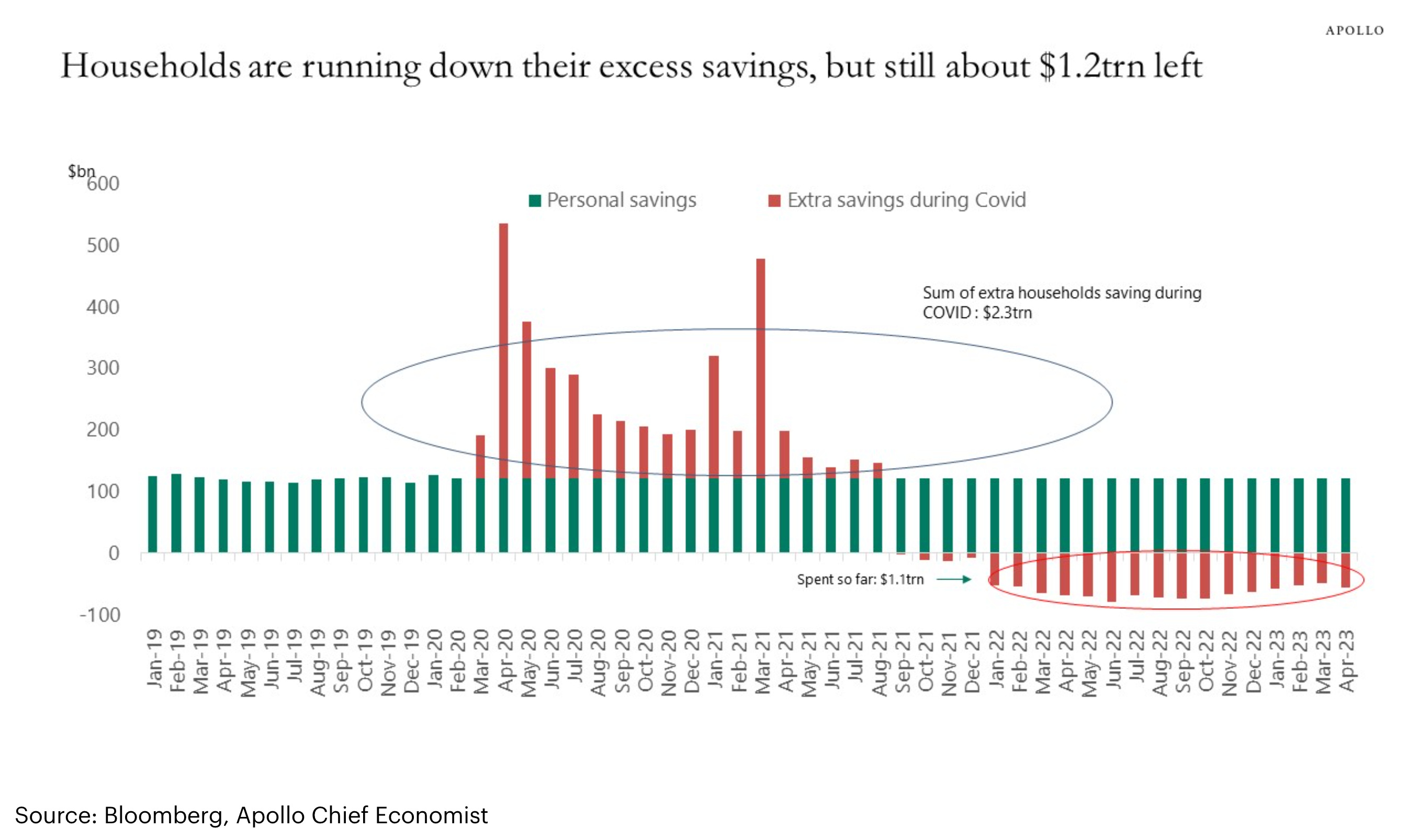

Households are still sitting on $1.2 trillion in excess savings.

TOPICS

Real Estate

OPINION - Spin it however you like, but we aren’t returning to 2018 levels of anything.

