2022 Week 48

Notes, thoughts and observations - Compiled weekly

Recession fears, the Fed Rate and resetting energy expectations

TOPICS

Fed Rate

To understand Modern Monetary Theory, understand why the banker in Monopoly can never run out of money. - MMT aphorism

OBSERVATION :: A tale of two recessions; some see an end in sight and others think it’s just beginning

-

(Keith Fitz-Gerald) :: Most investors are NOT prepared for what happens next

- Keith’s prediction = The markets will take off like a rocket if there is even a hint of a pause

-

(Mish) :: 2-10 Yield Curve Inversion Recession Signal is the Strongest in Over 40 Years

- The 10-year to 3-month inversion is 64 basis points, the deepest since January of 2001.

-

(Mark Zandi) :: The US Treasury yield curve has inverted to its deepest level since the early 1980s. Is this a recession red flag or is this time different? Tune in to the latest Inside Economics so I can persuade you that this time IS different.

- (DiMartinoBooth :: “The only time you see the curve invert when we’re already in recession…I think to jay Powell’s point he is watching the right thing f he continues pressing forward with tightening he is tightening into recession. Another fed official said as much today.”

Energy

The Stone Age came to an end, not because we had a lack of stones, and the oil age will come to an end not because we have a lack of oil. - Sheikh Ahmed Zaki Yamani

OPINION :: High energy prices will drive inflation and cause global recession

- (Over My Shoulder) :: Gasoline in Perspective

- Electric vehicle owners have traded gasoline price exposure for grid power exposure

- Distant Wind - Most of the wind production is located a long way from major population centers.

- (Ken Fisher) :: Fathom Perking Positives Pessimists Can’t See

- International Energy Agency says Europe’s storage is 95% full—above the five-year average! Germany is at 100%

- MY COUNTER ARGUMENT: Doing so by stockpiling and building LNG terminals; Liquefaction is most expensive way to transport natural gas

- (Liz Ann Sonders) :: Record spread between average diesel and gasoline prices in U.S.

- COMMENTARY :: Time to start burning that waste oil (if you have mechanical injection)

- (Peter Zeihan) ::

- Europe paying spot prices to avoid long term contracts

- Seeing higher inflation

- Germany shutting down industry to reduce demand

- Seeing a de-industrialization (cars, fertilizer, etc.)

- Can’t purchase from to US b/c we need it

- Natural gas is our only flexible fuel that can spin up/down to match demand

- Next winter will be tougher on Europe

- Europe paying spot prices to avoid long term contracts

Recession

It’s a recession when your neighbor loses his job; it’s a depression when you lose yours. - Harry S Truman

OPINION :: Recession will be shallow in US, it will suck for a year but US will snap back; not sure about Europe and parts of Asia

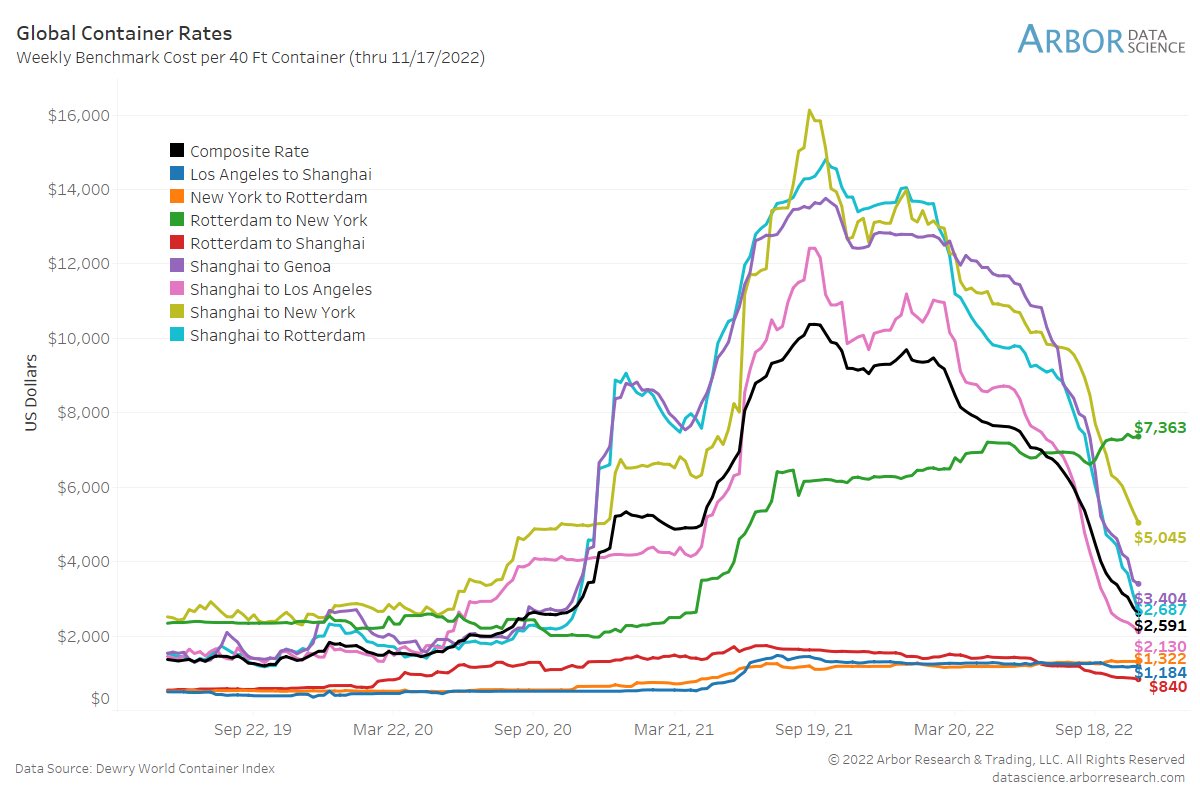

- (LizAnnSonders) :: Global shipping rates still in free-fall … only route not participating in drop is from Rotterdam to New York

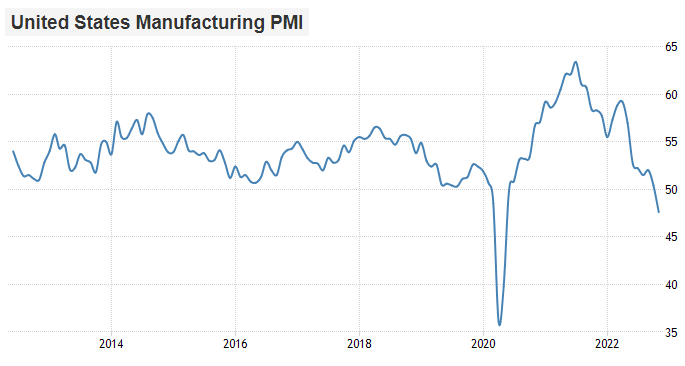

- (Lyn Alden) :: Us manufacturing PMI is now in a contraction.