2023 Week 15

Notes, thoughts and observations - Compiled weekly

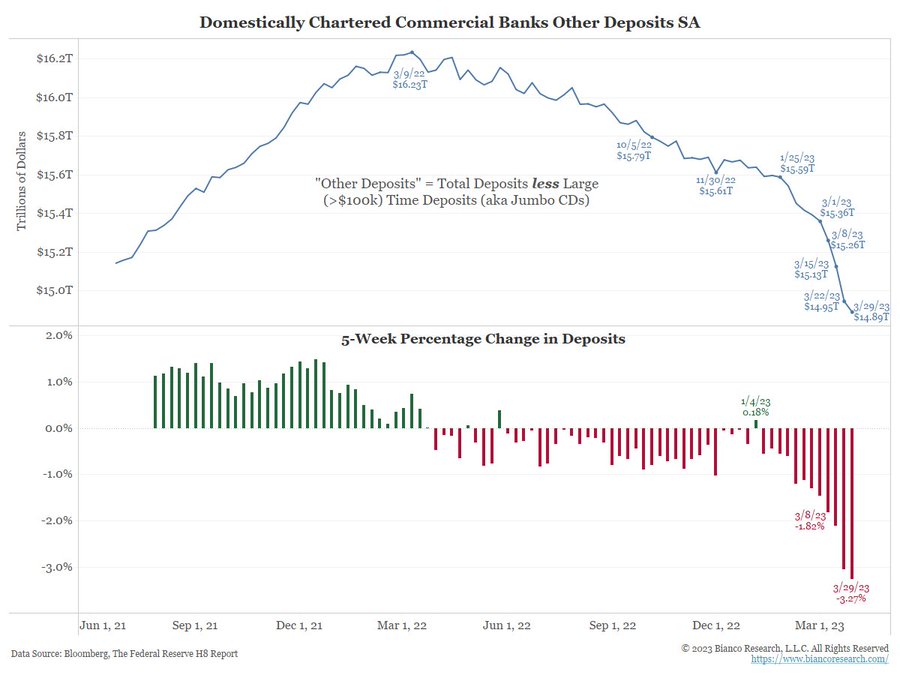

A couple of takeaways for the week. First, we are seeing signs that the liquidity crisis may not be over, the huge draw down in deposits may still cause problems. Consumer debt is also a concern as it’s more difficult to get credit than one year ago.

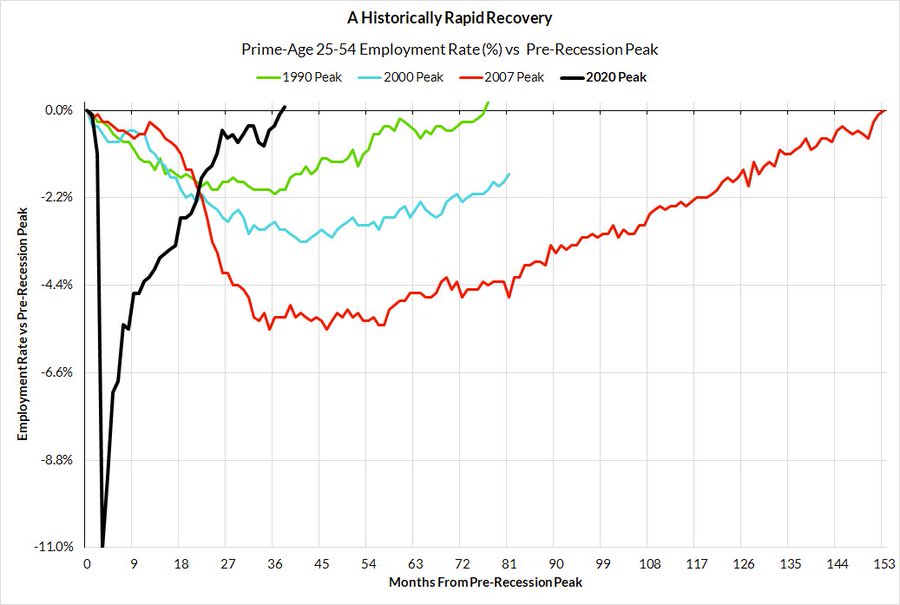

Second, increasing number of economist speculating that we are in, or are entering a recession. Recessions are notoriously hard to identify until after the fact, and a lot of contributing factors that may make this one double difficult to spot. For example, the labor market is looking very peculiar with the prime-age employment recovering in record time.