- (DiMartinoBooth)

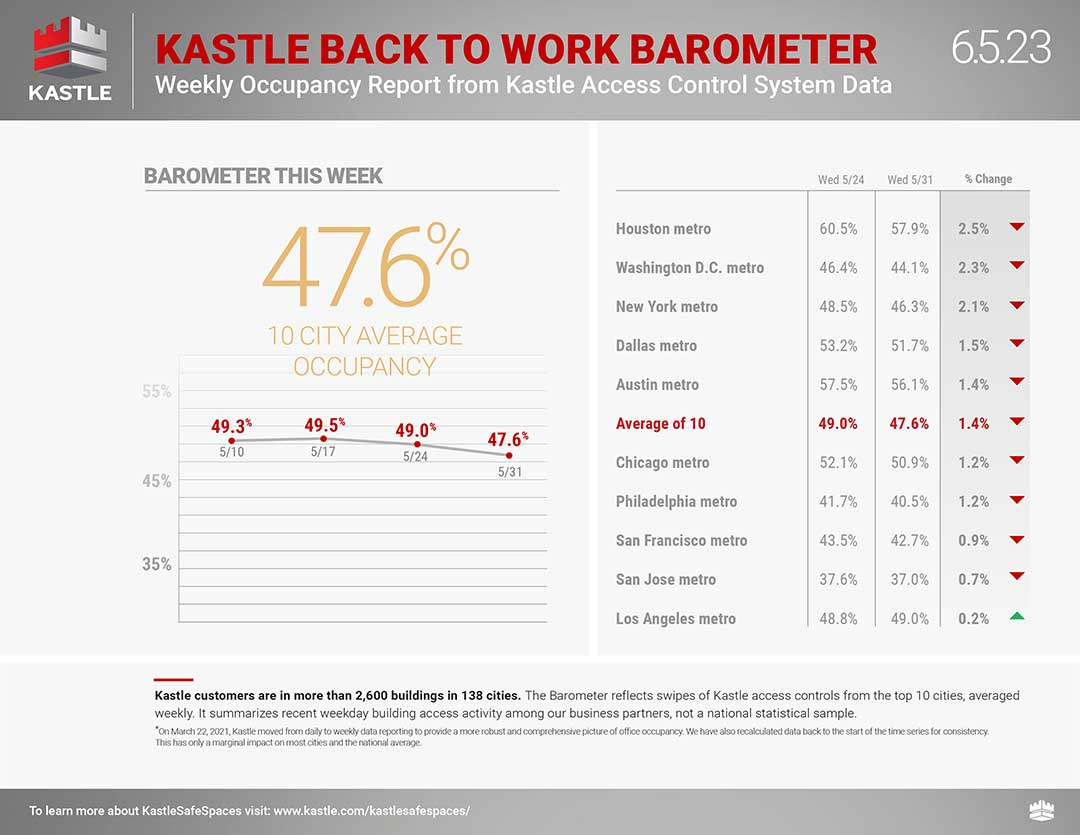

- NYC 😇> 50% office occupancy, a milestone. “Other cities, like Washington, D.C., and San Francisco, have yet to break the 50% mark.”

OPINION - This will cause a problem in commercial real estate

- (TKer)

- 🏢 Offices are very empty.

- Kastle Systems: “Office occupancy fell 1.4 points to 47.6% this past holiday week, according to Kastle’s 10-city Back to Work Barometer.

- The drop in occupancy was widespread, with all tracked cities seeing declines except for Los Angeles.

- 🏢 Offices are very empty.

