2022 Week 27

Notes, thoughts and observations - Compiled weekly

THIS WEEK

Inflation

Inflation feels good at first but the endgame is grim - Jens O. Parsson

Observation :: Theories abound, but no one really knows what is going on

THOUGHTS :: Commodities ran up with speculation, corn prices are through the roof because of Ukraine. End of the day this fuels inflation, but didn’t start it.

- Cramer :: Commodity collapse: falling prices on corn, soy, copper, lumber. Morgan Stanley says much more to come zinc, aluminum, nickel, iron, copper, coal.

THOUGHTS :: 70s much? Old timers warn us about the bad old days. Bottom line is inflation was low for a long time and we need to readjust to a more realistic level

- New Items :: Leading economies are close to “tipping” into a high-inflation world where rapid price rises are normal, dominate daily life and are difficult to quell, the Bank for International Settlements warned on Sunday.

THOUGHTS :: No two ways, this is bad. Supply chain can and probably will extend inflation long after the economy corrects

- Clips That Matter :: Shipping Time

- Port snarls in 2021 helped launch the current inflation.

- The crunch eased considerably last fall and winter, falling from over 12 days to only three days as 2022 arrived.

- Unfortunately, that improvement now looks temporary. Delays escalated again starting in February 2022 and are now near last year’s peak level.

- As every investor knows, time is money. Higher prices are one result, so this is a sign inflation may not recede soon.

THOUGHTS :: Ritholtz nailed it, not one cause but many compounding

- Barry Ritholtz :: Who Is to Blame for Inflation?

- Covid-19

- Congress

- President Biden CARES Act 3

- President Trump CARES Acts 1+2

- Consumers (overspent without regard to cost)

- Consumers (shift to Goods)

- Russian Invasion of Ukraine

- Just in Time Delivery (supply chains)

- Fed/Monetary Policy

- Wages/Unemployment Insurance

- Home Shortages

- Semiconductors/Automobiles

- Corporate Profit Seeking

- Tax Cuts (2017) / Infrastructure (2022)

- Crypto

Take-away :: Many things “caused” inflation, and we should adjust our outlook to rising prices for the foreseeable future

US Recession

It’s a recession when your neighbor loses his job; it’s a depression when you lose yours. - Harry S Truman

OPINION :: We can play games and pretend like it’s not happening, but that won’t change the fact that it’s happening

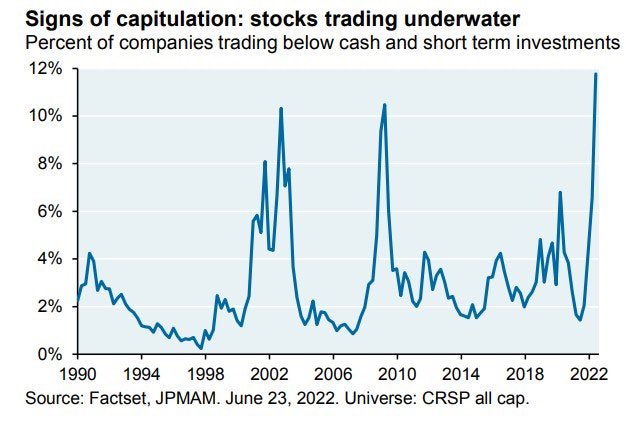

OBSERVATION :: This seems different.. typically capitulation AFTER the decline, are we there yet?

- Liz Ann Sonders :: Historically-elevated percentage of companies trading below cash and short-term investments

THOUGHTS :: Layoffs spread, seems like the start of a recession

- Seeking Alpha:: Unity Software cuts hundreds of staffers

- Unity Software (NYSE:U) has laid off hundreds of staffers in broad-ranging cuts, according to media reports.

- An all-hands meeting two weeks ago brought assurances from CEO John Riccitiello that the company wasn’t in financial trouble and no layoffs were imminent - but the cuts have hit

- Laid-off workers are being given a month of pay and another month of severance and health coverage, but Unity has reportedly enacted a hiring freeze across all departments.