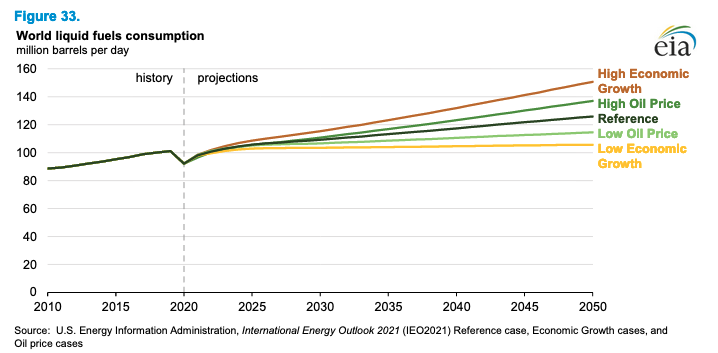

Last, the hype cycle continues on both the end of oil and the end of the US dollar. In my opinion both are long term risks but can be mitigated. Beware of snake oil and fear mongering, it takes a long time to systemically change a global economy. Just as COVID was a challenge for the global supply chain, it did not end overnight.

Is long term demographic trend (boomers retiring) a contributing factor?

TOPICS

Financial

OBSERVATION - Not sure what this means, but probably not done with the liquidity crisis

- (biancoresearch)

- Here is an update of the all-deposit drawdown chart. Excluding the 9/11-related drawdown (see the note on the chart), this is the largest drawdown in the 50 years of series data.

Recession

OBSERVATION - Confirmation of my theory that we’re already in recession or at least the cycle

- (Keith Fitz-Gerald)

- Forget the recession, focus on the recovery—here’s why

- I believe we’ve been in a recession since early last year.

- There have been 11 recessions since 1953—the average length being 10.3 months and the longest being 20+ months during the Global Financial Crisis of 2008.

- The cumulative return for the S&P 500 is lowest on average in the year leading up to the recession (-3%), but the average loss during the recession itself is just -1%. More than half the time, the returns are actually positive, which catches a lot of folks by surprise.

- But—and here’s the takeaway—investing money when a recession begins leads far more often to profitable outcomes than it does to additional losses.

OPINION - Not a surprise, but I think this indicates we are in the second half of the overally bubble cycle where the downturn spreads to other industries

-

(EPB Weekly)

- Manufacturing Recession Intensifies

- Recent ISM and leading employment data increase the probability the US economy is in recession.

- Cycle-sensitive sectors have lost jobs over the last five months.

- The leading index of employment fell to a new cyclical low suggesting more weakness for broader employment is coming.

- I am bullish of bonds and cash in preparation of a credit crunch.

- Manufacturing Recession Intensifies

Energy

OPINION - End of oil is one of the three most over-hyped topics today

- (BrianGitt)

- MYTH: The end of oil is near. Fact: In no scenario, does@EIAgovproject we will use less oil in 2050 than we are using now. In fact, oil consumption could reach 64% above 2020 levels with high economic growth.

OPINION - Regulators routinely shooting themselves in the foot.

- (chigrl)

- Judge cancels #Montana gas plant permit over climate impacts A judge canceled the air quality permit for a natural gas power plant that’s under construction along the Yellowstone River in Montana citing worries over climate change.

- So ridiculous..this project started in 2016..it is almost completed…at least they are going to appeal

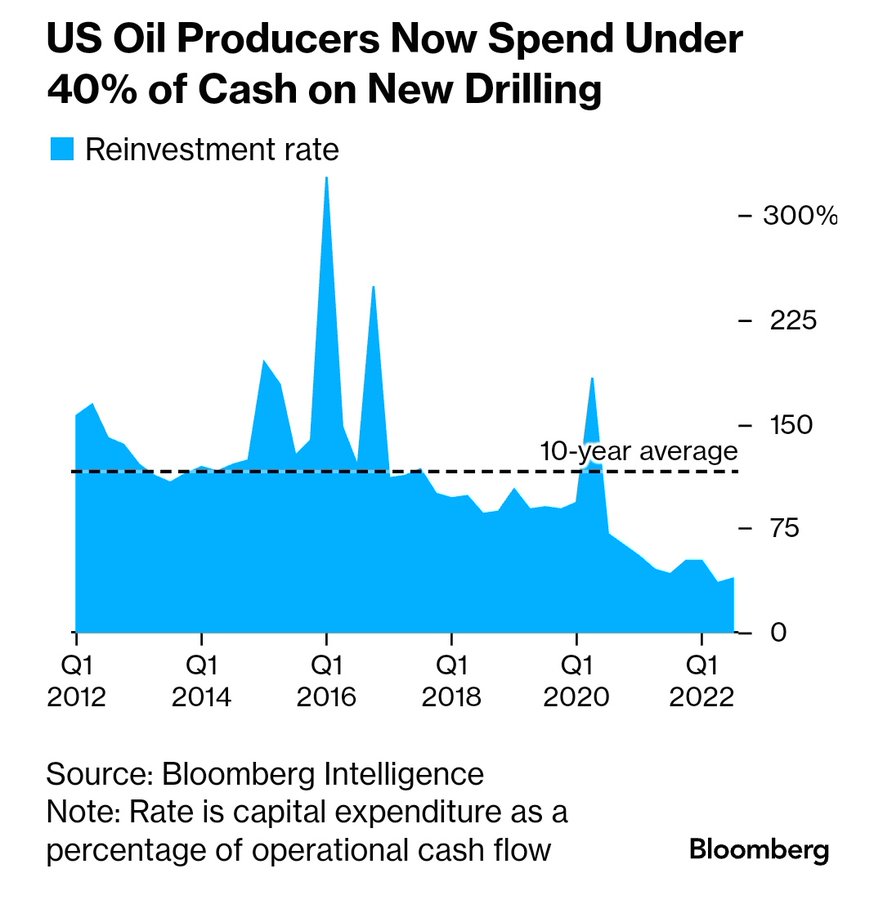

OPINION - This will no hold long term, eventually we need to drill

- (chigrl)