Financial

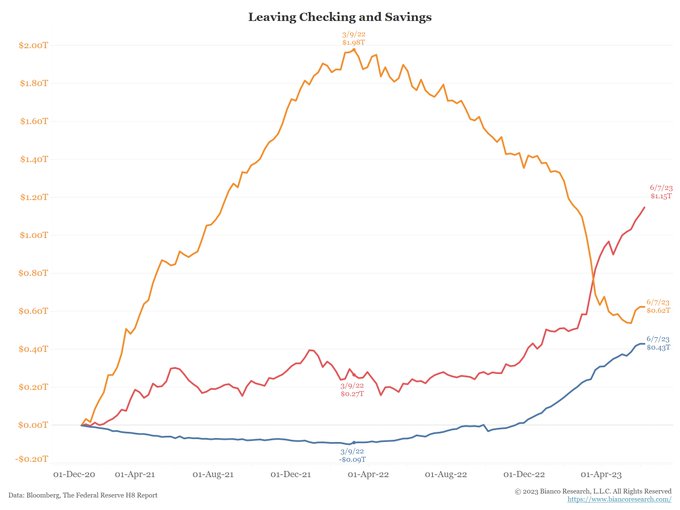

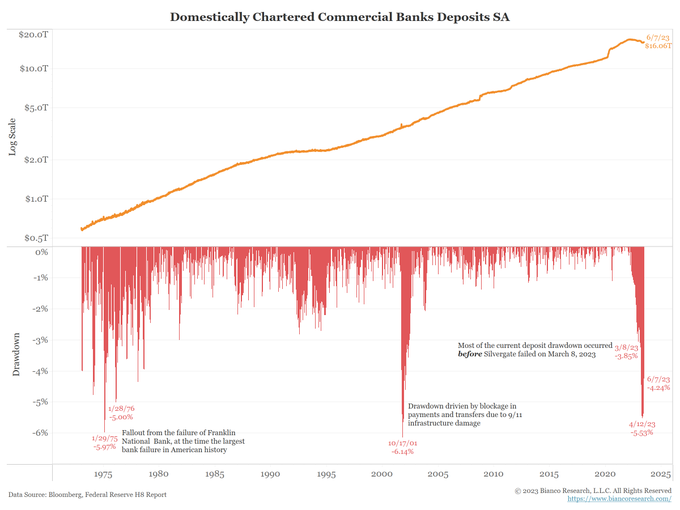

OBSERVATION - Continued out flows can’t be a good sign; have to wonder the impact of a Fed pause on this trend

- (biancoresearch)

- Deposit (orange) continue to fall. ~$1.4T have left deposit accounts since March 2022 (1st Fed hike).

- This is the biggest drawdown (bottom panel) in overall bank deposits since 2001. But this was a structural problem around 9/11 due to infrastructure damage. Take that out as a special circumstance, and this is the largest deposit drawdown in 50 years.

- Why is this a record drawdown. The combination of mobile banking apps and rapid Fed hikes have made money market rates, and CDs rates, far more attractive than checking and savings account rates.

- Deposit (orange) continue to fall. ~$1.4T have left deposit accounts since March 2022 (1st Fed hike).

Energy

Well alrighty then..

- (chigrl)

- #Netherlands Set to Close Europe’s Biggest Gas Field in 2023 Groningen gas field to shut down permanently from Oct. 1

OPINION - Tide is beginning to turn, even as Internet trolls lambaste energy companies.

- (BrianGitt)

- Shell gets sober.

- It’s pivoting away from renewable energy & doubling down on oil & gas.

- European oil companies like Shell & BP who pursued wind & solar power are getting crushed by US oil majors who stayed focused on their core business.

OPINION - Investment means future growth, due to ESG it was hard for these companies to get loans.

- (chigrl)

- Family Offices Step Up to Fund Oil, Gas Insiders say family offices are increasingly willing to take on oil, gas investment risks as returns skyrocket

