Category:

Business

2023 Week 10

Notes, thoughts and observations - Compiled weekly

TOPICS

China taking advantage of a steep Russian discount

Debt

OPINION - Debt (reset) will be a problem

- (KobeissiLetter)

- The U.S. Now Has:

- Record $16.5 trillion in household debt

- Record $11.9 trillion in mortgages

- Record $1.6 trillion in auto loans

- Record $986 billion in credit card debt Total mortgage debt is now more than double the 2006 peak.

- Meanwhile, 36% of Americans have more credit card debt than savings with balances rising at the fastest pace since 1999.

- This is all while mortgage rates just hit 7.1% and credit card debt rates hit a record 24.9%.

- We are “fighting” inflation with debt. This can’t end well.

- The U.S. Now Has:

Labor Market

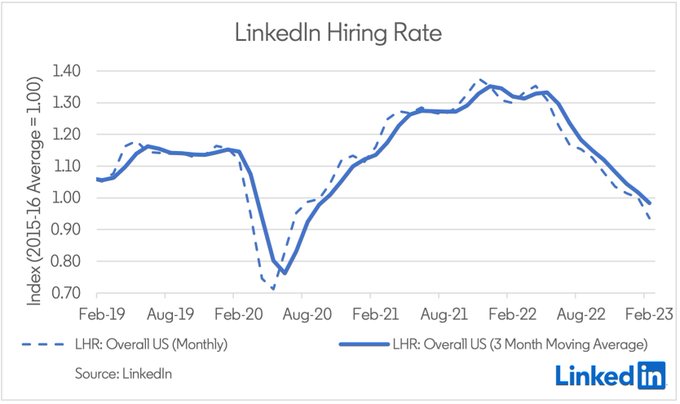

OBSERVATION - Hiring peaked, but still labor market still stronger than expected

- (EconBerger) - February was unfortunately a month of bad news: The US LHR was down 6.5% M/M seasonally adjusted, the biggest 1 month decline since 2020. Hiring is now down 30.8% from April 2022 (when declines began), and 27.9% Y/Y.

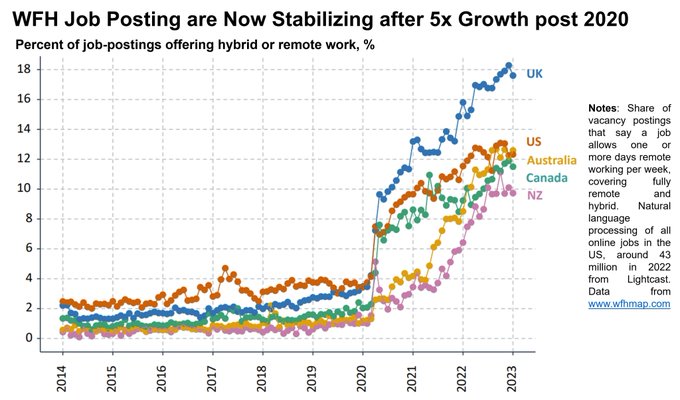

OBSERVATION - Same for Remote Work, is peaking but not reversing

- (I_Am_NickBloom) - Data from a new project analyzing over 50 million job-postings a year for hybrid and fully-remote jobs. We find #WFH postings grew 5-fold across after 2020, but are now stabilizing. This, and other data, suggest we have now reached the new normal. Data: http://wfhmap.com

OPINION - Profit sharing needs to return, to retain any semblance of equity as corporate profits climb

- Unshared Profits - Employers are taking a bigger share of the pie.

- Capitalism Is Broken If Record Profit Margins Don’t Revert

Energy

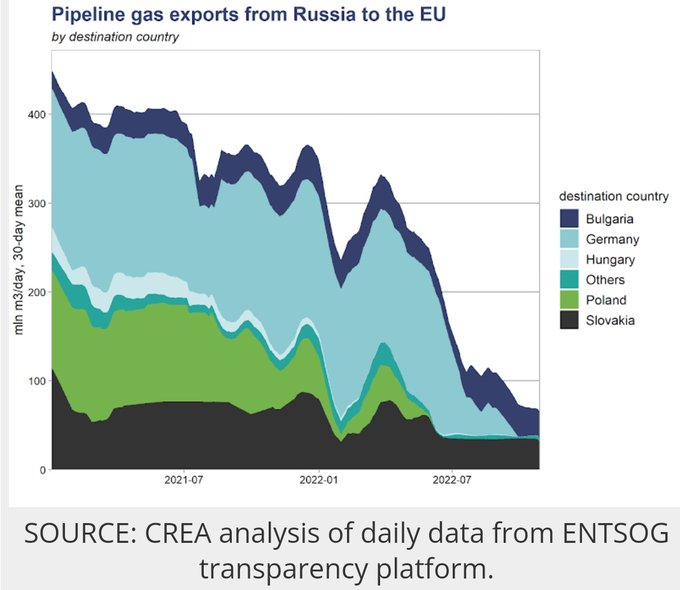

OPINION - That’ll hurt next winter. Europe slipped past with a mild season, but German industry will be the big loser.

