2022 Week 40

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Raw Materials

Two out of every five people on Earth today owe their lives to the higher crop outputs that fertilizer has made possible. - Bill Gates

- (Clips that Matter) :: Lumber futures are back to 2020 levels

- Prices are notoriously volatile, but the last 2-3 years was crazy

- Changes in the housing market, changing import rules, weather, and labor shortages were just some of the factors generating big swings

- Prices have been softening ever since a war-driven rally last winter.

- Housing construction seems likely to diminish as the Fed pushes mortgage rates higher.

THOUGHT :: Price decline is more a predictor of home builder activity and outlook

Labor Market

Maintain austerity in good times to avoid layoffs in bad times. - Carlos Slim

- (Clips that Matter) :: American workers are confident they can quit.

- The “quits rate” is best understood as an indicator of worker confidence.

- Theory: People don’t quit their jobs unless they are sure another one is waiting or available

- Employers didn’t have to compete for talent like this until the last few years

- Could change if the Fed generates a severe recession that raises unemployment much higher… which seems to be their goal.

- The “quits rate” is best understood as an indicator of worker confidence.

THEORY :: Idea that labor shortage will become a surplus ignores the demographic facts and long COVID numbers

Real Estate

Location, location, location

-

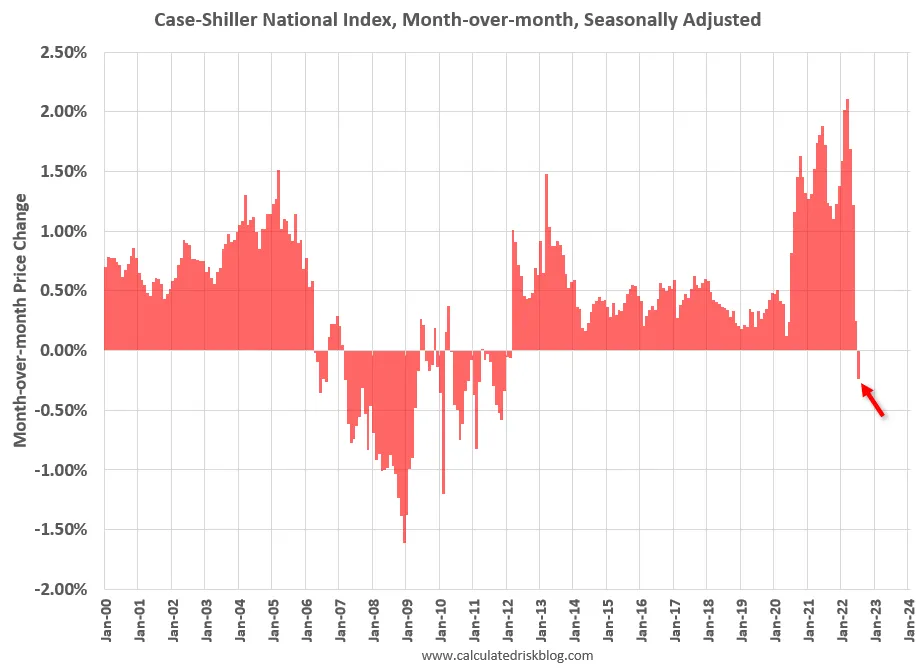

(Calculated Risk) :: Case-Shiller: National House Price Index “Continued its Deceleration” to 15.8% year-over-year increase in July

- FHFA: “House prices fell nationwide in July, down 0.6 percent from the previous month”

- MoM decrease in Case-Shiller was at -0.24%

-

(Wall Street Silver) :: Everything is fine …… 🔥 🔥 🔥

-

(Liz Ann Sonders) :: Average 30y mortgage rate now back to late-2008 levels

OPINION :: Rates matter, houses are expensive, buyers are stretched.. prices will decline

Recession

It’s a recession when your neighbor loses his job; it’s a depression when you lose yours. - Harry S Truman

-

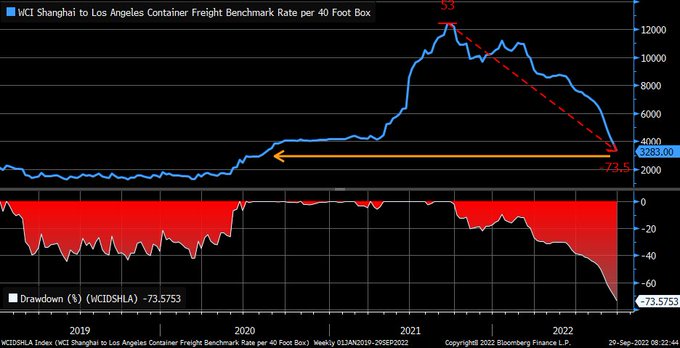

(Liz Ann Sonders) :: Unbelievable decline in shipping rates … cost to send 40-ft container from Shanghai to Los Angeles has fallen by 74% from peak and is back to August 2020 levels

-

(Mohamed A. El-Erian) :: For the history books: 1-week move in the yield on UK 30-year government bonds This 1-week journey

- 270 basis points from bottom to top and back—was essentially unthinkable for most economists market participants, and policymakers.(Remember, these are long duration UK bonds)

-

(John Ellis) :: Levels of Stress

- Around the world, financial markets look increasingly distressed.

- At the heart of the turmoil is the relentless rise of the American dollar and global interest rates.

- The DXY, an index of the dollar’s worth against a basket of rich-world currencies, has climbed 18% this year, reaching its highest in two decades.