Credit Crunch

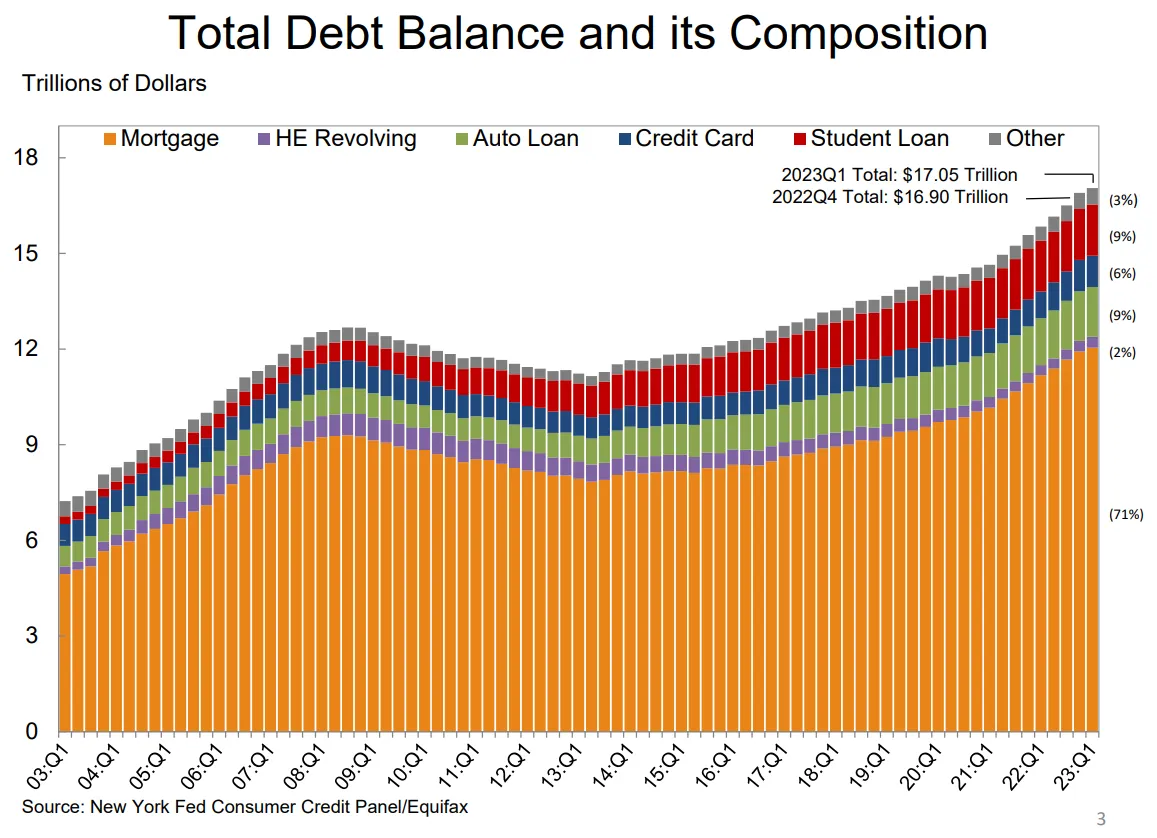

OBSERVATION - Consumers weaker than expected

- (Sandbox Daily)

- Total U.S. debt surpasses $17 trillion dollars

- Mortgage balances climbed by $121 billion and stood at $12.04 trillion at the end of March.

- Auto loan and student loan balances also increased to $1.56 trillion and $1.60 trillion, respectively, but credit card balances were flat at $986 billion.

- Since the pre-pandemic era in 2019, the debt load has increased by $2.9 trillion, $148 billion (or 0.9%) of which came between January and March 2023.