- (chigrl) Pipeline gas exports from Russia to EU

OPINION - Oil is sticking around for a while

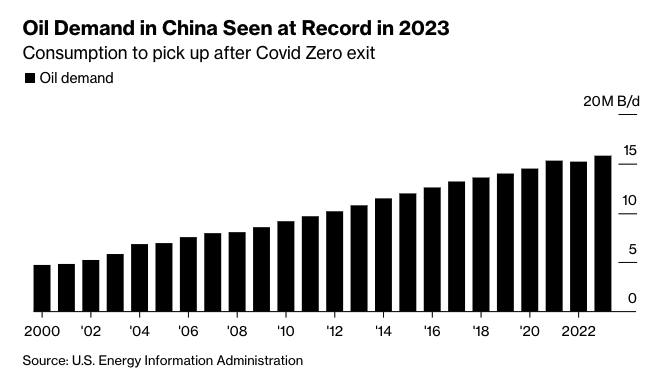

- (BrianGitt) Peak oil is nowhere in sight. Global oil demand is heading to a record 102 million barrels/day. Countries across the Asia-Pacific region are consuming more oil & will continue to do so for decades. Chinese oil consumption is poised to hit a record this year.

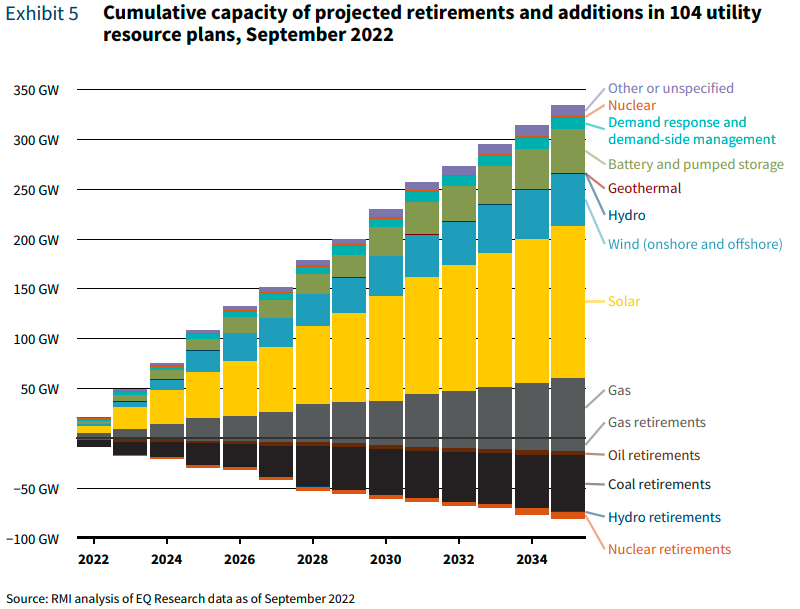

OPINION - Even if this chart is correct (too optimistic) the role of natural gas can not be ignored. Nuclear long-term, but near term natural gas is the ONLY reliable way to phase out coal.

- (BrianGitt)

- We’re witnessing a slow motion train wreck. Expect soaring electricity prices & more frequent power blackouts. Over reliance on wind & solar cause suffering to the poorest among us—a high cost for false moral comfort.

- California is the canary in the coal mine. It aggressively built out renewables & shut down power plants. Frequent power blackouts forced CA households & businesses to buy over 21,000 diesel-fueled backup generators to keep the lights on. Between 2011 & 2020, electricity prices rose 7X more (39%) in California than the US average (5%). Californians paid up to 88% more for electricity in the summer of 2022.

OPINION - Coal is low tech and more accessible to emerging economies than natural gas. To reduce carbon, globally, we need to get everyone off coal but it will be a lengthy, expensive endevor.

- (BrianGitt)

- “If we don’t understand why coal is so valuable, we have no hope of beating our addiction to it. Coal is cheap, reliable, & easy to store for indefinite periods. Replacement technologies that fail across these critical dimensions have no hope of decreasing global demand for coal.” - @DoombergT