- US Oil Producers Now Spend Under 40% of Cash on New Drilling

OBSERVATION - Interesting take, certainly a near term risk

- (Eric Rosen)

- I wrote about my concerns that oil is going higher at some point in 2023 due to supply shocks

- The vilification of the oil industry, largely in the US and Europe is making the market more vulnerable to shocks from OPEC, Russia, and other counties.

- The market is tight, and China is back online. Also, the US will need to buy back millions of barrels of oil to refill the Strategic Petroleum Reserve (SPR) which was depleted to manipulate oil prices.

- I won’t be shocked if we see $100 oil in 2023.

Debt

OPINION - Supports the case that we are in phase 2 of the downcycle

- (Mish Talk)

- Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

- If you are trying to get a loan, it’s much harder than a year ago.

- What’s Going On?

- The inverted yield curve and QT act to restrict lending

- Banks are fearful of a recession and credit losses

- All the banks that leveraged into duration are suffering mark-to-market losses on their Treasury and MBS portfolios. The banks know this (and knew this even before Silicon Valley Bank was taken over).

- Consumers Are Having a Much Harder Time Getting Credit Than a Year Ago

Labor Market

THOUGHT - Is long term demographic trend (boomers retiring) a contributing factor?

-

- US prime-age employment is fully recovered from COVID…

- The black line shows prime-age employment surpassing its previous high in just over three years.

- …But goods-producing businesses have stopped hiring.

- Private employment growth has been gradually declining from a February 2022 peak. Moreover, its composition has been changing as goods-producing job growth diminished to zero in the last two months

- US prime-age employment is fully recovered from COVID…

OPINION - More confirmation of a labor slowdown

- (Markzandi)

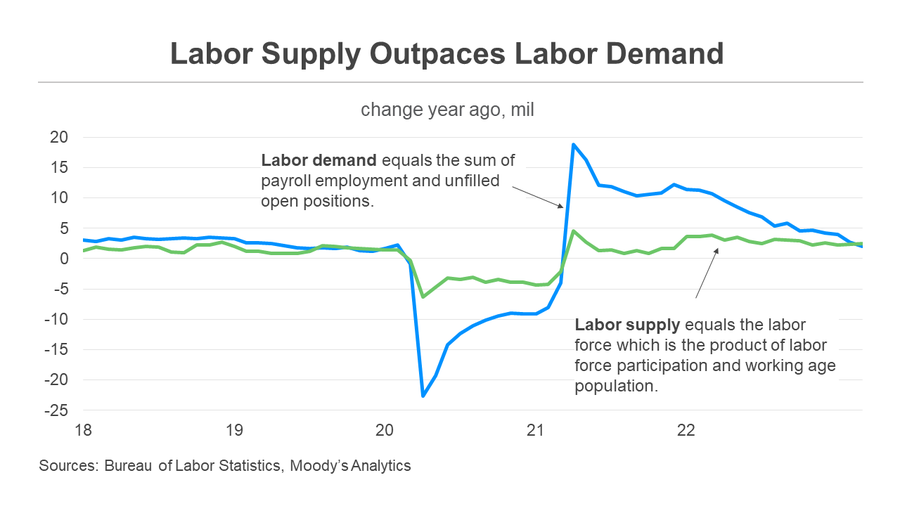

- For the first time since the pandemic shutdowns, labor supply is growing faster than labor demand. Unemployment, which hasn’t budged this past yr, will soon rise. This is needed to quell wage pressures and inflation. But it’s also when the economy is most vulnerable to recession.

OPINION - Labor is slowing down, but won’t look typical because of overall worker shortage. Need to focus on key industries and areas.

- (Over My Shoulder)

- Peter Boockvar: Jobs Data and What it Means for the Fed

- While overall growth was still strong, March showed the slowest pace of private sector hiring since February 2020, other than the COVID depths.

- The average work week fell to 34.4 hours, matching the lowest since September 2019, again excluding COVID.

- Leisure/hospitality still leads the way in both job growth and wage growth. In fact, all March’s job growth came from service sectors. The goods-producing side actually shed jobs.

- Combined with falling loan demand and banking issues, this data should make the Fed reconsider the risk of further interest rate hikes.