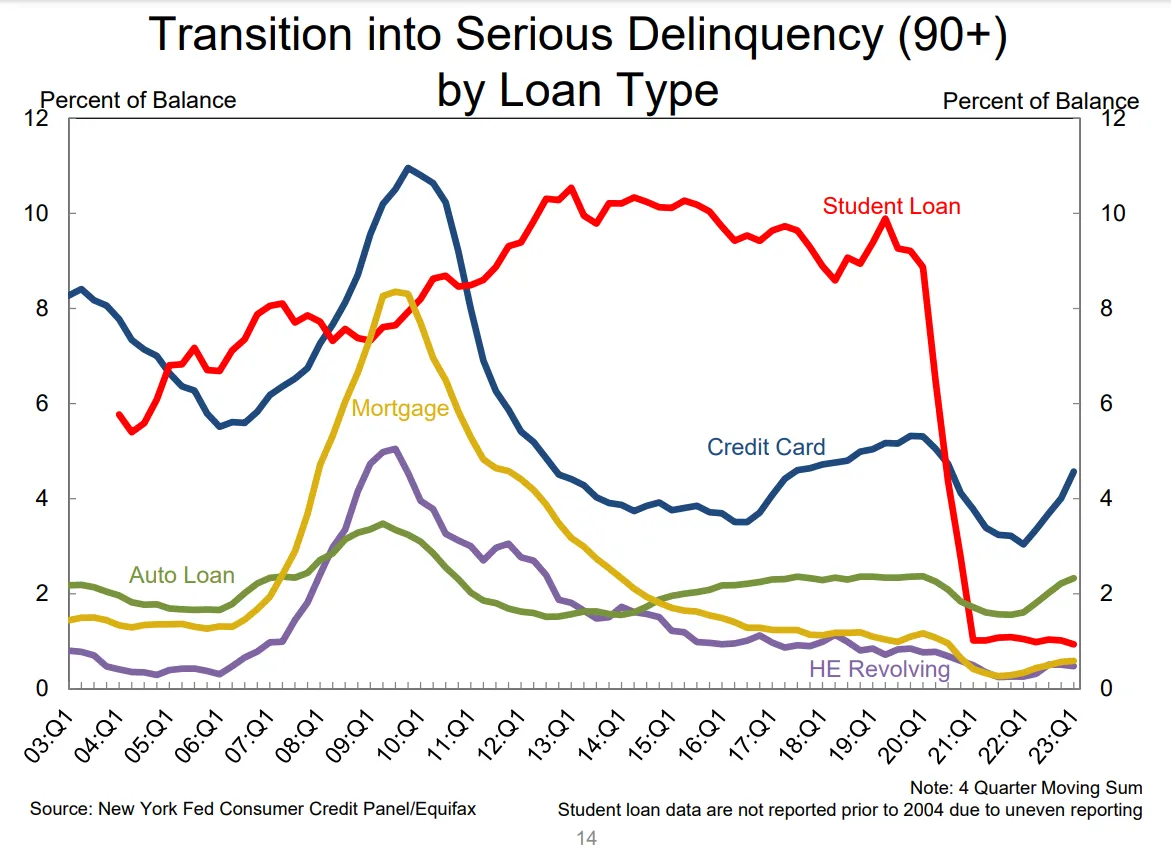

- Elsewhere, credit card and auto loan delinquencies are ticking up across the board.

- Total U.S. debt surpasses $17 trillion dollars

Recession

OPINION - Indicates a slow down in shipping, and probably retail

- (FreightAlley)

- Spot-market truckers are taking every load they can get.

- June is normally one of the best months

- Trucking spot rates (net of fuel) are now lower than 2019

- Trucking is a capacity constrained market

- This a supply issue (too much capacity) or little demand, or both?

- Volume index tells us that while freight volumes are not remarkable, the bigger issue is too much capacity.

- This a supply issue (too much capacity) or little demand, or both?

- What causes too much capacity

- Trucking market is very attractive for blue collar entrepreneurs that jump in when conditions are good, like we saw in 2021

- A trucker could net $200k/yr in those days, without a formal education or business experience

- Folks that joined the parade in 2021 were unaware of the volatility of trucking rate and demand

- This dynamic is showing up in “tender rejections”, i.e. the percentage of truckloads that trucking companies reject.

- Carriers are taking almost any load, without regard to rate or destination

- Spot-market truckers are taking every load they can get.

OBSERVATION - Fall likely to be the economic trough, stock market moving ahead of that

- (Wall Street Breakfast)

- Monthly employment report

- Forward looking indicators which have been bearish

- LEI report

- Claims data

- Retail Sales

- Pronounced move lower

- Summer will be revenge spending

- Sept-Oct-Nov natural trough point in economy

OPINION - Stubborn recession predictions

- (DiMartinoBooth)

- Of 7 factors that feed @nberpubs Recession Dating Committee’s calculus, the recession train has departed the station when the fraud w/i @IRSnews ERC program & broken NFP @BLS_gov which should be investigated taken into account.

Stock Market

OPINION - Economy is way better than some doomsters are willing to admit.

- (TKer)