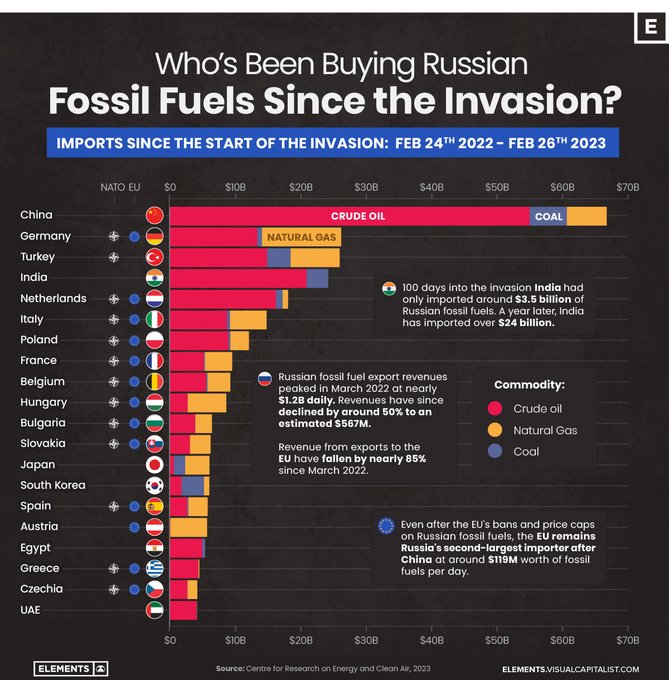

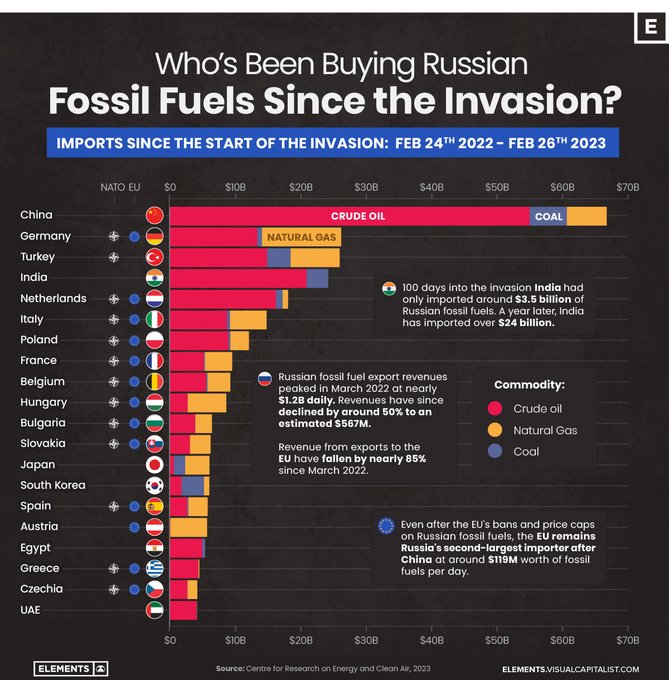

OBSERVATION - China taking advantage of a steep Russian discount

- (PeterZeihan)

- Great graphic. Note that it is total purchases for the full year (Germany’s we’re front loaded and are currently almost zero)

Stock Market

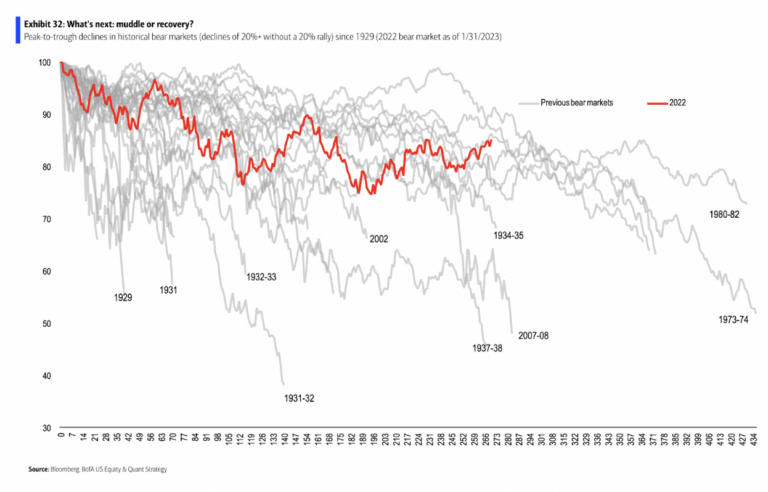

OPINION - Another big downleg and then we might be at the bottom

- Barry Ritzholtz - Chart shows the peak-to-trough declines of all the bear markets with the popular definition of a 20% decline, measured up until the start of the first 20% rally.2 The current move from 2022 highs is shown in red.

- ..all of these horrendous periods of market pain are already factored into long-term returns of equities. Meaning, you do not get the 8-10% long-term gains without living through a significant number of market events

OPINION - Great time to be a long term buyer, sucky time to be a trader

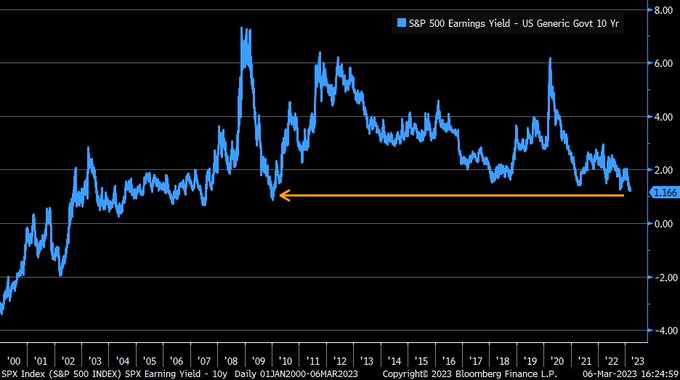

- (LizAnnSonders)

- Spread between S&P 500’s earnings yield and 10y Treasury yield continues to grind lower; now testing low point of 2010

OPINION - Market cycle tracks the same, another 6 monhts of uncertainity in the market and another year and a half to play out.

- (LizAnnSonders)

- Today vs. early 2000s bear market: Similarity: % drawdown this far into drop (around -16%) Difference: market this time fell much faster into bear territory [Past performance is no guarantee of future results]