THOUGHT :: Cathie Wood capitulates?

- Seeking Alpha :: Cathie Wood, CEO of ARK Invest “We think we are in a recession…”

- Can’t believe it’s taking more than two years [to resolve the supply chain] and Russia’s invasion of Ukraine of course we couldn’t have seen that. We think a big problem out there is inventories - the increase of which I’ve never seen this large in my career… and I’ve been around for 45 years.

THOUGHT :: Predicting it could get worse based on past performance, are we overcorrecting based on the brutality of early 2000 and 2008?

- Yahoo :: The S&P 500 Index may have another 24% to fall by year-end, if the past 150 years of financial-market history are any guide.

- Société Générale, which calculates the benchmark gauge may need to tumble as much as 40% from its January peak in the next six months to hit bottom.

- Earnings are the most important driver of stock prices in the long run.

- Analysts estimated S&P 500 earnings to grow 10.4% year-over-year to $230.52 per share in 2022

- “The dynamics of post-crisis fair value still call for a deeper correction to bring current prices in line with the reset anchor fundamental fair value.”

- “The current market valuation clearly stands as a bubble vis a vis the valuation reset of March 2020 and its trajectory,

Takeaway :: Stocks might get cheaper, but not a sure bet. At this point many trading at 52-week lows, hard to make strategic buys

Real Estate

Location, location, location

Observation :: Houses aren’t selling as quickly in my neighborhood, it’s probably rising rates

Current Rates

| Term | APR |

|---|---|

| 30-year fixed | 5.955% |

| 20-year fixed | 5.48% |

| 15-year fixed | 5.508% |

THOUGHT :: You have to wonder why folks can’t service a fixed rate mortgage and are already behind enough, facing eviction

- Liz Ann Sonders :: About 15%, or 8.4 million Americans, are behind on rent per early June @uscensusbureau survey … ~3.5 million households say they are very or somewhat likely to leave their house in next 2 months because of eviction

THOUGHT :: I don’t think you can read too much into this data. Housing completions are way behind which means fewer finalized sales

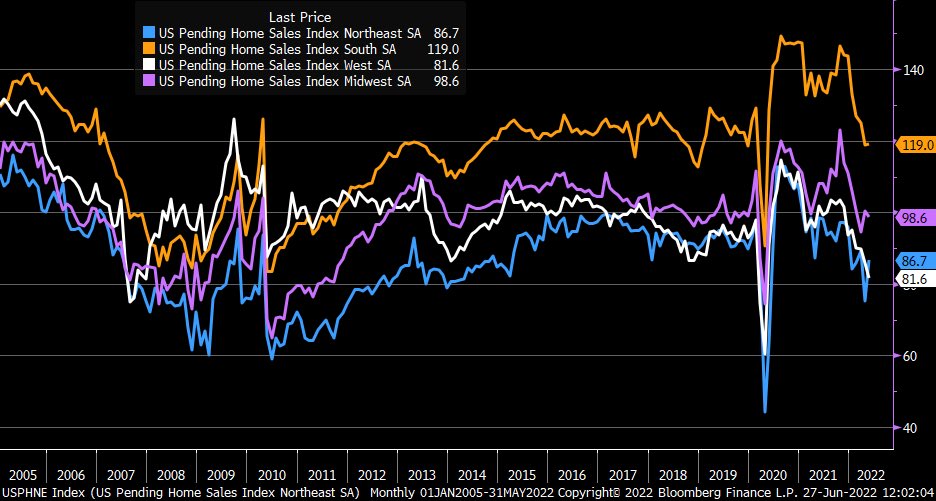

- (Liz Ann Sonders :: Except for Midwest, most regions saw peak in pending home sales in August 2020; since then, sales are down by 20% in south, 18% in Midwest, 23% in northeast, and 29% in west