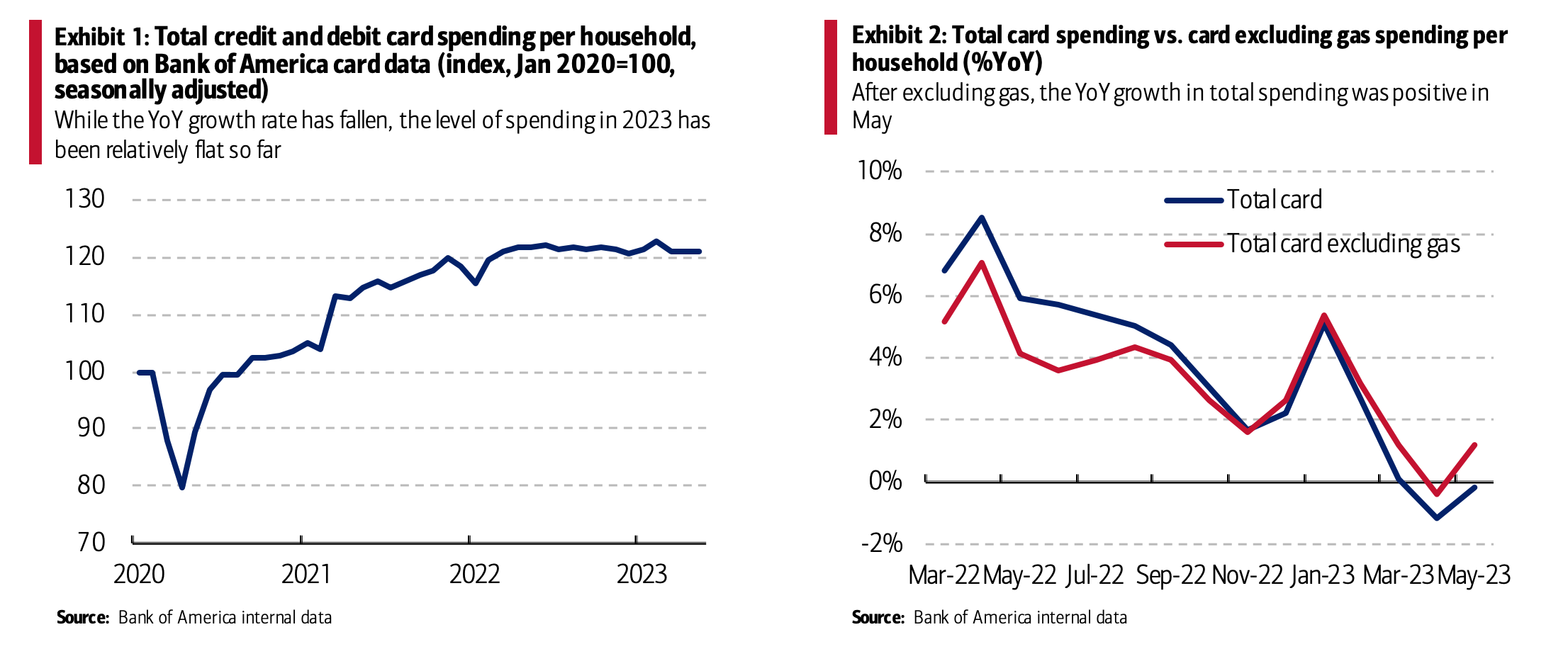

- 🛍️ Consumer spending is holding up.

- “Bank of America internal data suggests consumer spending was broadly stable in May

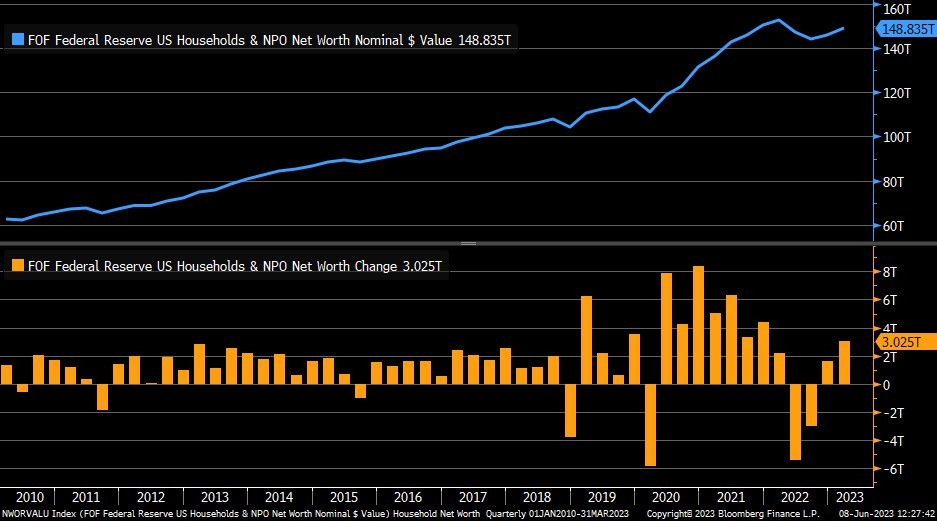

- 💵 Household net worth rises

- “Household net worth rose $3 trillion, or 2.1%, in the January-March period to $148.8 trillion after climbing $1.6 trillion in the prior quarter

- 💵 Consumers have excess savings

- Households are still sitting on $1.2 trillion in excess savings.

- A bit higher than the $500 billion recently estimated by the San Francisco Fed.

