Category:

Business

2023 Week 4

Notes, thoughts and observations - Compiled weekly

TOPICS

Electric Vehicles

IMPACT - EVs reduce our dependency on oil

OBVIOUS - Saying the quiet part out loud: Renewables and batteries are NOT a panacea for our energy needs.

(Doomberg)

- Tragically, Mass Dissonance™ holds no allegiance to any one nation

- the belief that rechargeable batteries will enable us to fully electrify the transportation sector and simultaneously solve the intermittency problem that plagues renewable sources of electricity.

OPINION - Dirty business, only cleaner if you ignore the facts.

(BrianGitt) ::

- A single electric-car battery requires digging and moving over 500,000 pounds of raw materials. The mining industry is 100% dependent on millions of gallons of diesel fuel, oils, and coolants to dig and haul raw materials.

Energy

IMPACT - Energy prices and availability impact every aspect our economy

UNDERRATED - “But I was told data is the new oil…” - AaronBobeck

(chigrl)

- Deep thoughts - If google disappeared tomorrow, the internet would still run. If oil disappeared tomorrow, the global ecomonomy would stop.

HOT TAKE - The real “Inconvenient Truth”

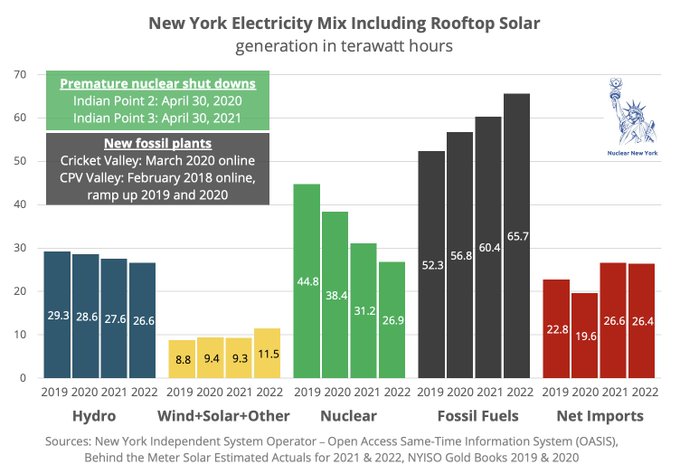

(nuclearny) ::

- New York’s electricity mix shift 2019-2022 (including rooftop solar) shows the increase in fossil combustion due to the forced premature closure of #IndianPoint, which produced 2.5x the carbon-free energy of statewide #solar & #wind.

Recession

IMPACT - You or someone you know is going to lose their job

TAKEAWAY - Economic leading indicators in decline for several months; Reading into Eric and Jared’s leading indicators, we either are or will be shortly in a recession.

- GDP is top layer ended 1.8% up form 0.9%

- 88% from consumption and investmetn

- Growth si flat in Q4, 0.6%

- 12% from govenment spending

- 88% from consumption and investmetn

- Consumption and Investment

- Housing, Durable Goods, Business Equipment

- 20% of economy, growth is slowing and went negative in Q4 (-3.2%)

- Contracting for 3 quaraters

- The 20% that drives the economy is point to a recession ahead, not a recovery in progress

- Coincident economic data that contracted in December: -Aggregate Weekly Hours -Retail Sales -Real Personal Consumption -Industrial Production -ISM Manufacturing -ISM Services Maybe it’s just a gully.

- Jan 18th - If you’re paying attention, coincident data fell apart in December… If you can’t see it now, you’re trying not to see it.

- Dec 15th - If you’re paying attention, coincident data fell apart in November…

- Jan 18th - If you’re paying attention, coincident data fell apart in December… If you can’t see it now, you’re trying not to see it.

- Coincident growth decelerated sharply in the second half of 2022, ending the year with under 1% annualized growth.

- Could see another recession in 2024; interest rates could spike again

- “Equity valuations are a function of the volatility of inflation”

- Will have more volatility in 2023

Ad Revenue

IMPACT - Many of the free or subsidized services we enjoy are supported by ad revenue

TAKEAWAY - Online advertising is losing effectiviness and will shrink, and may take ad funded services with it.

- Advertising trends and where the future is headed - Consumer behaviors are changing the world quickly and the internet advertising model is rapidly losing its grip on consumers…

- Online ads > 62% of advertising, being eroded by subscriptions, ad-blocking, online privacy requirements

- TV > 22% of advertising, diminishing due to lack of viewership, cord-cutting, content subscriptions

- Radio > 3.84, being eliminated by streaming audio

- Newspaper > 3.71%, needs no explanation

- the valuable demographics that brands pay to reach will simply not be in the ad-supported tier.

- Those that can afford $10-20 per month will simply opt-out of commercials, leaving the remaining viewers relevant to only a subset of advertisers

- Distribution of adv ertising spednign worldwise in 2022

- Bob Iger recently said traditional TV is going to head off a precipice.