Category:

Business

2023 Week 18

Notes, thoughts and observations - Compiled weekly

Bankruptcy, fire sales and corporate debt.. all part of the cycle. Banking news buried a couple of important stories this week. Bed Bath and Beyond was the big news, but the current cycle is also taking down Jenny Craig. Meanwhile Darden is scooping up Ruth’s Chris Steak House that has struggled since the pandemic. 70 major bankruptcies so far and counting, but AI & ML threatening to disrupt more businesses.

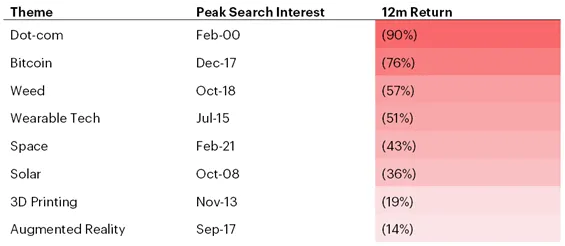

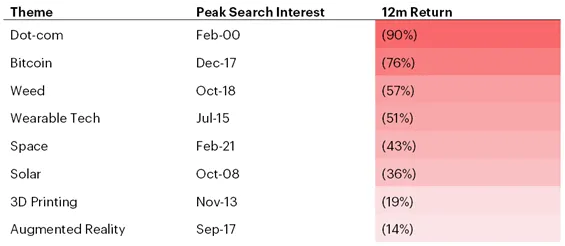

Previous “peak search engine” equity rallies have not ended well

TOPICS

Bankruptcy

OBSERVATION - Weak business failing during this part of the cycle

- (NBC News) - Jenny Craig tells employees it will shut its doors

- Employees got an email from the company Tuesday night indicating their jobs would be terminated by the end of the week or sooner for some.

- H.I.G. Capital when it acquired Jenny Craig for an undisclosed amount in April 2019. It now employs more than 1,000 people.

- The company has faced increased competition recently after a handful of drugs that can help people lose weight, such as Wegovy, Rybelsus and Ozempic, hit the market promising to help consumers shed pounds.

Mergers and Acquisitions

OPINION - Consolidation in the resturant industry, consistent with this phase of the economic cycle

- (AP News) - Darden buys Ruth’s Chris Steak House for about $715 million

- The company, now based in Winter Park, Florida, suffered as most restaurants did during the pandemic, closing 23 restaurants in early 2020, furloughing workers and announcing that executives were taking less pay.

- Darden, also based in Florida, is acquiring all outstanding shares of Ruth’s for $21.50 per share, a 34% premium.

- Darden Restaurants Inc. owns Olive Garden, LongHorn Steakhouse, Yard House, Cheddar’s Scratch Kitchen, The Capital Grille, Seasons 52, Bahama Breeze and Eddie V’s.

Corporate Debt

OBSERVATION - Weak businesses secumb to the business cycle as funds dry up and disrupted business models fall appart

- (Mish Talk) - There are 70 Major Bankruptcies in Just 4 Months This Year

- Liquidation sales are on, including Bed Bath and Beyond. There will be more.

- For 2009 there were 118 bankruptcies through April. In Covid-impacted 2020, there were 71 bankruptcies. In 2023 there have been 70.

- This is the third worst start to the year since 2000

- 2023 Bankruptcy Spotlight

- Bed Bath & Beyond: April 2023: Home goods, baby goods

- David’s Bridal: Date: April 2023: Bridal apparel

- Boxed: April 2023: An e-commerce platform selling wholesale consumer goods

- Independent Pet Partners: February 2023: Pet supplies

- Tuesday Morning: February 2023: Discount home goods

- Serta Simmons Bedding: January 2023: Bedding and accessories

- Party City: January 2023: Party supplies

- Forma Brands: January 2023: Beauty products

- 2023 Bankruptcy Spotlight

AI and ML

TAKEAWAY :: “Large-scale benefits from AI will likely take longer to materialize and have more modest applications and scope than today’s AI evangelists would lead us to believe.”

- (Sandbox Daily) - AI search interest is exploding - Some are already calling this peak AI narrative a bubble.

- Reflected in the search interest for “AI stocks” which hit an all-time high (supported by the daily articles and social media mentions)

- Previous “peak search engine” equity rallies have not ended well.

-

- Unlike the once-upon-a-time $3 trillion dollar crypto market that still seeks a pragmatic real world use-case solution, ChatGPT and other AI programs are already finding their way into the code-building community, complementing academic research, and helping businesses automate tedious tasks.

OPINION - Keep in mind that Open AI is considered speculative, every other “blah blah with AI” pitch is still half baked.

- (Tech Crunch) - OpenAI closes $300M share sale at $27B-29B valuation

- Microsoft investment closed in January. The money from VCs reported here, part of a tender offer

- VC firms including Tiger Global, Sequoia Capital, Andreessen Horowitz, Thrive and K2 Global picking up new shares. Founders Fund is also investing

- Altogether the VCs have put in just over $300 million at a valuation of $27 billion – $29 billion

- Outside investors now own more than 30% of OpenAI, the source said.

- At a moment when investors are on the hunt for interesting AI startups to back, OpenAI is likely seen as the kind of opportunity that looks good right now.