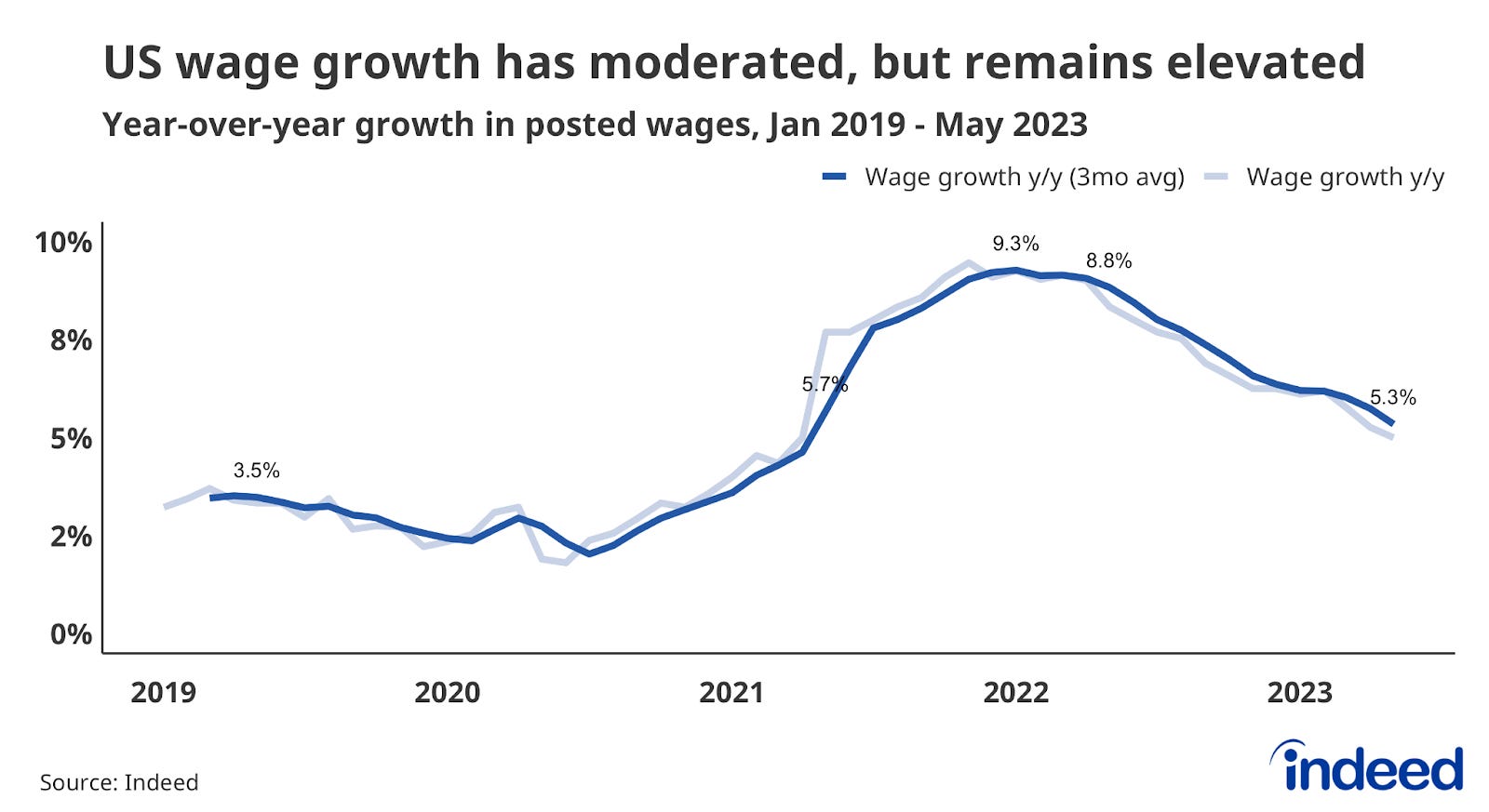

- 💸 Wage growth is cooling

- “Wages and salaries advertised in Indeed job postings grew 5.3% year-over-year in May

- Down considerably from the high of 9.3% set in January 2022

- Still well above the 2019, pre-pandemic average pace of 3.1%.

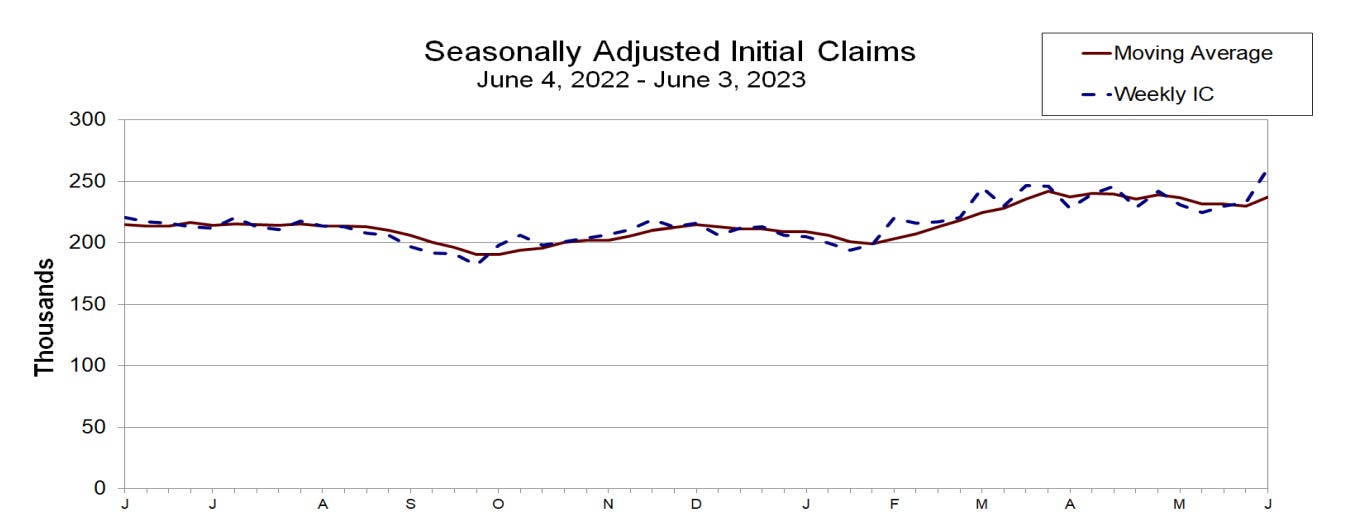

- 💼 Unemployment claims tick up

- Initial claims for unemployment benefits climbed to 261,000 during the week ending June 3, up from 233,000 the week prior

- Continues to trend at levels associated with economic growth

- 🛍️ Consumer spending is holding up.

OPINION - Can confirm, but I think the tech (AI) stock rise is a bubble, but it may not burst for quite some time.

- (Over My Shoulder)

- Key Points:

- The S&P 500 index rose 20% from October 12 through last week, a threshold widely viewed as the definition of a bull market.

- This rally was broadening until early March when the regional banking crisis made financial stocks dive. They are now rebounding.

- Meanwhile, AI excitement sparked a melt-up rally in the mega-cap tech stocks.

- Industrials and materials are also perking up as investors see potential growth from onshoring and infrastructure spending.

- Sentiment and breadth are still not good, but this could be the “wall of worry” every bull market must climb.

- Bottom Line: At the sector level, only Technology, Telecom and Industrials are beating the S&P 500. Of those, technology is far ahead of the other two. At the other end, Energy and Utilities are the worst laggards.

- Key Points:

Semiconductor

OPINION - Pretty obvious outcome for AMD to challenge, it’s chip wars all over again.

- (CNBC)

- AMD reveals new A.I. chip to challenge Nvidia’s dominance

- AMD said its forthcoming most-advanced GPU for artificial intelligence, the MI300X, will start shipping to some customers later this year, the company said on Tuesday.

- AMD’s announcement on Tuesday represents the strongest challenge to Nvidia, which currently dominates the market for AI chips.

- TAKEAWAY - Who else makes GPUs? And who do they buy their equipment from?

- AMD reveals new A.I. chip to challenge Nvidia’s dominance

Globalization

OPINION - Money fleeing the Chinese system, but yeah we’re worried about digital yuan and a gold backed BRICs currency.

- (PeterZeihan)

- Millionaires Are Fleeing China at a Faster Pace As the Economy Fizzles

- Business Insider - Millionaires are fleeing China at a faster pace as the post-COVID economic rebound fizzles

- China will see a net loss of 13,500 high-net-worth individuals in 2023, up from 10,800 in 2022, according to the Henley Private Wealth Migration Report.

- Meanwhile, India is poised to lose fewer millionaires, even though it just topped China as the world’s most populous country and overtook the UK last year as the world’s fifth largest economy.

- “In general, wealth migration trends look set to revert to pre-pandemic patterns this year, with Australia reclaiming the top spot for net inflows as it did for five years prior to the Covid outbreak